Justin Sullivan/Getty Images News

To me, there has never been a better time to invest in technology. While I agree that the excess multiples of 2020 and 2021 needed a sharp correction, weak sentiment has taken the selloff in most stocks too far. A dotcom mentality is creeping in here – with the main difference being that many of the biggest corrections this year have happened in tech companies that are still running stable, profitable businesses.

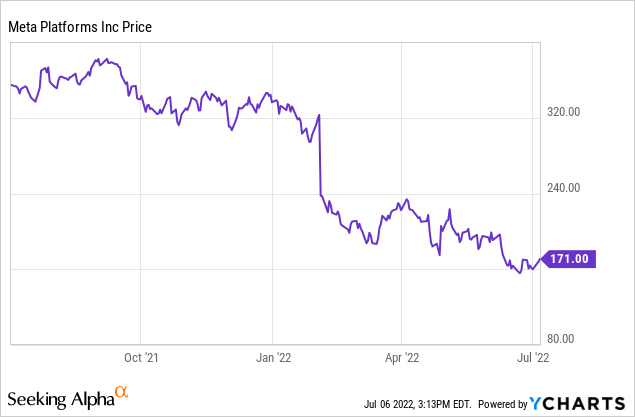

Look no further here than Meta Platforms (NASDAQ:META), which has lost 50% of its value year to date. The social media giant is tackling a host of challenges, but we have to ask ourselves rationally: should Meta, with all its global dominance, really be worth half as much as it was at the start of the year?

A quick rundown of the issues

The fall, of course, was not purely senseless. There are a number of both macro and company-specific concerns at play here which has Meta investors on edge. A rundown of the most pertinent ones:

- Ad-tracking and privacy changes that are hampering Meta’s advertising business, which is the lion’s share of its revenue

- A transition to short-form video content which is currently not well monetized

- Saturation and a slowdown in user growth

- A post-pandemic slowdown in e-commerce which is impacting Facebook’s Marketplace business

- Macro headwinds from the continuation of the Russia-Ukraine conflict as well as the expectation of a global recession, which is pulling down advertiser demand

These risks are real. But at the same time, we have to ask: is the 50% drop in Meta stock appealing enough to warrant that extra risk? In my view, the short answer is yes.

The upside

I’d encourage investors to think on a more long-term basis when it comes to Meta. Specifically, the key thought that runs through my head is: right now, I have an opportunity to purchase Meta at a historic discount versus consensus earnings expectations. I believe in the long-term thesis here enough to warrant patience through this rough patch.

To me, here are the key reasons that Meta remains incredibly relevant for the long term:

- Meta is the largest collection of social networks on the planet. While Facebook’s core site may be stagnating, “newer” platforms like Instagram are picking up the slack. While other social media companies have shown themselves to be more transitory in nature, Facebook’s self-branded “family of apps” has persisted for well over a decade and now act as a virtual platform of record for nearly half of the world’s population.

- One of the companies with the most advanced designs on the metaverse and augmented reality. Meta’s name change is a nod to the fact that the company views the next few decades to be dominated by the meta verse. While the concept has seen a lot of airtime in both the news and in fiction, few companies outside of Meta have made any R&D headway into it.

- Huge war chest. As of the end of its most recent quarter, Meta has $50.7 billion of cash on its books, completely unencumbered of debt. This gives the company significant firepower to chase both organic and inorganic growth opportunities. On top of this, Meta remains hugely profitable. In its most recent quarter, the company generated another $8.5 billion of free cash flow, up 9% y/y.

All of this comes at a very cheap price right now. At current share prices near $171, Meta trades at just a 12.3x forward P/E ratio versus FY23 EPS consensus of $13.85 (data from Yahoo Finance). That’s a significant discount to both Meta’s historical multiples as well as the S&P 500 (currently at a ~15x multiple).

Consensus believes 2022 will be the trough year for earnings, with estimates pointed to $11.74 this year (-15% versus 2021’s $13.77 in earnings), before ricocheting back in 2023. And with the recent engineering hiring slowdown (which the market took as a warning sign, but that I believe is a positive signal that the company is belt-tightening when it needs to), plus expectations for double-digit revenue growth in 2023, I think Facebook has meaningful levers to be able to realistically achieve these targets.

DAUs are still growing, as is ad revenue

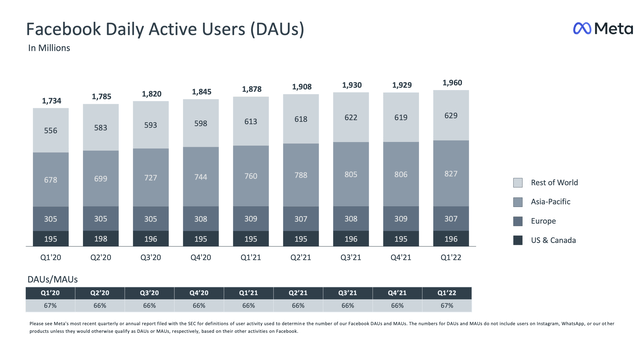

Earlier this year in February, fresh off Meta’s Q4 earnings print, one of the major concerns was that user growth was seeing a dramatic slowdown.

In Q1, the company added 31k net-new DAUs (daily active users), to end at 1.96 billion and up 3% y/y. This is a massive relief after DAUs showed a temporary and slight dip in Q4.

Facebook DAU trends (Facebook Q1 earnings deck)

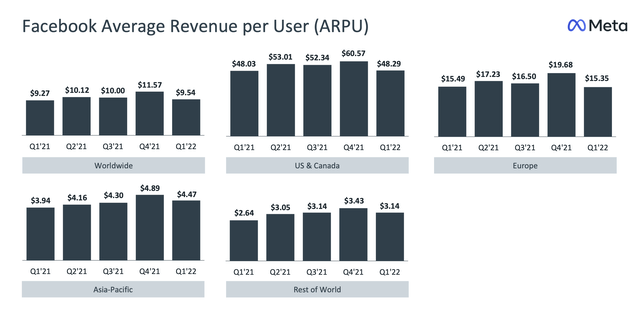

ARPU is down sequentially, but still up year over year as well – to $9.54 as of the end of Q1, up 3% y/y to $9.276 at Q1 of 2021.

Facebook ARPU (Facebook Q1 earnings deck)

Net/net, this means the company is still growing ad revenue – up 6% y/y.

Advertising still remains a huge and profitable business. It’s key to be aware that the company strategy is to keep milking the profits from the social media/ad business to keep driving multi-year efforts in the multiverse. Per CEO Mark Zuckerberg’s comments on the Q1 earnings call:

I also want to share how I’m thinking about investments and margins. Last year, we began looking at our business as two segments, Family of Apps and Reality Labs. On the Family of Apps side, I am confident that we can return to better revenue growth rates over time and sustain high operating margins. In Reality Labs, we’re making large investments to deliver the next platform that I believe will be incredibly important both for our mission and business are comparable in value to the leading mobile platforms today.

Now I recognize that it’s expensive to build this, it’s something that’s never been built before and it’s a new paradigm for computing and social connection. So over the next several years, our goal from a financial perspective is to generate sufficient operating income growth from Family of Apps to fund the growth of investment in Reality Labs while still growing our overall profitability.

Unfortunately, that’s not going to happen in 2022, given the revenue headwinds, but longer-term that is our goal and our expectation. Of course, our priority remains building for the long-term, so while we’re currently building our plans to achieve this, it’s possible that prolonged macroeconomic or business uncertainty could force us to trade off against shorter-term financial goals. But we remain confident in our long-term opportunities and growth.”

Facebook/Meta has long been a company that is very quick to spot generational trends and get ahead of the curve. Near-term moves like the shift to short-form video is a reflection of Meta’s agility, and I have confidence that the company will execute on its longer-term metaverse vision as well. In the meantime, investors still have a chance to buy into a hugely profitable business at a very opportune valuation.

Key takeaways

There’s a lot of pessimism built up into Meta’s stock, but as usual I think sentiment is much poorer than the reality of Meta’s fundamentals. I’d encourage investors to focus on the long term here and take the dip as a buying opportunity.

Be the first to comment