zorazhuang/iStock Unreleased via Getty Images

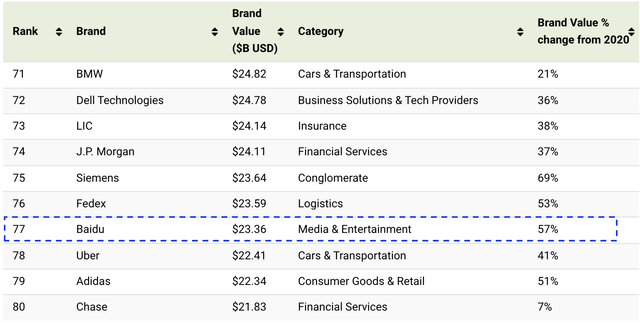

Baidu (BIDU), along with the broader Chinese tech sector, is feeling immense pain due to China’s regulatory crackdown, which has now dragged on for more than a year. This comes right after a multi-year crisis period involving Trump’s controversial trade war, which was largely targeted on China. In other words, China has been on the spotlight for too long. However, for a company to suffer indiscriminately just because it has Chinese origins is quite the stretch. In fact, Baidu is one of the world’s leading brands, making it on the world’s 100 most valuable brands list for 2021, ranking ahead of the likes of Uber (NYSE:UBER) and adidas (OTCQX:ADDYY).

World’s Most Valuable Brands

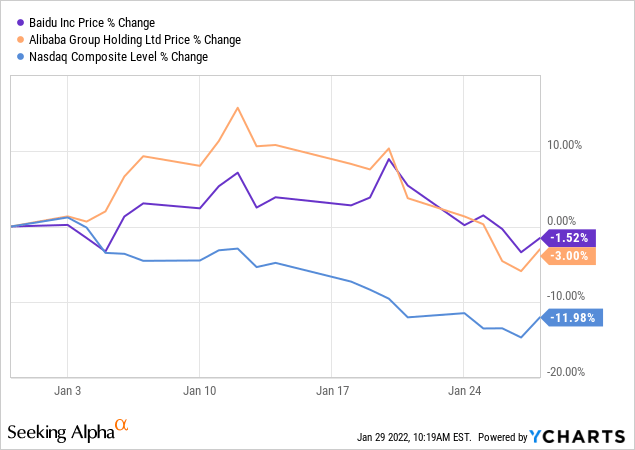

Baidu, along with other Chinese tech names such as Alibaba (BABA), was off to a promising start this year, in part aided by Charlie Munger’s purchases of Alibaba shares. However, all the gains have now disappeared and the stock is in negative territory on YTD basis, joining the severe stock market sell-off. That said, Baidu is performing better compared to the major US indices, such as the tech-heavy Nasdaq which is down more than 10% (i.e. in correction territory).

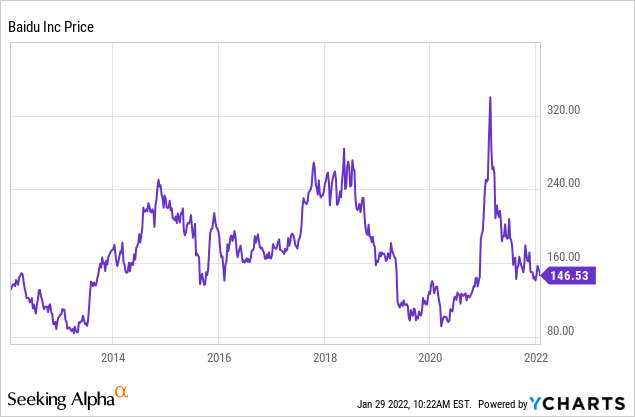

Zooming out, things are looking even worse. Even though the global markets have performed very well over the past decade, Baidu has been dead money:

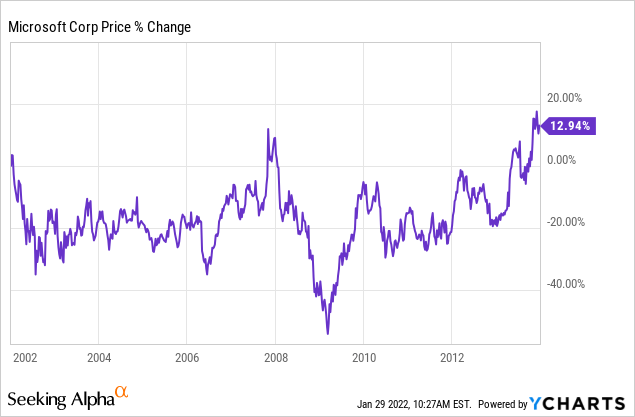

The good news is that sentiment will eventually change. China’s economy continues to grow (could overtake the US economy by 2030), and Baidu is making a lot of money. As a reminder, Microsoft (MSFT) was also dead money for more than a decade, until 2014:

In other words, life goes on, things change, and it is unwise to only look at the rearview mirror. Investors who acquire Baidu stock at today’s depressed valuation stand to benefit tremendously once the dust settles, and it will. It is a matter of time. That said, things can always get worse before they get better.

Over the past decade, unlike its share price, Baidu has made remarkable progress on multiple fronts including maintaining its lead in internet search (dominates China with more than 70% of market share). Even though Baidu is often referred to as the ‘Google of China’, just like Google (NASDAQ:GOOG) (NASDAQ:GOOGL), it is so much more than an internet search engine. Baidu has made significant progress on cloud computing and chips (Kunlun was recently spun off), owns a strategic stake in iQIYI (IQ) (often referred to as the ‘Netflix of China’), and has established a global leadership position in AI, including self-driving technology through Apollo (robotaxis, robobuses, etc.) Yet, the share price remains stagnant.

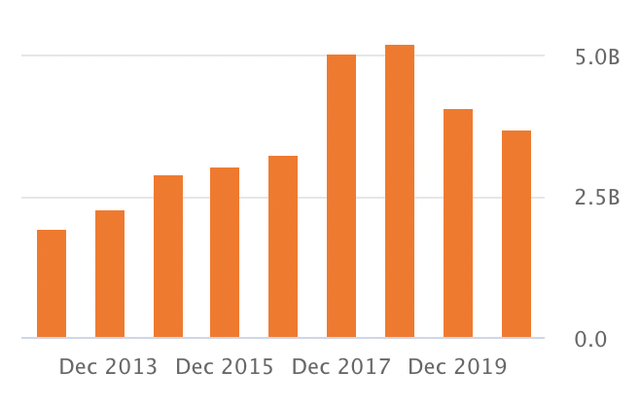

In addition to the progress on the aforementioned fronts, Baidu has also made substantial progress in terms of financials. Specifically, annual operating cash flow remains resilient (hovering around record high levels), consistently surpassing the $3 billion mark every year since 2015, and even surpassed the $5 billion mark for FY 2017 and FY 2018.

Baidu’s Operating Cash Flow

https://seekingalpha.com/symbol/BIDU/cash-flow-statement

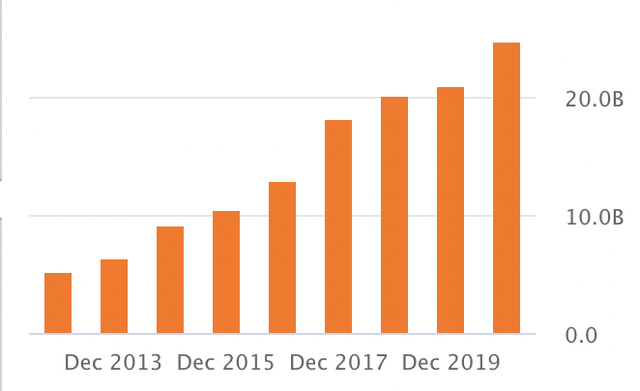

Baidu’s cash balance (including Short Term Investments and Restricted Cash), reached a new record of almost $30 billion.

Baidu’s Cash Balance

https://seekingalpha.com/symbol/BIDU/balance-sheet

Despite both operating cash flows and the cash balance hovering around record highs, the market cap remains depressed (hovering around multi-year lows), having fallen to just ~$50 billion. In other words, Baidu’s cash position now reflects more than 50% of its market, which is mind-boggling. In addition, after subtracting loans, the net cash position stands at ~$15 billion, which represents around 30% of the market cap, which is still mind-boggling. This clearly demonstrates that Mr Market is going through his manic-depressive phase, placing little to no value on many of Baidu’s assets.

Investors need to ask themselves: will Baidu be a bigger or smaller company over the next decade? I believe in the former i.e. bigger. For starters, YoY revenue growth exceeds 25% (boosted by AI cloud growing 71%). Intelligent driving as well as other growth initiatives, including Xiaodu (recently closed a new $5.1 billion valuation funding round), will help boost future cash flows. As such, going forward, despite China’s regulatory crackdown, it is reasonable to expect that annual operating cash flow will continue trending up, albeit in a bumpy fashion. Having said that, even if Baidu doesn’t grow that much over the next decade, it is important to emphasize that it is still remarkably cheap today. Why? Because both gross and net cash balances are unusually high (as a percentage of the market cap), and the market isn’t pricing any growth. In fact, it appears as if the market is expecting a doom-and-gloom scenario of negative revenue growth (i.e. Baidu will start shrinking in a material way). This doesn’t really make sense, especially with all the growth coming online from AI.

In any event, Baidu is taking advantage of the sell-off via share buybacks, bringing the cumulative repurchases to $2.5 billion over the past couple of years. I feel very comfortable with Baidu’s strong operating cash flows and massive cash position, which provides tremendous financial flexibility. In fact, it is reasonable to assume that, over the next few years, annual operating cash flow will eventually surpass the $5 billion mark again, and cash-rich Baidu will get cash richer, all else constant. This provides a strong margin of safety allowing the company to weather the storm, no matter how severe it is. Unlike others, I see the recent sell-off as a great buying opportunity. As always, there are risks, but I think that the regulatory concerns have gone too far, and most of the damage has been done on Baidu’s valuation.

Be the first to comment