Andrii Yalanskyi/iStock via Getty Images

Investment Thesis

Phillips 66 (NYSE:PSX) hasn’t quite delivered against its refining peers. Indeed, its share price hasn’t really moved off the $90 to $100 per share level for approximately seven years.

Now that the Phillips 66 new CEO, Mark Lashier, has been on board for a few months, Phillips 66 has had an Investor Day.

Phillips 66’s Investor Day discussed a multi-pronged approach to drive shareholder returns. From improving Phillips 66’s refining business through a focus on reducing costs to increasing its share buyback by $5 billion by the end of 2024, as well as keeping its framework of returning 40% of its cash flows to shareholders.

There are many positive aspects to get investors excited. So, let’s get to them.

Did Phillips Get The Dividend Memo?

We are at a very interesting crossroads right now. On the one hand, most governments have openly declared their animosity towards fossil fuel companies. ”Fat shaming” profitable energy companies gets political points from both sides of the aisle.

On the other hand, no suitable, realistic, affordable, and reliable energy source appears to be available at any point in the next five years.

Consequently, how should energy companies invest in capex in this environment? Nobody wants these companies to invest in capex.

Not politicians, that are actively doing everything to prevent an increase in supply. And not investors, that are clearly favoring companies with strong capital allocation policies. Particularly companies with strong dividends. That being said, on this front, PSX does not appear to have got the memo. As PSX continues to favor a balanced approach to capital returns.

Capital Allocation Policy, +40% Returns

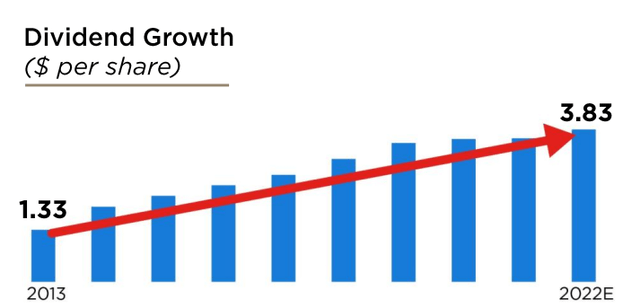

Before updating PSX’s current capital allocation policy, it’s noteworthy to highlight that since 2013, PSX’s dividend has grown by 18% CAGR. Investors often want to back high-quality companies, with strong dividends, and I believe that PSX fits that bill.

PSX Investors Day

However, I’m not going to say that staying invested in PSX over the past five years has been easy. Indeed, in the past seven years, the share price has stayed very firmly around the ballpark of $90 per share. And that’s perhaps part of the reason for a shake-up of management and to allow the new CEO Mark Lashier takes the reigns of Phillips 66.

PSX Investors Day

For their part, Phillips 66 declares that it’s eager to return more than 40% of its cash flows to shareholders.

That being said, keep in mind that in Q3 2022, PSX had already returned 40% of its cash flows to shareholders. Thus, with that in mind, I don’t believe there was much of a meaningful update coming out of PSX’s Investor Day.

PSX Stock Valuation — Approximately 7x Free Cash Flow

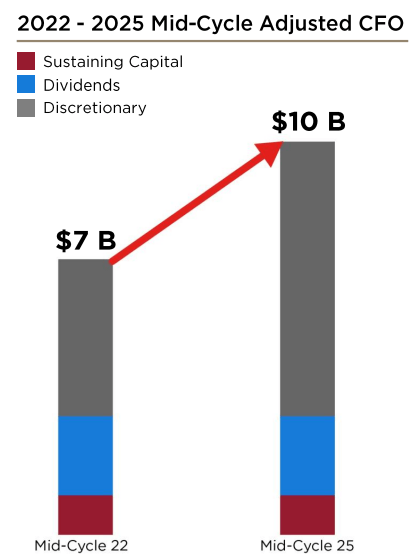

PSX believes that it can get its mid-cycle cash flows to $10 billion over the next three years.

PSX Investors Day

Meanwhile, Q3 2022 saw $3.1 billion of free cash flow. If we were to annualize this figure, we would see around $12.4 billion of free cash flow.

On the other hand, Q3 benefitted from periods when refining spreads were mighty strong. And I’m not sure it’s reasonable to expect these high refining margins to persist in 2023.

And given PSX’s substantially inbuilt operating leverage, small changes in refining margins can lead to pronounced changes in cash flows.

Hence, my point is this, $12.4 billion of free cash flows is something to aspire to rather than to expect.

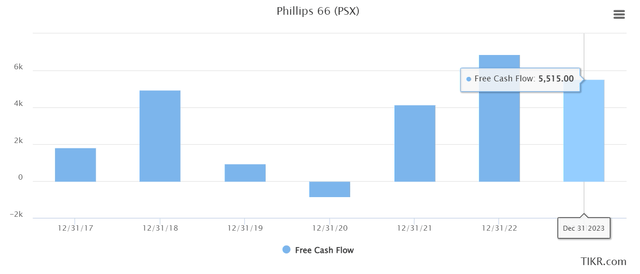

As a point of reference, consider what analysts presently believe PSX will report in 2023.

TIKR.com

As you can see above, analysts believe that PSX will mean revert lower in 2023. In fact, analysts believe that PSX’s full year 2023 will be less than $6 billion.

For my part, I don’t agree with that insight. Indeed, if anything, I believe that 2023 could be even better than 2022. However, I can’t be too quick to dismiss the fact that cash flows could be lower in 2023.

So, for now, I’m expecting much of the same, as my base case.

The Bottom Line

The one negative consideration facing Phillips 66 is that its dividend yield, at less than 4%, isn’t high enough to entice dividend investors into the stock.

On the other hand, as Phillips 66 continues repurchasing shares, its total shares outstanding will decrease, which will translate into higher dividends per share.

Be the first to comment