Arlette Lopez/iStock Editorial via Getty Images

Leading Mexican bank Santander Mexico’s (NYSE:BSMX) financial position may not be quite as robust as that of its peers BBVA Bancomer (BBVA) and Banorte (OTCQX:GBOOF), but profitability has been improving in recent quarters. Its third-quarter P&L results, for instance, were boosted by contained operating expenses, strong loan growth, and fee-based income while maintaining asset quality under control.

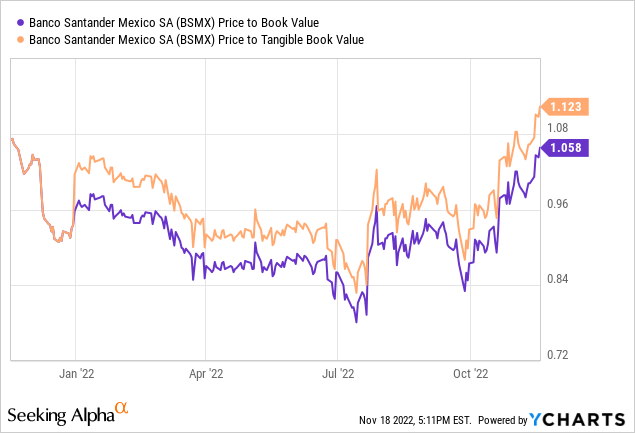

In the near term, results should continue to benefit from the tailwinds observed in Q3 2022 – rate hikes have shown no signs of abating anytime soon, while the recovery of Mexico’s economy remains on track. The valuation is cheap as well, but given the success of parentco Santander Group’s (SAN) tender offer for the remaining minority interest, any upside will be capped by the fwd book value of the company heading into an expected delisting in Q1 2023.

Broad-Based Strength Drives Record High ROEs

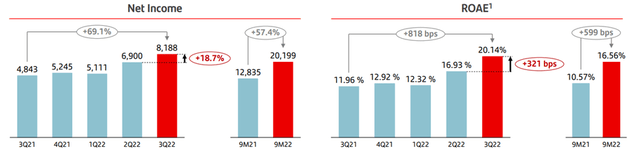

BSMX outpaced consensus in Q3, with net income reaching P$8.2bn (+19% QoQ and +69% YoY), largely on the back of a major P$3.7bn release of provisions related to large corporate loans. While this is a one-off earnings boost, the positive performance elsewhere, particularly in the retail portfolio, was commendable. The accelerated growth here means the share of consumer loans within the BSMX loan portfolio now stands at 17.0% in Q3 2022 – an impressive 2%pt gain relative to the 15.0% share in Q3 2020.

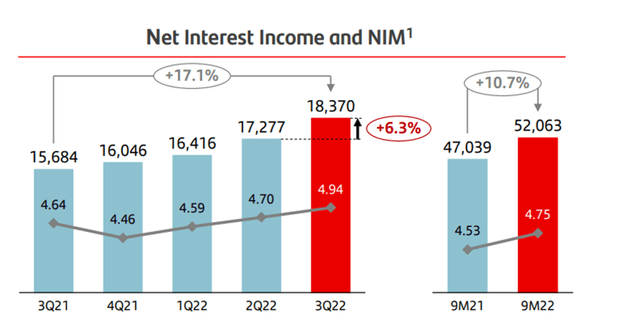

Overall, the net interest income expansion above loan growth for the quarter at (+6% QoQ and +17% YoY) was positive, and even though the net interest margin (NIM) remained at 4.3%, this was down to growth in interest-earning assets (+10% QoQ and +18% YoY). The combination of BSMX’s fundamental strength and lower provisions meant ROE expanded to a record high of 20.5% in Q3 – a +360bps QoQ rise and well above the 11.9% achieved last year. Perhaps even more impressively, this growth was achieved without sacrificing asset quality – BSMX reported a significant decline in delinquencies for the quarter, as well as historically low (and well below pre-COVID) NPL levels.

Guidance Revision Signals Continued Momentum Ahead

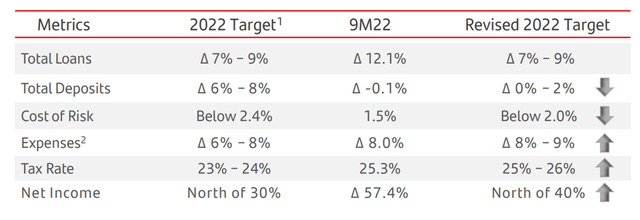

Coming off the Q3 outperformance, management has revised its guidance numbers higher. Earnings growth is now guided to hit ~40% this year (up from 30% previously), with cost increases expected to be in line with inflation at +8-9% this year. The cost guidance comes despite the bank’s commitment to investing in digital initiatives, including a separate digital bank. Per management, the bank has applied for a digital banking license and expects to receive approval in Q1 2023, with operations slated to begin by end-2023. While it remains early days, the rise of digital banking likely means more competition (and more spending) in the coming years, given the emergence of other new digital players. Yet, the growth opportunity from digital adoption, as well as the significant unbanked population in Mexico, should support an attractive long-term ROI.

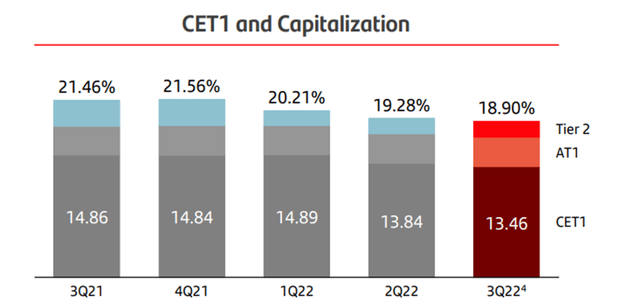

The outlook for the bank’s capital position also looks good – management has guided to a normalizing cost of risk in the coming quarters despite the shift toward higher-risk consumer and credit card loans. This makes sense, in my view, given that in Q3, all segments sustained charge-off ratios at multi-year lows despite the strong growth across the BSMX loan portfolio. Flexibility on capital return is limited, however, given the bank is constrained by a 12-12.2% tier-1 ratio target. That said, I wouldn’t be surprised to see the bank pay out excess capital next year should it pass the upcoming capital stress tests (due to be presented to the Mexican National Banking and Securities Commission (CNBV) early next year).

Santander Buyout on Track

Heading into earnings, parentco SAN had disclosed a cash offer for the remaining 3.76% stake in BSMX that it does not already own at a valuation equal to the book value per share of the last quarterly report. For context, the book value prior to the offer was P$23.61/share (equivalent to $5.90/ADR), so at a high-single-digit % premium to the pre-announcement closing price, the deal is a financially attractive one for SAN.

The deal will come as no surprise to investors – recall that SAN had previously launched three tender offers for minorities, with the last one in December 2021 resulting in the parentco crossing the 96% ownership threshold. Strategically, the tender offer also makes good sense, in my view, given SAN’s overall strategy of growing its presence in growth markets like Mexico. It also reflects the parentco’s confidence in the quality of the BSMX franchise as well as the long-term growth potential. Assuming the execution goes as planned, the deal is expected to close before Q1 2023, subject to regulatory clearance.

Pending Buyout Caps the Upside Potential

BSMX delivered record ROEs in Q3 2022, as its bottom-line results received a timely boost from a reversal of provisioning expenses, along with stronger revenue and below-inflation operating expenses. Even assuming no further provisioning reversals in the next few quarters, though, BSMX has ample room to grow its ROEs as interest rates in Mexico move (and stay) higher for an extended period of time. The ongoing recovery of Mexico’s economy presents a nice earnings tailwind as well. Yet, the tender offer from parentco Santander Group to acquire the remaining float means any upside will be capped at the fwd book value. With the valuation already at ~1x book and a competing bid unlikely, I am neutral on BSMX.

Be the first to comment