microgen

Banco Bradesco

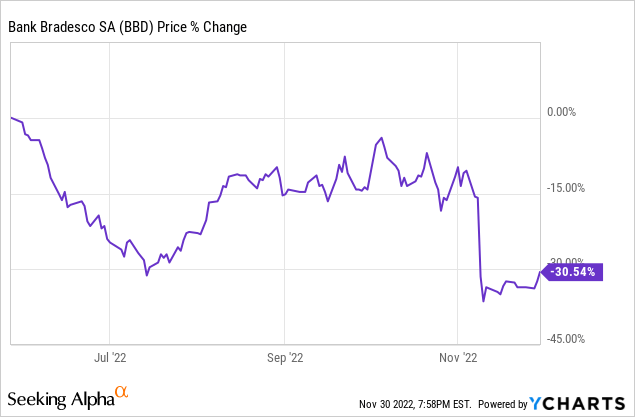

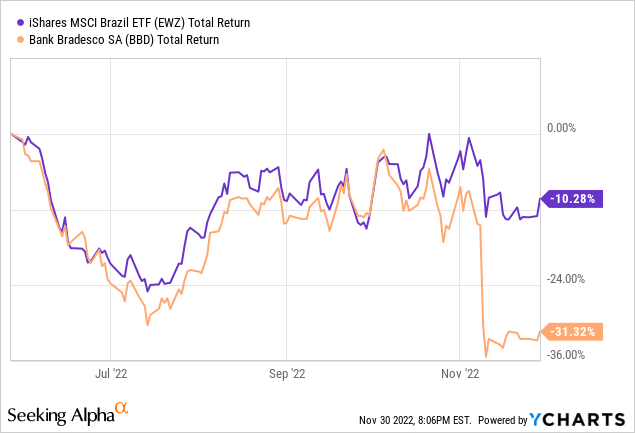

Banco Bradesco (NYSE:BBD) has sold off substantially since I covered the stock this May, due to fears over Brazil’s political and economic outlook. I am still equally optimistic about the company’s outlook, so I think now is an even better time to buy, and have changed from a buy to a strong buy rating.

Now is an even better time to initiate a position in Banco Bradesco based on company-specific factors and economic developments in Brazil. BBD is a strong buy below $3/share and could double with only moderate growth if multiples expand toward its historical average.

Digital Expansion

One trend I focused on previously was the increased digital banking environment in Brazil, and how traditional banks needed to adapt to avoid losing market share to fintech companies. In 2021, Banco Bradesco opened more digital bank accounts relative to traditional accounts. Banco Bradesco is continuing to focus on improving its digital presence in Brazil, allowing it to compete with regional fintech through organic growth and acquisitions. It also has plans to expand globally into markets with lower digital penetration rates. Banco Bradesco recently announced its plans to launch a digital bank in Mexico through the acquisition of Ictineo. Banco Bradesco has been expanding rapidly in Brazil, where the market is very competitive. New digital accounts for individuals and microentrepreneurs grew by 62-66% during the past 12 months. There were also 3x as many digital accounts overall in 9M 2022, compared to the same period in 2020.

Delinquency Trends and BBD’s Relative Advantage

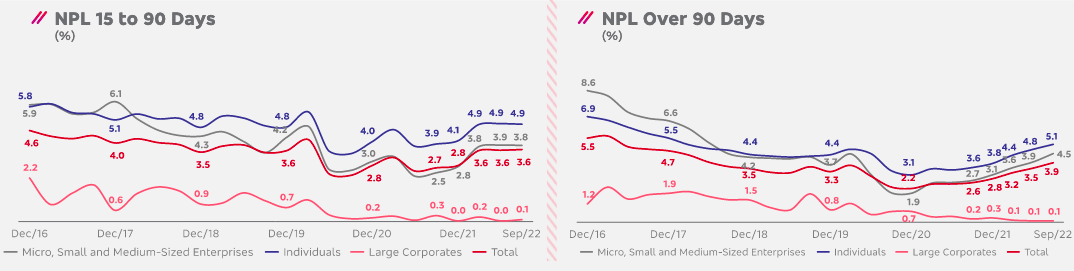

NPLs have increased considerably during the past few quarters, mainly due to consumers and SMEs, while larger corporations have had lower NPLs. Moving forward, banks in Brazil will need to provide less credit to consumers, even though interest rates are likely to decline in 2023.

Brazil’s Economic Ministry only projects 1.4-2.9% growth in 2023. Even though inflation in Brazil is lower than that of regional peers, consumers are still under stress, and banks will likely shy away from credit card offerings to these groups due to higher NPLs.

BBD

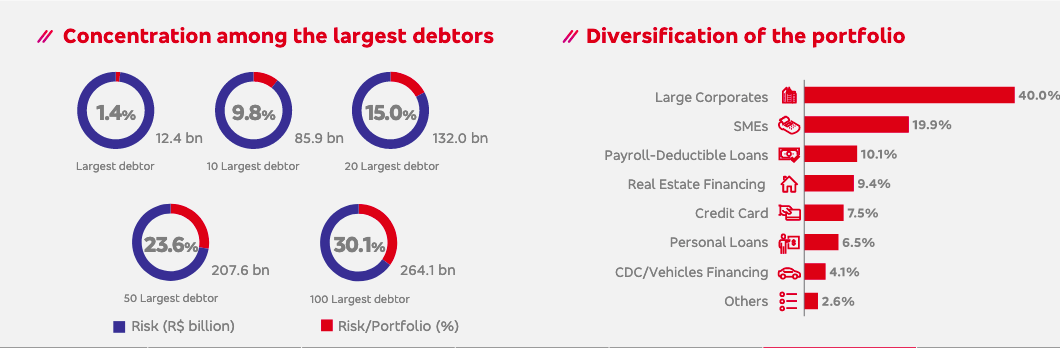

Banco Bradesco is a relatively safer bet because it focuses more on lending to larger corporations. Larger Corporations (40%) and individuals (40%) account for the majority of its loan portfolio, while SMEs account for the remaining 20%.

BBD

Most importantly, its top 10 debtors account for less than 10% of its loan portfolio, while the top 100 only account for 30.1% of its portfolio.

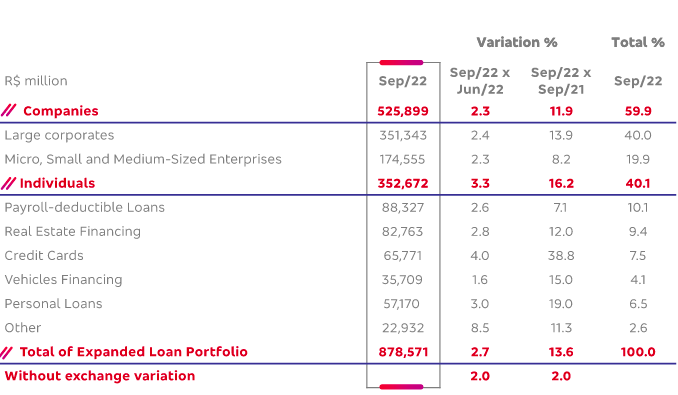

Growth had mixed results in each segment:

-

Large Corporations: 13.9% growth YoY and 2.4% growth QoQ

-

SMEs: 8.2% growth YoY and 2.3% growth QoQ

-

Individuals: 16.2% growth YoY and 3.3% growth QoQ

-

Credit cards (+38.8%) and personal loans (+19%) were the fastest-growing consumer segments, while real estate and payroll loans had below-average growth

BBD

Banks in Brazil will need to be more prudent due to slower growth and higher rates. Consequently, Banco Bradesco and other banks will like to aim for slower growth and focus on keeping NPLs under control. The bank currently only approves 48% of credit proposals compared to 58% a year ago and 68% in 2019.

2023 Outlook for Banco Bradesco

Conditions will certainly be more challenging for banks in Brazil in 2023, and I don’t expect Banco Bradesco to have a wonderful year. However, I think the bank could certainly outperform regional peers, and that the 30% decline in the share price in recent months reflects how these risks are certainly already priced in.

As I mentioned in my May article, Banco Bradesco will be a bit more volatile than other ETFs, like the iShares MSCI Brazil Capped ETF (EWZ).

On a long enough timeline, I believe this is positive, as Banco Bradesco could outperform the ETFs focused on Brazil. But if you are concerned about volatility or the political situation, then having no exposure or choosing safer options like an ETF is better. I am instead planning to gradually buy Banco Bradesco shares (anywhere below $3/share) this year and next year.

Inflation and Global Growth

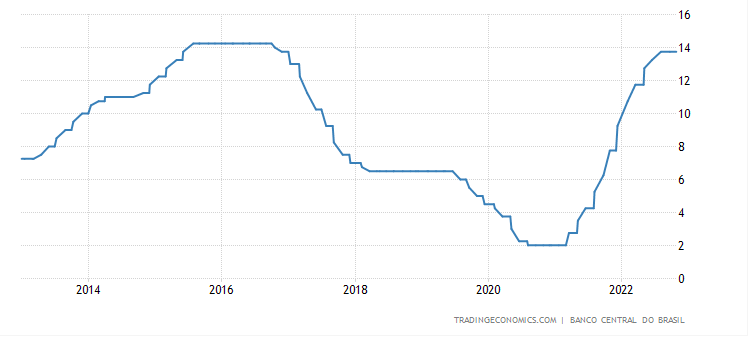

Inflation in Brazil was recently 6.5%, relative to 7.7% in the United States, 10.4% in Germany, 10.6% in Europe, and 11.1% in the United Kingdom. However, consumer confidence is still near a 10-year low, and growth has been lackluster, so these numbers are not as encouraging as they appear. However, Brazil has not cut rates drastically in response to improved inflation.

Benchmark Interest Rate

Trading Economics

Brazil has the potential to cut rates by 200bps or more in 2023 if inflation remains below 8%. While Brazil benefits strongly from being a strong commodity exporter, one major macroeconomic concern is the decline in global growth. Brazil’s top export markets include China ($67.9 billion), the United States ($21.9 billion), and Argentina ($8.57 billion). I appreciate Brazil because of the strong commodity exposure and low exposure to Europe. China’s gradual reopening, which has sped up recently, could also bode well for Brazil, whether this happens in December or early 2023.

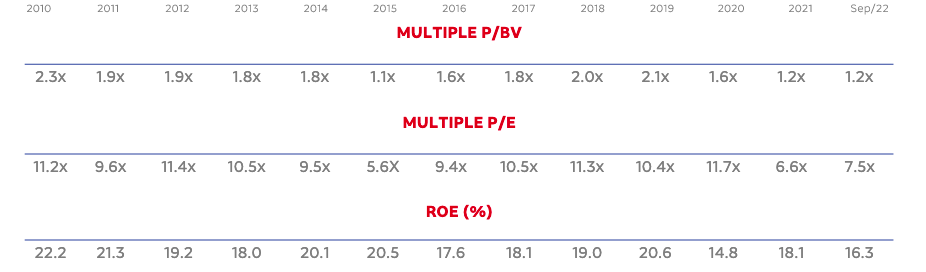

Valuation at a historical Low

Equities in Brazil are very cheap, at around 6x earnings. Banco Bradesco is trading at a historical low on a PE/PB basis and now looks like an even better time to accumulate shares. I think it’s fair for Banco Bradesco to trade in line with the MSCI Brazil Index, which includes a heavy weighting in energy (17%) and materials (19.61%).

BBD

It would be easy for Banco Bradesco to bounce back to $6-7/share assuming it can trade at 1.6-1.8x book again, and that its loan book grows at a modest 5-10% per annum.

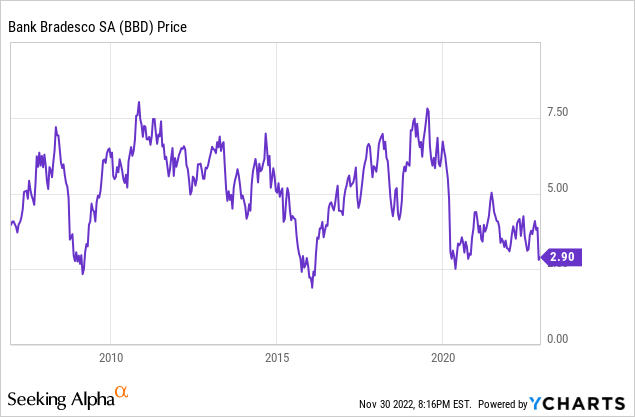

A long-term chart is useful for perspective. Banco Bradesco trades near the post-2008 lows and has traded much higher during positive economic times.

Banco Bradesco is a must if you want exposure to Brazil’s growth. The company is also a top 10 holding of many Latin American-focused ETFs. I am comfortable accumulating at less than $3/share.

Be the first to comment