jetcityimage/iStock Editorial via Getty Images

EV companies have taken the world by storm in the last few years, which does not come as a surprise given that EVs are considered the future of global transportation. Although Tesla, Inc. (TSLA) remains the prime attraction among EV investors, for the industry to succeed, both government and private entities would need to invest billions of dollars in building the necessary infrastructure that would support the adoption of electric vehicles. This is where ChargePoint Holdings, Inc. (NYSE:CHPT) comes in with its network of EV charging stations. After reaching an all-time high of over $46 in December of 2020, CHPT stock entered a downward spiral, and external shocks faced by the American economy have aggravated the pain this year. At the seemingly discounted stock prices of around $14, we will evaluate whether ChargePoint is an attractive bet today.

Is ChargePoint a Growing Company?

ChargePoint is an electric vehicle infrastructure company based in the United States. The company manages the world’s largest network of individually owned electric vehicle charging stations, with the ChargePoint Network now operating in 14 countries, and Network Operations Centers located in the U.S., London, and Hong Kong.

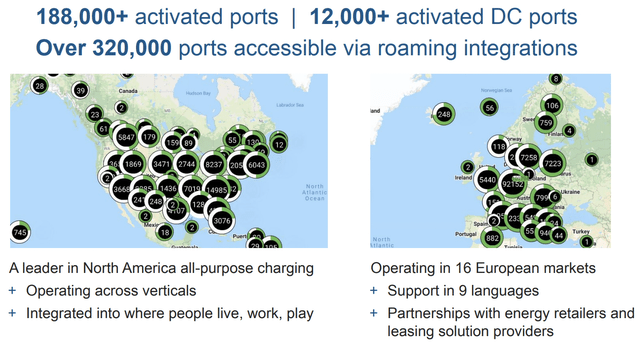

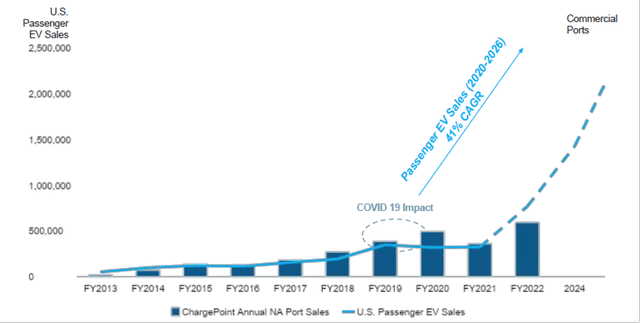

ChargePoint has activated 188,000 ports on its network with approximately 57,000 in Europe and 12,000 DC ports and has delivered over 113 million charging sessions to date, with vehicles tapping into the ChargePoint network every second, and 52% of Fortune 500 companies using its services. By 2050, it is expected that approximately half of all cars on the road in the United States would be EVs. ChargePoint’s EV charging port sales have been gradually increasing over the years, in line with the rise in EV sales in the United States. Increasing EV penetration will drive ChargePoint’s hardware and software revenue in the future.

Exhibit 1: ChargePoint’s presence in North America and Europe

Company presentation

Source: Company presentation

The company’s revenue has grown each year since 2018, from $61.9 million in 2018 to $282.1 million in the last 12 months. Stellar revenue growth has led to higher losses, understandably so because ChargePoint needs to scale a lot more to be able to enjoy a higher return on invested capital that would lead to profits.

ChargePoint is a growth company that is tapping into a lucrative industry, but the company faces many challenges including intensifying competition.

The Business Model of ChargePoint

ChargePoint has built a product portfolio that includes network hardware, software subscriptions, and other professional services. The company offers networked charging stations as well as solutions for the following markets:

- Commercial Products for retail, workplace, parking, recreation, education, and highway fast charging.

- Fleet Products for delivery, logistics, motor pool, transit, and shared mobility.

- Residential Products for homes, apartments, and condominiums.

In addition to charging hardware, the company generates revenue from cloud-based software services and extended parts and labor warranty solutions for customers. The software subscription offers a lot of benefits to commercial and fleet users as it includes several charging-management features. Site-host management allows commercial customers to make charging available to the general public or a select group of users, administer numerous sites and charging policies, perform remote diagnosis, and install software updates. Another feature is host pricing and payment remittance, which allows site owners to determine the pricing based on analytics. This feature also includes energy management and driver management solutions.

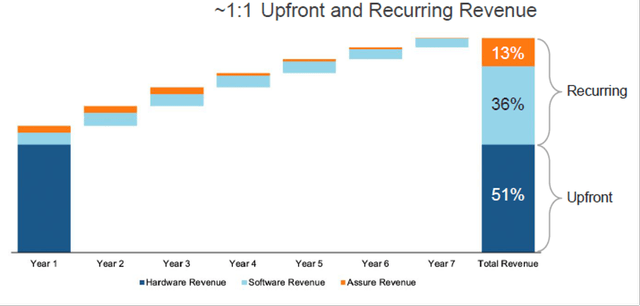

Exhibit 2: Illustrative unit economics of a CT4000 Dual-port station with software and Assure

Company presentation

Source: Company presentation

Recurring software and warranty revenue are expected to account for approximately half of the lifetime revenue of a unit. The margins on software subscriptions are often higher than those on hardware sales. As a result, an increase in subscription sales should help the company’s bottom line.

Recent Financial Performance

On May 31, ChargePoint reported a loss of 27 cents per share for the first quarter of fiscal 2023 ended April 30, wider than the loss expected by analysts. The company reported revenue of $81.6 million, up 102% year-over-year. Revenue from networked charging systems came to $59.6 million, up 122% from $26.8 million in the same quarter the previous year, while subscription revenue was $17.6 million, up 63% from $10.8 million in the comparable quarter. ChargePoint ended the quarter with $541 million in cash and equivalents.

Despite promising revenue growth, ChargePoint is yet to achieve profitability, and the loss for the quarter came to $89.3 million. Continuous supply chain challenges, which continue to drive up material and logistics costs, had a severe impact on the profitability of the company in the last quarter. Add to that the company’s aggressive regional expansion and rising operating costs. These investments are expected to put the company in a good position to gain from the EV sector’s growth in the future, and therefore, cannot be trimmed down at a time when competitors are aggressively investing in building and expanding charging infrastructure solutions.

What Does the Macroeconomic Outlook Hold for ChargePoint?

The EV industry will be driven forward by increasing government support for vehicle electrification targets around the world and changing consumer preferences. Given this policy support and incentives, many automakers have announced plans to electrify their fleets completely by 2050. The Biden administration has proposed to spend $174 billion to boost domestic electric vehicle manufacturing as well. By 2030, the government wants to establish a national network of 500,000 electric vehicle chargers, replace 50,000 diesel transport vehicles, and electrify 20% of yellow school buses. None of this would be possible without a well-spread, nationwide network of EV chargers.

According to Bloomberg, EV sales will increase to 26 million units in 2030. This means ChargePoint and other charging infrastructure companies could become big winners in the long run as more people embrace EVs. According to IEA, sales of electric cars including fully electric and plug-in hybrids doubled in 2021 to 6.6 million. Electric car sales nearly tripled to 3.3 million in China, 2.3 million in Europe, and 630,000 in the United States. In the first quarter of 2022, global electric car sales came to two million despite global supply chain challenges. It would be reasonable to conclude that the long-term macroeconomic outlook facing ChargePoint is promising.

The company, however, will face some challenges in the short run, including rising prices for several critical materials used in battery manufacturing as well as supply chain problems. Because port sales are directly proportional to EV sales and that rising material costs will influence overall EV sales, ChargePoint could potentially see a slowdown in growth in the short run.

Exhibit 3: ChargePoint sales in direct proportion to EV sales

Company presentation

Source: Company presentation

However, as previously said, subscription revenue can aid the company’s growth because it offers substantially greater gross margins than hardware sales, but for investors to make the most of this, it would be inevitable to take a long-term perspective on ChargePoint’s potential.

Is Now a Good Time to Invest in ChargePoint?

ChargePoint stock has plummeted from its highs in December 2020. However, the demand for EV charging stations has continued to increase gradually, and the demand for EV chargers will undoubtedly continue to grow exponentially through 2030 as electric vehicles go mainstream. ChargePoint is well-positioned to acquire a meaningful share of this booming industry given its reach in North America and Europe today which serves as a good platform for the company to scale faster.

With approximately 188,000 charging ports across North America and the EU as of the first quarter of 2022, the company continues to increase its market share and geographic footprint. The company operates a capital-light business model which should enable ChargePoint to scale profitably in the next five years. The company has already established partnerships with key EV players in both North America and Europe as well, which should be another driver of growth in the future and these partnerships could potentially help the company thwart the threat of competition – at least to some degree – in the coming years.

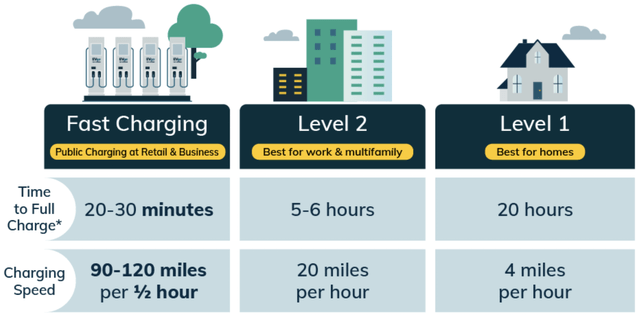

The success of ChargePoint will depend largely, in our opinion, on its ability to gain market share in the EV fast-charging segment. As of today, ChargePoint dominates the AC charging sector in the U.S. but fast charging is likely to play a big role in the adoption of EVs. For this reason, we believe it makes sense to closely monitor how ChargePoint ventures into this segment without breaking the bank.

Exhibit 4: EV fast charging

EV fast charging

Source: EVgo

ChargePoint has already laid out plans to ramp up the manufacturing of fast charging products, which is a good thing. However, these are still very early days, and there is more than enough room for disruption in this segment. Therefore, it would make sense for investors to closely monitor how ChargePoint’s fast-charging products gain traction in the next few quarters to determine whether the company could dominate the industry in the long run.

With many things going right for ChargePoint and the EV industry, we believe now is a good time to gain some exposure to the company, but at the same time we will be wary of going all-in given the need for ChargePoint to quickly adapt to changing industry dynamics while navigating through macroeconomic challenges that have affected almost all business sectors today.

Takeaway

ChargePoint has a long runway for growth but the company will have to navigate many challenges and scale efficiently before reaping the full rewards of its first-mover advantages. Growth investors with an extensive investment time horizon may want to get in on the act at these depressed prices to build a long position on CHPT stock.

Be the first to comment