XH4D

Q1 recap and Q2 outlook

Meta Platforms (NASDAQ:META) reported its 2022 Q1 earnings on April 27th, 2022. The results were mixed and not well-received by the market. In terms of financials, top line growth was healthy (or even robust). Total revenues dialed in at $33.7 billion, an almost 20% growth both YOY and relative to the previous quarter. The bottom line was less exciting. Earnings per share of $3.67 fell short of the $3.88 total from the previous year and also the consensus estimates.

What’s more worrisome are the user growth, active times, and management’s outlook for the near future. The management team explained that it is currently dealing with a number of challenges, such as inflation, disruptions in the supply chains of advertisers, disruptions from the Russian/Ukraine war, and privacy changes to Apple’s iOS system. All of these add to an increased difficulty of monetizing, muted user growth, and margin pressures.

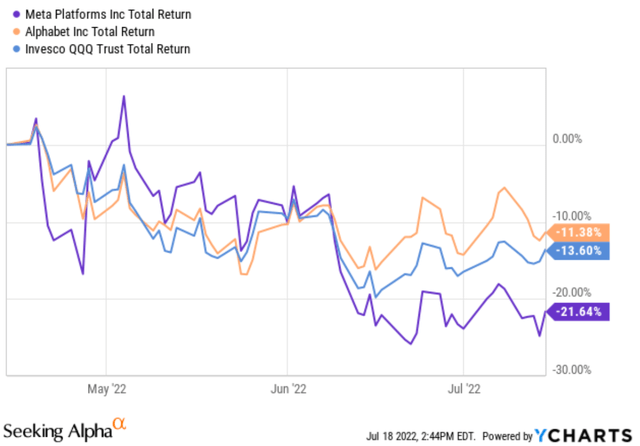

As a result, the stock price has suffered a sizable correction since the Q1 earnings report as you can see from the following chart. META has suffered a loss of more than 21% since then. To put things under perspective, the broader tech sector (represented by QQQ) suffered a correction of 13.6%. And the other leader in the digital ad space, Google (GOOG) (GOOGL), only suffered an 11.3% correction.

Looking ahead, I am seeing many of these headwinds persist into Q2 and even beyond. Although I am bullish on the long-term prospects as you can see from my previous META articles (the most recent one is here). In the remainder of this article, I will elaborate on a few near-term headwinds. The goal is to help investors better prepare for the Q2 earnings report and better contextualize it.

Growth and Margin heads likely to persist

The growth pressure and margin pressure are likely to continue, or even worsen, in Q2. A brief recap from the Q1 earnings report to set the stage. CFO Dave Wehner really summed up these challenges during the Q1 earnings report (abridged and emphases added by me):

First quarter operating income was $8.5 billion, representing a 31% operating margin… Now moving to our segment results. I’ll begin with the Family of Apps segment. Q1 total Family of Apps revenue was $27.2 billion, up 6%… Growth decelerated from the fourth quarter due to a variety of factors. Prior to the war in Ukraine, we faced expected headwinds related to the continued slowdown in our online eCommerce vertical…

We experienced a further deceleration in growth following the start of the Ukraine war due to the loss of revenue in Russia as well as a reduction in advertising demand both within Europe and outside the region…

Foreign exchange rates were also a headwind to growth in the quarter.

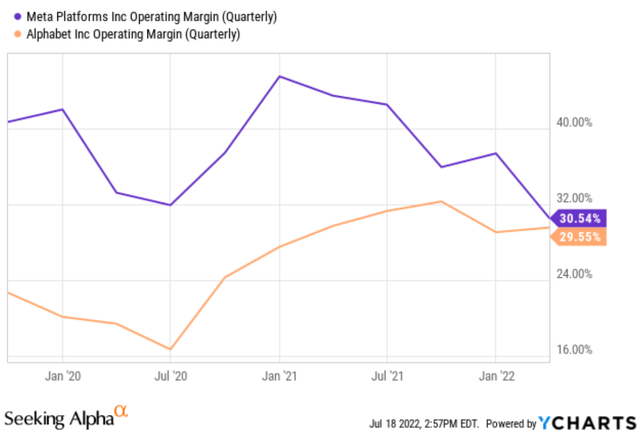

Since the Q1 earnings report, all the above factors have either persisted or even worsened. The Russian/Ukraine war is still ongoing and with no end in sight. The impact of the foreign exchange rates probably has worsened. As the Fed continues rate raises to fight inflation, the dollar index has strengthened by more than 7% in the past 3 months, from about 100 three months ago to the current level of above 107. To contextualize the 31% operating margin Wehner mentioned above, the next chart shows META’s operating margin in recent quarters compared to GOOG’s. As seen, its margin has been in a nosedive since 2021. The margin shrank from about 45% to the current level of 31%. GOOG’s margin, in contrast, has been improving since 2021. It improved from about 17% to the current level of 29.5%.

META’s margin will likely be under pressure in the near term due to the factors mentioned above. Anticipating such pressure can help us to stay rational during the Q2 earnings report (and after all, its current margin is still on par with GOOG, its closest peer).

We’ve just got so much attention to spend

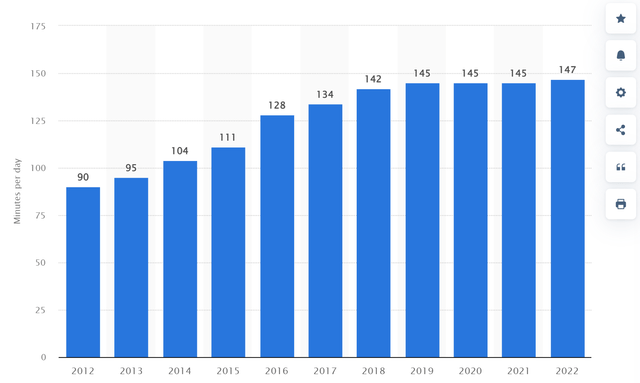

Another broader backdrop is that global social media time seems to have saturated already according to the following data. It shows the daily time spent on social networking by internet users worldwide from 2012 to 2022 in minutes.

As can be observed, internet users globally spent an average of 147 minutes per day on social media in 2022. It is a record amount. And it is a mindboggling amount of total time given there are more than 7 billion people out there with their eyes glued to their phones. It is estimated that the total time spent on social media in the 2022 Q2 alone reached 2.5T minutes! But the number is not that different from the 2019 level. It is only 2 minutes more, despite the fact that COVID has supposedly caused many of us to spend more time in isolation and hence on social media.

If there is one resource that is truly limited, it is human attention. Everything else, energy, gold, clean water, et al, technology probably eventually figure out a way to produce more and enlarge the pie. But each of us only gets 24 hours of attention. If we spend more of it on A, we will have less to spend on B. And META is not grabbing more of our attention lately, as you will see next.

And META is not grabbing more of our attention lately

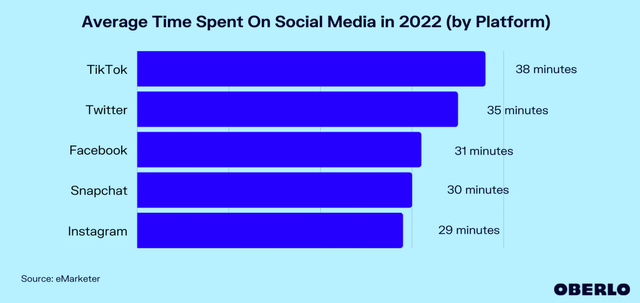

According to the latest data on time spent on social media provided by eMarketer, the APP that grabs the most of our attention in the U.S. is TikTok. U.S. users spent an average of 38 minutes a day on TikTok in 2022, followed by Twitter (35 minutes). Facebook came in third place, grabbing 31 minutes of our attention per day.

Furthermore, the latest trend is moving in the wrong direction for META. According to this latest Morgan Stanley report, both TikTok and YouTube saw a rise in usage during Q2 2022, but Facebook (and Instagram) see declines. To wit, TikTok saw a 14% rise in total time spent during Q2 YoY, but META suffered a 1% decline.

I would be especially interested in management’s perspective on such trends (both the saturation issue and META’s share). And I would also pay particular attention to the update on its Reels and see how it has performed against TikTok during the past quarter.

Reality Labs

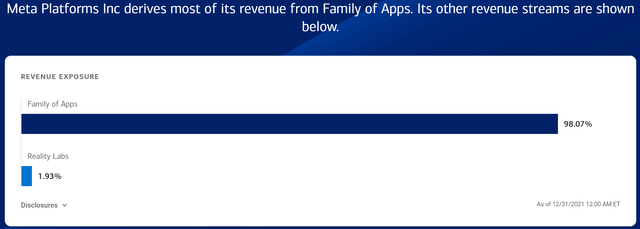

After all the above issues, a highlight to look forward to is an update on its Reality Labs. Currently, its Reality Labs only contributes a minor portion of its income (1.93%). But its addressable market is tremendous. The market size is anticipated to increase at a phenomenal pace of 44.8 percent CAGR. META is making strong investments in this area as CEO Mark Zuckerberg commented over the last earnings call below (abridged and emphases added by me). Even modest progress in this area could trigger a positive market reaction.

In Reality Labs, we’re making large investments to deliver the next platform that I believe will be incredibly important both for our mission and business are comparable in value to the leading mobile platforms today. Now I recognize that it’s expensive to build this, it’s something that’s never been built before and it’s a new paradigm for computing and social connection. So over the next several years, our goal from a financial perspective is to generate sufficient operating income growth from Family of Apps to fund the growth of investment in Reality Labs while still growing our overall profitability.

Final thoughts

A few final thoughts before closing. For Reality Labs, a lack of progress probably won’t trigger a negative market reaction anymore. Zuckerberg already cautioned the market that investment in Reality Labs might be dialed back a bit in 2022 given the revenue headwinds anticipated. So a slowed pace has already been priced in both the market.

Another area to pay attention to obviously is, always is, the earnings outlook for the next quarter and full year 2022. Its Q1 provided revenue guidance in the range of $28-30 billion for the second quarter of 2022. This is in the same range as the same quarter last year (total revenues were $29.1B). The outlook factored in the softened growth as aforementioned, the war in Ukraine, and also a 3% currency exchange headwind. An updated outlook for the incoming quarter can shed more light on management’s updated assessment of the extent and duration of these headwinds.

Be the first to comment