Marko Geber/DigitalVision via Getty Images

The US Lodging Sector Is Resilient Despite Elevated Inflation and Risk of Recession

Despite elevated inflation weighing on hotel experts’ estimates of Average Daily Rate [ADR], a key performance indicator of hotel profitability, the lodging sector is leveraging a strong pricing power.

Furthermore, buoyed by a solid household balance sheet coupled with positive momentum in group travel and business travel, analysts say the lodging sector will be resilient in 2023, despite the expected economic slowdown due to US Federal Reserve [FED]’s hawkish stance on interest rates.

Given the extent to which the Fed is implementing tighter monetary policy to combat runaway inflation, there’s not a small chance that the recovery [in real terms] in ADR as well as RevPAR [revenue per available room] could occur well before 2025.

Investors May Want to Profit From the Continued Improvement in the US Lodging Sector Through Ashford Hospitality Trust

The recovery in the lodging sector represents an opportunity for investors to seize, and among US-listed hospitality stocks, Ashford Hospitality Trust (NYSE:AHT) appears to offer an excellent solution to achieve this goal.

The company invests in the U.S. hotel sector, but its portfolio appears to be better structured than many other companies to capture the key drivers that will help the industry to reach the pre-pandemic levels.

For those who are not used to certain information from the accommodation sector:

- ADR measures the average payment for a guest room over a given period of time.

- RevPAR gives an indication of a hotel’s profitability as it shows the number of rooms sold and the revenue generated by the bookings.

Ashford Hospitality Trust: The Portfolio Should Benefit from the Demographic Shift Towards Business-Oriented States

Based in Dallas, Texas, Ashford Hospitality Trust is a real estate investment trust [REIT] with a portfolio primarily focused on investments in upper upscale hotels that provide full service to clients.

Based on the EBITDA of each hotel in which Ashford Hospitality Trust has currently an interest, the US hotel REIT’s portfolio is divided into 63% upper upscale hotels, 25% upscale hotels, 6% independent hotels, 4% luxury hotels and 2% upper mid-scale. So the portfolio is highly exposed to upper-upscale hotels.

Based on each hotel’s EBITDA, 75% of the portfolio consists of full-service hotels, while the remaining 25% consists of select-service hotels.

The portfolio accounts for 100 hotels and 22,313 rooms of premier brand names [Hilton and Marriott] and premier hospitality management firms [Remington] located in 28 states of the United States.

These properties are predominantly located in the best markets in the US lodging sector and are, among other things, subject to favorable tailwinds from specific demographic changes.

65% of Ashford Hospitality Trust’s top 17 markets are in states that will welcome many companies from the Northeast, Rust Belt and West Coast. From these areas, potentially 25% of entrepreneurs are considering moving to states with the highest commercial activity and services.

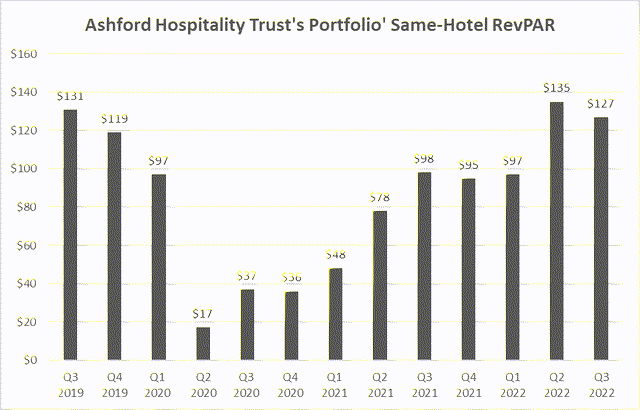

Third Quarter 2022 Financial Results: RevPAR and ADR Were Up while Occupancy Was Conventionally Below Industry

Results for the third quarter of 2023 were strong, particularly in the final month of the period when RevPAR performance was the best data since the COVID-19 crisis. The pandemic, with its lockdowns and other restrictions, negatively impacted the lodging business and weighed on profitability.

But Ashford Hospitality Trust’s portfolio is coming out of the crisis very well.

In Q3 2022, Ashford Hospitality Trust’s same hotel’s RevPAR increased 29.33% year over year to $126.72. While the same hotel’s RevPAR had its second-best quarterly performance since 2019, it was still 3% below Q3 2019.

Same Hotel RevPAR compares the RevPAR of a specific hotel in Ashford Hospitality Trust’s portfolio from a specific period to the same hotel’s RevPAR for the corresponding period in the previous year.

The same hotel RevPAR provided a clear signal of an ongoing recovery following improvements in two other equally important parameters that also provide a reliable measure of the profitability of Ashford Hospitality Trust’s portfolio.

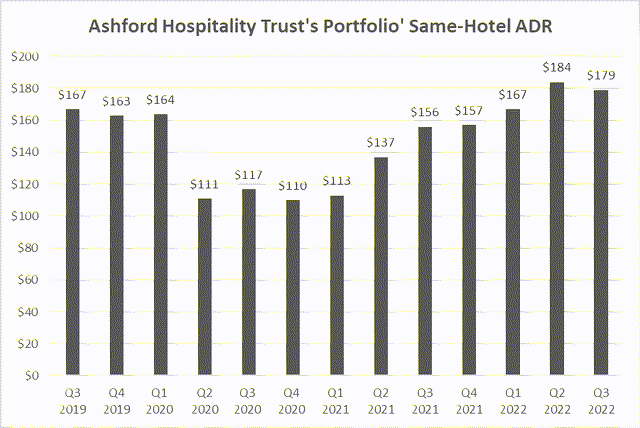

These are the same-hotel ADR and the same-hotel occupancy rate.

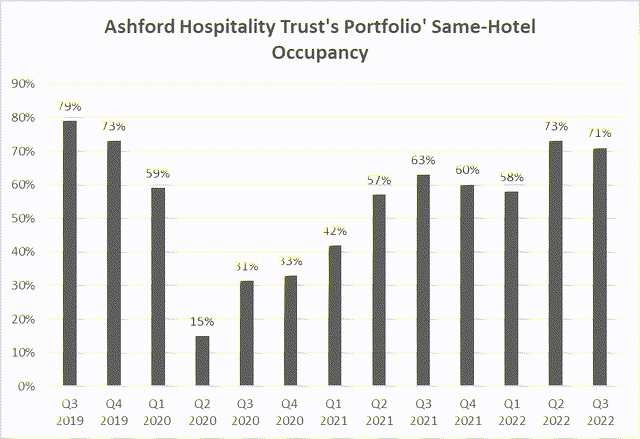

Same-hotel ADR increased 14.5% year-on-year to $178.57, while same-hotel occupancy rate increased 12.93% year-on-year to 70.96% in Q3 2022.

In addition, revenue increased nearly 33% to $328.16 million in Q3 2022, while net income from the Ashford Hospitality Trust portfolio reflected a net loss of $25.2 million, or a diluted net loss of $0.73 per share.

Three Graphs Illustrating the Ongoing Trend in the Main Performance Indices

Graph 1. Ashford Hospitality Trust’s Portfolio’ Same-Hotel Occupancy

Graph 2. Ashford Hospitality Trust’s Portfolio’ Same-Hotel RevPAR

Graph 3. Ashford Hospitality Trust’s Portfolio’ Same-Hotel ADR

Key Indicators from the Ashford Hospitality Trust Vs. Hotel Industry Forecasts: The Comparison Points to a Bright Future for the US hotel REIT

A comparison of Ashford Hospitality Trust indicators with the overall hotel industry in 2022 shows the following trend.

While Ashford Hospitality Trust is lagging in terms of occupancy, which, as explained below, is not surprising in Ashford’s case, Same-Hotel RevPAR and Same-Hotel ADR are performing much better than predicted by analysts.

Ashford’s occupancy rate averaged 63.3% for the first 9 months of 2022. This means that based on the trend observed in the first 9 months of 2022, Ashford’s occupancy rate should be around 71% by the end of 2022 [the estimate relates to the entire year 2022]. While STR and Tourism Economics forecast 95.5% as the occupancy rate for the industry by the end of 2022.

Ashford’s Same-Hotel RevPAR averaged $119.67 for the first 9 months of 2022. Based on the trend observed in the first 9 months of 2022, Ashford’s Same-Hotel RevPAR should be around $127.2 for the entire 2022. While STR and Tourism Economics forecast $107.7 as Same-Hotel RevPAR for the industry by the end of 2022.

Plus, Ashford’s Same-Hotel ADR averaged $176.67 for the first 9 months of 2022. Based on the trend observed in the first 9 months of 2022, Ashford’s Same-Hotel ADR should be around $179.7 for the entire 2022. While STR and Tourism Economics forecast $112.8 as Same-Hotel ADR for the industry by the end of 2022.

These comparisons underscore the characteristics of Ashford Hospitality Trust’s portfolio, which focuses on investing in premium accommodations in the best US markets. It intercepts demand from customers who travel a lot for business reasons. So short overnight stays, but above all being able to afford expensive accommodation. Occupancy will hardly exceed the hotel industry average.

In fact, Ashford’s higher RevPAR and ADR indicators suggest Ashford’s portfolio’s ability to charge a much higher price than many other smaller hotel operators.

Interestingly, this characteristic of Ashford’s portfolio continues to align well with the next trend analysts are anticipating in the US lodging industry.

STR and Tourism Economics expect leisure travelers looking for more luxurious accommodations to determine the fate of the lodging industry for the foreseeable future.

Given the composition of the portfolio, Ashford Hospitality Trust shareholders can only welcome the future scenario drawn by analysts.

The US hotel REIT company owns stakes in well-known operators of upper upscale accommodations in the US premier markets but for transient leisure customers and business customers. Of course, the hotels also welcome tourists in groups and other visitors.

The Financial Condition of Ashford Hospitality Trust

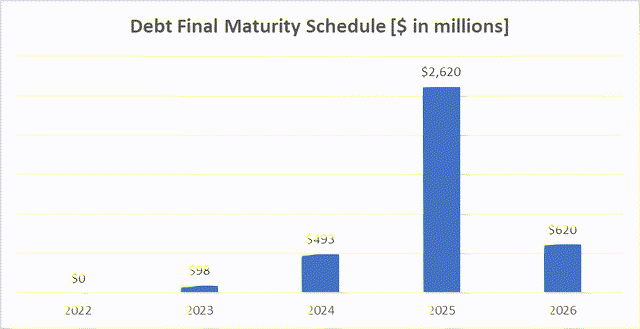

As of September 30, 2022, Ashford Hospitality Trust’s balance sheet reported total debt of approximately $3.9 billion, which far exceeded cash on hand, which instead totaled approximately $505 million.

However, despite its high level, this financial burden should not worry shareholders, as the company says it is characterized by a comfortable repayment schedule plan.

AHT-September-2022-Investor-Deck

The company aims to reduce debt over time. In the last 2 years, Ashford Hospitality Trust has reduced its net debt by more than 15%.

The company plans to deleverage through the proceeds of the issuance of non-traded preferred stock, which will offer preferred shareholders an approximately 8% annualized dividend yield and the opportunity to participate in a dividend reinvestment plan.

Part of the funds raised will be used for acquisitions to increase the quality of the entire portfolio. Currently, only 15% of hotels in Ashford Hospitality Trust’s portfolio can use the excess cash flow they generate for corporate purposes and are not held by the lender.

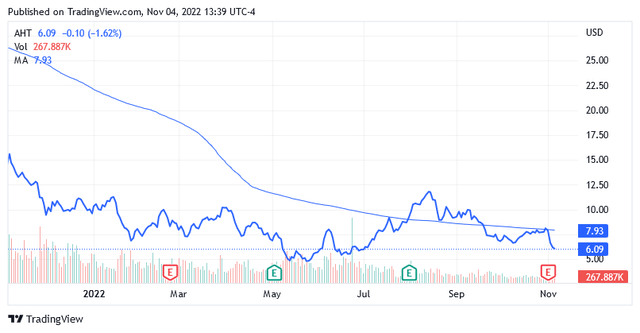

The Stock Valuation: Shares Do Not Look Expensive

As of this writing, Ashford Hospitality Trust’s stock was trading at around $6.09 per share determining a market cap of $240.89 million and a 52-week range of $4.61 to $16.41.

Shares don’t look expensive given the upside potential, as the stock reflects a well-positioned portfolio of upper upscale hotels exposed to the current industry trend. That is, the improvement of the US lodging sector is being driven by transient leisure travelers seeking accommodation in hotels with strong pricing power.

From a technical standpoint, shares are now trading significantly lower than year-ago levels, as the stock is currently over 40% below the middle point of $10.51 of the 52-week range. Also, the stock trades below the long-term trend of the 200-day moving average of $7.93.

After falling more than 60% over the past year, Ashford Hospitality Trust’s share price could still fall amid market headwinds from aggressive monetary tightening and the risk of a recession. But a 14-day relative strength indicator of 32.20, meaning oversold levels are not far away, could suggest a bottom is approaching.

Additionally, the stock has a Price to Funds from Operations [P/FFO] forward [FWD] ratio of 3.31 versus the sector P/FFO [FWD] of 13.35.

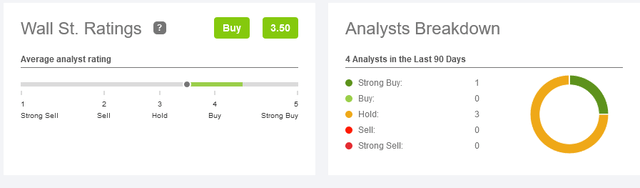

Wall Street’s Recommendation Ratings and Price Target

On Wall Street, analysts have recommended a strong buy and four holds for a medium buy rating.

seekingalpha/symbol/AHT/ratings/sell-side-ratings

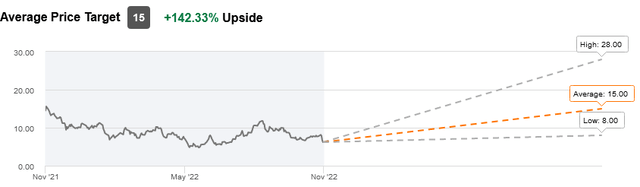

Ashford Hospitality Trust stock has an average price target of $15, reflecting a 144% price increase that could potentially materialize within the next 52 weeks.

seekingalpha/symbol/AHT/ratings/sell-side-ratings

Conclusion – Stock Appears Compellingly Valued Given the Presence of Strong Upside Potential

The shares are trading at a compelling price given the current upside potential of an investment in Ashford Hospitality Trust US publicly traded stock.

The US lodging industry is still healing well after the devastating effects of the COVID-19 virus pandemic. The next recession could slow things down, but that shouldn’t threaten Ashford Hospitality Trust US. The portfolio includes holdings in upper upscale full-service hotels run by respected managers. Therefore, these companies should not be affected by a potential economic slowdown.

Additionally, a large portion of Ashford Hospitality Trust’s US markets could see increased demand over the next few years due to expected business relocations to more business-friendly areas and with a higher per capita income. An interesting trend is also transient holidaymakers who want to stay in hotels of the same standard as in the Ashford Hospitality Trust portfolio.

Be the first to comment