gorodenkoff/iStock via Getty Images

Fathom Digital Manufacturing Corporation (NYSE:FATH) appears to offer valuable manufacturing solutions to big partners and innovative sectors. The robotics industry and the consumer electronics sector are expected to benefit from FATH’s digital manufacturing platforms. Even taking into account a decrease in headcount growth, future free cash flow would justify a valuation of close to $4.9 per share. I believe that FATH is undervalued.

Fathom Holdings

With 12 manufacturing facilities distributed throughout the different time zones in the United States, Fathom Digital Manufacturing bills itself as one of the largest digital manufacturing platforms in North America.

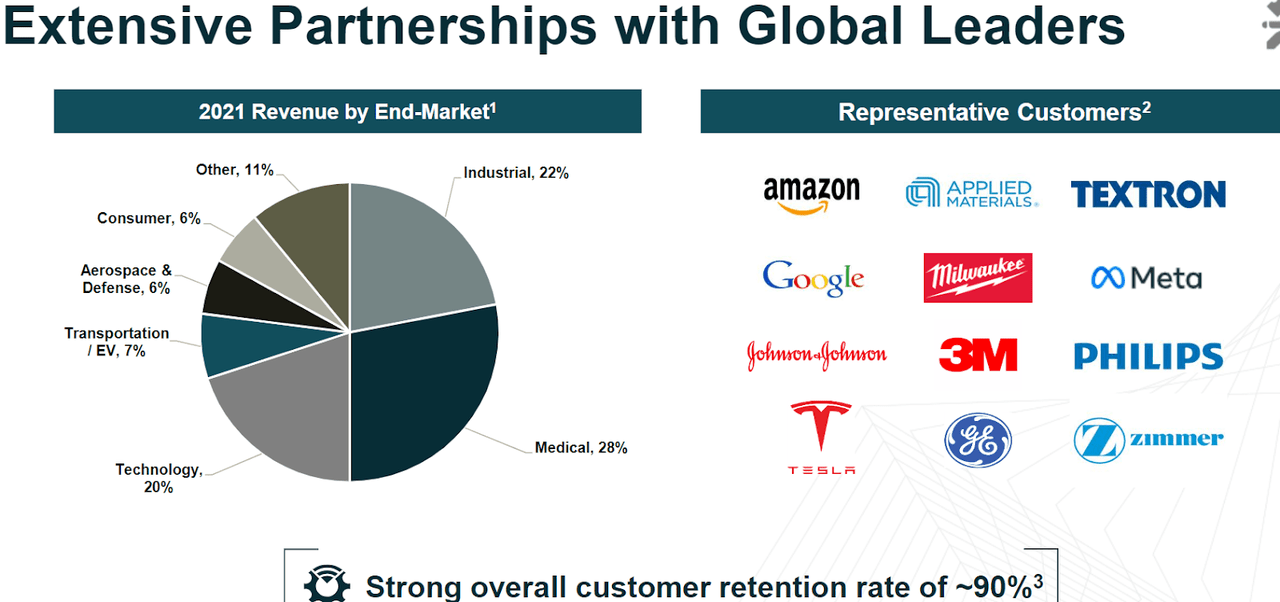

Fathom Digital’s functions are a hybrid between the traditional industrial manufacturing terms and the technological development typical of industry 4.0, made up of companies that offer digital solutions to industries in different fields, with specific emphasis on software development, implementation plans, project management, and administration. FATH is probably offering very unique services. Besides, the company’s agreements with large corporations and the current customer retention close to 90% are good reasons to research FATH.

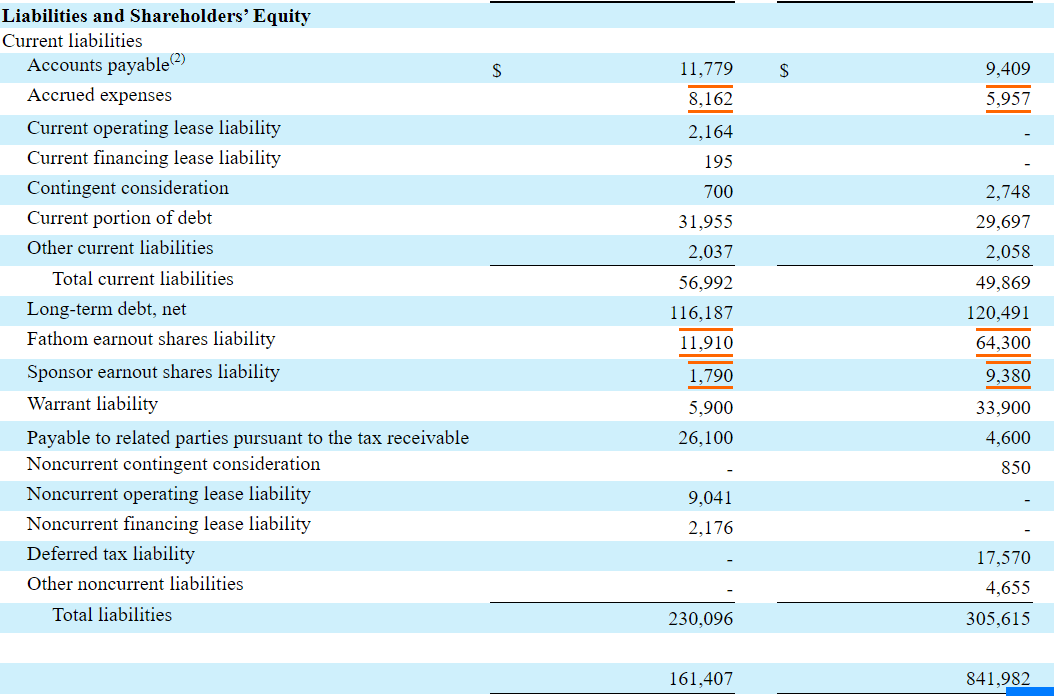

Source: Presentation To Investors

In addition to its usual manufacturing and technological implementation services, the company offers the possibility of ISO and ITAR certification of the products. As a valuable addition to its traditional services, the company has long-term training and training courses, specifically oriented to the development of professional careers. At present, they are opening a great contract process throughout the United States.

I believe that the company’s diversification will likely enhance revenue generation. Some of the industries that Fathom Digital usually works with are technology, aviation, defense, medical, and automotive among others. According to statements by the corporation, 7 of the top 10 aeronautical companies as well as 8 of the 10 largest industrial companies are using the services of Fathom Digital.

As a result of our scale and superior offerings, we have developed a loyal base of approximately 3,000 customers, including many of the largest and most innovative companies in the world, with excellent representation across Fortune’s 500 list. As of December 31, 2021, our customers included: 7 of the top 10 aerospace companies, 4 of the top 10 automotive and electric vehicle companies. Source: 10-K

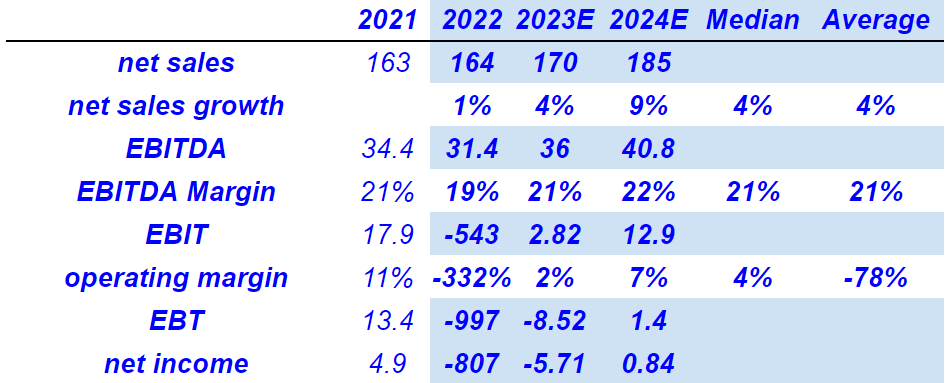

Expectations From Analysts Include Growing Free Cash Flow Margins And Positive FCF From 2023

I believe that the expectations delivered by FATH are quite positive. Fathom expects sales growth close to 7%-8.5% y/y, adjusted EBITDA margin close to $30 million, and an EBITDA margin around 18.4% and 19.4%.

For the full year 2022, Fathom expects revenue to range between $163 million and $165 million, representing year-over-year growth of approximately 7% to 8.5%. Fathom also expects Adjusted EBITDA to range between $30 million and $32 million, representing a year-over-year decrease of approximately (12.5%) to (7%) and an implied Adjusted EBITDA margin of 18.4% to 19.4%. Source: Fathom – Fathom Digital Manufacturing Reports Third Quarter 2022 Financial Results

For 2024, analysts foresee net sales of $185 million. In addition, 2024 EBITDA is expected to be close to $40.8 million with an EBITDA margin of 22%. 2024 EBIT would stand at $12.9 million, and the operating margin will likely be around 7%. Finally, the net income is expected to be close to $0.84 million.

I calculated some median and average figures in order to design my discounted cash flow models. I believe that investors would be interested in having a look at them.

Source: Marketscreener.com

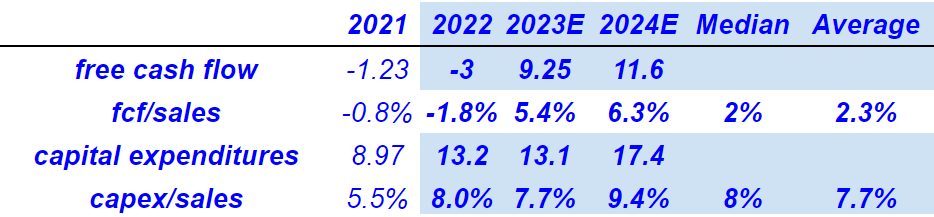

On the other hand, 2024 free cash flow is expected to be close to $11.6 million with the FCF/sales of 6.3%. Besides, 2024 capex would stand at $17.4 million with capex/sales ratio close to 9.4%.

Source: Marketscreener.com

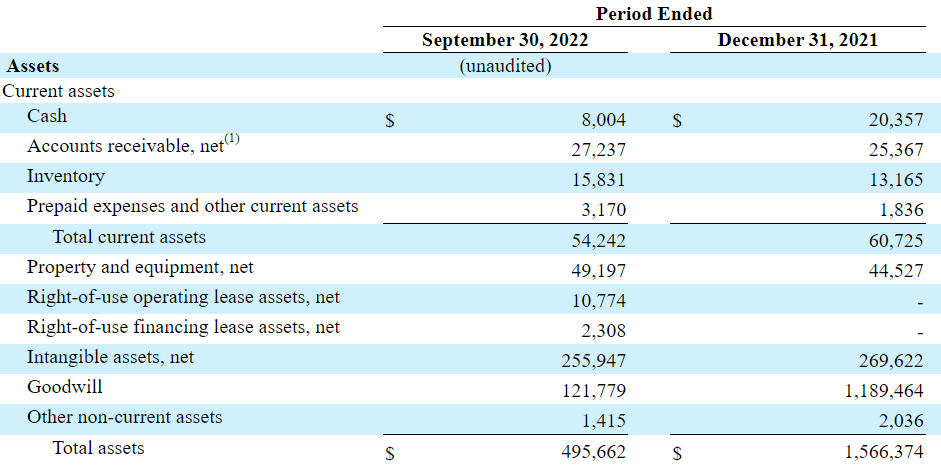

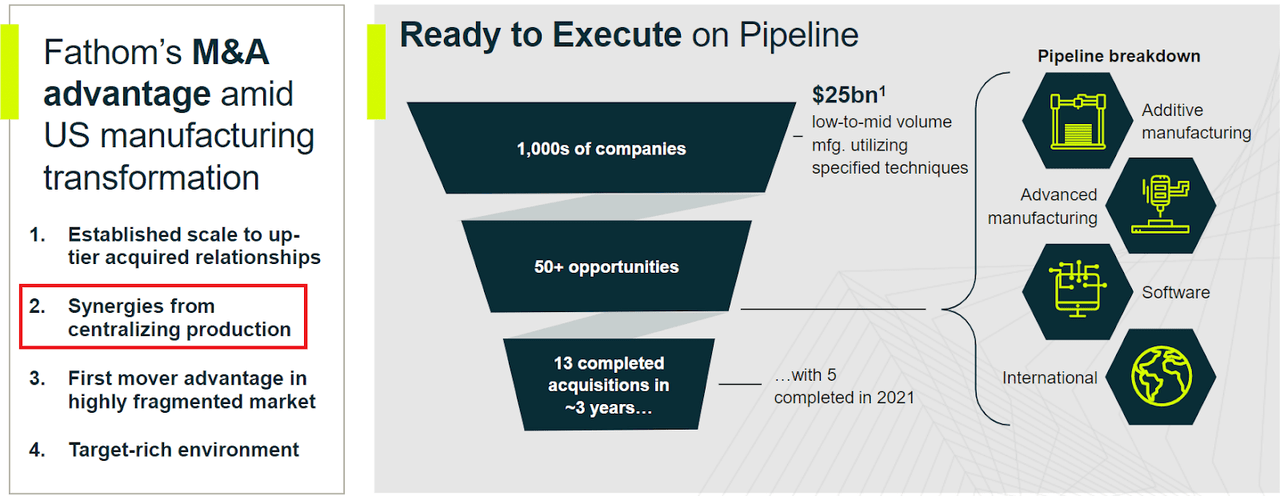

Balance Sheet

As of September 30, 2022, FATH reported cash of $8 million with accounts receivable of $27.237 million, inventory of $15.831 million, and total current assets of $54.242 million. The current assets/current liabilities ratio is lower than 1x, but I really wouldn’t expect liquidity issues.

Property and equipment stands at $49.197 million with intangible assets worth $255.947 million, goodwill worth $121.779 million, and the total assets of $495.662 million. The asset/liability ratio is close to 2x, so I believe that the balance sheet stands in good shape.

Source: 10-Q

The list of current liabilities include accounts payable of $11.779 million, accrued expenses of $8.162 million, and current portion of debt worth $31.955 million. Total current liabilities are equal to $56.992 million. The long term debt stands at $116.187 million with an earnout shares liability of $11.910 million and payable to related parties of $26.100 million. Finally, total liabilities are equal to $230.096 million.

Source: 10-Q

Conservative Case Scenario: Robotics, Consumer Electronics Sector, And M&A Would Imply A Valuation Of $4.9 Per Share

Under my conservative case scenario, FATH would find significant demand from very different end markets and different technologies. It is worth considering that FATH works with some of the fastest growing sectors out there. Take for instance the robotics industry, which could reduce time to market from 12 weeks to 5 weeks, and may benefit from the digitalization of macro trends. Besides, companies operating in the consumer electronics sector may also solve customer labor shortage thanks to FATH’s manufacturing services.

Source: Presentation To Investors

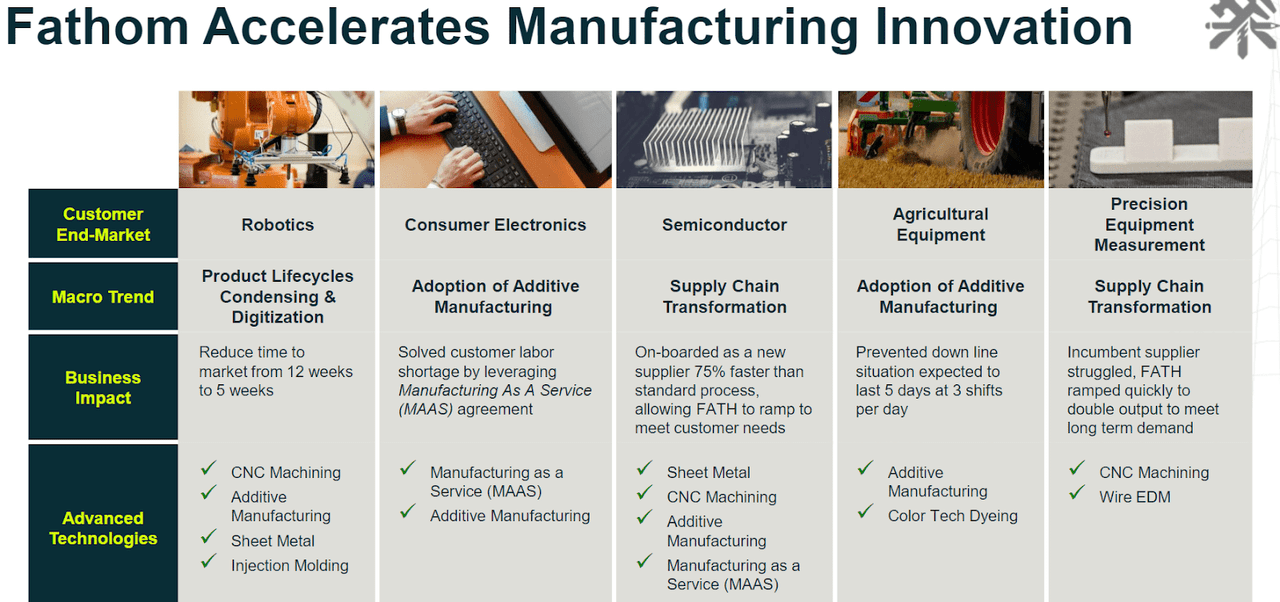

In line with my previous thoughts, management noted that the target market is expected to grow at a significant rate, which may enhance revenue growth. Keep in mind that the market opportunity is expected to grow from $25 billion in 2021 to $33 billion in 2025.

This market is projected to grow from $25 billion in 2021 to $33 billion in 2025, fueled by growth in demand for additive manufacturing and continuation of the trend of customers increasingly outsourcing their product development prototyping and low-to mid-volume manufacturing needs. Source: 10-K

I would also expect certain concentration in the industry, which may bring synergies from centralizing production. Let’s note that we are talking about sectors that are significantly fragmented. In a recent presentation, FATH noted close to 50 opportunities from a margin of close to 1000s of companies.

Source: Presentation To Investors

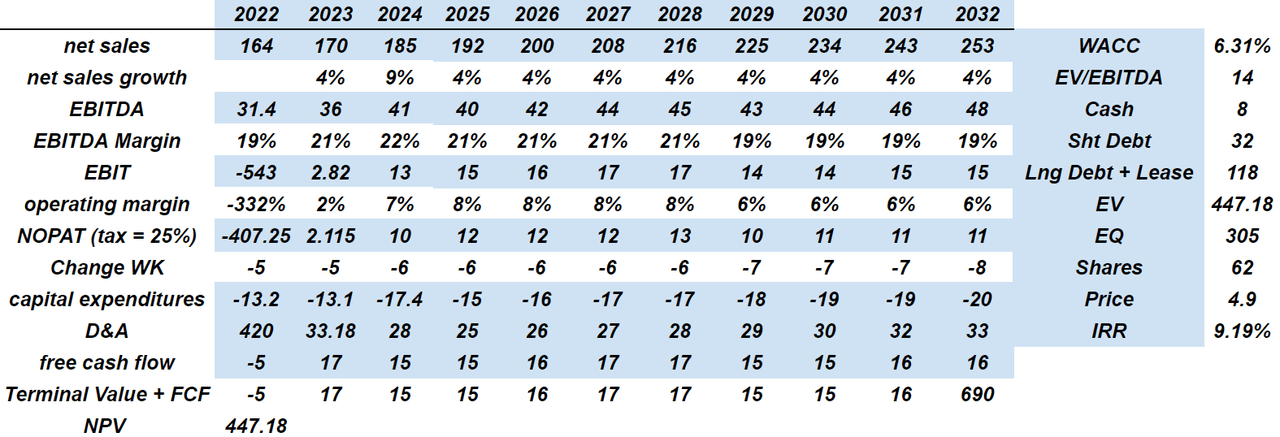

Under my conservative case scenario, I assumed 2032 net sales of $253 million and net sales growth of 4%. 2032 EBITDA will likely be around $48 million with an EBITDA margin of 19%. In addition, 2032 EBIT would stand at close to $15 million with an operating margin of 6%. The NOPAT obtained would stand at close to $11 million.

Source: Author’s Compilations

With a 2032 change in working capital close to -$8 million and 2032 capital expenditures of -$20 million, 2032 FCF would be close to $16 million. With a WACC of 6.31% and an exit of 14x EBITDA, the sum of future FCF would stand at $447.18 million. If we also include cash in hand of $8 million and short-term debt of $32 million, the equity valuation would be close to $305 million. Finally, the fair price would be $4.9 per share, and the internal rate of return would be close to 9.19%.

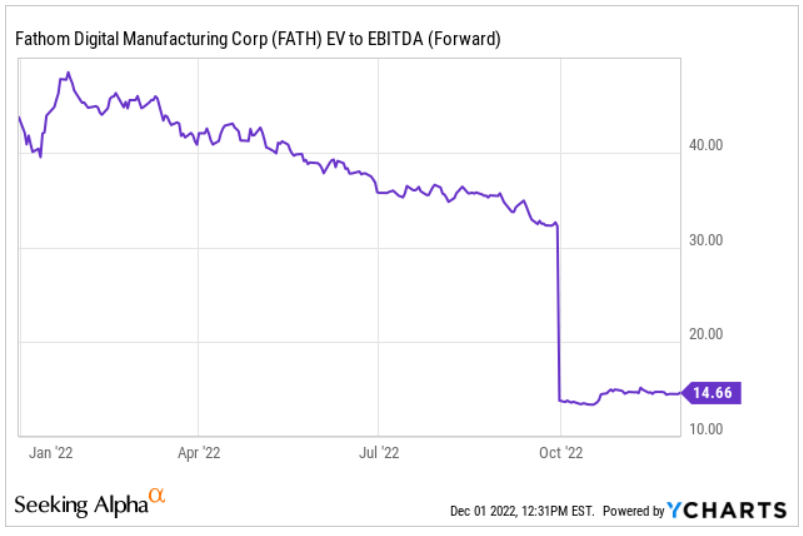

Source: YCharts

Risks From Failed Acquisitions, Lack Of Scalability, Less Headcount Growth Could Imply A Valuation Of $1.55 Per Share

Under a very bearish case scenario, I would include failed acquisitions and strategic relationships with large companies. As a result, the company’s new offering would not grow as expected, and revenue growth would be limited. Management discussed these risks in a recent annual report.

We have completed 13 acquisitions during the last three years, and we intend to continue to aggressively pursue attractive opportunities to enhance or expand our offerings through acquisitions, strategic relationships, joint ventures or investments that we believe may allow us to implement our growth strategy. Source: 10-K

FATHs’ headcount increased significantly from 2018. The number of employees multiplied by more than 15-16. In my view, it may be difficult for management to grow the headcount at the same rate in the coming years. Lack of personnel could lead to less sales growth and lower free cash flow margins. As a result, I believe that FATH’s fair valuation would decline.

For example, we have grown from 44 full-time employees as of October 31, 2018 to 706 full-time employees as of December 31, 2021. We expect this growth to continue and the number of facilities from which we operate to increase in the future. Source: 10-K

Finally, technological challenges may arise as FATH tries to grow. If FATH can’t scale up its operations and can’t adapt the company’s existing technology, in my view, revenue growth would be lower than expected. Management discussed these risks in a recent report.

Similarly, our manufacturing automation technology may not enable us to process the large numbers of unique designs and efficiently manufacture the related custom parts in a timely fashion to meet the needs of our customers as our business continues to grow. Any failure in our ability to timely and effectively scale and adapt our existing technology, processes and infrastructure could negatively impact our ability to retain existing customers and attract new customers, damage our reputation and brands, result in lost revenue, and otherwise substantially harm our business and results of operations. Source: 10-K

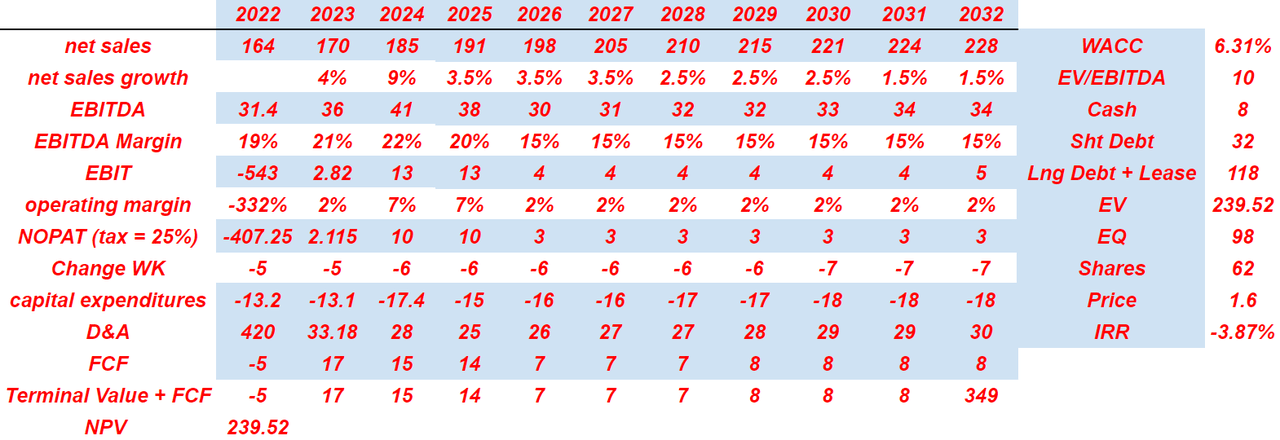

Under the previous conditions, I assumed 2032 net sales of $228 million with a net sales growth of 1.5%, 2032 EBITDA of $34 million, and an EBITDA margin of 15%. 2032 EBIT would stand at $5 million with an operating margin of 2%, which implied a NOPAT of $3 million.

Source: Author’s Compilations

By assuming 2032 change in working capital of -$7 million, 2032 capex of -$18 million, and D&A of $30 million, I obtained FCF of $8.5 million. The sum of future free cash flow discounted with a WACC close to 6.5% stands at close to $239.5. Let’s note that I am assuming a terminal EV/EBITDA of 10x, cash of $8 million, and long term debt and leases worth $118.5 million. The results included a price of $1.55 per share, and an IRR close to -3.5%.

My Takeaway

FATH brings innovative technology to clients in growing sectors involved in the industry 4.0 revolution. Clients in the robotics industry or consumer electronics sector are expected to receive valuable technological additions from FATH’s digital solutions. Besides, both management and financial analysts are expecting growth in free cash flow. Under my own discounted cash flow analysis, I obtained a fair valuation that is significantly higher than FATH’s current stock price. I also found several risks from potential decrease in the headcount growth and potential lack of scalability. With that, I don’t believe that potential risks may justify the current market capitalization.

Be the first to comment