Sascha Schuermann/Getty Images News

Investment Thesis

When people talk about monopolies, they think about the likes of Google (GOOGL) in search, Meta (META) in social media, or Apple’s (AAPL) App Store – they tend to be bad for consumers, but good for investors, and some near-monopolies are certainly small enough to stay under the government’s radar.

Enter Axon (NASDAQ:AXON), a company that has transformed law enforcement in the United States. Its original namesake product, the TASER, is used by the majority of police departments in the US. The company has since expanded into additional offerings such as body cameras, as well as diving into the SaaS world with cloud-based software for the justice system. These SaaS offerings have become industry standard and helped supercharge Axon’s growth whilst creating an ecosystem of stickier products.

But at a market cap of ~$6.5 billion, does Axon look like a good investment right now? I take it through my investing framework to find out.

Business Overview

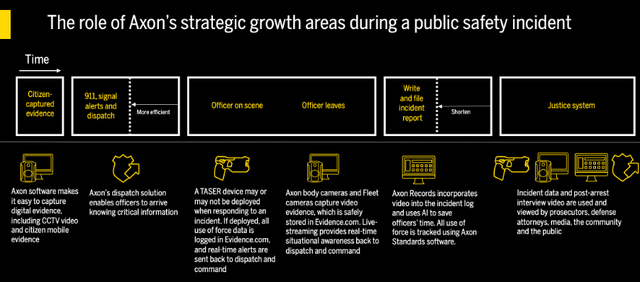

Axon Enterprise creates weapons, cameras, and software primarily for law enforcement agencies. The company has one of the best mission statements I’ve ever heard – ‘to protect life’ – and its long-term strategic goals include obsoleting the bullet, reducing social conflict, enabling a fair and effective justice system, and building for racial equity, diversity, and inclusion.

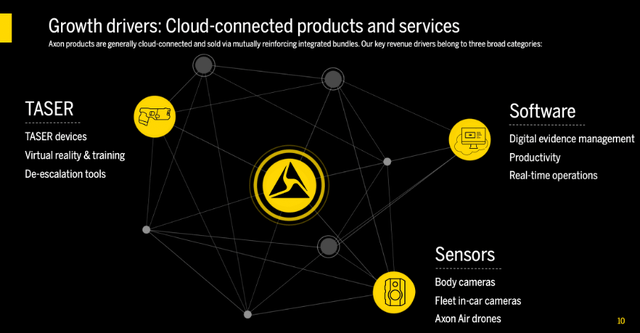

Axon has three operating segments that generate revenue: TASER, Sensors, and Software.

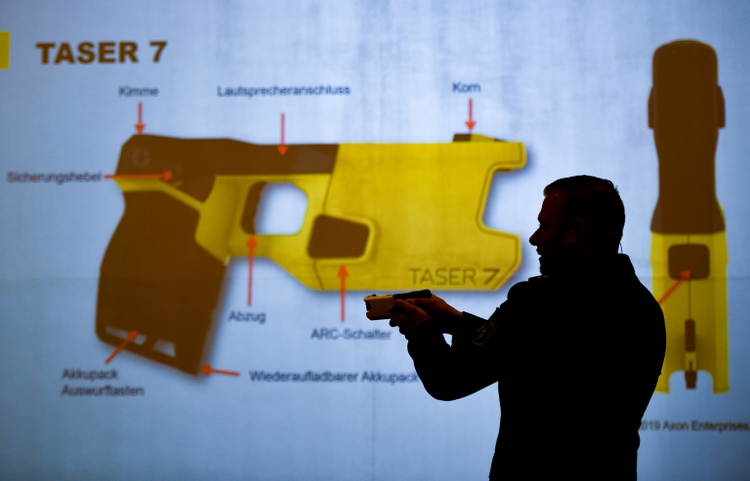

The company was formally known as TASER, which is one of the most recognisable brands when it comes to law enforcement. A TASER is a handheld device that uses electricity to stun people – it enables those who use it to incapacitate someone without having to resort to lethal force. TASERs are used by a majority of US police departments on a daily basis, and Axon sees potential to expand into the personal protection market for individuals.

TASER (Axon)

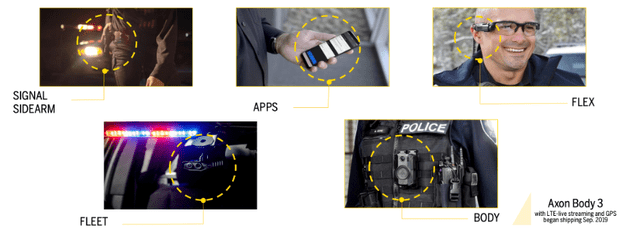

The product categories within Axon’s ‘Sensors’ segment include Axon body cameras, Axon Fleet in-car systems, as well as additional devices. These products help to increase transparency and trust in law enforcement, and are also used to capture evidence accurately.

Axon Q1’22 Investor Presentation

This Software segment includes a suite of cloud-based SaaS solutions that integrate seamlessly with Axon’s hardware products such as TASERs or body cameras. The company has a multitude of SaaS solutions, which can help with digital evidence management, productivity, and real-time operations. Axon Evidence is the world’s largest cloud-hosted public safety data repository of public safety video data & other types of digital evidence.

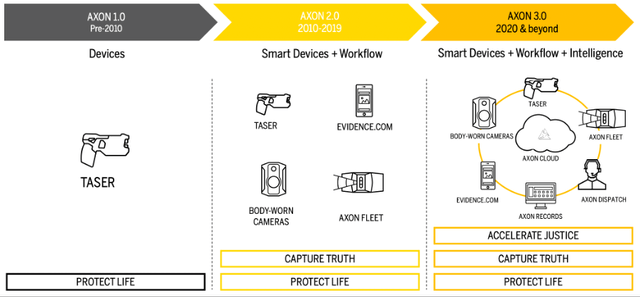

The company has shown its ability to evolve successfully over time, transforming itself from a hardware story with TASER to a fully-fledged SaaS business with ~$350m in annual recurring revenue.

Axon Q1’22 Investor Presentation

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

I think the most substantial economic moat possessed by Axon relates to switching costs. It already has a monopoly with the TASER devices, and that already gives Axon an advantage against any potential newcomer, but the real switching costs have been enabled through its software solutions.

As mentioned, Axon Evidence is the world’s largest cloud-hosted digital evidence management system, which makes it easier for law enforcement agencies to store and search for all different types of evidence. So first and foremost, it would be incredibly difficult for any law enforcement department to shift all of their evidence away from this industry-standard solution to a different storage platform. This is before mentioning the fact that Axon’s hardware products (TASERs, body cameras etc.) all integrate seamlessly with its software solutions, making it even easier for evidence to be automatically captured and stored.

Axon Q1’22 Investor Presentation

So a law enforcement department would not just be changing how it stores its evidence, but it would also have to find a completely new way to get evidence uploaded from its hardware onto some different software. Axon is just far too embedded in the day-to-day processes of a law enforcement department to switch from, and this is further highlighted by the company’s 119% net dollar retention rate.

Axon Q1’22 Investor Presentation

The company also benefits from some network effects. Firstly, if a law enforcement agency is already using Axon software or hardware, then that agency will be incentivised to purchase additional software or hardware from Axon. As we just saw, this company has created a network of products that work better together – so if I’m using Axon software & know that the company’s hardware will easily integrate with my system, then why wouldn’t I purchase Axon hardware? This creates a network effect, as the more products a law enforcement agency purchases from Axon, the more it is incentivised to do so in the future.

The company also benefits from network effects courtesy of Axon Evidence. This is described by Axon as ‘the industry’s only scalable solution for justice system collaborators’, since it is used across the entire justice system – including for prosecutors and public defenders. When something becomes industry standard, it is onerous to try and use a different software; if everyone uses Axon Evidence, then the ability to share and collaborate between different law enforcement agencies or different arms of the justice system becomes a lot easier. As a result, more and more organisations will be compelled to use Axon Evidence, and as more get added, the more appealing it becomes, creating a network effect & helping Axon to continue its growth.

I will also give Axon credit for its brand, and specifically for the TASER name. As mentioned, TASERs are used by the majority of US police departments, and the company is also expanding globally. When it comes to weapons, trust and reputation are key. The fact that TASER is a well-known, widely adopted brand with a strong reputation will give it a huge advantage over any market newcomer. It is a risk to arm law enforcement officers with new weapons from an unknown company, and so I think agencies are more likely to stick with their existing solutions as long as they effectively do the job.

Outlook

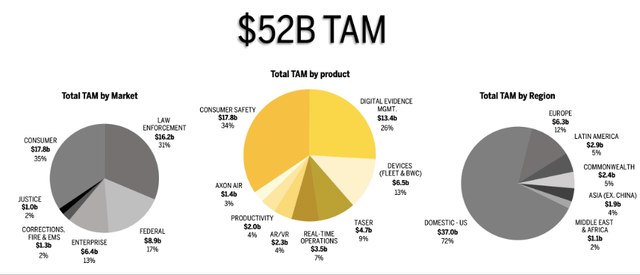

Thanks to the new products and solutions that Axon has been rolling out over the past decade, the company has successfully expanded its total addressable market and created new opportunities for itself. As of its Q1’22 results, Axon estimates its TAM to be $52 billion – if this is to be believed, then Axon has only captured <2% of its TAM.

Axon Q1’22 Investor Presentation

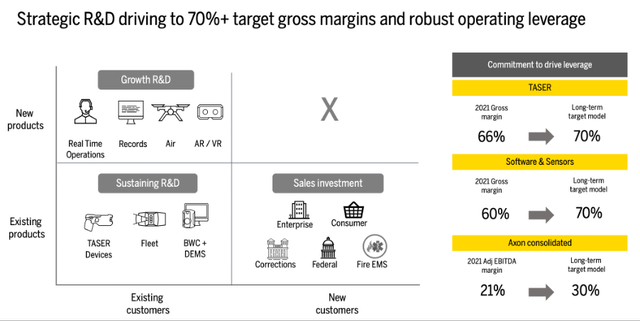

I also think this company has a lot of room ahead of it to expand margins. It has been in growth mode over the last few years, reinvesting heavily back into the business in order to grow and expand its cloud offerings. The company believes that it should be able to grow its adjusted EBITDA from 21% in 2021 to 30% as part of its long-term operating model, and it is hoping to improve gross margins for Software & Sensors by 1,000 basis points over the long-term.

Axon Q1’22 Investor Presentation

Management

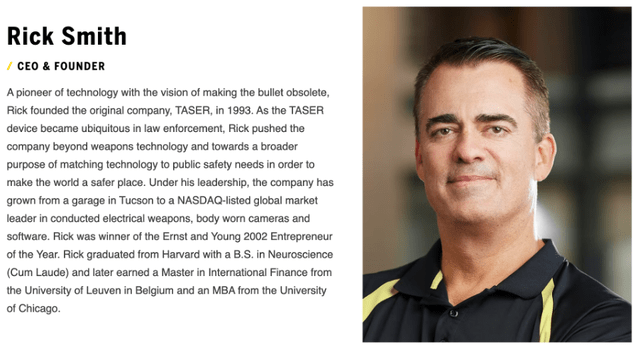

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where insider ownership is high. I’m happy to say that we have a founder-led business in Axon, as CEO Rick Smith founded Axon way back in 1993 and has grown from a garage in Tucson to a ~$6.5 billion company. Having founded & led the company for almost 30 years, it is clear that CEO Smith has soul in the game; Axon is more than just a money-maker to him.

CEO Rick Smith (Axon)

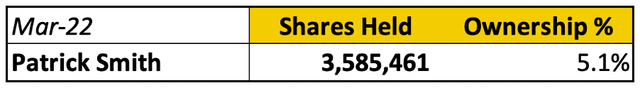

I want to invest in companies where leadership has skin-in-the-game, and when it comes to Axon, I’m happy to see CEO Smith with an ownership level of ~5% – but this isn’t the most impressive part.

Axon 2022 Proxy Statement / Excel

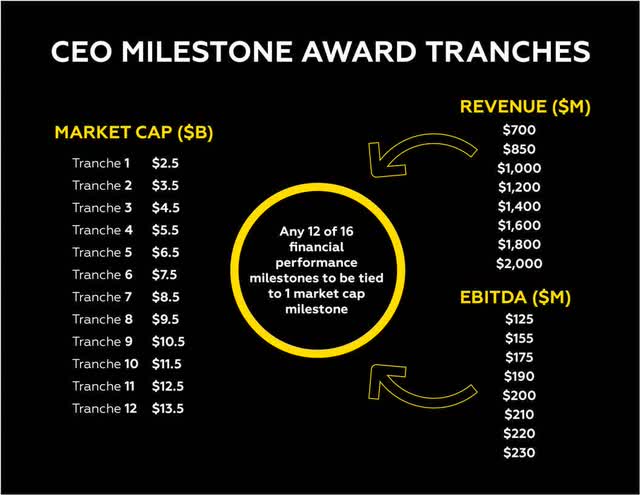

In 2018, the decision was taken by CEO Smith and the Board to grant him a new CEO Performance Award. Smith relinquished his salary, and instead his compensation was linked almost entirely to future company performance and market capitalisation milestones. He has achieved many of these since 2018, and that has taken his ownership level from below 2% to the 5% it is today – talk about skin-in-the-game.

Axon February 2018 Press Release

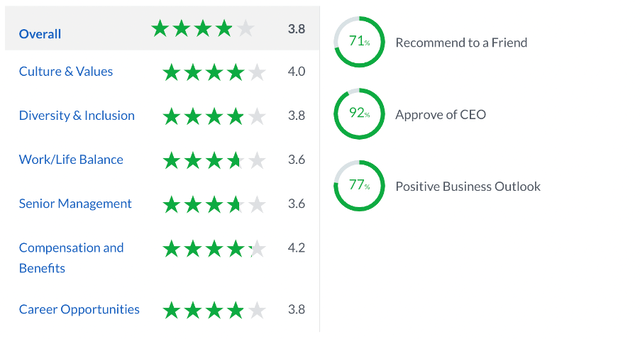

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Axon gets some fairly average scores from the 400 reviews left by employees. Any score over 4.0 is impressive, and Axon only achieves this in Culture & Values and Compensation and Benefits. It falls short in Work/Life Balance and Senior Management, scoring only a 3.6 on both, and these are categories where companies do tend to struggle. On the plus side, 92% of employees approve of CEO Rick Smith – which does not surprise me, as everything I’ve learned about him paints a very good picture.

Glassdoor

Financials

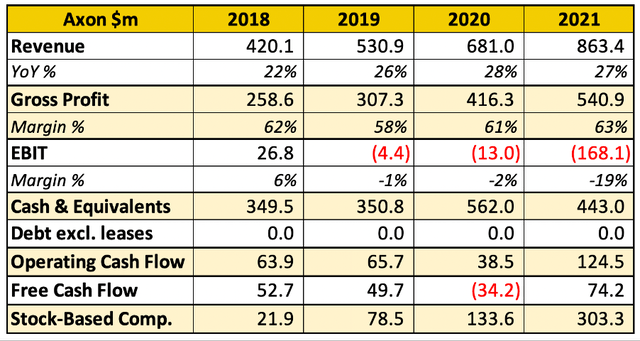

Axon’s financial profile is changing over time as it transitions from a hardware company into a more hybrid hardware and software business.

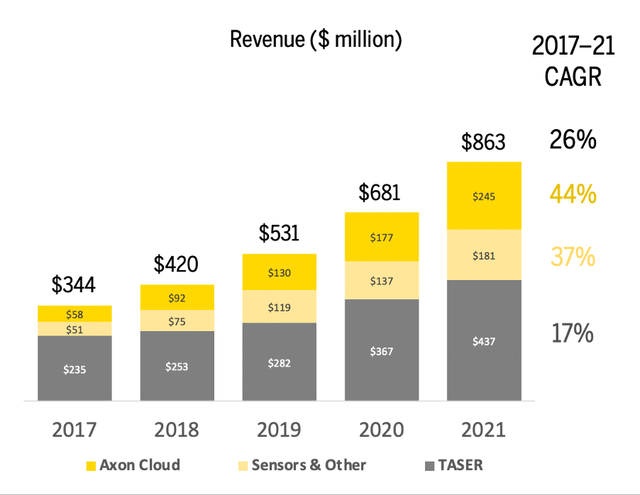

Axon SEC Filings / Excel

Revenue growth has accelerated, boosted by the fast-growing Sensors and Software business segments becoming more substantial contributors to overall revenue. In fact, from 2017 through to 2021, TASER grew at a 17% CAGR, Sensors & Other grew at a 37% CAGR, and Axon Cloud grew at a 44% CAGR.

Perhaps surprisingly, the TASER gross margin of 66% was higher than the combined Sensors & Software gross margin of 60% in 2021; this is a great sign for the future, as it means Axon has even more room to expand margins in these faster growing segments.

Axon Q1’22 Investor Presentation

The company has a stellar balance sheet, with $443m in cash, cash equivalents, and short-term investments at the end of 2021, and zero debt. It is also operating and free cash flow positive, and has been for almost every single one of the past four years.

One area of concern for some investors will be Axon’s lack of profitability combined with its high stock-based compensation. But a reminder; that high stock-based compensation is primarily driven by CEO Rick Smith’s successful performance in growing Axon’s share price – so long-term investors certainly won’t mind this dilution, as the fruits of Smith’s labour have been exceptional.

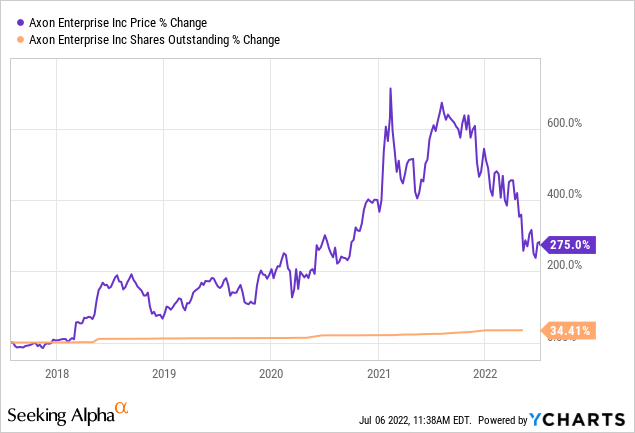

Any shareholders over the past 5 years will have been diluted by ~34%, but still will have seen their shares rise in value by ~275%, which is a pretty good trade off. It’s also worth highlighting that any high future stock-based compensation will likely come only if CEO Smith continues to deliver for investors – if this is the case, I have no issues with it.

Valuation

As with all high growth companies, valuation is tough. I believe that my approach will give me an idea about whether Axon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

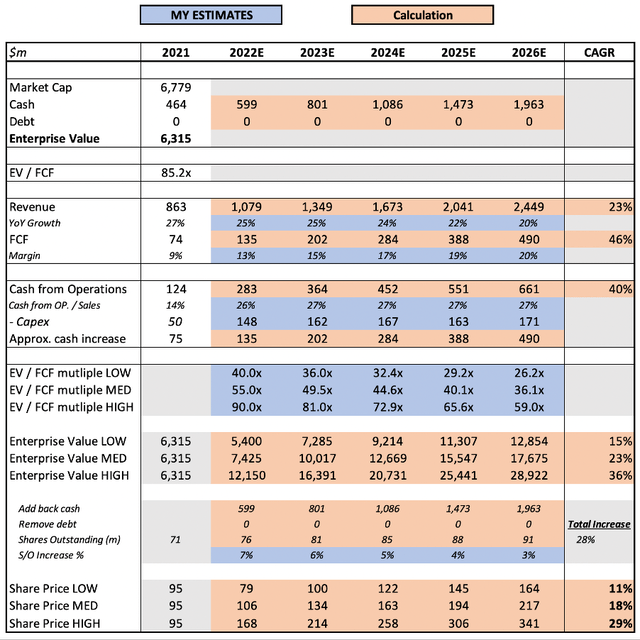

Axon SEC Filings / Excel

I am grateful to the Axon management team for providing a detailed outlook for 2022 in their Q1’22 Shareholder Letter. As such, my 2022 assumptions for revenue growth, free cash flow, and capital expenditure are all taken from this guidance. I have assumed gradually slowing revenue growth from 2023 onwards, although this is a conservative assumption – I think Axon is more than capable of accelerating revenue growth over the coming years.

I have also assumed a continued free cash flow margin expansion. I was particularly impressed by the 2022 free cash flow guidance from Axon of $125m-$145m considering it expects elevated capital expenditure in 2022, driven by an $85m development of its Scottsdale manufacturing facility and campus. As such, I have assumed that Axon will be able to continue expanding FCF margins, especially as software continues to make up a larger share of revenue.

I have assumed continued shareholder dilution, although I think this should start to ease up towards the end of my forecast period as CEO Smith has fewer and fewer new objectives to obtain. It is difficult to forecast this, since it’s almost impossible to forecast exactly how much stock-based compensation Smith will receive, but I have tried to assume a prudent forecast that would result in shares outstanding increasing by 28% over the period 2021-2026.

Put all that together, and I am forecasting an 18% CAGR for Axon shares through to 2026 in my mid-range scenario.

Risks

I think the single biggest risk to a company such as Axon is bad publicity surround its product; specifically, the risk of a product either being used in the wrong way, or worse, it’s product malfunctioning and resulting in the injury or death of a person. However, TASERs still do a much better job of preventing deaths than firearms, and they are only to be used in situations where an individual has to be forcibly incapacitated.

There is an interactive Reuters tool examining the 1,081 deaths involving TASERs, of which only two have resulted in the court ruling against the manufacturer. These were in 2008 and 2014, so it’s clear that Axon has done all it can to mitigate this risk.

Another risk for the business is the potential impact of a security breach within its cloud-based evidence platform. The footage captured on this platform is incredibly confidential, and a significant security breach could damage the trust in Axon’s platform forever. Axon has several steps to mitigate these risks, such as vulnerability identification and remediation, security monitoring and response, regular updates and advanced protections.

Summary

I still don’t think I’ll see a better mission statement than ‘to protect life’, and this is a company that truly lives by its mission statement. Not only does it have a founder with true soul in the game, but Axon has created its own powerful monopoly within law enforcement.

Long-term shareholders of this company have been rewarded, but even though shares have returned more than 18,000% since this company came public in 2001, I think the future looks bright.

Given all this, I think the current share price looks very attractive for a category defining business that has a huge runway ahead.

Be the first to comment