StockByM/iStock via Getty Images

When I was a kid, I was always fascinated by The Jetsons, a cartoon series set in 2062 in Orbit City.

Specifically, I loved all the futuristic technology.

For those who aren’t old enough to remember, the Jetsons lived in the Skypad Apartments and had a robot maid Rosie. All of the household chores could be accomplished with the push of a button, thanks to the home’s numerous space-age conveniences.

And George Jetson commuted to work via aero-car with a transparent bubble top. (Fun fact: George Jetson’s supposed birthdate was just passed-July 31, 2022.)

Back then, I never could have imagined how close we were to living similarly technology-driven lives…

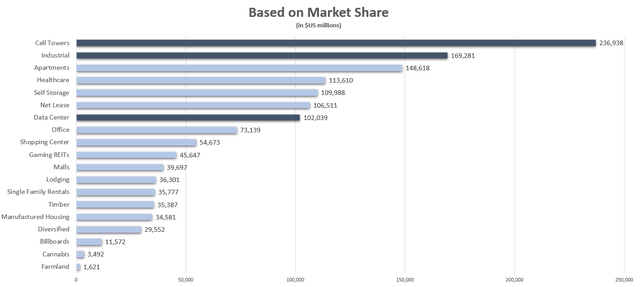

Today, tech-driven real estate investment trusts (“REITs”) now make up much of REITdom. As I explain in my book, The Intelligent REIT Investor Guide, “…technology has become a critical element for most every real estate subsector, much of the recent focus has been on how e-commerce is challenging retail landlords.”

Source: iREIT on Alpha

These three sectors-cell towers, data centers, and industrial properties-are at the heart of the digital ecosystem, providing critical infrastructure for the e-commerce value chain. As asset manager Cohen & Steers explains:

Every time you make a purchase on your smartphone or computer, it sets a sequence in motion that travels through a network of communications, data, and logistics facilities.

Since many of those properties are owned by REITs, it’s more than safe to say that they “play an integral role in getting your package from the warehouse to your doorstep, giving investors a way to participate in the potential growth of ecommerce.

And once again citing my book:

Unlike many other REIT structures, the wireless tower model is simple and straightforward. Wireless devices (i.e., basic phones, smartphones, tablets, connected cars, etc.) transmit data over the air via wireless spectrum, from radios inside the devices to those mounted at the top of towers, or cell sites.

That data is transferred back to the core network over fiber or copper lines – or spectrum, in some situations – then directed toward the appropriate end user’s location via the nearest tower.

Cell tower REITs can be compared to apartment owners, with wireless carriers as the renters. The big difference is that they don’t need to spend capital to entice-or hold onto-big customers.

All they need is a good zoning staff and $200,000-300,000 to build the tower. Or they can work off of rooftops. Regardless, once the structure-which essentially serves as an antenna-is in place, tenants flock to them.

In this article, I want to provide an update on two of the most popular cell tower REITs-both of which I, of course, own. And if George Jetson were around, I think he would own them, too…

American Tower Corporation (AMT)

American Tower Corp., a net lease REIT, has been a staple of its industry. The company has long-term leases with built-in annual rent escalations.

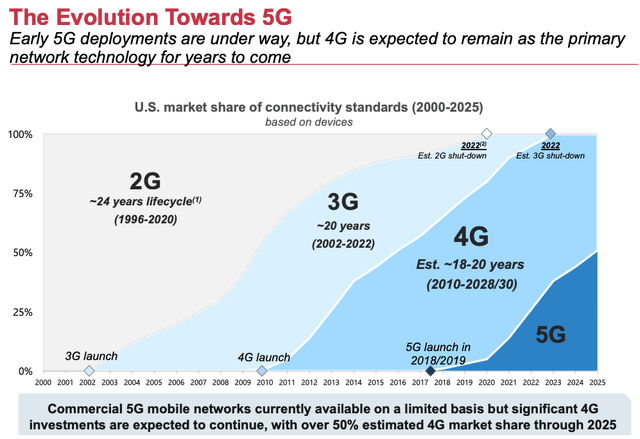

Mobile network technology continues to expand, and developed countries are rolling out 5G. This 5th-generation network is designed to connect virtually everyone and everything-including machines, objects, and devices.

AMT Q2 Investor Presentation

None of this works without cell towers… an industry in which American Tower is a dominant force.

On the year, shares of AMT are down only 6%, outpacing the S&P 500 and the Vanguard Real Estate ETF (VNQ), down 15% and 9%, respectively.

American Tower can be compared to popular net lease REITs like Realty Income (O) in that it has long-term leases with contractual rent escalations and high renewal rates.

Leases are typically non-cancellable and have an average length of 5-10 years, with multiple 5-year renewals built into the agreement. In the U.S., the average annual escalator is a fixed 3%, with international escalators more dependent on local inflation. Of the company’s outstanding lease agreements, 73% won’t come due until 2026 or later.

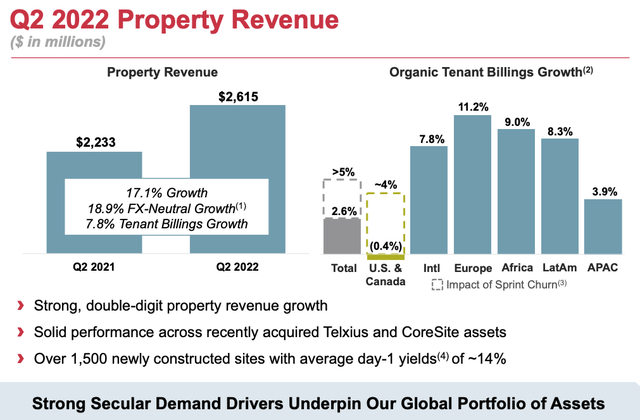

During the second quarter (Q2) of 2022, AMT reported property revenues of $2.6 billion, an increase of 17.1% year-over-year (YoY). The company is global, with sites in Europe, Africa, Latin America, and Asia-Pacific. During the most recent quarter, the company saw organic tenant billings grow 11.2% in Europe and 9% in Africa.

AMT Q2 Investor Presentation

As AMT is a cell tower REIT, you can probably guess its largest tenants: As of Q2, the big three wireless carriers make up 42% of total property revenues for the company.

- T-Mobile (TMUS): 17% of Q2 property revenues

- AT&T (T): 14% of Q2 property revenues

- Verizon (VZ): 11% of Q2 property revenues.

The remaining revenues see 45% come from international tenants and pass-through entities, 7% from data centers, and 6% from smaller U.S. and Canada carriers.

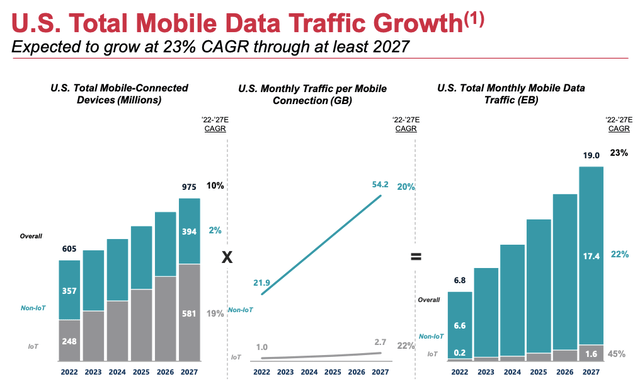

Global mobile growth continues to be a driver for the company. As connected devices grow globally, American Tower is primed to benefit.

AMT Q2 Investor Presentation

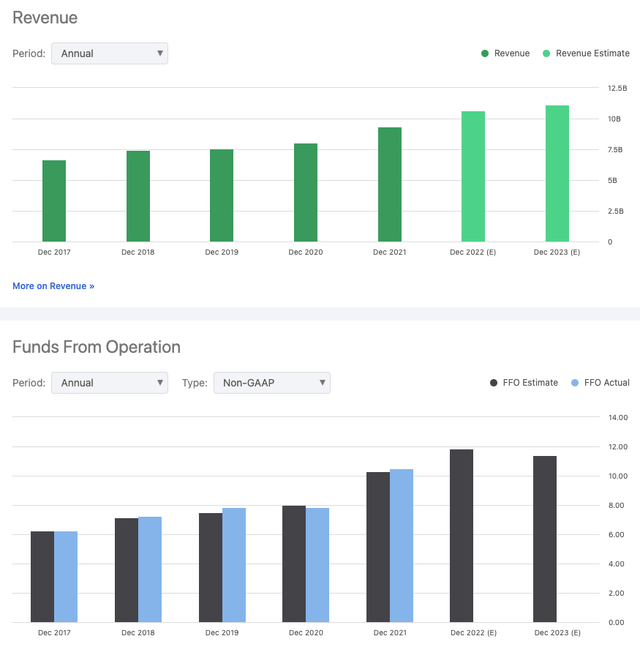

The company continues to grow not only both revenue and funds from operation (FFO), which, combined, has fueled the company’s growing dividend. AMT currently pays a dividend of $5.72, or a yield of 2.2%.

Not often do REITs get referred to as a “dividend growth stocks,” but over the past five years, AMT has increased its dividend at a staggering annual rate of 18.3%.

And the payout ratio sits at only 58%, suggesting the dividend is not only covered, but has plenty of room to continue climbing. It’s also backed by a quality balance sheet with a BBB- rating.

SeekingAlpha.com

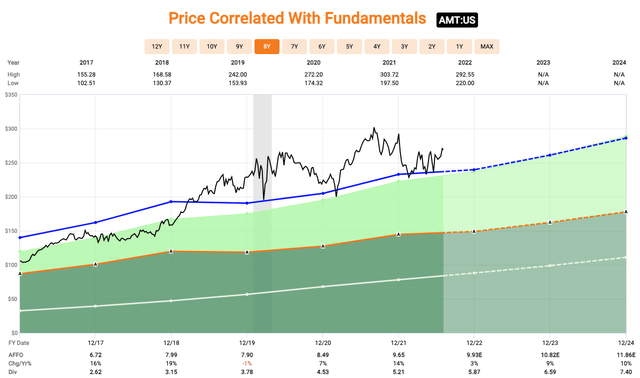

AMT shares trade at a 2023 adjusted FFO (AFFO) multiple of 24.8x, roughly in line with where shares have traded over the last five years. Analysts expect 9% and 10% AFFO growth in 2023 and 2024, respectively.

Fast Graphs

It’s clear the company has a bright future and plenty of tailwinds.

In terms of valuation, as we just saw, shares are by no means a screaming “buy.” But keep this name high on your watchlist for when the opportunity presents itself.

Crown Castle Inc. (CCI)

American Tower is easily the largest cell tower REIT on the market, with a market cap of $126.2 billion. The next-largest cell tower REIT is Crown Castle Inc., with a market cap of $77.6 billion.

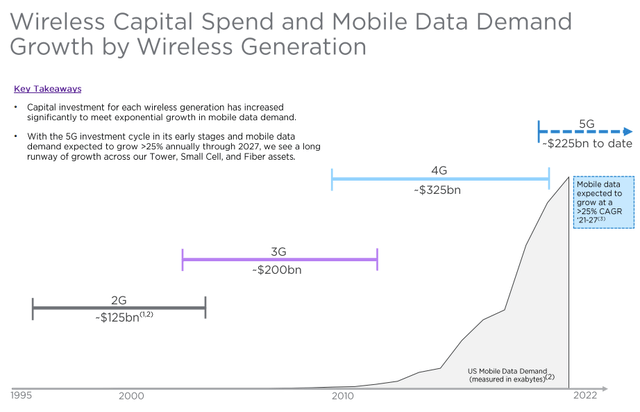

Let’s take a closer look at why the 5G rollout is a tailwind for cell tower REITs like AMT and CCI…

The 5G network was preceded by 4G, and before that by 3G, and so on.

With each new generation came more opportunity… but at a cost. Simply put, the newer and more powerful the variations, the shorter their propagation-or transmission capabilities. That means cell sites need to be closer together for 5G to work properly… which means we need more cell towers.

With each new generation, carriers have had to significantly increase their capital investment in order to meet data demands. Here is a great chart from CCI’s Q2 earnings presentation that shows spending from 2G through 5G to date.

CCI Q2 Earnings Presentation

This is certainly a tailwind for both CCI and AMT.

Crown Castle is the nation’s largest provider of shared communications infrastructure. Its portfolio consists of more than 40,000 cell towers, approximately 115,000 on-air or under-contract small cell nodes, and more than 80,000 route miles of fiber-giving the company a presence in every major U.S. market.

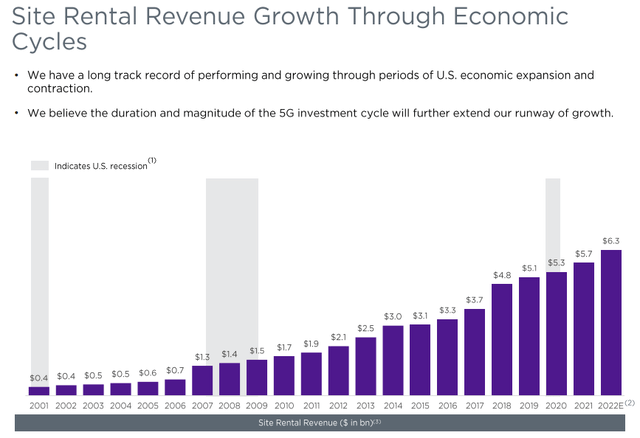

CCI has continuously increased its rental revenue each and every year since 2001, as new generations have been rolled out into more cities.

CCI Q2 Earnings Presentation

For Q2 2022, CCI reported rental revenues of $1.57 billion, an increase of 10% YoY. Adjusted EBITDA grew 13% during the quarter to $1.07 billion, with AFFO growing 5% to $1.80.

Management reaffirmed its 2022 guidance for rental revenues and AFFO, looking for YoY increases of 10% and 6%, respectively. Full-year adjusted EBITDA guidance increased by $20 million, equating to growth of 14%.

When it comes to tenants, the three largest are once again the major U.S. wireless carriers, but they play an even larger role, as CCI is a U.S.-only company.

- T-Mobile: 34% of 2021 revenues

- AT&T: 21% of 2021 revenues

- Verizon: 20% of 2021 revenues

CCI currently pays an annual dividend of $5.88, which equates to a yield of 3.3%. Over the past five years, shareholders have enjoyed a dividend growth rate of 9%.

The company has a quality balance sheet, with a net debt to EBITDA rating of 4.9x and a credit rating of BBB-.

Shares trade at a 2023 AFFO multiple of 23.4x, above the company’s five-year average of 22.8x, suggesting shares could be slightly overvalued at current levels. Right now, we rate shares of CCI a “hold” due to the higher valuation-but this another high-quality name to keep high on your watchlist.

In Closing…

The cell tower sector has tremendous tailwinds, including:

- Additional spectrum coming to market

- Greater smartphone penetration

- Traffic growth expanding by double digits

- The emergence of new wireless competitors

- The 5G rollout.

Exponential growth in data usage is driving carriers to fortify their networks or add capacity.

I’m certain that if George Jetson were alive today (and not a newborn), he would have invested in these cell tower REITs and would be living the life of a “jet-setter” dividend growth investor.

As always, thank you for reading and commenting.

Be the first to comment