RoschetzkyIstockPhoto

Overview

The Invesco Solar Portfolio ETF (NYSEARCA:TAN) provides exposure to companies in the solar energy industry. The fund tracks the MAC Global Solar Energy Index (“Index”) and will invest at least 90% of its total assets as per the Index.

The fund and Index are refreshed on a quarterly basis. As at 12/13/2022, the fund was invested in 53 different holdings.

The fund has an expense ratio of 0.66% per annum. According to etfdb.com, Invesco and Global are the only two ETF providers that offer pure solar energy ETFs.

The Invesco Solar ETF is more expensive than the Global X Solar ETF when comparing the expense ratios.

Fund Performance

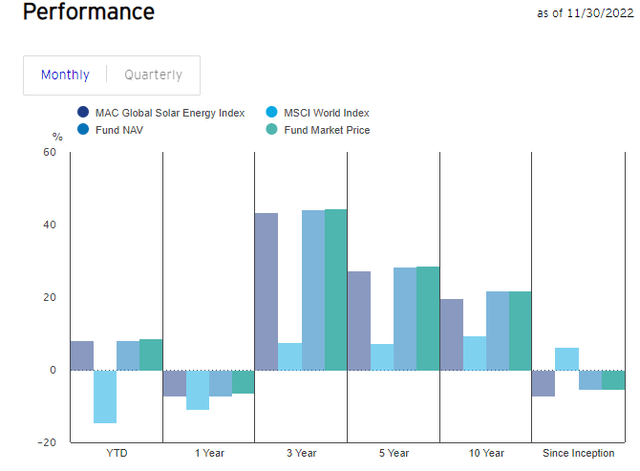

The TAN fund has returned -5.31% per annum since its inception in 2008. However, it has delivered remarkable returns over the last 3-, 5- and 10-year periods, outperforming the MSCI World Index over the same periods.

The fund’s performance can be seen below:

According to Invesco, a hypothetical investment of $10,000 in 2012 would be worth nearly $55,000 in 2022, reaching a peak of $80,000 in 2021.

I am an advocate of long-term passive investing, but knowing when to buy and take profits can lead to outsized market-beating returns, as demonstrated by the fund performance history.

Portfolio

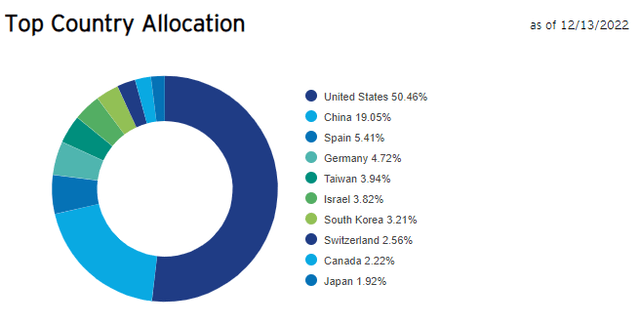

The fund’s portfolio exposures are regionally diversified across multiple countries, with the highest country exposure being the United States and Japan the smallest.

The fund is heavily weighted towards the United States, China, and European countries, which constitute nearly 80% of the portfolio exposures.

The fund’s country breakdown can be seen below:

The fund is ideally positioned to benefit from the energy policy reforms being implemented via the Inflation Reduction Act (United States), the REPowerEU plan (European Union), and the 14th Five-Year Plan (China).

In the next section, we will discuss some positive catalysts for the fund.

Positive Catalysts

The Russian invasion of Ukraine has been a turning point for renewables globally. Governments around the world have made energy security a primary focus, which has expedited the transition to clean energy.

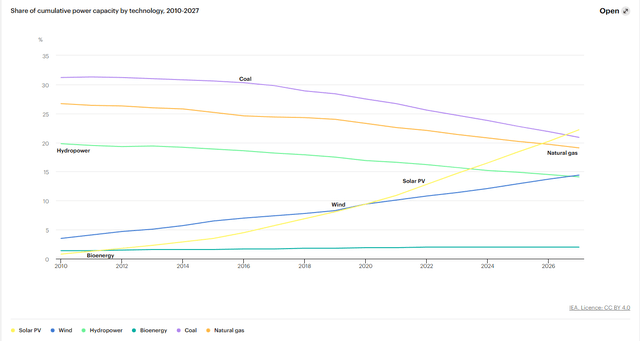

The IEA forecasts that solar PV capacity is expected to surpass coal by 2027, becoming the largest share of power capacity in the world.

The main drivers behind the forecast are the energy policy reforms in the U.S., China, and the European Union.

The graph above shows that the cumulative solar PV capacity is expected to double from 2021 to 2027, exceeding natural gas by 2026 and coal by 2027.

Global solar PV capacity is expected to grow year-over-year as it remains the least costly option for many countries due to energy policy reforms.

The Inflation Reduction Act (United States), which was passed in August 2022, provides clean energy tax credits to incentivize the production of renewable energy.

Clean energy tax credits lower the upfront capital cost of solar PVs, which encourages investment in solar.

The IEA forecasts that solar PV capacity is expected to double in the U.S. by 2027 due to the Inflation Reduction Act.

The legislation offers long-term policy visibility until 2032 and therefore provides strong traction for the expansion of solar PV projects.

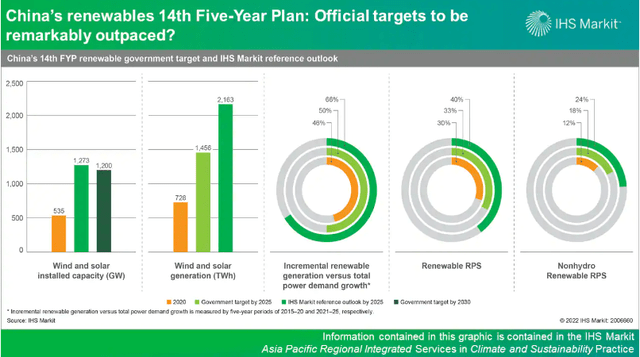

Similarly, China has also announced its intention to double its renewable capacity by 2025. The government indicated a target of 1,273 GW by 2025 for additional wind and solar capacity, which is equivalent to a 50% growth of China’s entire installed power capacity today.

In the next section, we look at some of the risks which may impact the fund.

Risks

China continues to dominate the manufacturing of global solar PV, although its global share is expected to decrease from 80-95% today to 75-90% as India and the United States ramp up their investments in the sector.

Hence, supply chain risks and potential trade barriers between the U.S. and China remain a key risk for the fund. The intense technology war between the U.S. and China could spread and hit the solar manufacturing segment.

Higher commodity prices have also been a pain point, increasing the upfront cost for installing solar PVs.

Conclusion

The TAN fund is ideally positioned to benefit from the energy policy reforms being implemented in the United States, European Union, and China.

Overall, I think that the recent decline in the fund market price provides a good opportunity to build long-term exposure in the solar energy thematic.

Be the first to comment