eyegelb/iStock via Getty Images

With the Q4 Earnings Season nearly complete, many gold producers are busy reporting their updated resource and reserve estimates for 2021. One of the more recent companies to upgrade its resource is B2Gold (NYSE:BTG), and in line with the company’s usual operating performance, the results were phenomenal. This was evidenced by a significant maiden Indicated resource at Anaconda and Cardinal (satellite deposits in Mali) and a massive increase in the Inferred resource base. With an industry-leading dividend yield, a team with a near-flawless track record, and a bright future ahead in Mali, I would view any pullbacks below $3.90 on B2Gold as buying opportunities.

Fekola Project – Mali (Company Presentation)

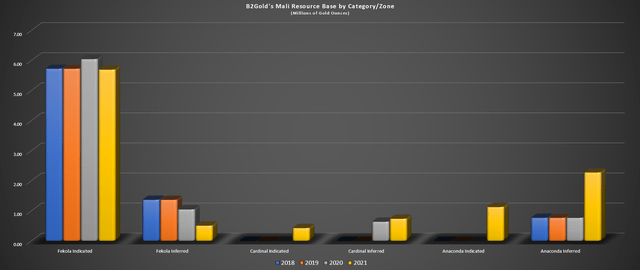

B2Gold released two resource updates over the past two months at satellite deposits in Mali, with the first at Cardinal (500 meters from Fekola) and the second from the Anaconda. These two zones (Cardinal and Anaconda) now have a combined resource base of ~4.5 million ounces, a huge upgrade from the previous resource base of ~1.41 million ounces last year. Notably, the resource base is also more robust, given that there are nearly 1.6 million ounces in the Indicated category. Let’s take a closer look below:

Anaconda Zone

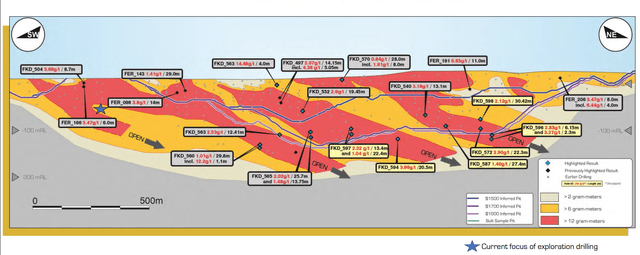

Beginning with Anaconda, which is 20 kilometers north of the company’s flagship Fekola Mine, B2Gold announced a resource base of ~32.4 million tonnes at 1.08 grams per tonne gold in the Indicated category (~1.13 million ounces of gold). This was a huge upgrade from no indicated ounces in the 2017 resource estimate. Meanwhile, the Inferred resource base nearly tripled to ~2.28 million ounces of gold at an average grade of 1.12 grams per tonne gold (~0.77 million ounces previously). The significant increase in both categories has boosted the total Anaconda area resource to 3.41 million ounces of gold.

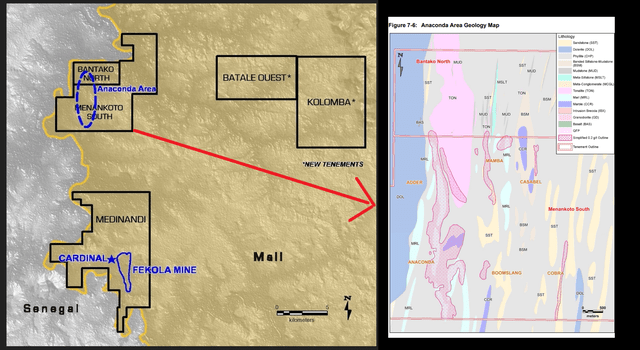

B2Gold’s Malian Land Package (Company Presentation)

For those unfamiliar, the Anaconda Area comprises multiple zones, including Anaconda, Adder, Cobra, Cascabel, Mamba, and Boomslang, and a map of the geology is shown above. As we can see, the Anaconda-Adder saprolite zone boasts a strike length of more than five kilometers and is up to 500 meters wide in some areas and up to 200 meters wide in the Adder Zone. Meanwhile, the Mamba saprolite Zone to the east extended one kilometer in strike as of 2019 drilling but now extends more than three kilometers well into the Bantako North Permit.

It’s worth noting that there is still the potential to add additional ounces at depth below the saprolite mineralization, and the company believes that there’s a potential for Fekola-style sulphide mineralization down plunge below the softer saprolite material. For those unfamiliar, B2Gold was in a brief dispute over the Menankoto South Permit, which makes up a large portion of the resource area, with this permit now reinstated. Hence, the fact that the company has proven up a resource of this size at Anaconda despite missing out on a year of drilling (only able to drill Bantako North) is even more impressive.

Based on less than $40 million spent to date on exploration at Menankoto South/Bantako North, B2Gold’s discovery cost for ounces in the Anaconda appears to be less than $15/oz across all resource categories and just ~$35/oz on solely Indicated resources, an exceptional figure.

Cardinal Zone

Moving over to the Cardinal Zone, which lies just 500 meters from Fekola, the resource here also saw a massive upgrade. This was evidenced by a maiden Indicated resource base of ~430,000 ounces at 1.67 grams per tonne gold, with an Inferred resource base of ~740,000 ounces at 1.21 grams per tonne gold backing up the Indicated resources. This has moved the total Cardinal resource to ~1.08 million ounces of gold, a significant increase from ~640,000 ounces previously.

Cardinal Resource (Company Presentation)

The plan for Cardinal is to provide excess material to top up the Fekola Mill, which has proven it can run well above nameplate capacity at ~9.0 million tonnes per annum. As of year-end, B2Gold has mined ~164,000 tonnes at Cardinal at an average grade of 1.66 grams per tonne gold, and the company believes that this should boost annual production from Fekola by ~50,000 ounces per annum and up to 60,000 ounces from sulphide mineralization over the next 6-8 years. Given the proximity of Cardinal to the Fekola Mine, these are very low-cost ounces and will help to fill in any gaps in the Fekola mine plan.

Updated Resource Base

Putting this all together, we can see B2Gold’s total Malian resource base now stands at just shy of 11 million ounces of gold. This is based on ~5.7 million ounces of Indicated resources and ~500,000 ounces of Inferred resources at Fekola, plus an additional ~4.6 million ounces of gold at Anaconda and Cardinal combined. This is a massive resource base, and as shown below by the chart displaying the progression of resource growth over the years, this is a very positive development for the company. As we can see, while Fekola’s resource base has remained relatively flat despite mining depletion, Cardinal and Anaconda have grown substantially.

B2Gold’s Malian Resource Base by Category/Zone (Company Filings, Author’s Chart)

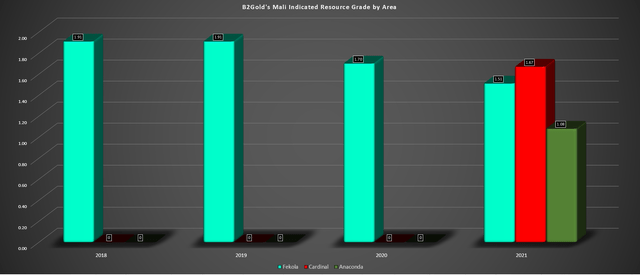

Moving over to resource grades in solely the Indicated category, we can see that Cardinal boasts very impressive resource grades that are actually slightly above that of the Fekola Indicated resource. Meanwhile, though Anaconda does have lower grades at just ~1.08 grams per tonne of gold in the Indicated category, the company is confident that a pit situated in the Anaconda area could provide selective higher-grade saprolite material at an average grade of ~2.2 grams per tonne gold.

B2Gold’s Mali Indicated Resource Grade by Area (Company Filings, Author’s Chart)

The hope, subject to permits being granted, is that the company could begin trucking material by year-end. This would be an 80,000-ounce to 100,000-ounce per year incremental opportunity, with the ability to blend soft saprolite material from Anaconda with the current Fekola feed. However, the other possibility, albeit still subject to a scoping study, is that Anaconda could end up becoming its own stand-alone operation. Previously, I thought this was a stretch, but with a resource base of ~3.4 million ounces of gold and growing, this is certainly a possibility going forward.

Updated Production Profile

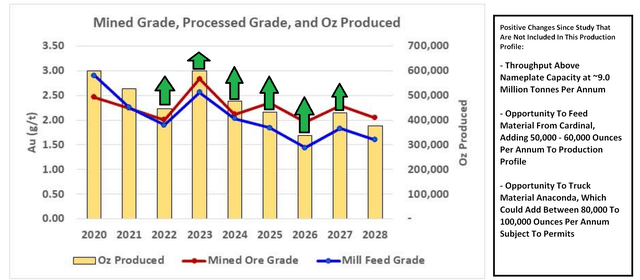

Under the previous mine plan (2020 Technical Report), there was some worry that B2Gold’s crown jewel would have its best years behind it post-2020, given that mill feed grades were declining sharply (ex-2023). B2Gold initially helped maintain its production profile by increasing mill throughput well above the expansion capacity of 7.5 million tonnes per annum. Still, even at this higher rate, it would not be easy to overcome the sharp drop in grades post-2023. This would mean that production would sink below the 540,000-ounce mark, even with the benefit of higher processing rates.

Fekola Mine Plan (2020) & Updated Potential Plan (Anaconda/Cardinal Contribution) (Company Report, Author’s Drawings/Estimates)

However, with a ~55,000-ounce per annum incremental opportunity from Cardinal and an incremental ~90,000-ounce per annum contribution (subject to permits) from Anaconda, this has provided a much-needed facelift to the old mine plan, which was very solid, but would see declining production. As we can see by the arrows I’ve drawn in, the new mine plan should be able to maintain a 570,000-ounce to 620,000-ounce per annum production profile until 2025, with what should be a very strong year in 2023 (assuming permits are granted). In summary, this is a huge improvement.

Long-Term Upside

While the recent developments certainly help fill in gaps and can relax any anxiety investors had until 2026 at Fekola, the bigger opportunity is the possibility of a stand-alone project at Anaconda. Based on the aggressive drilling B2Gold is completing at Anaconda, the fact that there’s upside from additional targets like Fekola Underground, Anaconda at depth (sulphide down-plunge), FMZ, and other regional targets (Heron, Falcon, Eagle), we could see B2Gold decide to go ahead with a stand-alone mill at Anaconda. This would likely be a post-2025 opportunity vs. simply trucking ~1.5 million tonnes of saprolite material per annum south to the Fekola Mill, which could be done in the interim.

Under this scenario, it’s possible that Anaconda could produce over 250,000 ounces per annum with a decent-sized mill, which could give B2Gold a Malian Mining Complex capable of producing ~850,000 ounces per annum later this decade. Obviously, this is all speculative in nature, especially with an Indicated resource at Anaconda of less than five years at this production rate. However, B2Gold has proven to be very competent in the past, and its track record speaks for itself. Therefore, I would imagine the company will aggressively drill out Anaconda, Cardinal, Fekola, and FMZ to see if this could become a reality.

In the most recent press release, B2Gold noted that it will be working on a scoping study to look at potential project economics while advancing work to get permits and hopefully start trucking Anaconda material to the Fekola Mill within 12 months. This is certainly a development worth watching for B2Gold. Under a stand-alone scenario, B2Gold could grow its production profile to more than ~1.25 million ounces per annum by later this decade, even without Gramalote. After adding in its interest in Gramalote and assuming a construction decision in Colombia, the production profile would have upside to ~1.45 million ounces per annum, or 45% growth from current levels.

B2Gold – Exploration Drilling (Company Presentation)

After going from a junior producer in 2012 (~150,000 ounces per annum) to 1 million ounces per annum of production in less than a decade, B2Gold was an unrivaled growth story, except for Kirkland Lake Gold (KL). However, the issue has been that Gramalote looks like it won’t begin production until 2026, and within the portfolio, there wasn’t much in the way of immediate growth, at the same time as Fekola’s best years looked to be behind the asset. This understandably led to the stock underperforming its peers last year.

However, with a massive upgrade to the company’s Malian resource base and a path to maintaining a ~600,000-ounce per annum production profile at Fekola over the next few years, this is a major improvement. Meanwhile, the discussion of a stand-alone at Anaconda, now supported by a solid resource base, has made the story even more encouraging. This is excellent news for investors. If it works out, B2Gold could see up to 50% production growth by 2029 while the company advances its greenfields opportunities in Finland and Uzbekistan to work on its next pillars for possible growth. Let’s look at the technical picture below.

Technical Picture

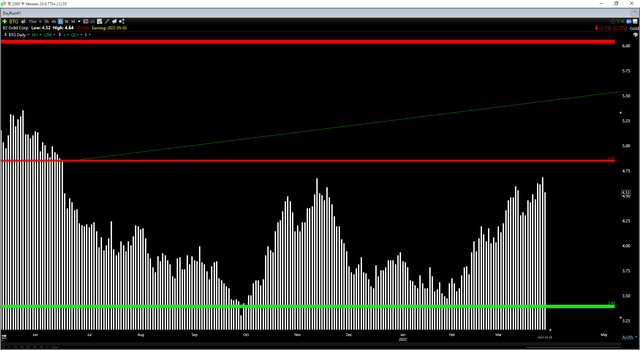

While the recent upgrade to the company’s Malian resource base is undoubtedly positive, B2Gold continues to sit in the upper portion of its expected trading range, sitting just shy of short-term resistance at US$4.85 – US$5.00. Meanwhile, the stock’s long-term support comes in between US$3.40 – US$3.60. Even if we use the upper portion of resistance and the upper portion of support, this translates to $0.47 in potential upside for B2Gold to resistance and $0.93 in potential downside to support. This translates to a reward/risk ratio of 0.50 to 1.0, which is well below the 4.0 to 1.0 reward/risk ratio I prefer for starting new positions.

This doesn’t mean that the stock can’t head higher, and from a valuation standpoint, I still see meaningful upside from current levels. However, from a technical standpoint, the time to aggressively buy the stock was in the $3.40 – $3.60 range, and we’re now more than 30% above this level. For this reason, while I am bullish long-term on B2Gold and believe it has a very bright future, I remain neutral short-term. In order for the stock to move back into a low-risk buy zone, the stock would need to dip below $3.90.

B2Gold Buy Rating (Seeking Alpha Premium)

With an industry-leading dividend yield, a team with a near-flawless track record, and a very bright future with the possibility of a Mali mining complex that could produce close to 900,000 ounces long-term, there’s a lot to like about the B2Gold story. Additionally, we should get more clarity on the opportunity at Gramalote later this year, which could be a 20,000-ounce per annum opportunity, with a Feasibility Study due by Q3. However, with B2Gold up sharply off its lows, I would not rule out further weakness, and the best time to buy the stock has generally been on sharp pullbacks. So, while the boost to resources is an upgrade to the investment thesis, I see BTG as a Hold for now.

Be the first to comment