Oat_Phawat

Introduction

Vancouver-based Equinox Gold Corp. (NYSE:EQX) reported its third quarter 2022 results late on November 2, 2022.

This article is an update of my preceding article, published on August 6, 2022. I have followed EQX on Seeking Alpha since February 2021.

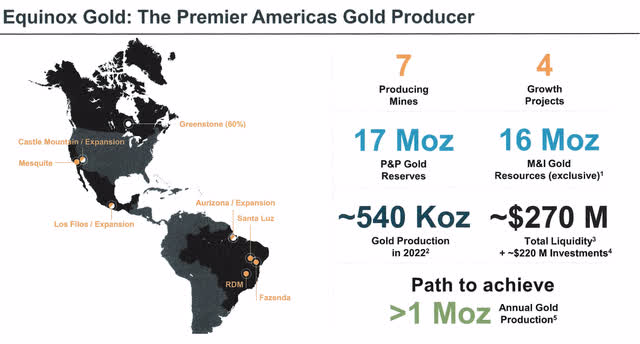

The company is a mid-tier gold producer with seven producing mines and 4 growth projects with 17 Moz in P&P reserves. The company-producing assets are located in Canada, Mexico, USA, and Brazil.

EQX Map (EQX November Presentation)

1 – 3Q22 highlights

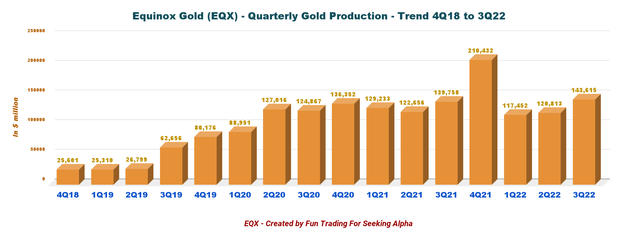

Equinox Gold produced sequentially significantly higher in 3Q22 with 143.615 Au oz, a 2.8% increase over 3Q21 (139,758 Au oz) and up 18.9% sequentially. In the press release:

The Company sold 4% more gold ounces in Q3 2022 compared to Q3 2021. The increase was mainly driven by increased production at Mesquite and the contribution of pre-commercial production ounces at Santa Luz, offset by decreased production at Los Filos, Aurizona, and RDM, and by no gold sales at Mercedes as the operation was sold on April 21, 2022.

The revenues came in at $245.13 million, the same as last year’s quarter. The company posted a loss of $30.12 million compared to a loss of $8.08 million last year. The adjusted EBITDA for 3Q22 was $25.7 million.

Revenues were lower than analysts’ expectations, and the stock took a severe hit after reporting lower guidance. However, it seems an overreaction at first glance, even if the company indicated that it expects full-year production to be approximately 540K Au ounces of gold and AISC to exceed the upper end of guidance by about 5%.

One subject of concern: The company intends to finance the Greenstone Project using its stock, and I see a potential dilution that I will explain later in this article.

The Santa Luz mine is ramping up with continuous commissioning and delivered 17,184 Au ounces this quarter (first gold pour end of March). The mine achieved commercial production effective October 1, 2022.

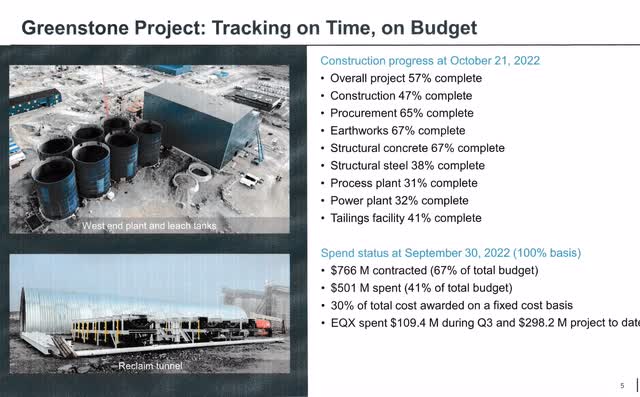

Also, Equinox commenced Greenstone construction with 57% of the overall project completed and 41% of the initial CapEx spent, or $501 million.

EQX Greenstone project (EQX November Presentation)

Note: On September 1, 2022, Greg Smith, President of Equinox Gold, succeeded Christian Milau as Chief Executive Officer and a Director of Equinox Gold

2 – Investment thesis

Equinox Gold is struggling with temporary technical issues related to its RDM (low-grade stockpile material while the open pit is being dewatered) Aurizona mines and the four-day suspension of its operations at Los Filos as the result of a community blockade which forced the company to revise its 2022 guidance.

However, the company enjoys a solid balance sheet and solid future growth that deserve a long-term investment status. Excellent mineral reserves of nearly 17 Moz with an estimated 540K Au ounces production in 2022.

Thus, despite this weak period and extra CapEx due to inflationary pressures, I still consider Equinox Gold a long-term investment but with some reservations.

Because EQX is tightly associated with gold, it could quickly drop if the gold price fall due to the Fed raising interest on December 12 by 75-point again.

Finally, On October 24, 2022, EQX filed a preliminary base shelf prospectus with the exchange that, when finalized, will be effective for 25 months and allow for raising to $500 million through “various sources of capital.” I see a risk of dilution here.

Therefore, I suggest trading 65% LIFO of your long-term position to protect you from a sudden drop in the gold price. This dual strategy is what I am suggesting in my marketplace, “The Gold and Oil corner.”

3 – Stock performance

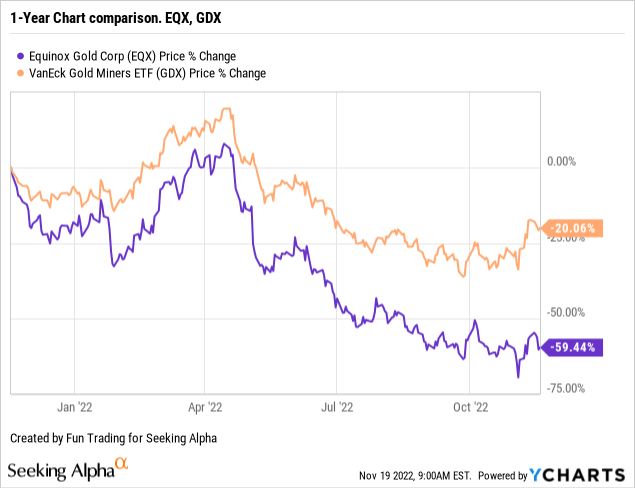

Equinox Gold has significantly underperformed the VanEck Vectors Gold Miners ETF (GDX) and plunged since April. EQX is now down 59% on a one-year basis.

CFO Peter Hardie said in the conference call:

Compared with Q3 2021, the decrease in average gold price that I mentioned, combined with higher cost, compressed our margins. On the revenue side, we’re down $70 an ounce compared to Q3 last year.

Equinox Gold – Financial Snapshot 3Q22 – The Raw Numbers

| Equinox Gold | 3Q21 | 4Q21 | 1Q22 | 2Q22 | 3Q22 |

| Total Revenues in $ Million | 245.13 | 381.23 | 223.16 | 224.60 | 245.13 |

| Net Income in $ Million | -5.24 | 184.08 | -19.78 | -78.70 | -30.12 |

| EBITDA $ Million | 47.55 | 244.29 | 35.91 | -41.00 | 31.43 |

| EPS diluted in $/share | -0.02 | 0.54 | -0.07 | -0.26 | -0.10 |

| Operating Cash flow in $ Million | 64.76 | 155.42 | -16.35 | -26.88 | 54.16 |

| Capital Expenditure in $ Million | 71.51 | 107.44 | 123.88 | 142.20 | 151.49 |

| Free Cash Flow in $ Million | -6.75 | 47.99 | -140.23 | -169.08 | 97.33 |

| Total Cash $ Million | 459.93 | 546.03 | 328.54 | 257.41 | 211.97 |

| Total Long-term Debt in $ Million | 545.09 | 540.69 | 536.25 | 631.86 | 725.76 |

| Shares outstanding (diluted) in Million | 300.51 | 350.97 | 302.23 | 303.68 | 304.98 |

Data Source: Financial statement

Gold Production And Balance Sheet Details

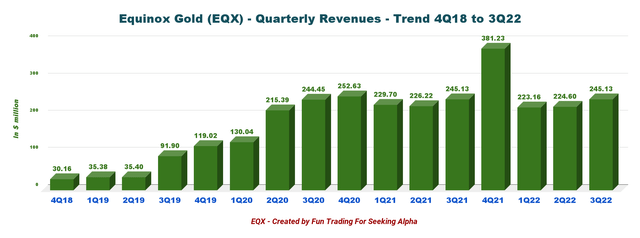

1 – Revenues were $245.13 million in 3Q22

EQX Quarterly Revenues history (Fun Trading)

In Q3 2022, earnings from mine operations were $7.4 million (Q3 2021 – $45.7 million) and for the nine months ended September 30, 2022 were $52.9 million (nine months ended September 30, 2021 – $131.2 million). Earnings from mine operations were lower in Q3 2022 compared to Q3 2021 due to lower realized gold price per ounce, higher operating costs, supply constraints, and inflationary pressures, particularly from increased prices of oil and other consumables (M&A release).

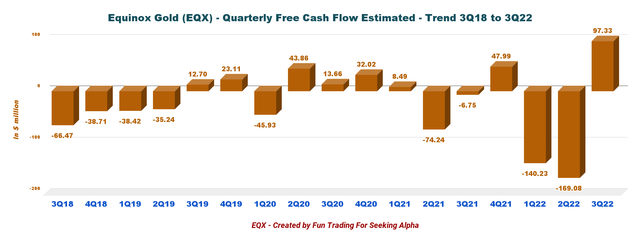

2 – Free cash flow was $97.33 million in 3Q22

EQX Quarterly free cash flow history (Fun Trading)

Trailing 12-month free cash flow was an estimated loss of $163.99 million, with an income in 3Q22 of $97.33 million.

The loss in free cash flow is due mainly to the CapEx attached to Santa Luz and Greenstone. Therefore, it should not be considered a negative but an excellent investment for future growth.

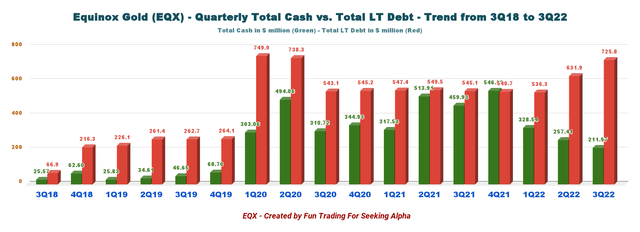

3 – Net debt is $583.8 million, and cash of $211.97 million in 3Q22

EQX Quarterly Cash versus debt history (Fun Trading)

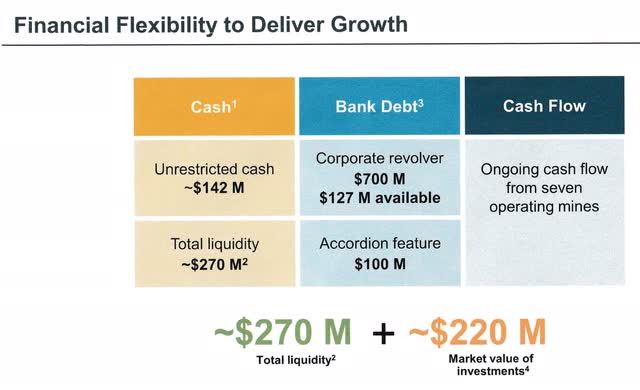

As of September 30, 2022, the total cash was down to $211.97 million, and the total liquidity was ~$270 million. Also, the company owns $220 million in the market value of investments (Solaris, I-80 Gold, and Bear Creek mining).

The company indicates a Net debt that increased to $583.8 million on Sept. 30, 2022.

- On October 21, 2022, the Company drew down an additional $100 million on its revolving credit facility.

- EQX Increased the Revolving Facility from $400 million to $700 million.

- $73.3 million of outstanding principal balance under the term loan rolled into Revolving Facility, eliminating the need for principal payments through mid-2026.

- $99.8 million of the Revolving Facility was drawn in July 2022, and $100.0 million was removed in October 2022; $127.2 million of the Revolving Facility was undrawn as of this MD&A.

- Added a $100 million uncommitted accordion feature.

- Extended the maturity from March 8, 2024, to July 28, 2026, with the ability to request a one-year extension.

- Decreased borrowing costs by reducing the Revolving Facility interest rate by an average of 25 – 50 basis points.

EQX liquidity, Revolver and net debt (EQX November Presentation)

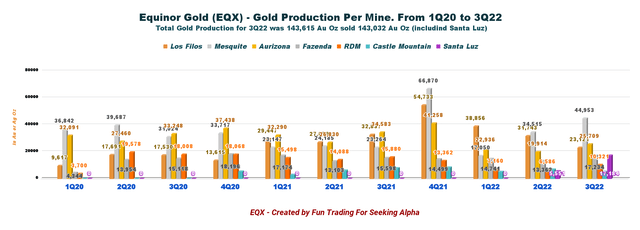

4 – Gold production consolidated details – 3Q22 gold production was 143,615 Au Oz (143,032 Au Oz sold)

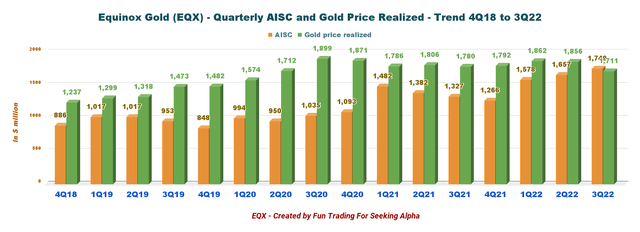

EQX Gold production history (Fun Trading) The decrease in production was mainly due to lower gold sales at Aurizona and RDM, which were impacted by lower gold production. Lower gold production at Aurizona was due in part to lower gold grades, as high rainfall impeded access to higher-grade ore. Lower gold production at RDM was mainly due to the temporary suspension of mining and plant operations in mid-May due to a delay in receiving permits for the scheduled TSF raise and suspension of plant operations from mid-February to mid-March to reduce water levels in the TSF to comply with regulatory requirements. AISC in 3Q22 was $1,749 per ounce sold, and the gold price realized was $1,711 per ounce. The AISC is very high this quarter due to Santa Luz and Greenstone. However, it should go down soon. EQX Quarterly AISC and gold price history (Fun Trading)

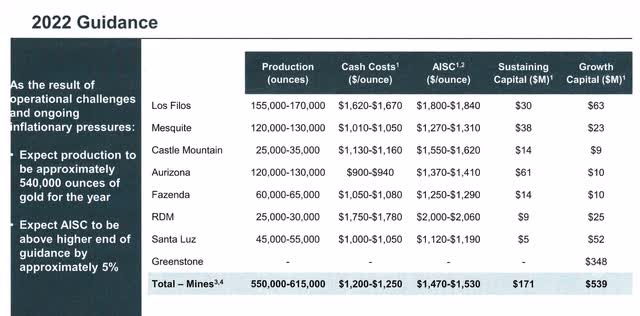

5 – Updated 2022 Guidance. 2022 Gold production is expected to be 540K Oz with AISC at $1,500 per ounce (mid-point).

Equinox Gold updated again its 2022 Guidance from 582.5K Au Oz indicated in 2Q22 to now 540K Oz. It is nearly 20% down from the initial guidance. Furthermore, AISC is expected to be 5% higher or between $1,470-$1,530.

The company said in the press release:

Based on production to date at Los Filos and Aurizona, both of which experienced operational challenges that are expected to affect Q4 2022 production, and the ongoing inflationary macro-economic environment, the Company expects gold production to be approximately 540,000 ounces for the year with costs to exceed the upper end of AISC guidance of $1,530 per oz by approximately 5%.

EQX New guidance 2022 November Presentation (EQX November Presentation)

6 – Production details per mine

EQX Quarterly production per mine history (Fun Trading)

Also, Equinox began full-scale construction at the Greenstone project in Canada. The project is 41% complete on schedule and budget at the end of 3Q22.

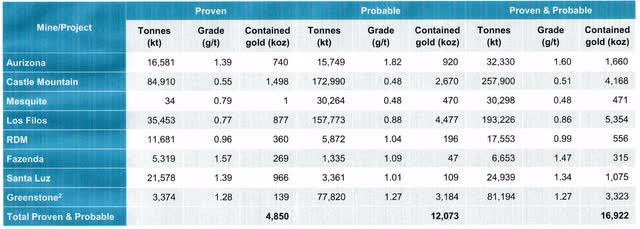

7 – Proven and Probable Mineral Reserves

Mineral reserves are now 16.922 Moz with the incorporation of the Santa Luz and Greenstone project.

EQX New mineral reserves (EQX November Presentation)

Technical Analysis (Short Term)

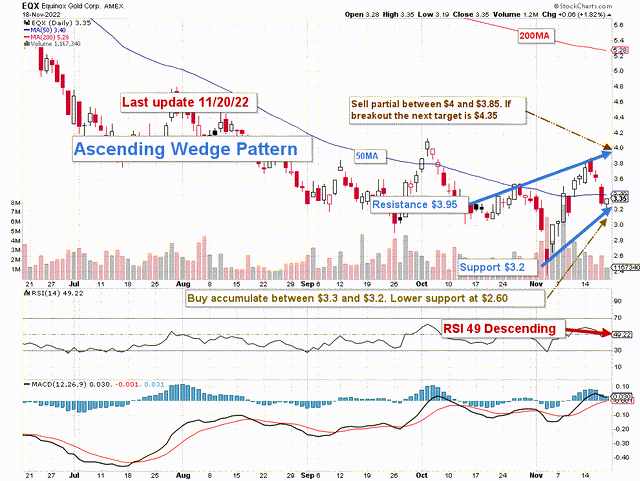

EQX TA chart short-term (Fun Trading StockCharts)

EQX forms an ascending wedge pattern with resistance at $3.95 and support at $3.20.

Warning: The rising or ascending wedge pattern is considered a bearish chart pattern that signals an imminent breakout to the downside.

The dominant trading strategy that I usually promote in my marketplace, “The gold and oil corner,” is to maintain a core long-term position and use about 65% to trade LIFO while waiting for a higher final price target for your core position between $5 and $6.

I believe it is safe to accumulate long-term, but there is a definite risk of dilution here. The company will probably continue to finance its Greenstone project using its stocks (bought-deal or ATM). Therefore, I recommend buying EQX cautiously between $3.3 and $3.2, with potential lower support at $2.60.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States to generally accepted accounting principles (GAAP). Therefore, only U.S. traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment