Zigmunds Dizgalvis/iStock via Getty Images

Investment Thesis

Construction Partners (NASDAQ:ROAD) is a civil infrastructure company. They recently announced the Q4 FY22 result. Their revenues are growing at an impressive rate, and the management has updated with FY23 guidance, with revenue of FY23 expected to exceed the revenue of FY22 by more than 16%. They also acquired three hot mix asphalt plants in Nashville metro area, expanding their business in the new growing market. I am very optimistic about the company’s growth, and I think ROAD is a great buying opportunity right now, which can give solid returns in the future.

About ROAD

ROAD is a civil infrastructure company that mainly focuses on constructing and maintaining roadways across Alabama, North Carolina, South Carolina, and Georgia. It was incorporated in 1999 and headquartered in Dothan, Alabama. It also manufactures hot mix asphalt and sells it to third parties engaged in construction and paving activities. Public sector projects like state roadways and airport runways make up a majority of its business, but they also undertake private projects like shopping centers and industrial parks.

Financial Analysis

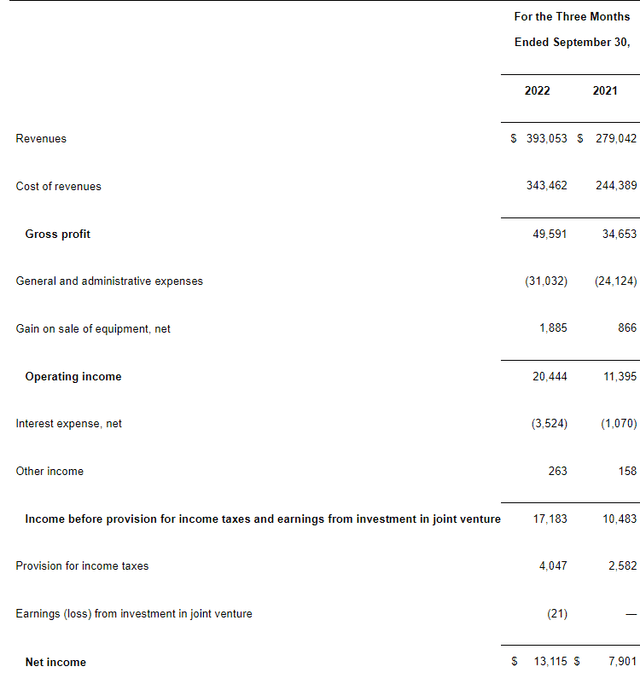

ROAD recently announced its Q4 FY22 results, and in my view, it’s quite impressive. They beat the market EPS estimates by 2.46% and market revenue by 10.14%. The reported revenue for Q4 FY22 was $393 million, a rise of 40.8% compared to Q4 FY21. In my opinion, the main reason behind this increase was the healthy funding of projects at the state and federal levels; another reason was the robust project demand environment. They reported a net income of $13.1 million for Q4 FY22, an increase of 66% compared to Q4 FY21. I think the primary reason behind this increase was the increase in project bidding margins. Their Q4 FY22 adjusted EBITDA also rose by 45% compared to Q4 FY21. The reported diluted EPS for Q4 FY22 was $0.25, a rise of 66.6% compared to Q4 FY21. Overall, the financial performance of ROAD in Q4 FY22 is very impressive, and they have constantly been posting solid financial results from the last two financial years.

Technical Analysis

Currently, ROAD is trading at the level of $27.96, and it is consolidating in the range of $32.87-$25. The stock has broken the structure of lower highs and lower lows, forming from November 2021. We should wait for the stock to break the level of $33. If it breaks the level of $33, we can see an upside of 30%. The stock is currently taking support of the 200 ema, which is at the level of $27.6, and the next big support for the stock is at $24. If the stock reaches a $24 level, one can add it to their portfolio for long-term investment purposes.

Should One Invest In ROAD?

Recently, ROAD has acquired three hot mix asphalt plants in the Nashville, Tennessee, metro area. Nashville metro is a fast-growing area, and I think these acquisitions will help increase its future revenues and solidify its position in the new market. These acquisitions show that the management is committed to expanding its business, ensuring an optimistic future for the company. Even in this time of rising inflation, the company posted solid financial results throughout the year, showing its potential and ability to generate income even in tough times.

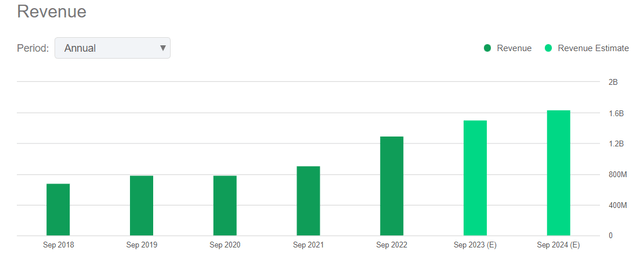

Now talking about the revenue estimates, they have estimated the annual FY23 revenue to be around $1.51 billion, which is approximately 16.1% higher than the FY22 revenue. I think the acquisitions done by them and their expansion in new markets will help them achieve their revenue targets for FY23. They have revenue growth (YOY) of 42.9% and revenue 3-year (CAGR) of 18.45%. We can see in the last three years their revenue has grown at an impressive rate and I think they will continue to grow in future.

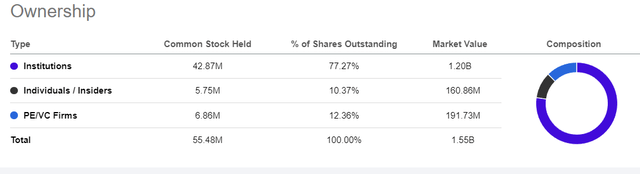

The shareholding pattern of ROAD also looks impressive. Institutions own 77% of the shares in the company, which is a positive sign. This is the reason we see less volatility in the price fluctuations of ROAD shares. This shareholding pattern also shows us that institutions trust ROAD for the future.

After looking at all the parameters, I believe ROAD is a safe and attractive buy for the future. I think it can give handsome returns in the next one year.

Risk

High Dependence On Public Funded Projects

They highly depend upon the state and federal government’s contracts for infrastructure construction. In FY22, publicly funded projects and the distribution of construction materials to local and state governments accounted for 61% of its revenues. This shows their high dependence, which can be a matter of concern. If there is a decrease in government spending, then the revenues of the company might be severely affected. Government spending depends upon the economic condition, and various factors can affect the budget, like inflation, recession, and the global economic situation. So the budget can be very volatile, and most of the contracts are determined through the bidding process, which makes it very difficult to win a contract because of the high competition in the industry.

Bottom Line

In the last two years, they have performed well financially. The strategic acquisitions and management’s optimistic FY23 guidance shows the caliber of the company. They are trading at 38%, down from their all-time high, which provides a great investment opportunity because I think they can give solid returns in FY23 due to the increased revenue estimates and their expansion in new markets. So after analyzing all the parameters, I believe ROAD can be a good bet for the next two years, and I am long on ROAD.

Be the first to comment