Daniel Balakov

A Quick Take On Xometry

Xometry, Inc. (NASDAQ:XMTR) went public in June 2021, raising approximately $303 million in gross proceeds from an IPO that was priced at $44.00 per share.

The firm provides an online marketplace for buyers and sellers of manufacturing products and services.

In a continued rising cost of capital environment, high operating loss companies like XMTR will continue to face downward stock price pressures despite a recent price rally.

Given an apparent continuation in interest rate increases for the near term, I’m on Hold for XMTR.

Xometry’s Overview

Derwood, Maryland-based Xometry was founded to develop an online platform to source on-demand manufacturing capacity for product needs.

Management is headed by co-founder and CEO Randolph Altschuler, who was previously co-founder and Executive Chairman of CloudBlue Technologies.

The company’s primary offerings include:

-

Large network of buyers and sellers

-

Xometry Supplies for MRO

-

Financial products – Advance Card and FastPay.

Since the firm operates a two-sided marketplace, it seeks both buyers and sellers via a variety of online and offline sales & marketing efforts.

Management says the company is the largest on-demand manufacturing marketplace by revenue and that it has connected over 5,000 unique manufacturer sellers with more than 43,000 unique buyers.

Xometry’s Market & Competition

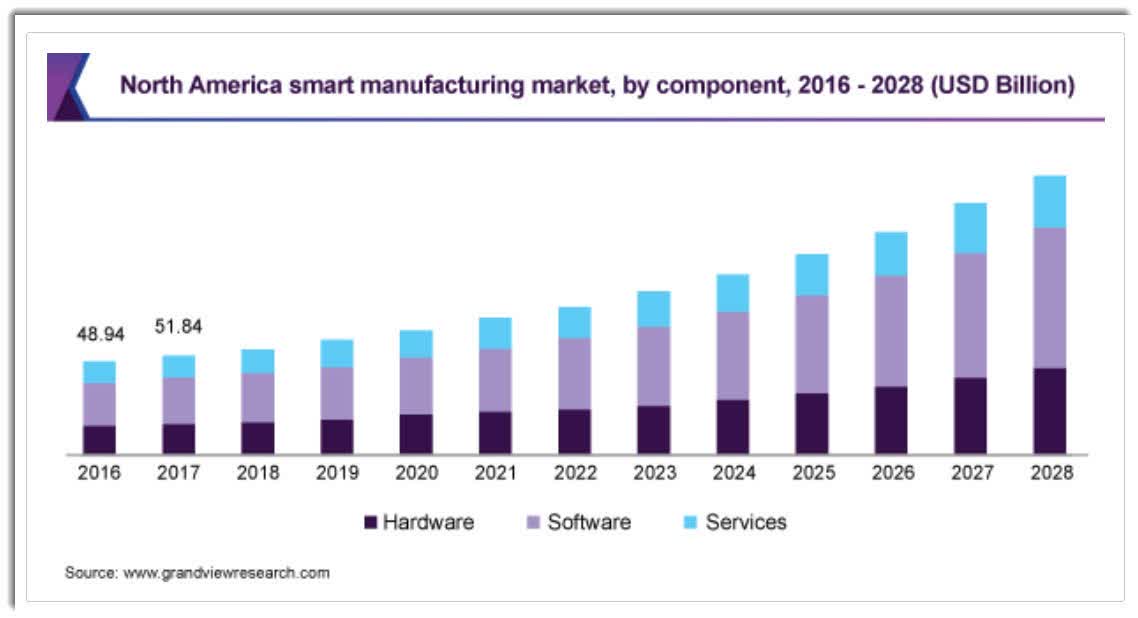

According to a 2021 market research report by Grand View Research, the global market for “smart manufacturing” was an estimated $236 billion in 2020 and is forecast to reach $601 billion by 2028.

This represents a forecast CAGR of 12.4% from 2021 to 2028.

The main drivers for this expected growth are a growing need by manufacturers for new sources of revenue in an efficient manner through digitization.

Also, below is a historical and projected future chart of the U.S. smart manufacturing market from 2016 through 2028:

N. America Smart Manufacturing Market (Grand View Research)

Major competitive or other industry participants include:

-

Stratasys

-

3D Systems

-

Independent machine shops

-

3D printing service bureaus

Xometry’s Recent Financial Performance

-

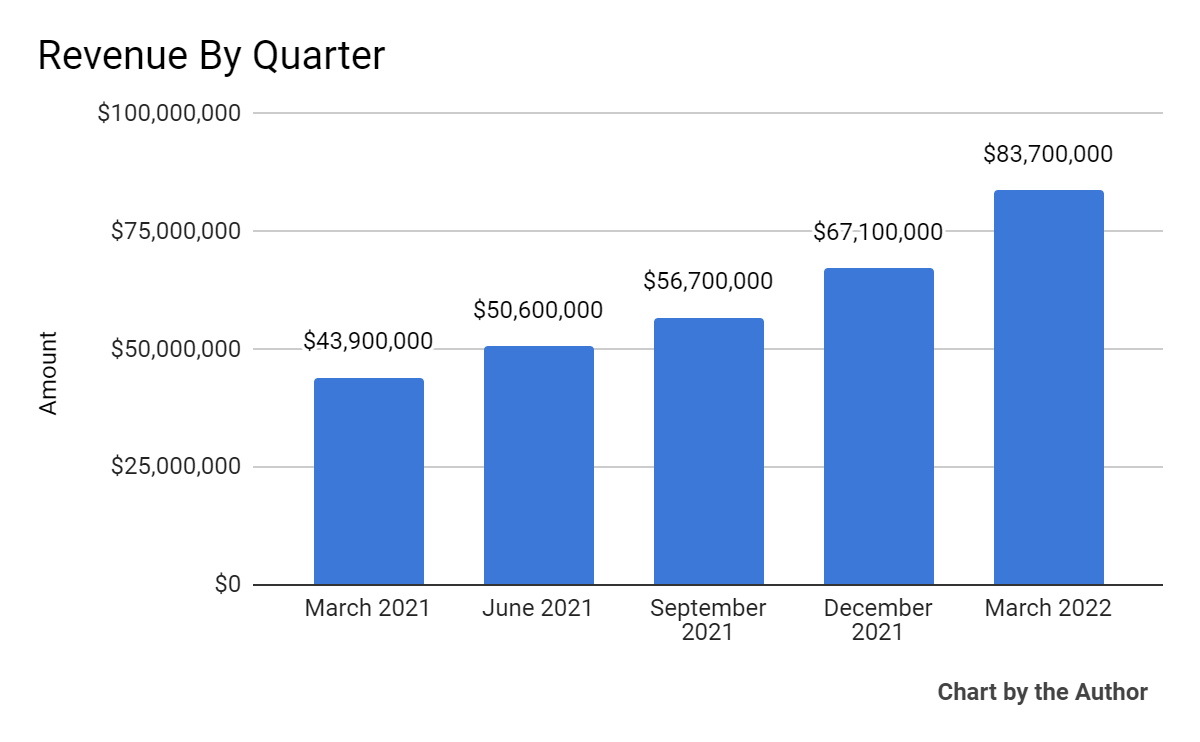

Total revenue by quarter has grown markedly in the past five quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

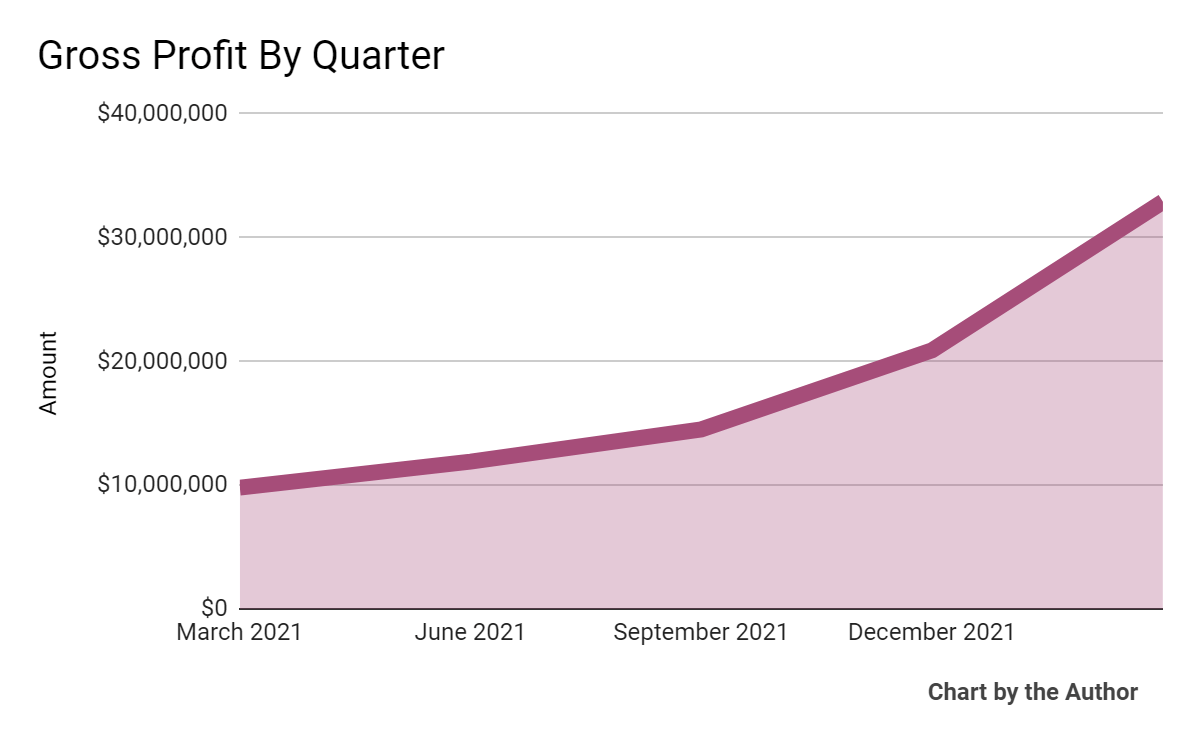

Gross profit by quarter has also risen considerably:

5 Quarter Gross Profit (Seeking Alpha)

-

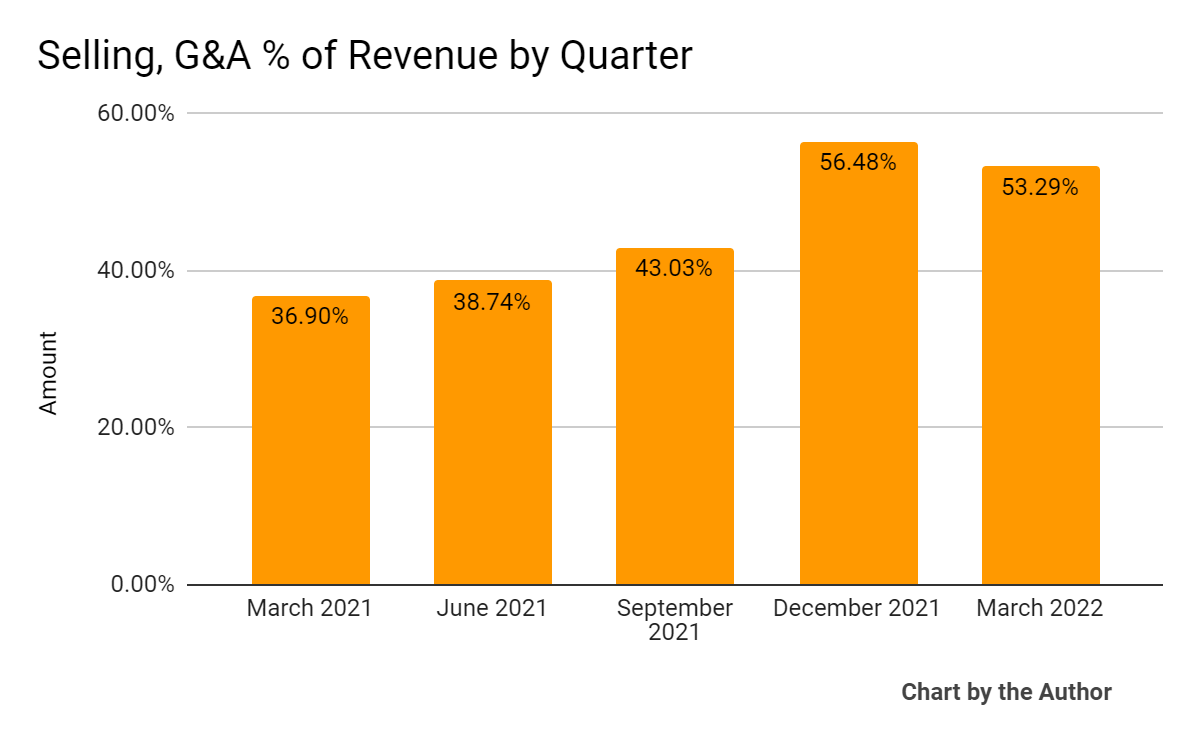

Selling, G&A expenses as a percentage of total revenue by quarter have grown as revenue has increased:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

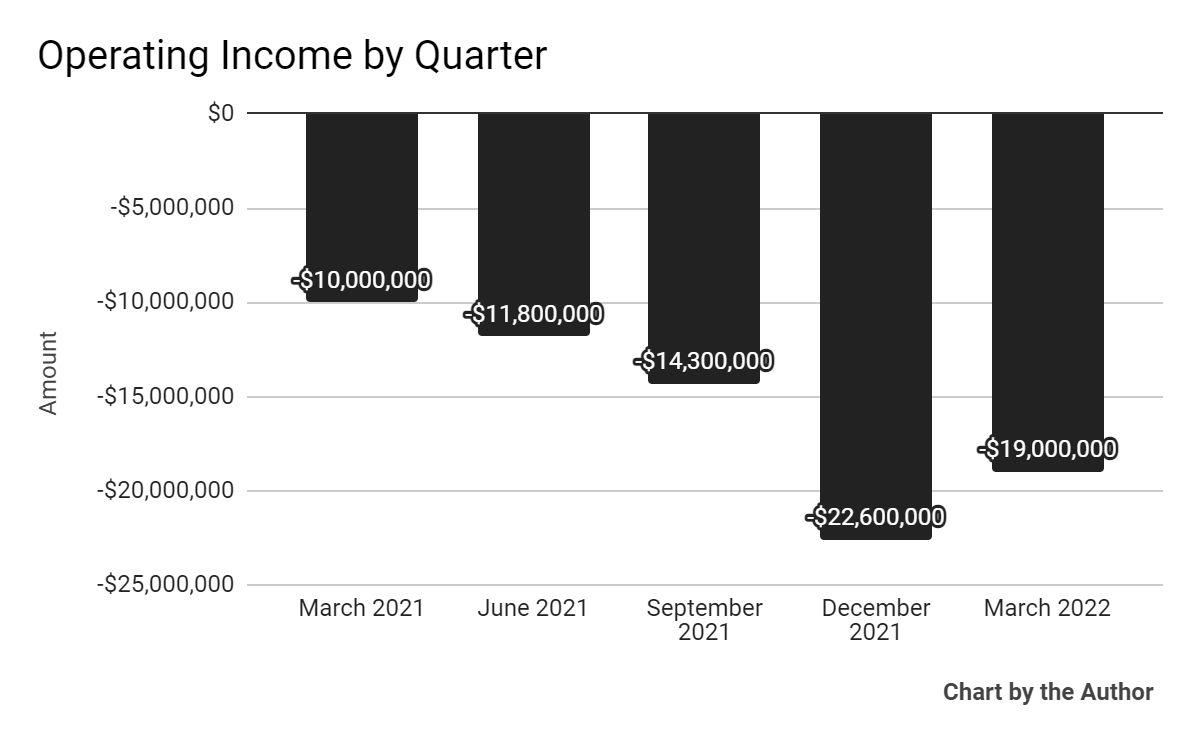

Operating losses by quarter have increased markedly in recent quarters, as the chart shows below:

5 Quarter Operating Income (Seeking Alpha)

-

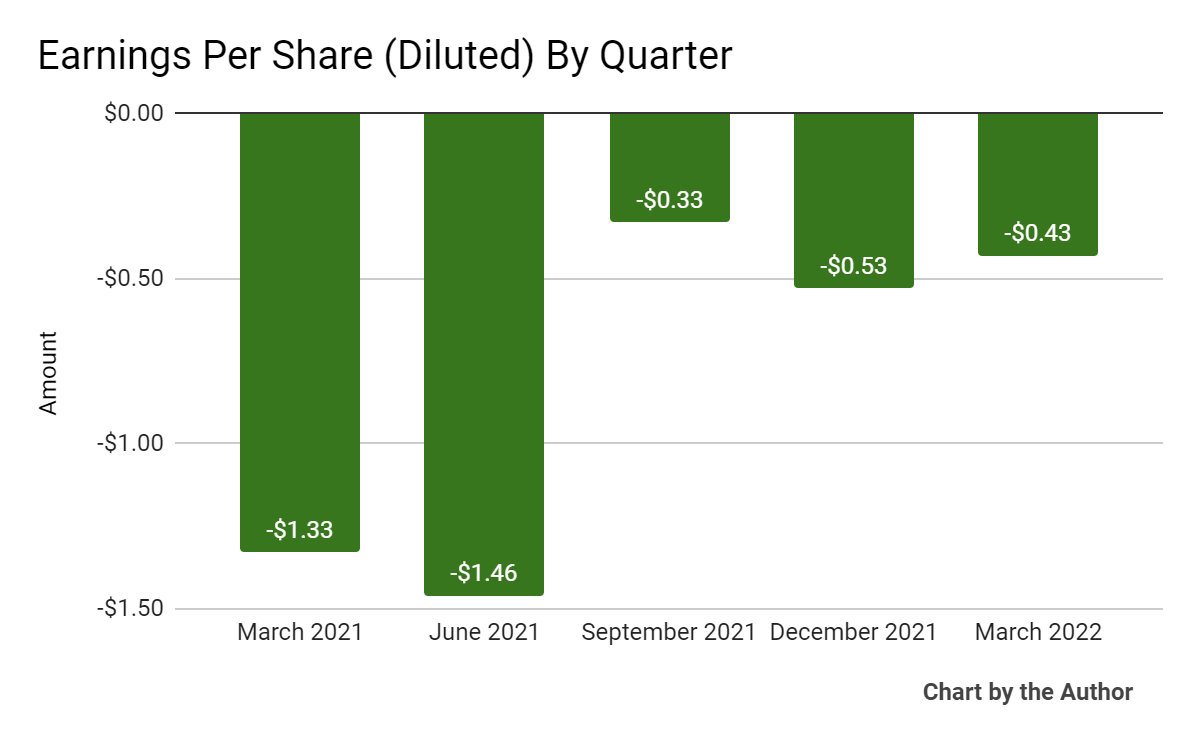

Earnings per share (Diluted) have remained significantly negative since its IPO in mid-2021:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

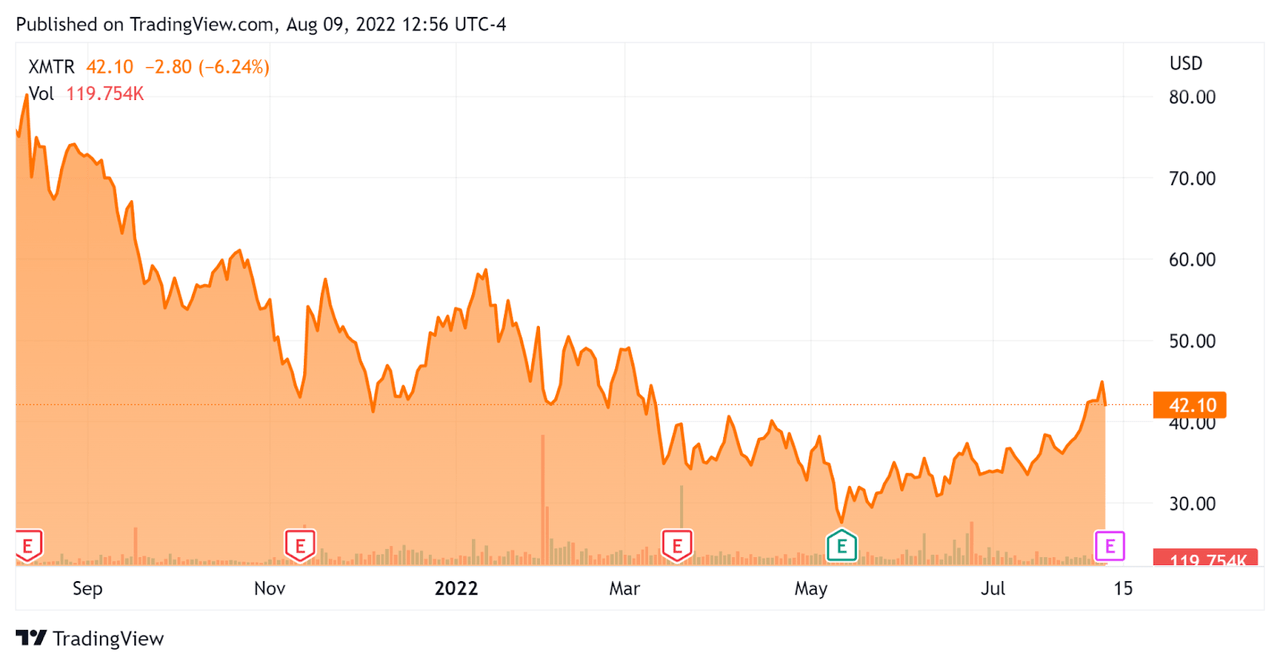

In the past 12 months, XMTR’s stock price has dropped 44.3% vs. the U.S. S&P 500 index’ fall of around 7.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Xometry

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$2,040,000,000 |

|

Market Capitalization |

$2,110,000,000 |

|

Enterprise Value/Sales (TTM) |

7.91 |

|

Revenue Growth Rate (TTM) |

62.69% |

|

Operating Cash Flow (TTM) |

-$82,890,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.75 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

XMTR’s most recent GAAP Rule of 40 calculation was 38% as of Q1 2022, so the firm has performed reasonably well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

63% |

|

GAAP EBITDA % |

-24% |

|

Total |

38% |

(Source – Seeking Alpha)

Commentary On Xometry

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its growth during a disruptive period since the pandemic began, proving its ability to assist fractured supply chains with a transformation to digital activity for the manufacturing industry.

The firm continued to invest in sales and marketing, pursuing its ‘land and expand’ approach within enterprise account prospects.

Also, management focused on integrations with other software systems to embed its marketplace solutions within existing ‘product design and procurement workflows.’

As to its financial results, its marketplace revenue grew by 50% year-over-year, with active buyers exceeding 30,600 representing growth of 44%.

Notably, its international business rose 146% year-over-year, driven by its European expansion and the company formally launched its platform in China during Q1.

Gross profit rose 235% year-over-year while non-GAAP operating expenses grew by 145% partially due to its $300 million Thomas acquisition which it acquired to expand its buyer and seller network.

For the balance sheet, the company finished the quarter with cash, equivalents and marketable securities of $369 million.

Looking ahead, management raised the bottom end of its revenue guidance for full year 2022, with expected revenue of $392 million to $400 million, or approximately 81.5% revenue growth at the midpoint of the range.

Regarding valuation, the market is currently valuing XMTR at an EV/Revenue multiple of 7.9x.

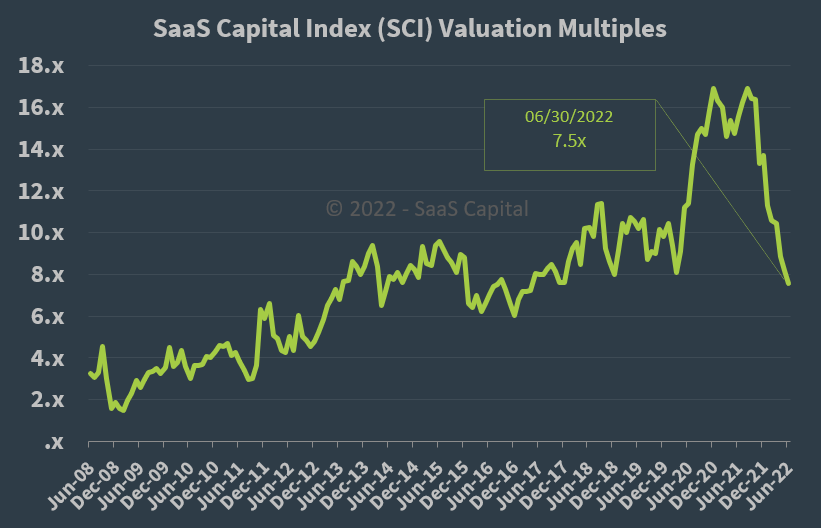

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, XMTR is currently valued by the market at a slight premium to the SaaS Capital Index, at least as of June 30, 2022, although a case could be made that the firm is more of a B2B marketplace than a true SaaS company.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow manufacturing activity and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a ‘short and shallow’ economic downturn and continued supply chain ‘healing’, enabling firms to increase manufacturing activities.

The stock market has punished high operating loss technology stocks as the cost of capital assumptions has risen due to interest rate hikes.

It is difficult to determine if these hikes will abate any time soon, as a recent U.S. jobs report showed surprising strength, reducing the Federal Reserve’s excuse for potentially lowering the trajectory of interest rate increases.

While XMTR appears well-positioned to continue its growth trajectory, management hasn’t made any progress on reducing operating losses.

In a continued rising cost of capital environment, companies like XMTR will continue to face downward stock price pressures, despite a recent price rally.

Given an apparent continuation in interest rate increases for the near term, I’m on Hold for XMTR.

Be the first to comment