DNY59

Investment thesis

Upstart Holdings (NASDAQ:UPST) is an AI financial technology company that has been harshly punished by Mr. Market due to the high uncertainty of today’s economic environment. Inflation and rising interest rates have caused a decline in consumer loan demand, as institutional investors require higher returns on their investments. I am highly confident in UPST stock at its current price; I project it will deliver a 23.2% CAGR over the next six years with 71% margin of safety – an attractive cushion for investors seeking above-average returns.

I believe Upstart to be deeply undervalued due to the high cyclicality of its business model. This is a short-term issue because they are shifting towards bank and credit unions as a funding funnels opposed to capital markets, plus interest rates will normalise soon. With their AI models ahead of the competition, I assign a buy rating on Upstart.

The business

Upstart was founded in 2012 by former Google employees Dave Girouard, Anna Counselman, and by Peter Thiel fellow Paul Gu. With the idea that credit should be more accessible as opposed to traditional lending being too slow and cumbersome with multiple pain points, Upstart focuses on providing an alternative to make it easier for people to access credit. Its platform connects borrowers with investors from bank partners or institutional investors who fund and purchase loans.

Upstart offers personal loans to consumers with no or limited credit history. Its lending process employs machine learning and data-driven underwriting, enabling it to better assess borrowers’ creditworthiness based on factors like education, employment history, and income. Upstart’s interest rates are lower than legacy lenders’, allowing individuals access to cheaper credit. Data shows that average loan APRs continue improving as the company’s models become more autonomous.

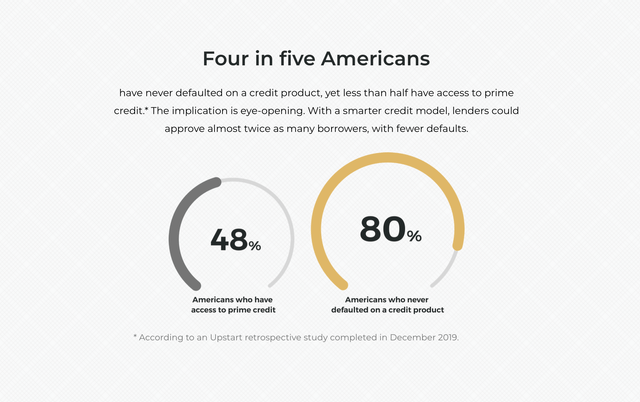

Upstart stands out from other fintech and legacy companies with its ability to offer loans at cheaper rates to a larger pool of people. This ease–of–use would not be available without Upstart’s machine learning solutions, which have achieved impressive results in recent years: 43% more black borrowers were approved for credit last quarter, with 24% lower average percentage rates (APR) than legacy models; additionally, 46% more Hispanic borrowers received approval from Upstart‘s model at 25% lowerAPR than traditional underwriting methods.

Value proposition

I believe Upstart offers a superior value proposition, which can be broken down into two different parts: the consumer and the bank partner. With regards to consumers, Upstart can offer a product with a 16% lower average APR for approved loans while approving more than 27% of borrowers than traditional models.

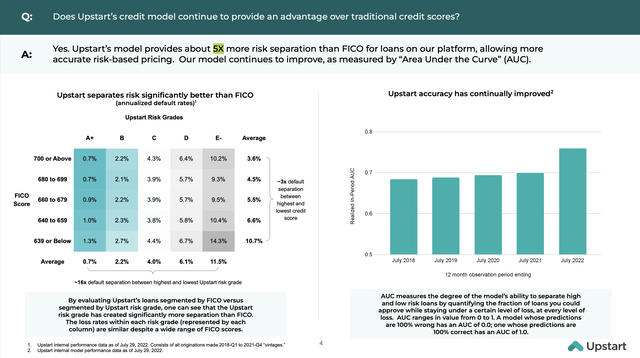

Traditional lending systems employ FICO scorecards, which leverage only a restricted number of variables (12 to 20 variables) as opposed to Upstart’s model with approximately 1,600 variables spanning from credit experience to educational history, occupation to the cost of living, etc. Therefore, I believe that consumers have far greater advantages when choosing Upstart over traditional models as they can borrow money at more convenient terms and pricing conditions based on their actual creditworthiness.

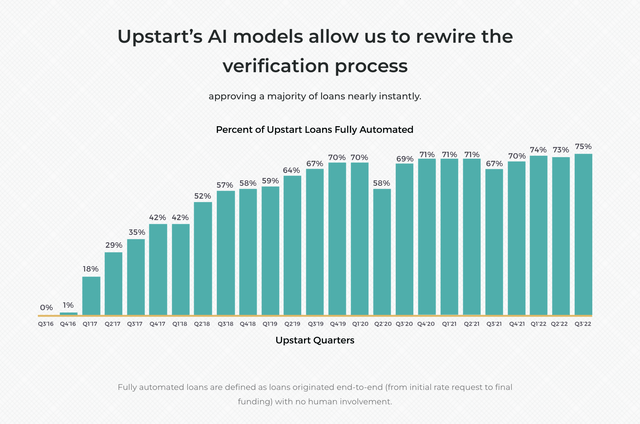

The company’s value proposition to its bank partners allows them to easily integrate with Upstart’s platform (the company’s application programming interface software works with 99% of banks’ systems), also enabling them to acquire new customers with higher loan approvals for the same risk loss and also with more ease, as 75% of loans are performed without documentation alongside with the option to apply from any device at any time with no human interaction.

Like consumers, Upstart’s bank partners can benefit from its AI technology, as they can further grow their penetration rates and contextually originate more loan volumes because of better risk assessment capabilities allowed by Upstart’s AI technology.

So, what I believe Upstart is trying to accomplish is to make credit more accessible to as many people as possible with limited or no credit history focusing on eliminating frictions related to loan originations “increasing sophisticated models that predict cash flows of loans” (Dave Girouard at the JMP securities technology conference, March 8, 2022).

Upstart does not originate loans, but it enables its bank partners to underwrite them through AI models. In 2022 the banks retained 28% of these (compared with 16% in 2021 and 21% in 2020), while institutional investors bought 72%, via Upstart‘s funding programs (80% and 77%, respectively). The rest was kept by Upstart for R&D purposes. As of December 31, 2021, 94 % of revenues came from fees; 6 % from interest income. Fees were further broken down as follows:

- Referral fees: in 2021 they accounted for 62% of fee revenues. They are paid when a loan is referred from Upstart.com to the bank or credit union partners’ website.

- Platform fees: they make up 29% of total fees, and are paid whenever a loan is originated through the company‘s platform, regardless of who sourced the borrower.

- Servicing fees: they depend on the outstanding principal and are paid monthly over the life of loans powered by Upstart.

AI/ML models

There are three core fundamental building blocks on which Upstart’s AI model is based:

- Rows of data (repayments data of all the loans that have been performed)

- Columns of data (every piece of information that Upstart knows about people who have applied for a loan)

- Learning algorithms

During Citi’s 11th annual fintech conference, Paul Gu highlighted that to successfully build and develop an AI system, it’s necessary to address the aforementioned three building blocks “in concert,” since if only one is moved, the remaining two become limiting factors quickly. For example, even with a large number of training data but weak AI models or powerful AI models with limited data columns/rows, the result will be worse despite betterment in one or two building blocks.

I believe Upstart has a more efficient and effective model than the traditional ones as it is demonstrated by the data provided below:

- 75% fewer defaults at the same approval rate

- 27% more approvals than traditional models, with 16% lower APR for borrowers

- 173% more approvals at the same loss rate

- More than 80 NPS (Net promoter score) compared to less than 30 NPS achieved by top tier banks

- High rating on Trustpilot: 4.9/5 stars

- 5x more predictive than credit score during Covid-19

- 70% of loans are fully automated without documentation. Differently from traditional models, Upstart offers an all-digital experience without documentation

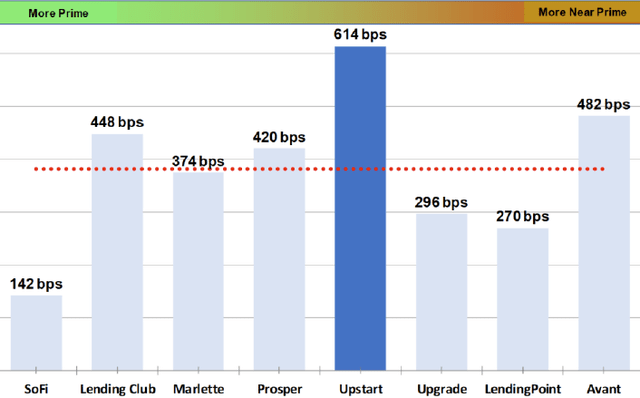

I think is insightful to compare Upstart’s loans to those of other digital lending platforms. The Citi Research team has conducted an analysis based on several data points from Kroll Securitization Trust Surveillance Reports that were issued during the last twelve months highlighting Upstart’s competitive advantage versus its competitors.

Citi research

The study revealed that Upstart‘s loans (issued to third parties) outperformed Kroll‘s base case estimates of its cumulative net loss (CNL) by 614 basis points and the average by 240 points. Additionally, Upstart’s securitized loan rating was far higher than LendingClub at 448 basis points or Sofi at 142. This indicates that Upstart can target borrowers perceived as riskier by their competitors, but are actually less risky than thought.

The company’s overperformance (Delta = 240 BPS) shows how much Upstart’s AI models are superior at predicting risk by that amount compared to other online lending platforms. As of October 2022, Upstart’s model managed to be more accurate at predicting defaults by 5x compared to FICO.

Competitive advantage

What I regard to be Upstart’s main competitive advantage is the combination of its machine learning capabilities and the data that were fed to the company’s AI system over the last 9+ years. These are two parts of the same equation that cannot be separated when they are addressed. As was already mentioned above, Paul Gu explained the peculiarity of building and further developing an AI system addressing “in concert” the three following building blocks: rows of data, columns of data, and learning algorithms.

I believe this major competitive advantage from Upstart is demonstrated among other things by the superior ratings (see Citi’s results that were mentioned above) that the company’s loans received compared to competitors like Sofi, LendingClub, or Avant. With regards to data, Upstart employs more than a thousand variables and millions of repayments data (rows of data) in order to train its models, which constantly learn from them, as opposed to traditional systems using 10 to 20 variables.

I expect that as Upstart’s AI models get better over time and the amount of data employed continues to grow, the higher will be the number of bank partners and credit unions, and also the number of loans that will be powered by leveraging the company’s AI technology. This network effect will continue to strengthen over time: more data and more accurate AI models lead to higher approval rates at the same loss rate and also better pricing conditions, which lead to more borrowers and potential bank partners and the cycle continues.

Valuation

|

Loans |

Q3 2022 |

Q2 2022 |

Q1 2022 |

2021 |

2020 |

2019 |

|

Loans retained by partners (%) |

28% |

26% |

N/A |

16% |

21% |

23% |

|

Loans purchased by Institutional investors (%) |

65% |

67% |

N/A |

80% |

77% |

70% |

|

Loans retained by Upstart (%) |

7% |

7% |

N/A |

4% |

2% |

7% |

I believe that in 2022 and in 2023 Upstart is going to underwrite much fewer loans as further interest rate hikes are on the horizon. This will inevitably undermine Upstart’s profitability over 2022 and 2023 as institutional investors prefer to remain on the sideline. Despite this, Upstart’s contribution margins have constantly increased both Q/Q and Y/Y. This reflects Upstart’s take rate increase, which is the result of the company’s significant pricing power.

|

KPIs |

Q3 2022 |

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

|

Contribution margin |

54% |

47% |

47% |

52% |

46% |

|

Take rate |

9,7% |

7,9% |

6,9% |

7% |

6,7% |

Upstart‘s revenue guidance forecasts $800 million in 2022. However, I think 2023 could be uncertain due to a potential recession and weak macro conditions. On the other hand, Upstart is rapidly growing its auto lending segment by gaining new dealerships at a rapid rate which may positively impact their 2023 results. Therefore I assume no growth for 2023 but 25% revenue growth from 2024–2027 as interest rates fall and demand from institutional investors rises again.

|

Assumptions |

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

|

Revenue |

$800 |

$800 |

$1000 |

$1250 |

$1562,5 |

$1953,1 |

$2441,4 |

|

Revenue growth |

0% |

25% |

25% |

25% |

25% |

25% |

Figures are in million excluding percentages

I estimate Upstart‘s FCF margin will be 30% by 2028, resulting in a fair value of $4.88 billion based on a discounting rate of 15%. Dividing the previous figure by the company’s shares outstanding (without assuming buybacks) yields an intrinsic value per share of $59.5 and provides 71% upside from today’s price of $17/share. This implies a 23.2% CAGR by 2028.

|

Assumptions |

Estimates |

|

FCF margin |

30% |

|

FCF (2028) |

$732,4 |

|

Discount rate |

15% |

|

Intrinsic value |

$4882,6 |

|

Shares outstanding |

81,96 |

|

Intrinsic value per share |

$59,5/share |

Figures are in million excluding percentages

Risks

Worsening macroeconomic conditions have significantly harmed Upstart‘s economic results, resulting in a strong reduction of loans volume and demand in the second half of 2022. I believe this will continue to damage its unit economics next year. As discussed earlier, Upstart should reduce its funding source from capital markets and rely more on bank partners to reduce its reliance on changes in macro conditions.

Conclusion

I believe that Upstart’s business performance will suffer in the short term (last quarter of 2022 and 2023). Nevertheless, if the business continues to strengthen its AI model underwriting capabilities and land new bank partners while operating in a normalized interest rate environment, I expect Upstart to further scale its business operations. I think that for Upstart to continue to grow its volumes and top line, it needs to keep shifting its funding source from the capital markets to its bank partners, which would ultimately result in a more resilient take rate for the company

Be the first to comment