hapabapa/iStock Editorial via Getty Images

Price Action Thesis

We follow up with a detailed price action analysis on Lucid Group (NASDAQ:LCID) stock after our post-earnings update in May. We highlighted in our previous article that LCID stock was testing a critical support level and has not demonstrated price action signals of a bottom.

However, its near-term bottom has formed after we published our article. As a result, we can discern its critical support and resistance zones, helping investors visualize them better.

Our price action analysis suggests there wasn’t a bear trap from its May bottom. However, a subtle bull trap followed its May recovery and met stiff resistance, represented in its near-term resistance.

As a result, we believe the price action signals are unclear for now, and investors should continue to bide their time. Nevertheless, we posit a potential re-test of its near-term support moving forward, unveiling critical clues on where the market intends to take LCID stock forward.

Accordingly, we reiterate our Hold rating on LCID stock.

Watch The Momentum Spikes

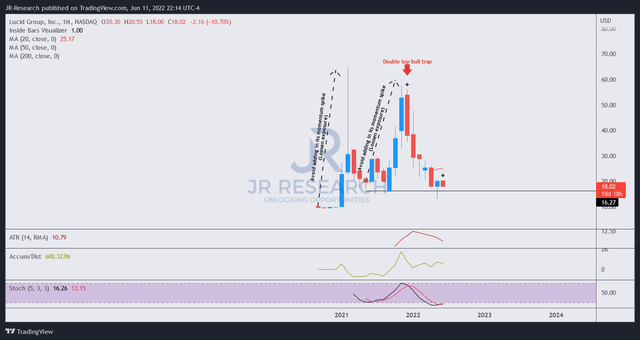

LCID price chart (TradingView)

LCID investors must observe such momentum spikes carefully, as seen above. These spikes are often price action signals by the market to draw in buyers rapidly before the sellers force the selling and digest the gains.

Admittedly, we were too early when we first revised our rating on LCID stock from Hold to Buy in December. We have not paid sufficient attention to these price action signals previously.

Instead, we paid more attention to the Street analysts’ ratings and Lucid’s story. Even though we don’t own LCID stock, it has taught us an invaluable lesson, which we hope to communicate to our readers. Consequently, we have made it a critical point that every stock must pass our price action “litmus test” before we can issue a Buy/Sell rating.

But why has the market been so harsh on LCID stock, drawing in buyers for the double top bull trap “slaughter,” sending it down almost 70% from its November highs?

Lack of Medium-Term Free Cash Flow Profitability

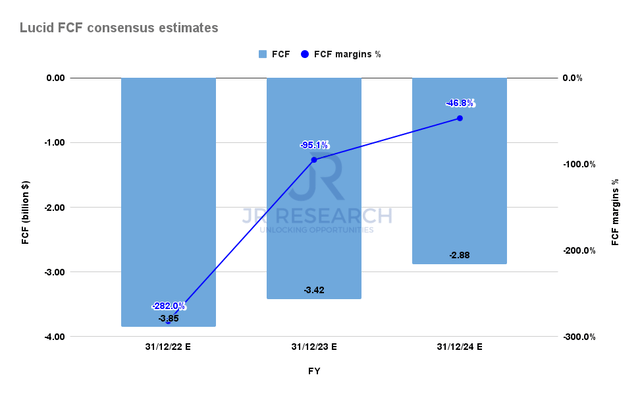

Lucid FCF consensus estimates (S&P Cap IQ)

The market hasn’t singled out lucid over the past six to seven months as high-growth stocks collapsed. But, Lucid’s lack of medium-term free cash flow (FCF) profitability has been parsed and annihilated.

As seen above, Lucid is unlikely to turn FCF profitable through FY24 and is expected to burn through $10.14B in cash. The company reported cash and equivalents of $5.39B in FQ1. However, the company also has a cornerstone shareholder in The Kingdom of Saudi Arabia, which has recently committed a further $3.4B in funding to help build its Saudi Arabian production facility.

Therefore, we do not think the market is overly concerned with the company’s ability to raise the necessary financing. But instead, we believe the market is not impressed with deeply FCF unprofitable companies like LCID currently.

Near-Term Bottom In Position – Watch For Re-test

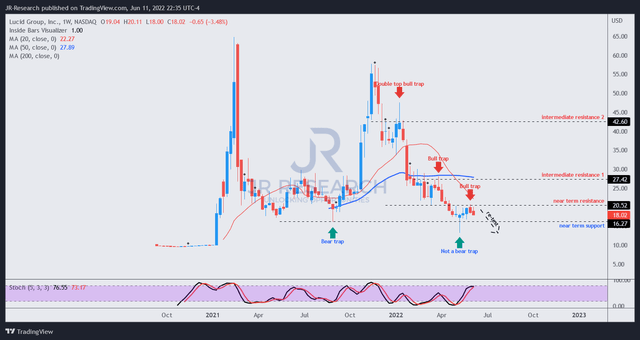

LCID price chart (TradingView)

Zooming into LCID stock’s weekly chart, we can observe the potency of the double top bull trap. As seen above, it sent the stock into negative flow (decisive bearish momentum) after the double top formed.

However, we noted a near-term bottom that broke below its previous bear trap (August 2021) lows before recovering. Therefore, we believe it should be a credible near-term support, but investors should note a lack of bear trap price action. As a result, such a support zone is potentially tenuous until proven otherwise subsequently.

Of considerable concern, we observed a subtle bull trap in late May that formed after its recovery from its May near-term bottom. As a result, we accord a greater price action significance to its late May bull trap.

Is LCID Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on LCID stock. We noted the significance of the late May bull trap, thus resolving the price action signal from its May bottom.

As a result, we urge investors to consider waiting for a re-test of its near-term support before considering adding exposure. Thus, we will be watching for the re-test closely and will reassess our rating subsequently.

Be the first to comment