Spencer Platt/Getty Images News

Introduction and Thesis

Allbirds (BIRD) is a relatively new lifestyle brand primarily selling footwear and apparel products sourced from naturally derived materials. Allbirds claims that their footwear is environmentally friendly while being the most comfortable shoes. The relatively young brand initially saw a huge increase in its share price after the initial public offering in November 2021; however, since then, the valuation has been consolidating to this date. Many investors called out that the company’s valuation was expensive considering the market conditions and the growth prospects while some worried that the excitements around Allbirds could be temporary. These negative claims regarding Allbirds are legitimate, but I am cautiously bullish on Allbirds. I believe Allbirds’ current brand loyalty and growth potentials built because its technologies, environmental attention, and comfort create a lasting and potentially strong brand. Thus, I think investors should keep a close watch on Allbirds to act on an opportunity in the near future.

Not a Fad

I do not think Allbirds will be a fad. The brand launched in 2014 and started selling shoes in 2016, so some investors worry that the current popularity of Allbirds may die down given the relatively short track record of success. However, I disagree. I believe Allbirds brand will continue seeing growth for the foreseeable future for two reasons.

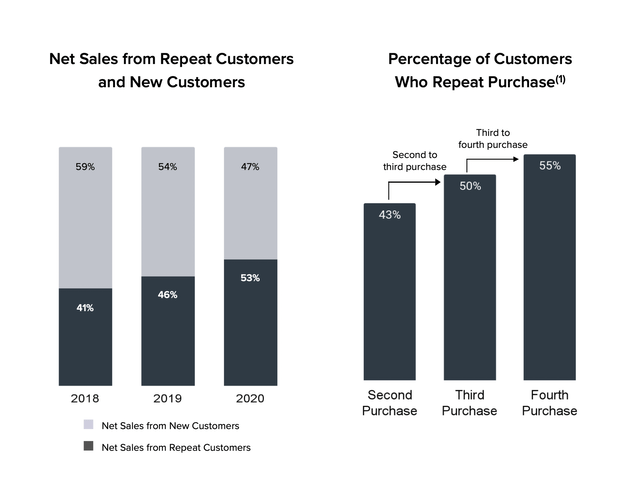

First, Allbirds footwear is unique and lives up to its claim of being one of the most comfortable shoes in the world, which is shown in the company’s return rate. As the picture below shows, Allbirds have a high rate of repeat customers. 43% of the customers are likely to purchase another footwear from Allbirds while 50% of those customers are likely to purchase their third product. As such, I think this data clearly shows that Allbirds has a unique product that strongly satisfies its customers creating loyalty and a stronger brand.

Second, the company has a favorable underlying trend. As the environmental concerns grow, an increasing number of everyday consumers are seeking environmentally friendly products creating a strong generational trend, and Allbirds is expected to benefit from this trend. Since its inception, Allbirds has been focused on creating an ethically sourced and environmentally friendly product resulting in carbon-neutral operations with further goals to reduce Allbirds’ carbon footprint. Further, Allbirds shoes emit about 30% less carbon than the footwear industry average. As a result, 50% of Allbirds consumers in 2020 said that they considered sustainability before purchasing Allbirds while only 7% of the consumers reported similar answers in 2016. I believe this data clearly shows the growing consumer interest in the environment and sustainability. Therefore, I believe Allbirds will be able to benefit from this huge underlying trend allowing Allbirds brand to continue to prosper going forward.

Growth Potential

Allbirds is still a small company with strong potential. The brand awareness in the U.S. only sits at about 11% while the apparel products are only contributing to about 10% of Allbirds’ revenue. Given the growing interest in sustainability along with Allbirds’ unique and comfortable footwear, I believe the potential for expansion is immense.

To address this potential, the management team has said that the company “need[s] to reach more customers.” To achieve this, the management team believes that expanding retail stores will have a huge impact. Allbirds stores “drive brand awareness, creating a halo effect for the rest of the business.” As customers interact within the physical store, the overall brand presence including its digital operations has been improving. Further, through this means of expansion, Allbirds will be able to continue to grow its loyal customers along with new customers.

Apparel business also poses an immense opportunity. Currently, the majority of Allbirds growth and revenue comes from its footwear business, but over time, as the company scales, I believe the company can leverage its technology and brand power to grow its apparel business. The overwhelming majority of the apparel industry today relies on synthetics, so Allbirds plans to leverage its sustainable material technology used in footwear to continue to expand its sustainable apparel products.

Apart from the sustainability of its apparel, the management team has pointed out that the success of the apparel business will be the result of strong brand power. Allbirds believes that after earning “credibility with [the] customers,” the company is “ideally positioned to be able to connect new apparel offerings to [the] footwear franchise.” The company plans to leverage its strong brand to grow into more than a footwear company in the future creating strong potential.

However, the fact that a brand has low awareness and a small market cap does not always correlate to high potential. While it is true that the opportunity may be immense because the company has significant room to grow, this will not be the case for every small company, but I believe the comfortable and sustainable products differentiate Allbirds from others. It is unique in its industry creating a premium brand image, and with the strategy to connect customers in both physical and virtual stores, I believe the potential in Allbirds is achievable.

Financials and Valuation

Allbirds reported a 2021Q3 revenue growth of about 33% to $63 million on about 54.1% gross margin, which was about 120 basis points higher than the prior year. Further, the company reported a GAAP net loss of about $13.8 million with an adjusted EBTIDA loss of about $6.3 million. The company’s operations are still young and have room for improvement. On the other hand, the company’s balance sheet is relatively stronger. Allbirds has cash of about $65 million with an even stronger inventory of about $99 million. Given that the company’s adjusted EBITDA loss is expected to be at about $12 to $17 million including IPO costs of about $5 million, I believe the current level of cash and inventory is strong. Further, Allbirds is expected to receive about $250 million from its IPO creating a huge cash pile for the company to utilize in its growth. Given these circumstances, I believe Allbirds have financial health that can sustain the company’s operation and future growth.

Valuation, unlike the financials, is not as strong. Even after a dramatic valuation consolidation, the company is worth about $1.8 billion. The company is expected to report revenue of about $270 million in 2021 and about $350 million in 2022 bringing the price to sales ratio to about 6.66 while the forward price to sales ratio will be about 5.1. The company will continue to be unprofitable for the foreseeable future as growth opportunities are favored over stability; thus, I do not think the valuation is cheap.

Risks

Allbirds is still a young brand with significant risks. The greatest risk may be that the company is not profitable. Federal Reserve has signaled that they will be raising rates resulting in unfavorable market sentiments toward unprofitable businesses creating a valuation correction. Further, making matters worse, Allbirds may continue to favor growth over profitability to unlock as much potential as possible. Therefore, even if the brand continues its growth, due to Allbirds’ high valuation and the market sentiment, significant risks exist.

Summary

It may be too early to tell, but I believe Allbirds has an interesting story. The company manufactures a sustainable and environmentally friendly product that is extremely comfortable to wear. I think this fact creates a loyal fanbase as well as premium branding that can expand into an apparel business. However, because the story is in the early stages and the valuation is fairly high, I think investors should keep a close watch on the company while waiting on the sidelines for an opportunity.

Be the first to comment