Blue Planet Studio/iStock via Getty Images

One good thing that comes out of bear markets – probably the only good thing – is that valuations and expectations tend to come down too quickly, and too far, for great companies. This is particularly true for economically sensitive – and therefore quite aggressive – sectors of the market. We see this with consumer discretionary, areas of technology, and others that tend to see big swings in valuations during bull and bear runs, respectively.

One area that I happen to think is going to lead us out of the bear market is semiconductors, as I see the group’s long-term fundamentals as essentially unchanged. However, valuations in the sector have plummeted and that has created some outstanding buying chances, particularly if I’m right that the bottom in stocks has either already happened, or will very soon.

A name in the semiconductor space that I like very much today is ON Semiconductor (NASDAQ:ON), as the fundamental setup is one of the best in the space, and the chart looks great for a buying chance right here, right now.

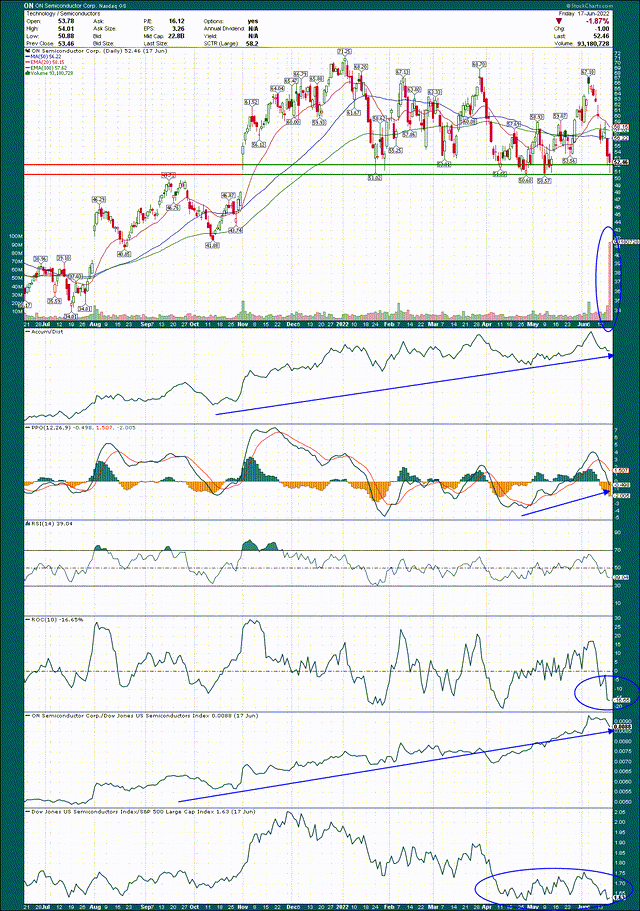

ON had a massive run in 2021 but has been consolidating in a range of about $20 since last November. The eight months or so that have passed with ON essentially going nowhere is certainly sufficient time to digest the big gains the stock made last year, and if we look at the momentum indicators, I believe that’s exactly what’s happening.

On the price chart, there is hugely consequential support in the low-$50s, which ON bounced off of last week. So long as this support holds, ON’s bias is firmly to the upside. Of course, if it breaks down from there, you have to get out immediately because a precipitous decline is almost certain to ensue. I don’t think that will happen, but you must keep stops in place anyway.

I also liked the extraordinarily high volume we saw on Friday last week, which occurred right at critical support. There were plenty of sellers, but the bulls fought them back, successfully. To me, that’s very telling, and I think if the stock can be defended by that sort of onslaught, selling pressure is at or near capitulation.

The PPO is making a much higher low than it did at the last relative price low, which is another bullish sign. In addition, the PPO is well into the bullish territory and returning to the centerline on this pullback.

The 10-day rate of change is also in very oversold territory, and right where it has bounced significantly in the past.

Finally, the bottom two panels show relative strength of the stock against its peer group and the peer group against the broader market. The semiconductors go through boom and bust cycles, as I mentioned earlier, with 2021 being the former and 2022 being the latter (so far). If you notice, the semis have actually been level with the S&P 500 for the past two months, while the index was making new lows. Again, this is very telling to me because it says money is rotating back into semis, which means I want to own exposure.

ON, to its credit, has been outperforming its peers for a very long time, and in a big way. Thus, since our goal is to own leaders within leading spaces, ON’s leadership in what I believe will be a leading space later this year is tremendously attractive.

The TL;DR on the chart is that ON successfully defended critical support yet again, has been a leader in the semi space, and momentum is very bullish at the moment. I think the chart says we’re going a lot higher, but let’s now take a look at the fundamentals to see if they line up.

Exposure to growth

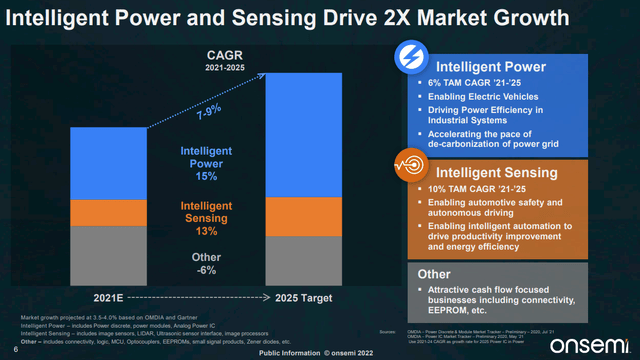

To make all of what I just laid out possible, we have to see a clear growth path for ON and some evidence that it is actually achieving it. Market participants tend to lump all the semis together, but in reality, the various players tend to focus on highly differentiated segments of the market. Some are exposed to gaming, crypto mining, or in ON’s case, what I really like is its exposure to the automotive sector. ON’s revenue streams are generally growing at decent rates, but for the next few years, the mega-trend ON is counting on is electric vehicles continuing their outstanding growth.

The company has various automotive applications for its chips, and as we can see with this total company revenue outlook, legacy businesses are set to contract at about 6% annually, but the growth areas are both expected to post mid-teens annual growth. That’s highly attractive, and keep in mind that legacy areas eventually run off, and what you’re left with is just the best bits of the business. Keep in mind also that these legacy businesses are providing valuable cash flow that ON can invest in growth areas, decrease leverage, etc.

Now, let’s focus on those growth areas to see what ON is projecting for the years to come.

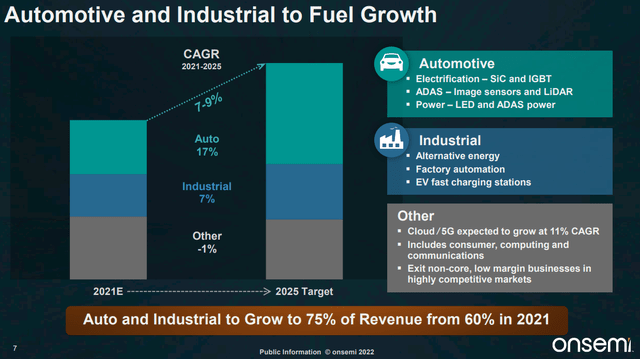

ON is banking on the automotive sector continuing to grow from an EV perspective, and why not? The past couple of years have seen EV launches explode with just about every major manufacturer entering the fray. ON has developed expertise, scale, and cost-efficiency in what should be a huge area of growth for many years to come. EVs are still a tiny fraction of all vehicles on the road, and as internal combustion is gradually made illegal around the globe, this will only accelerate. ON is extremely well-positioned to take advantage of this through selling chips to OEMs, but also in the way factories operate, the charging stations EVs use, and more.

ON has a diversified set of revenue streams that I find very attractive, and its investment in its ability to support the transition from ICE to electric in the automotive industry should support growth for many years to come.

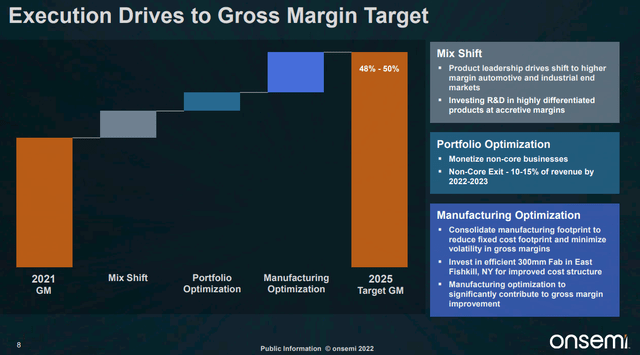

However, higher revenue isn’t all we should be looking out for with ON, because there’s a tremendous margin story unfolding as well.

The company has been on a journey to boost its margins via a combination of shifting product mix, optimizing what it sells, and reconfiguring its manufacturing setup. This holistic view on margin improvement is the sign of a well-managed company, and that’s something I put a lot of value on when finding great stocks to own.

I won’t read the boxes to the right to you but they’re worth a quick look if you’re interested in owning this stock. On the manufacturing front, ON is shifting to what it calls a “fab-liter” model, wherein it is looking to divest certain manufacturing sites and use external manufacturers instead, which is more flexible and capital-efficient than doing it in-house. ON will let other fabricators make common products, and this effort is already boosting margins in a big way.

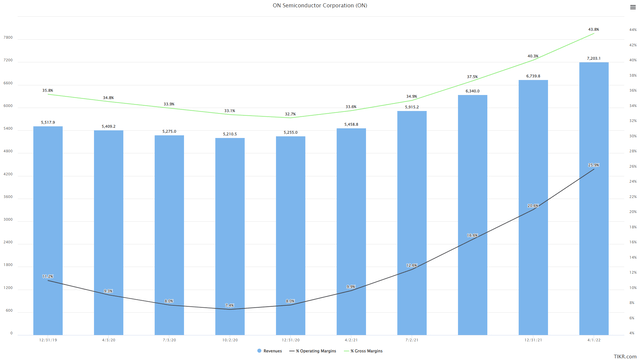

Below we have trailing-twelve-months revenue, gross margins, and operating margins for the past handful of years.

Revenue began rising in earnings in 2021, and that corresponded to the company’s margin optimization effort. You can see gross margin has risen very sharply in the past few quarters, hitting ~44% on a TTM basis in the most recent quarter. That’s still meaningfully below the company’s target of 48% to 50%, so there’s strong potential for more.

What’s more impressive – and more important – is operating margins. I love operating margin as a metric because it combines a company’s ability to generate revenue at low cost, and sell their products/services at high prices. In ON’s case, operating margins were in a trough for years, but the past six quarters have seen operating margin more than triple from just over 7% to 26%.

Part of this is due to gross margins rising, but part is because ON is generating revenue that is growing more quickly than expenses. So long as this continues, operating margins – and therefore, profits – should continue to rise very nicely.

Revisions up, valuation down

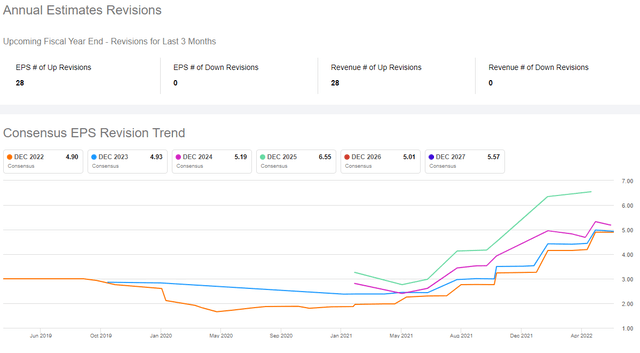

If anything has characterized 2022, I’d say downward revisions in revenue and earnings have been that thing. We’ve seen revision after revision – along with price target reductions – come in across a variety of industries all year. On the other hand, you have ON:

The past three months have seen 28 EPS revisions, and 28 revenue revisions: 100% of them have been higher. We can see a stair-step move higher in EPS and that’s because ON reports earnings, blows away expectations, and analysts scramble to boost estimates in response. I cannot think of anything more bullish than this chart, and it’s fully supportive of the technical picture, and as we’ll see now, the valuation picture.

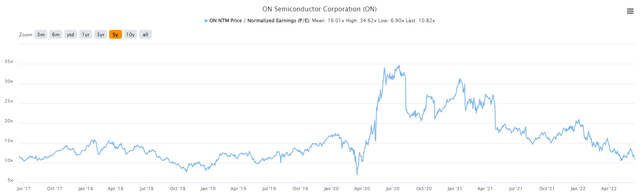

Below we have price to adjusted forward earnings, and it’s really quite extraordinary what we see here.

ON is trading for the same valuation it did pre-COVID, which is about one-third of its peak valuation. Now, I’m not saying ON is going to trade for 35X earnings again anytime soon, but the idea that a company that has not only grown the top line immensely, but margins as well, should trade for the same valuation as when it had declining revenue and declining margins is impossible for me to reconcile.

ON’s valuation chart suggests there’s probably some kind of massive headwind on the horizon, such as lower revenue and/or lower margins. But we know this is far from the truth, and as such, I think we could very easily see 15X to 18X times earnings when the bull market resumes. That would be ~40% to ~65% higher than today’s levels, without the benefit of higher earnings. That’s the opportunity here, and given the way ON is holding critical support, I see no reason we shouldn’t get there later this year.

Be the first to comment