Lemon_tm

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 3rd, 2022.

AllianceBernstein Global High Income Fund (NYSE:AWF) is a fairly standard global high yield fund. However, they carry only a relatively small sleeve outside of the U.S. Based on higher interest rates and credit risks that pop up during an economic slowdown, this fund’s underlying portfolio has become quite discounted. That would be on top of this fund’s discount based on its share price compared to its NAV per share.

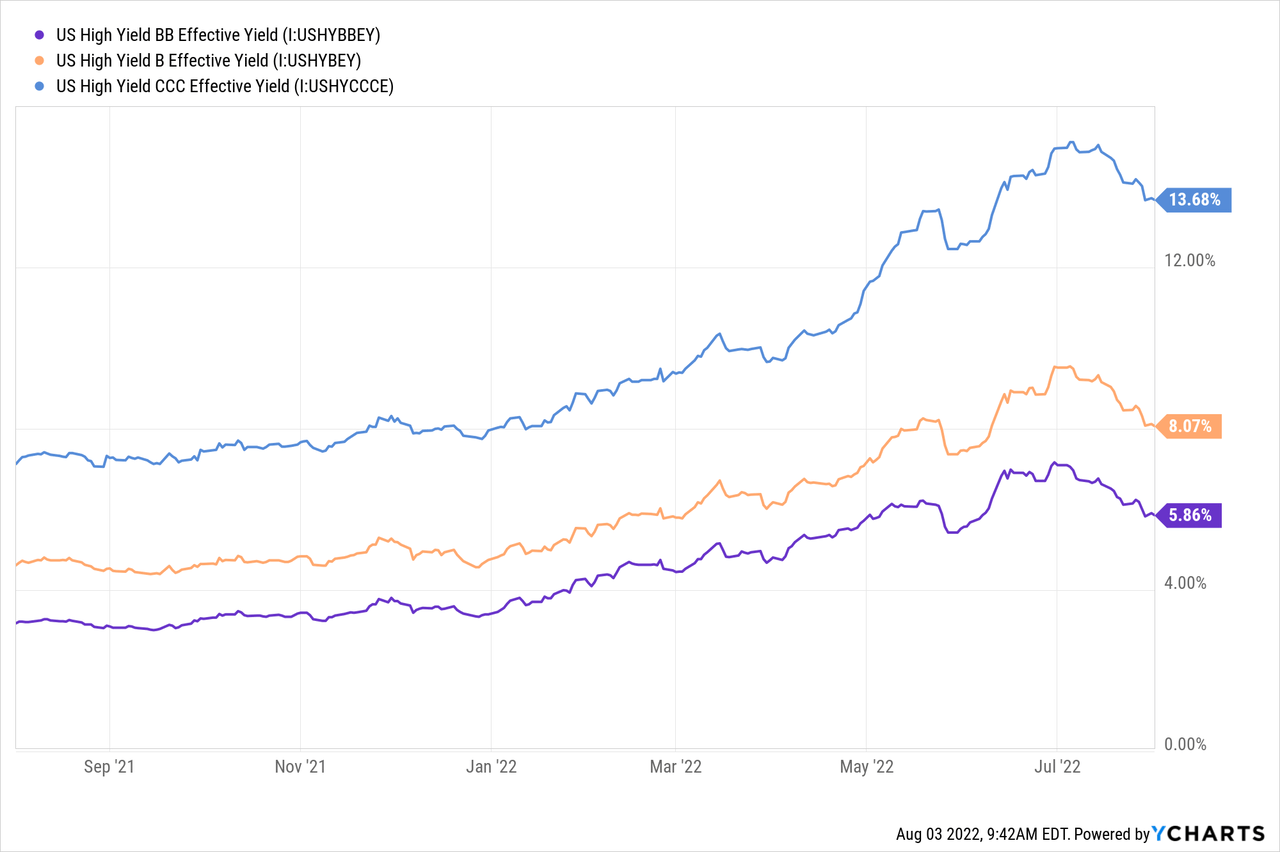

High-yield bonds generally carry a relatively lower effective duration than their safer, investment-grade counterparts. That’s generally a function of the portfolio’s average maturity being lower. When lending to a riskier company, getting your capital back sooner rather than later is often seen as better. That would allow for less time for something to go potentially wrong.

Of course, with the Fed raising rates, some economists and analysts now believe we will be pushed into a recession. More of a recession than just the technical recession we’ve seen in the first half of 2022. This puts the credit risk of the portfolio into focus.

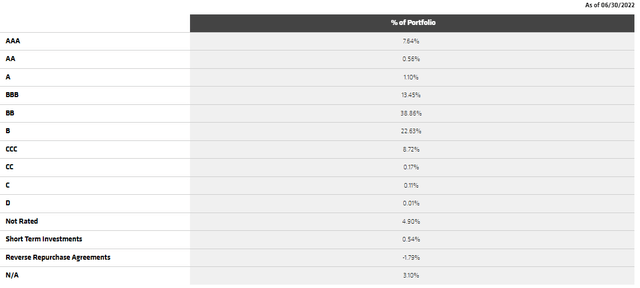

I would say that while AWF is invested in junk-rated bonds, they aren’t too deep into junk territory. The largest allocation is to double B and single B. A fairly sizeable allocation follows that up in the triple B, considered investment grade. They are even sitting on some triple A in its allocation too.

The Basics

- 1-Year Z-score: 0.61

- Discount: -5.62%

- Distribution Yield: 7.54%

- Expense Ratio: 1.00%

- Leverage: 34.03%

- Managed Assets: $953 million

- Structure: Perpetual

AWF’s investment objective is quite simple; “seeks high current income, and secondarily-capital appreciation.” They do this by investing through “a globally diversified portfolio that takes full advantage of our best research ideas by pursuing high-income opportunities across all fixed-income sectors.” They invest “under normal conditions, substantially all of the Fund’s net assets in lower-rated bonds, but may also invest in investment-grade and unrated debt securities.”

This fund utilizes leverage, but not in the typical manner we see through bank borrowings. Instead, it is through their “investment operations.” They also have a very small amount of reverse repurchase agreements in their portfolio that would be included in what we often see as leverage.

AWF Leverage (AllianceBernstein)

Interestingly, the fund’s leverage previously was via tender option bonds. This has now been completely removed.

The fund reminds me a bit of a PIMCO fund, with various and copious derivative contracts in the portfolio. That includes futures, swaps and forward currency exchange contracts. Futures and swap contracts have notional values. At first, I had thought that was what the “investment operations” leverage would include. However, that was also present in their previous reports.

Additionally, I couldn’t find any information about their tender option bonds in any of their previous reports. That being said, we had also discussed their unusual leverage previously. Where the fund doesn’t appear to be leveraged but really is, as their own reporting shows.

They also include interest rate swaps in their portfolio. That’s a positive when rates are rising because it acts as a hedge against rising rates.

Performance – Running Below HYT, But Easy To See Why

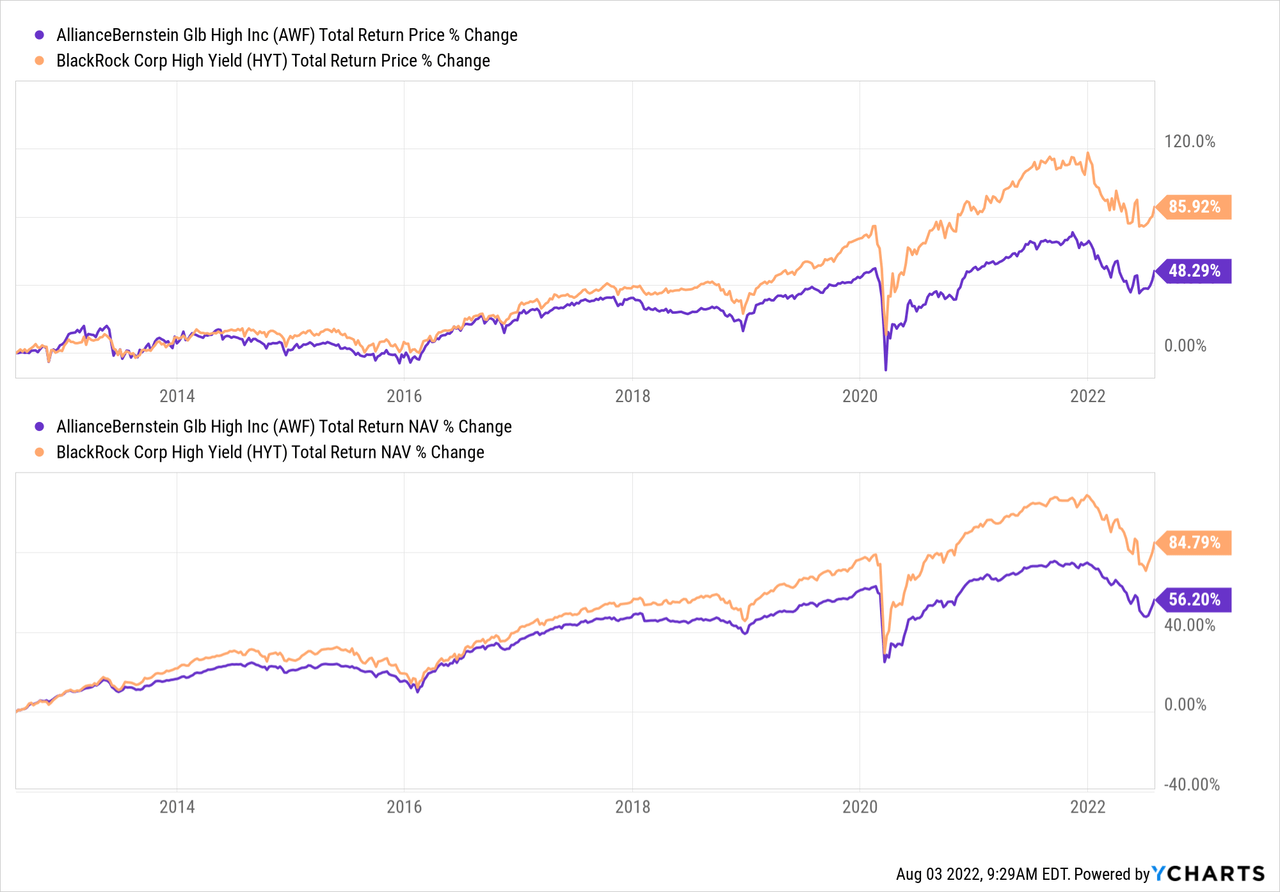

I like to run a comparison between the BlackRock Corporate High Yield (HYT) because I consider it the gold standard of closed-end fund high yield investments. In this case, AWF has lagged meaningfully. HYT is a fund with fewer layers. Instead of opting for the hundreds of derivative contracts that are put into place, they run with exposure mostly to high yield bonds with a sparse number of future and forward currency contracts.

Other factors to why AWF could have performed so poorly against HYT could be the slightly higher exposure to global investments. HYT also isn’t restricted to U.S. high yield holdings but runs a higher concentration on U.S.-based investments.

One last factor I noticed with HYT is the higher exposure to junkier bonds. They go deeper down the quality spectrum than AWF. That has certainly paid off over the years.

YCharts

But, it would suggest that HYT is a bit riskier than AWF. Here is one example; HYT carries 14.66% CCC rated debt, with AWF at less than 9%. Another is that the largest weighting for HYT is BB rather than AWF’s BBB having the highest weighting. Going down the quality spectrum is riskier, but has paid off as default rates have been significantly low. At the same time, yields at those levels of risk have to pay more which adds up to higher returns.

YCharts

All this is not to mention the exposure AWF has to AAA, where HYT has none. So while AWF certainly doesn’t have appeal if we simply look at total returns, there are reasons for it.

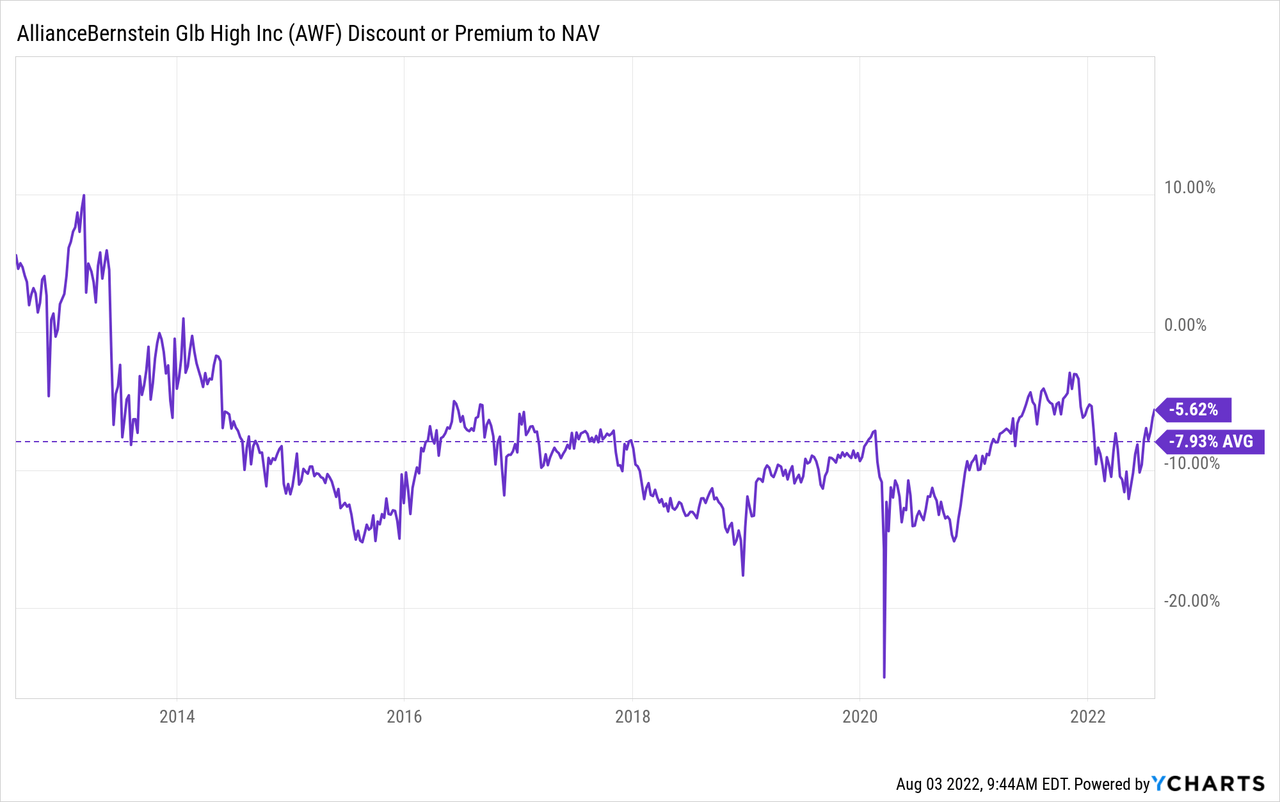

Another factor to consider for AWF is the fund’s discount. In recent weeks, they had really narrowed their discount as the fund, and the broader market ran higher. This has pushed the fund to trade above its longer-term average. That generally means we could see some further widening from here. On the other hand, it isn’t overly above its average either.

YCharts

Distribution – Attractive Yield, But Watching Coverage

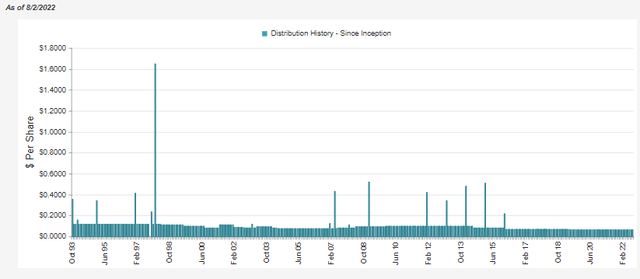

This is an old fund, and there have been several adjustments over the years. Many changes aren’t necessarily bad when you have a fund with as much longevity as this fund, especially when interest rates have gyrated over the last 30 years.

The reduced payouts are simply a function of the trend towards lower rates in this period. If higher rates actually stick around for a while, AWF could see a rise in the distribution yield it could pay to investors.

AWF Distribution History (CEFConnect)

The fund’s distribution rate comes to 7.54%, with the NAV yield coming in at 7.12%.

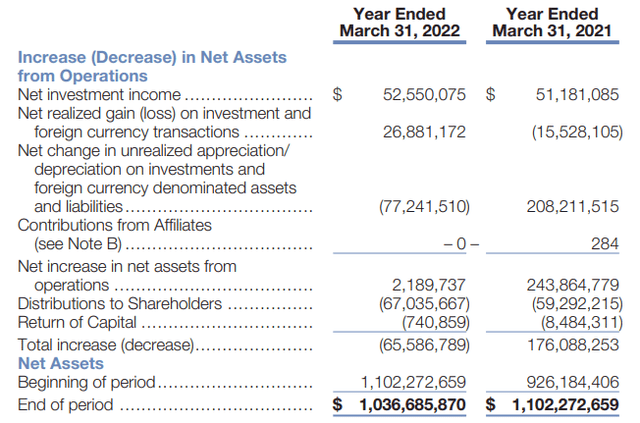

For now, though, their coverage remains on watch. The net investment income has come in shy over the last two fiscal years. NII did have a small increase year-over-year, however. We often want coverage at over 100% for fixed-income funds. NII coverage came to only 77.5% in the prior fiscal year.

AWF Annual Report (AllianceBernstein)

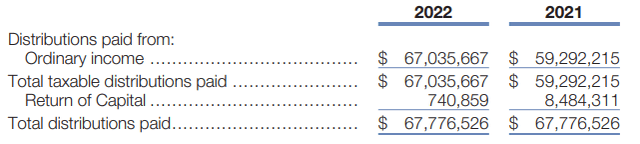

For tax purposes, the distribution will often have a high characterization of ordinary income. That’s due to being a fixed-income fund. The fund collects interest payments from the underlying bonds. Those interest payments then get passed out to shareholders via distributions.

They have also had classifications of return of capital. In the case of 2022, this appears as though it would have been a destructive use of ROC. The unrealized gains were enough to offset the NII and realized gains of the fund. That decreased the total amount of assets. Therefore, the ROC could have been considered destructive.

AWF Distribution Classification (AllianceBernstein)

AWF’s Portfolio

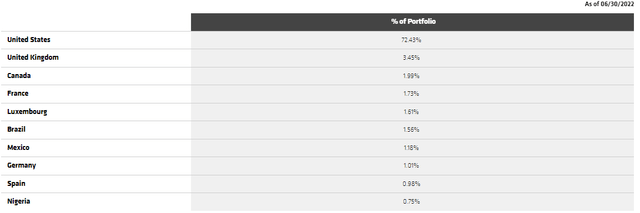

As we noted above, the fund is primarily invested in the U.S. However, there is no restriction on investing in or outside the U.S. The name of the fund would even suggest that there would be a bit more global than what really appears.

AWF Geographic Exposure (AllianceBernstein)

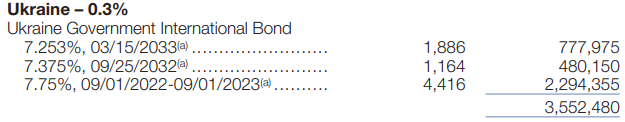

They have a bit of exposure to several emerging markets around the world. Most notably is perhaps where they don’t have exposure, and that would be Russia. However, they carry some small exposure to Ukraine.

AWF Ukraine Exposure (AllianceBernstein)

I don’t believe that this amount of exposure is detrimental to the fund, even if they never received another cent from these bonds or the principal. We are looking at only 0.3% of exposure.

For a junk fund, it was quite surprising to see some AAA exposure here. It was increased from the last time we touched on the fund. Although, the BB and B rated debt have remained the largest weightings of the fund.

Some of this AAA exposure comes via agency mortgages but mostly U.S. Treasury Bonds and Notes. That would seem more like a place for them to park cash before putting it to work rather than an actual position they plan to hold long-term. I believe that to be the case because the exposure here changes quite a bit. At the end of March 2022, in their annual report, U.S. Government Securities were just 3.3% of the fund.

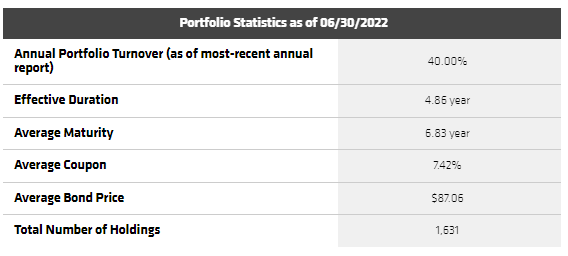

There are options on the market that provide more exposure to floating rate types of debt investments, but AWF’s duration is relatively low for a high-yield bond fund. Looking at HYT again, the effective duration is 5.49 years.

AWF Portfolio Stats (AllianceBernstein)

In the above, we can see that the average bond price of AWF comes to around $87. That means the fund’s portfolio is quite discounted on top of the fund’s discount. This discount reflects the potential credit risks the markets see during an economic slowdown.

Also notable is the number of holdings in the fund. We see this in a lot of high-yield bond funds. They invest in hundreds or thousands of positions. That way, if a handful of companies declare bankruptcy or default, it isn’t going to impact AWF too much.

Conclusion

For investors looking for some high-yield bond exposure now that things have sold off, AWF could be an interesting place to look. The fund’s discount is rather attractive, even if a bit tighter than where the fund has traded historically. The fund’s discount is combined with the underlying portfolio discount now that an economic slowdown appears on the cards. Just like any high-yield fund, there are certain risks here to consider. However, the portfolio’s credit quality is on the higher end overall.

Be the first to comment