HJBC/iStock via Getty Images

Chesapeake Energy Corporation (NASDAQ:CHK) is an oil and gas producer, which sells crude oil, natural gas and natural gas liquids (“NGLs”). Chesapeake currently does not produce liquified natural gas (“LNG”) but is planning to expand into the LNG export market.

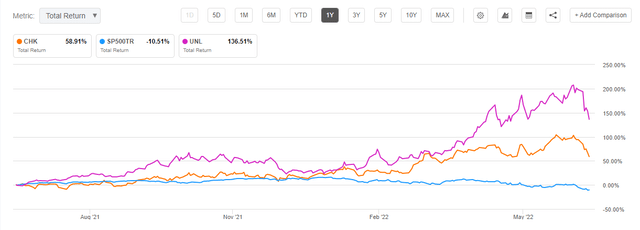

About 70 % of its 1Q22 sales came from natural gas and natural gas liquids. As a result, I compared the stock performance of CHK to the United States 12 Month Natural Gas Fund, LP ETF (UNL), since UNL is a portfolio of 12 natural gas futures contracts.

Over the past year, CHK rose by 59 %, whereas UNL rose by 137 %, as of the snapshot of the performance below. SP500TR (SP500TR) lost 11% over the same period.

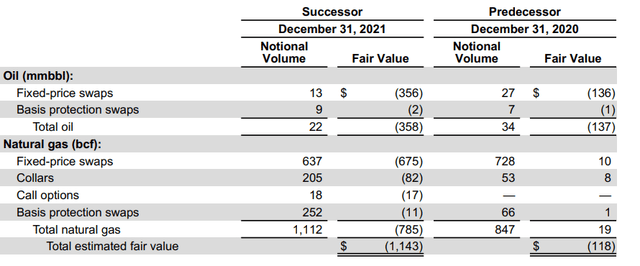

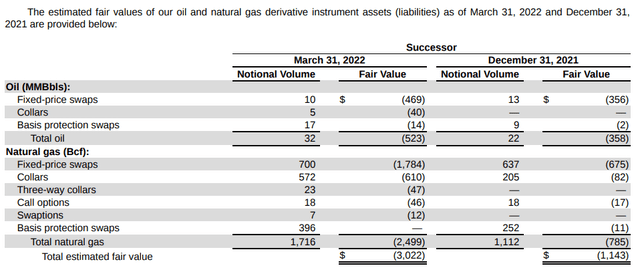

However, as of December 31, 2021, CHK had hedged 1,112 billion cubic feet of natural gas, primarily through fixed-price swaps and collars.

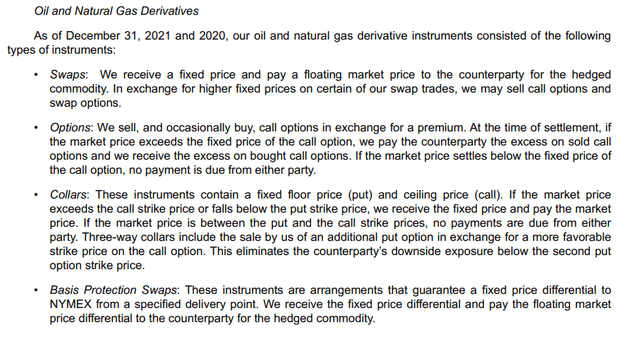

Chesapeake explained its derivatives/hedging activities in its 2021 Annual Report.

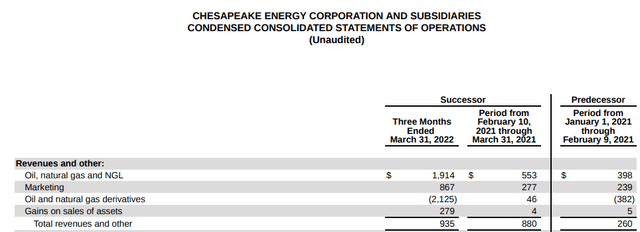

CHK underperformed UNL because Chesapeake hedged its energy price risk. In fact, Revenues from oil, natural gas and NGL amounted to $1.9 billion in 1Q22, and CHK lost $2.1 billion in oil and natural gas derivatives. Net total revenues were just $935 million, mainly from marketing.

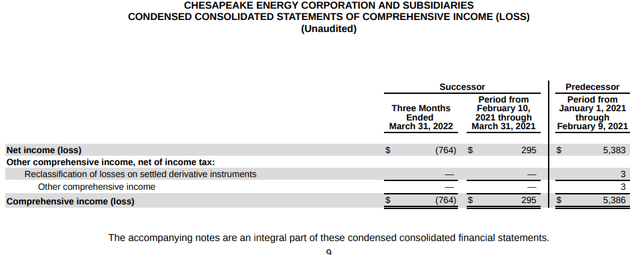

Once operating costs were factored in, CHK made a loss of $764 million, as compared to Net Income of about $5.7 billion in 1Q21.

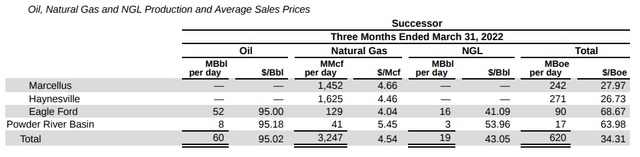

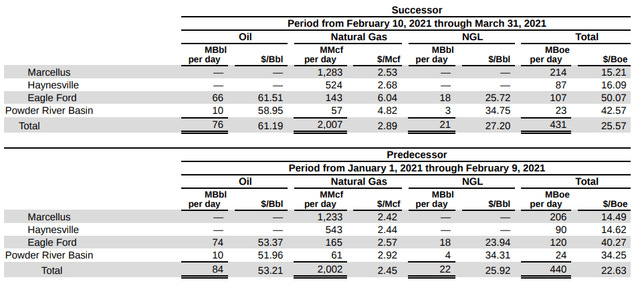

That was despite the fact that average sales prices for natural gas were $4.54/Mcf and crude sales prices averaged $95.02/bbl in 1Q22, up an estimated 68 % and 65 %, respectively, from 1Q21 (Predecessor/Successor).

As a basic principle of hedging, the hedge impact should not exceed the total impact on income of changes in the prices of the items being hedged. However, in its 2021 Annual Report, Chesapeake explained that “None of our open oil and natural gas derivative instruments were designated for hedge accounting as of December 31, 2021 and 2020.”

Therefore, there was a mismatch between the hedge impacts and the items being hedged. According to Deloitte:

Some entities mitigate certain risks by entering into separate contracts that meet the definition of a derivative instrument. For such circumstances, ASC 815 allows entities to use a specialized hedge accounting for qualified hedging relationships.

If hedge accounting is not applied, changes in the fair values of derivative instruments are recognized in earnings in each reporting period, which may or may not match the period in which the risks that are being hedged affect earnings. Therefore, the objective of hedge accounting is to match the timing of income statement recognition of the effects of the hedging instrument with the timing of recognition of the hedged risk.”

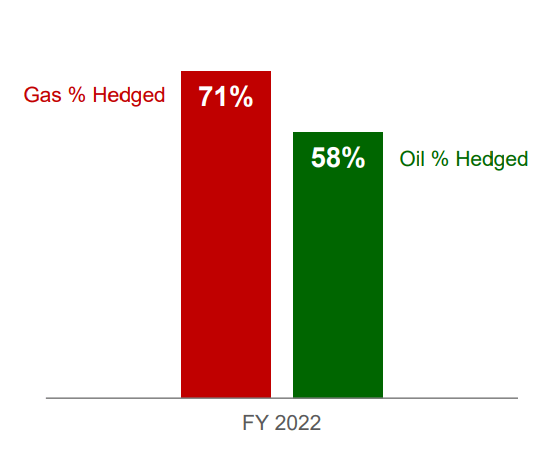

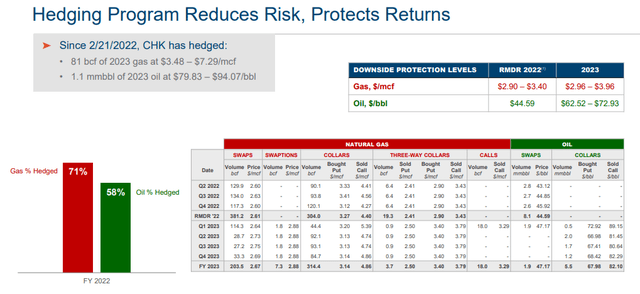

Chesapeake claims that its hedging “Reduces Risk, Protects Returns,” as indicated in the presentation slide below…

…but because it does utilize hedge accounting, reported earnings are more volatile if there are large derivative gains or losses in a reporting period.

As of March 31, 2022, the fair value of CHK’s oil and natural gas derivatives was $3.022 billion. The fair value is presumably for open positions and represents unrealized losses.

Since March 31st, the NYMEX second nearby natural gas futures contract price has risen by $1.209/MMbtu through June 17th while the NYMEX second nearby WTI crude futures contract has risen by $9.47/bbl. If CHK has maintained the same hedges, its unrealized losses have risen since end-1Q22.

Hedges, Company Projections and Market Outlook

For FY 2022, Chesapeake reported that it had hedged 71 % and 58 % of its natural gas and oil production, respectively.

CHK

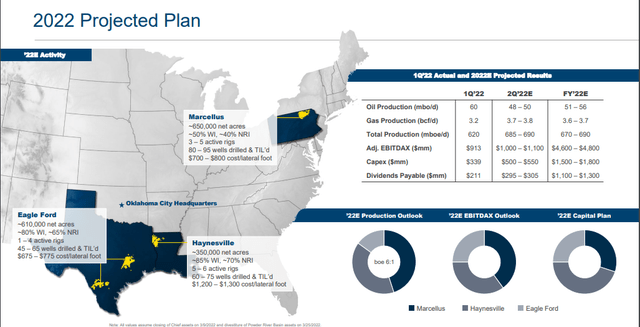

And Chesapeake updated its 2022 Projected Plan in a recent presentation.

Natural gas sales represent the lion’s share of Chesapeake’s revenues. And so I will focus on that market. And I recently wrote about my crude oil outlook in an article, XES – Oilfield Services ETF A ‘Dry Hole’ Long-Term.

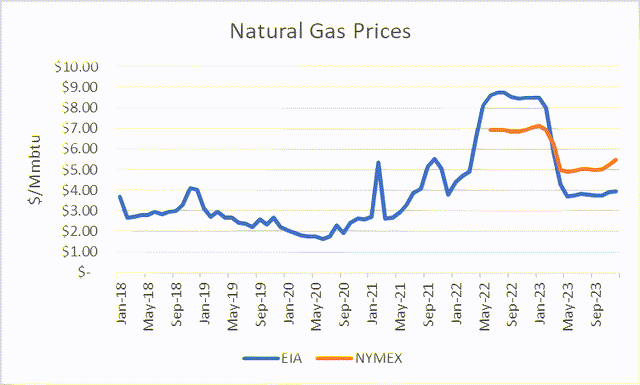

Natural gas prices recently soared to a new price range, as compared to prior years. However, both the EIA and NYMEX futures market expect prices to ease at the end of next heating season, around March 2023.

I recently published an article on May 31st, UNL: Likely To Become Overvalued This Summer. UNL is an ETF that is composed of 12 natural gas futures contracts. I advised that the ETF would likely drop this summer, and it has fallen about 12 % since that article, as of this writing.

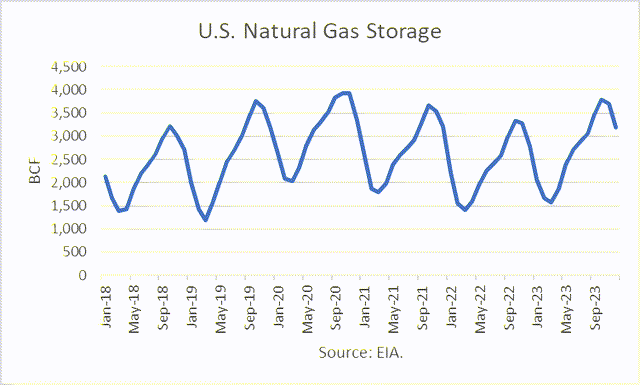

EIA projects that U.S. storage levels will return to more normal levels in 2023.

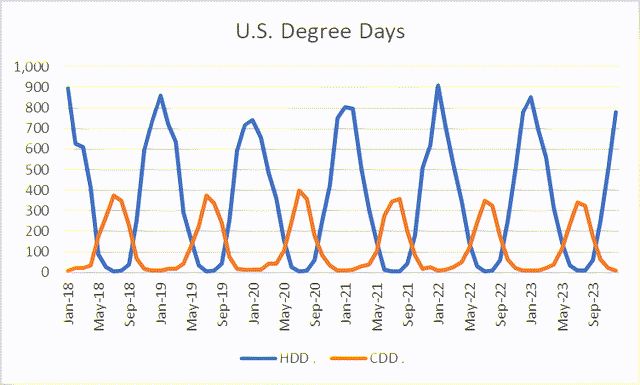

However, that forecast is based on experiencing normal heating-degree days, which affects natural gas consumption and therefore inventory levels.

Conclusions

Due to the fact that the Company reports its hedges as marked-to-market derivatives, and hedges out over many quarters into the future, its reported earnings are heavily affected by uncontrollable commodity market price changes. This is the offset effect of the use of hedges to reduce earnings fluctuations and protect earnings.

In addition, natural gas prices soared to a much higher price range, but there is no signal by the Company that it may be reconsidering its hedging strategy as a result. California Resources Corporation (CRC) recently announced such a signal, as I discussed in a recent article, California Resources: Hedging Strategy To Change.

In my opinion, the Company should revisit its hedging strategy and how it accounts for hedges. Because investors have little clue about what earnings to expect with the outsized derivative impacts, and the market price range has changed substantially, which should prompt a hedge strategy revision.

If the Company addresses those issues, I believe its share price will respond favorably. But for now, I am holding back from buying.

Be the first to comment