Ceri Breeze

Earnings of Bar Harbor Bankshares (NYSE:BHB) will continue to surge on the back of moderate loan growth. Further, earnings will benefit from the lagged effect of interest rate hikes on the net interest margin. Overall, I’m expecting Bar Harbor Bankshares to report earnings of $2.88 per share for 2022, up 10% year-over-year. For 2023, I’m expecting earnings to grow by 15% to $3.31 per share. Compared to my last report on the company, I’ve raised my earnings estimate for this year because I’ve revised upwards both my loan and margin estimates. Next year’s target price suggests a small upside from the current market price. Based on the moderate total expected return, I’m maintaining a buy rating on Bar Harbor Bankshares.

Impressive Loan Growth To Slow Down Due To Interest Rates

The loan growth remained much higher than usual for Bar Harbor Bankshares in the third quarter of 2022. The portfolio grew by 4.5%, or 18% annualized, in the quarter, which took the nine-month growth to 12.6%, or 17% annualized. The third quarter’s growth exceeded my expectations given in my last report on the company. As this level of growth is unsustainable, the loan growth will likely start to decelerate from the fourth quarter onwards. Further, the 375 basis points hike in the fed funds rate so far this year will dampen credit demand, especially for residential real estate and home equity loans, which make up around 37% of total loans.

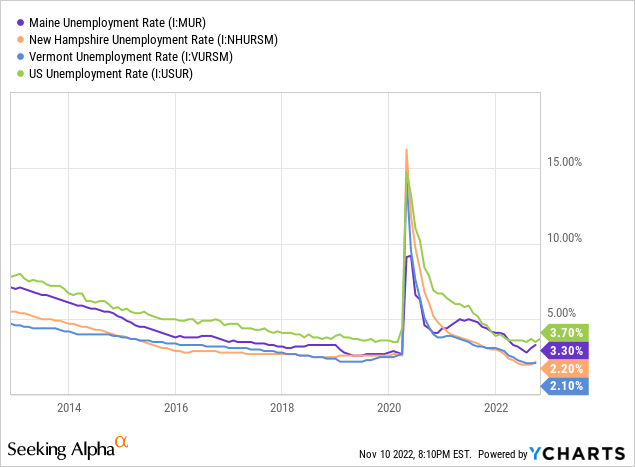

The outlook for commercial loans is better. Bar Harbor mostly operates in the states of Maine, New Hampshire, and Vermont. All three states currently have job markets that are hotter than in most other states. The unemployment rates for all three states are below the national average, as shown below.

Low unemployment rates signal that economic activity will remain healthy for at least the near term, which bodes well for commercial loan growth. Considering these factors, I’m expecting the loan growth to slow down to 1.5% in the fourth quarter of 2022, leading to full-year loan growth of 14%. For 2023, I’m expecting the loan portfolio to grow by 6%.

In my last report published before the release of the second quarter’s results, I estimated loan growth of 8% for 2022. I’ve increased my 2022 loan growth estimate because the growth beat my expectations in the third quarter of the year. Further, I’ve increased my fourth quarter’s estimate mostly because of the third quarter’s performance.

Lagged Effect Of The Up-rate Cycle To Boost Earnings Next Year

The net interest margin expanded by 28 basis points in the third quarter, following the 24-basis points growth in the second quarter of 2022. This impressive growth is attributable to the rising rate environment as well as the deployment of excess cash into higher-yielding assets. As the cash balance is now almost back to normal, this factor will not act as a catalyst any longer. However, the rate hike so far this year will continue to boost the margin well into 2023.

The asset side of Bar Harbor’s balance sheet is somewhat slow to reprice partly because of the sizable securities portfolio, most of which is based on fixed rates. The security portfolio made up 16.5% of total earning assets at the end of September 2022, according to the 10-Q filing. On the other hand, the liability side is quicker to reprice because of the large balance of adjustable-rate deposits. These deposits, namely savings, money market, and NOW accounts, made up 67% of total deposits at the end of September 2022.

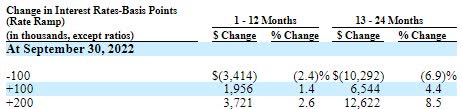

As Bar Harbor’s assets are slower to reprice than liabilities, the bulk of the benefit of this year’s up-rate cycle will be observed next year. The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis points hike in interest rates could boost the net interest income by 2.6% in the first year and 8.5% in the second year of the rate hike.

3Q 2022 10-Q Filing

Considering these factors, I’m expecting the margin to increase by 12 basis points in the fourth quarter of 2022 and 20 basis points in 2023. Compared to my last report on the company, I’ve raised my margin estimates, mostly because my interest rate outlook is more hawkish than before.

Earnings Likely To Surge By 15% Next Year

The anticipated loan growth and margin expansion discussed above will drive earnings through the end of 2023. On the other hand, a commensurate increase in operating expenses will limit earnings growth. Meanwhile, I’m expecting provision expenses for loan losses to be near the historical norm.

Overall, I’m expecting Bar Harbor Bankshares to report earnings of $2.88 per share for 2022, up 10% year-over-year. For 2023, I’m expecting earnings to grow by 15% to $3.31 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Summary | ||||||

| Net interest income | 91 | 90 | 99 | 96 | 112 | 134 |

| Provision for loan losses | 3 | 2 | 6 | (1) | 3 | 4 |

| Non-interest income | 28 | 29 | 43 | 42 | 36 | 35 |

| Non-interest expense | 76 | 90 | 95 | 91 | 90 | 102 |

| Net income – Common Sh. | 33 | 23 | 33 | 39 | 44 | 50 |

| EPS – Diluted ($) | 2.12 | 1.45 | 2.18 | 2.61 | 2.88 | 3.31 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Bar Harbor Bankshares, I estimated earnings of $2.71 per share for 2022. I’ve increased my earnings estimate because I’ve revised upwards my estimates for both loans and the margin.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Further Equity Book Value Erosion Likely

Bar Harbor Bankshares’ equity book value (tangible) has plunged from $19.8 per share at the end of December 2021 to $16.8 per share at the end of September 2022. Most of this drop is attributable to the building up of unrealized mark-to-market losses on the available-for-sale securities portfolio. These securities made up 16% of total earning assets at the end of September 2022. As interest rates rose this year, the market values of these securities fell, resulting in unrealized losses.

The tangible book value per share will fall further in the fourth quarter because of the 75 basis points hike in the fed funds rate in early November. Moreover, I’m expecting a further 75 basis point hike till the mid of 2023. Overall, I’m expecting the tangible book value per share to fall to $16.1 by the end of 2022 before rising to $17.6 by the end of 2023.

The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 2,476 | 2,626 | 2,544 | 2,509 | 2,868 | 3,044 |

| Growth of Net Loans | 0.1% | 6.0% | (3.1)% | (1.4)% | 14.3% | 6.1% |

| Other Earning Assets | 761 | 704 | 822 | 848 | 604 | 616 |

| Deposits | 2,483 | 2,696 | 2,906 | 3,049 | 3,175 | 3,337 |

| Borrowings and Sub-Debt | 724 | 531 | 336 | 179 | 251 | 262 |

| Common equity | 371 | 396 | 407 | 424 | 369 | 392 |

| Book Value per Share ($) | 23.8 | 25.4 | 26.7 | 28.2 | 24.4 | 25.9 |

| Tangible BVPS ($) | 23.8 | 17.3 | 18.3 | 19.8 | 16.1 | 17.6 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Moderate Total Expected Return Justifies A Buy Rating

Considering the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.28 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 33% for 2023, which is below the five-year average of 43%. Based on my dividend estimate, Bar Harbor is offering a forward dividend yield of 3.5%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bar Harbor Bankshares. The stock has traded at an average P/TB ratio of 1.28 in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Tangible BVPS ($) | 23.2 | 23.8 | 17.3 | 18.3 | 19.8 | |

| Average Market Price ($) | 29.3 | 28.1 | 24.9 | 20.2 | 27.7 | |

| Historical P/TB | 1.26x | 1.18x | 1.44x | 1.10x | 1.40x | 1.28x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $17.6 gives a target price of $22.5 for the end of 2023. This price target implies a 28.6% downside from the November 10 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.08x | 1.18x | 1.28x | 1.38x | 1.48x |

| TBVPS – Dec 2023 ($) | 17.6 | 17.6 | 17.6 | 17.6 | 17.6 |

| Target Price ($) | 19.0 | 20.8 | 22.5 | 24.3 | 26.0 |

| Market Price ($) | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | (39.7)% | (34.1)% | (28.6)% | (23.0)% | (17.4)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.5x in the past, as shown below.

| FY17 | FY18 | FY19 | FY20 | FY21 | Average | |

| Earnings per Share ($) | 1.70 | 2.12 | 1.45 | 2.18 | 2.61 | |

| Average Market Price ($) | 29.3 | 28.1 | 24.9 | 20.2 | 27.7 | |

| Historical P/E | 17.2x | 13.3x | 17.1x | 9.3x | 10.6x | 13.5x |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.31 gives a target price of $44.8 for the end of 2023. This price target implies a 42.1% upside from the November 10 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.5x | 12.5x | 13.5x | 14.5x | 15.5x |

| EPS 2023 ($) | 3.31 | 3.31 | 3.31 | 3.31 | 3.31 |

| Target Price ($) | 38.1 | 41.4 | 44.8 | 48.1 | 51.4 |

| Market Price ($) | 31.5 | 31.5 | 31.5 | 31.5 | 31.5 |

| Upside/(Downside) | 21.0% | 31.5% | 42.1% | 52.6% | 63.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $33.6, which implies a 6.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.2%. Hence, I’m maintaining a buy rating on Bar Harbor Bankshares.

Be the first to comment