Try Media/iStock via Getty Images

Introduction

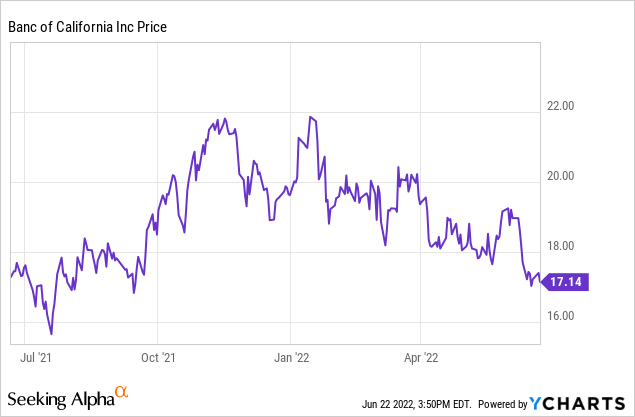

In November of last year, I rated Banc of California (NYSE:BANC) a “hold” as even though I liked the bank’s performance, I wasn’t willing to pay 13 times its earnings and a substantial premium to the tangible book value. We’re now more than six months later and the bank’s share price has fallen by about 20%. That’s in line with the S&P 500 performance in the same period, so BANC did not do materially worse than the market, but perhaps this is a good time to have another look at this California-focused bank.

The net interest income continues to increase, and the provision reversal provides a nice boost

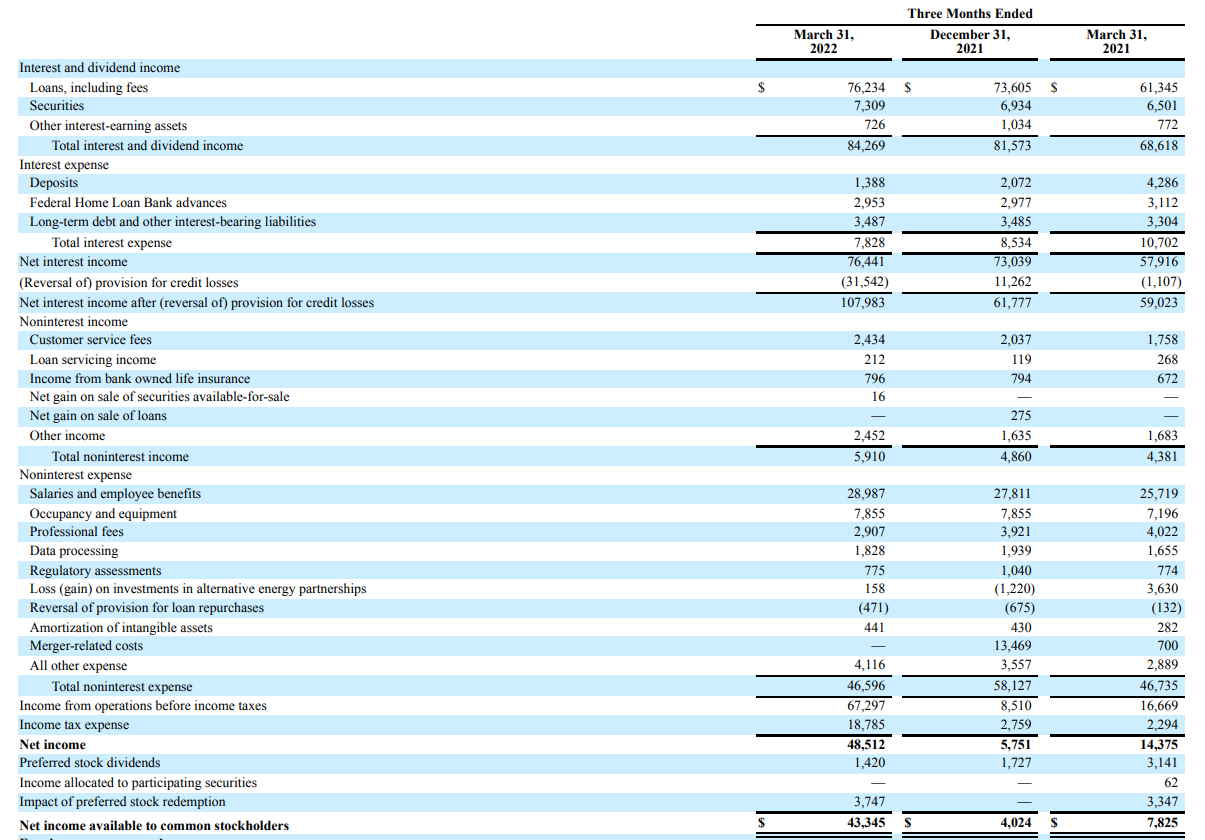

At first sight, the net interest income is still heading in the right direction as the bank reported a higher interest income and a lower interest expense. The combination of both caused the net interest income to increase from $73M to $76.5M on a QoQ basis.

BANC Investor Relations

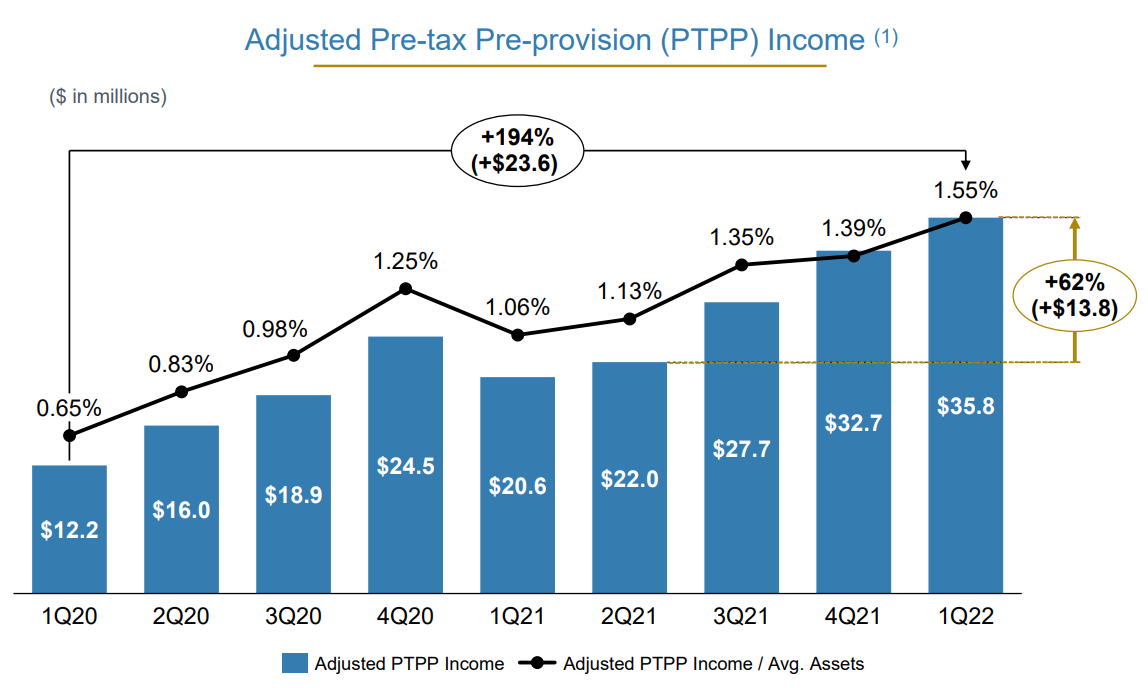

The bank also reported a non-interest income of $5.9M and a non-interest expense of $46.6M for a net non-interest expense of $40.7M. On a pre-tax and pre loan loss provision basis, the income was almost $36M. Fortunately for the bank’s shareholders, Banc of California was able to take back in excess of $31.5M in previously recorded loan loss provisions and this boosted the pre-tax income to $67.3M and the net income to $48.5M. After deducting the preferred stock dividends and the (non-recurring) impact of the redemption of those common shares, the net income attributable to the common shareholders was $43.4M or $0.69 per share.

BANC Investor Relations

Excluding the impact of the reversal of the loan loss provision and excluding the impact related to the preferred shares, the net income attributable to the shareholders of Banc of California would have been approximately $26M for an EPS of approximately $0.41. So the market was right to not trust the $0.69 EPS at face value as there’s more than meets the eye here.

BANC Investor Relations

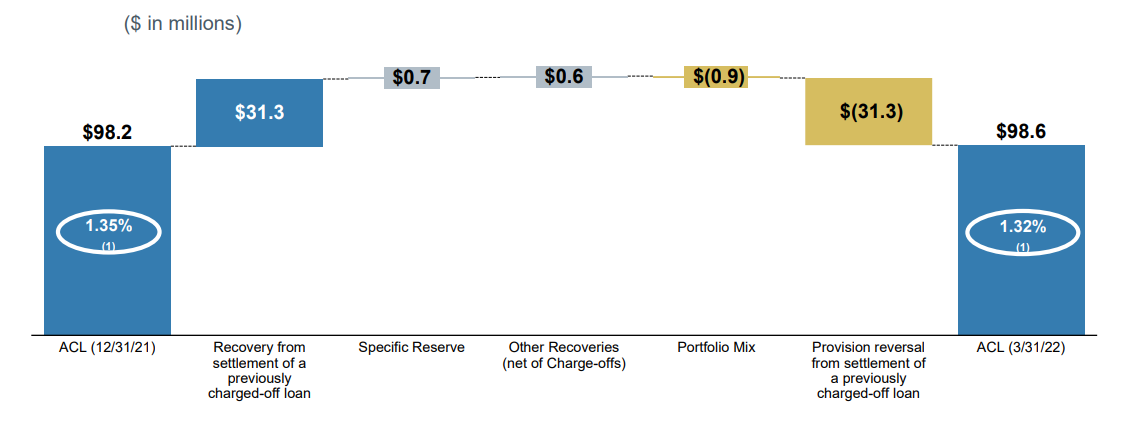

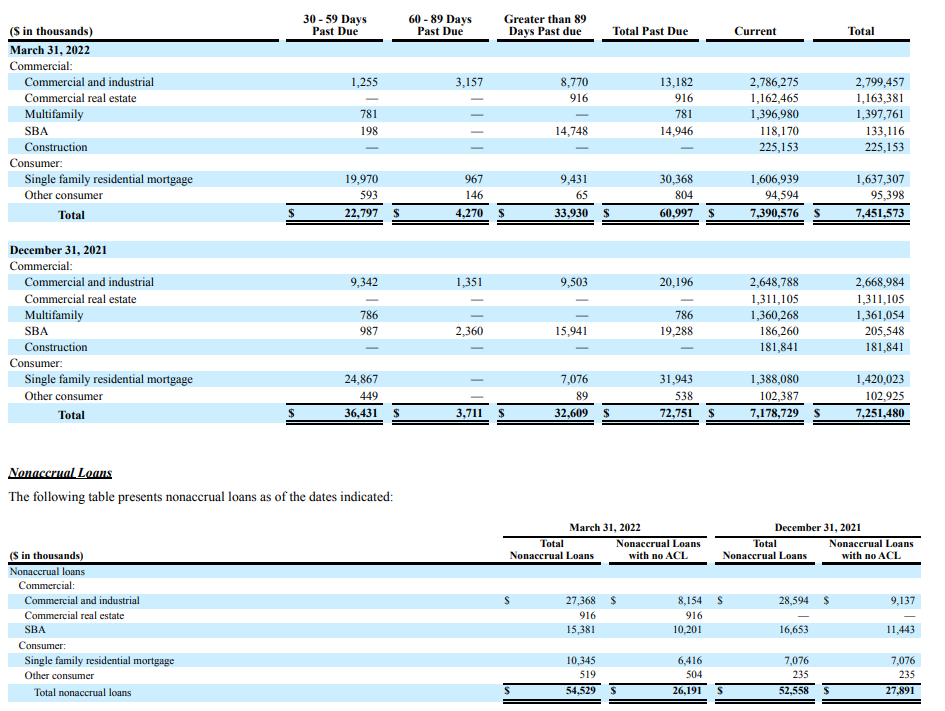

The reversal of the loan loss provision is interesting, but understandable. As of the end of March, the bank had just over $54M in non-accruing loans on a total of $7.25B in loans. An additional $61M of loans are past due, which means about $125M of loans are either non-accruing or past due. That’s a small improvement compared to the end of last year, when the total amount of non-accruing loans and loans past due totaled $125M.

BANC Investor Relations

And as you can see on the image above, the total amount of loans with no ACL has decreased even though the total amount of loans that are classified as non-accrual have increased.

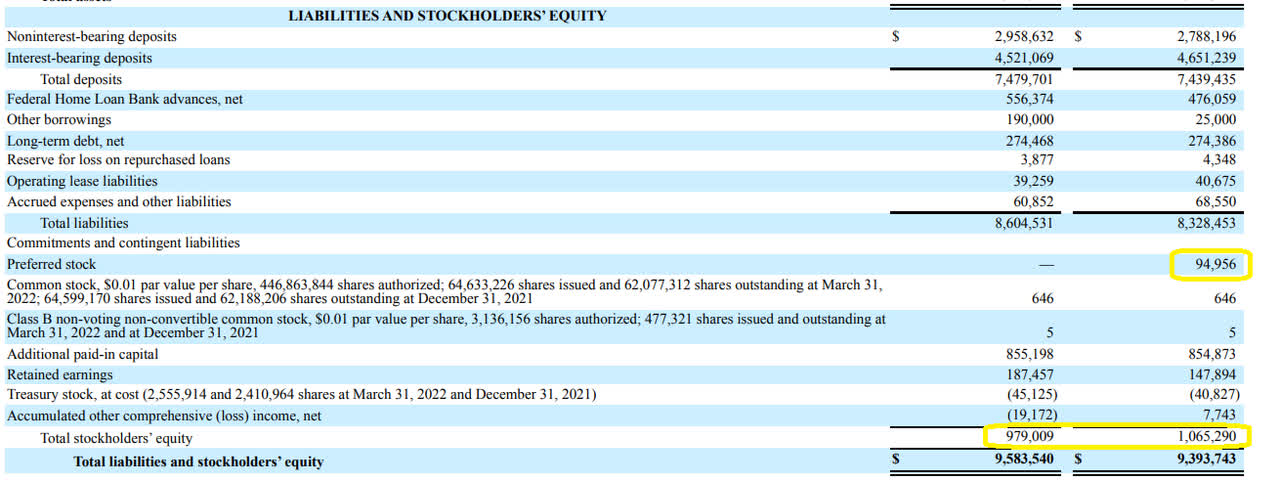

The equity value drops below $1B, but there’s no need to be alarmed

Looking at the liabilities and equity side of the balance sheet, we notice the total equity portion of the balance sheet has shrunk.

BANC Investor Relations

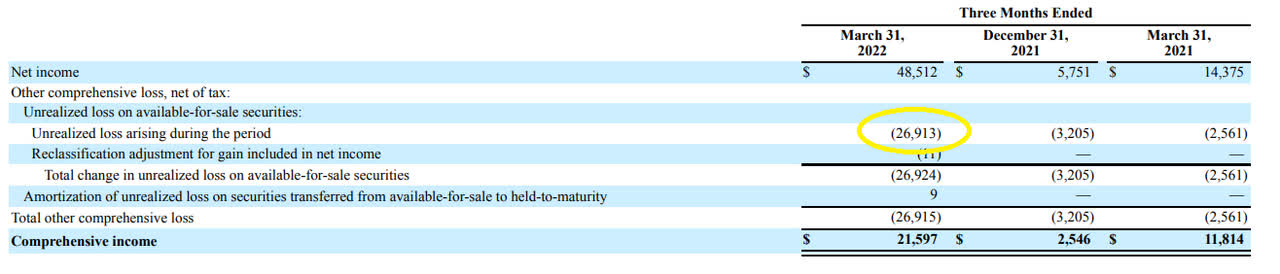

A portion of this decrease could be explained by the $27M in unrealized losses on the securities’ portfolio, but the main culprit is the decision of the Banc of California to redeem almost $100M in preferred shares (which were costing about $7M in preferred dividends per year). The unrealized loss on securities (shown below) was easily covered by the retained earnings in the first quarter (thanks to the non-recurring benefit of recouping previously recorded loan losses).

BANC Investor Relations

In fact, although the bank confirmed unrealized losses to the tune of $27M and spending almost $100M on redeeming the preferred shares, the equity value of the balance sheet decreased by just $86M to $979M.

Divided over the 60.9M shares outstanding, the book value per share was $16.08. After deducting the $100M in goodwill and other intangibles, the tangible book value came in at $14.43.

Investment thesis

Although the share price of Banc of California has decreased by about 20% since my last article, I’m still not a buyer just yet. I like the bank’s financial performance and even after excluding the non-recurring items from the Q1 income statement, the underlying EPS of in excess of $1.65 on an annualized basis is pretty strong. The bank’s move to reduce its exposure to securities and instead increase the size of its loan book has likely helped to keep the amount of unrealized losses on the securities down.

Banc of California is attractive at these levels and could be considered a buy for some, but I’m personally keeping some dry powder available for other (better?) opportunities. The banking sector is changing fast, and I don’t want to rush any decisions. A watchlist candidate for sure, but unfortunately I can’t buy every stock I see and like.

Be the first to comment