YinYang/iStock via Getty Images

Storm clouds have been gathering on the horizon for months. They are now hitting the shorelines.

The latest inflation data showed no reprieve. On top of that, the consumer is now beginning to pull back on spending.

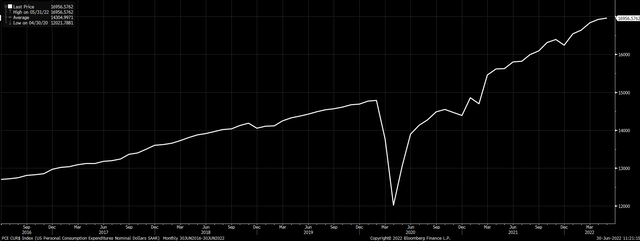

The good news is that the PCE data showed that inflation rates weren’t worse than expected. The bad news is that the pace of inflation month-over-month was up 0.6% vs. last month’s reading of 0.2%. Meanwhile, year-over-year PCE inflation was up 6.3%, the same rate as last month.

The consumer spending component came in much weaker than expected, while last month’s reading was revised lower, suggesting the consumer is starting to pull back.

The raw data may show it the best when looking at the consumer spending chart, which offers an apparent flattening, and perhaps even showing signs of preparing to roll over and head lower. It will make the next couple of months worth of data critical. Should consumer spending begin to roll over, it would indicate that the risk for a recession has risen dramatically.

Bonds Are Worried

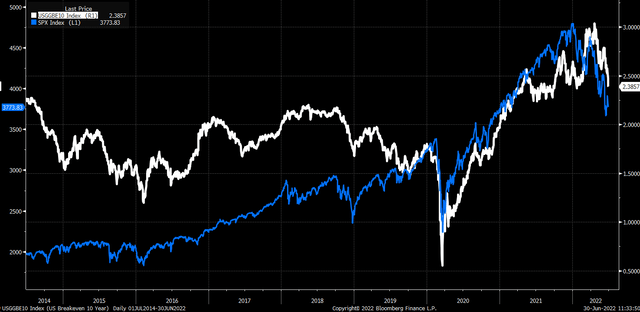

The response from the bond market is one of worry. Based on the bond market’s reaction, it appears the risk of recession is now outweighing that of inflation. 10-Year breakeven inflation rates have been falling off a cliff recently and are down to 2.38%. The 2.25% to 2.4% region for inflation expectations has been a massive region of support in the past. If inflation expectations drop below 2.25%, it would indicate that the market’s fear of a recession is genuine. At this point, inflation expectations are entering that support zone and need to be watched for signs of further deterioration.

Inflation expectations tend to relate to equity markets over time because rising and falling inflation expectations also indicate future growth expectations. Therefore when inflation expectations fall, they suggest that expectations for future growth decline. While it is not a perfect relationship, a relationship is present, and falling inflation expectations indicate slowing growth in this case, which is bearish for stocks.

The slowing growth aspect and the Fed rate hiking process due to the still stubbornly high inflation rates pose the most significant problems for the equity markets. The data likely to come in over the next couple of months will still show persistent high inflation rates. But the market is now anticipating the increased odds of a recession and inflation rates falling. With the Fed very data-dependent and, in a sense, backward-looking and the markets forward-looking, the risk of the markets and the Fed becoming decoupled will increase, creating a tremendous amount of market volatility as the market worries about the Fed overtightening.

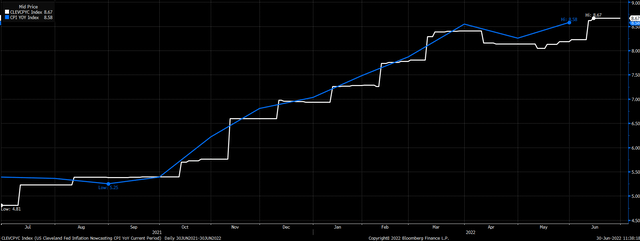

Inflation Rates May Still Be Rising

The Cleveland Fed Inflation Nowcast is projecting a fresh cycle high for June CPI on a year-over-year basis at 8.7%. A print of 8.7% would be the headline number that the Fed is focused on, based on the press conference for the June FOMC meeting.

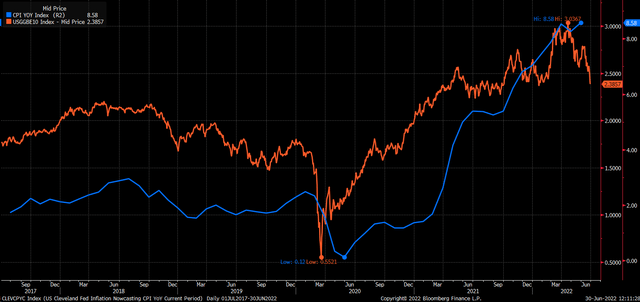

On the one hand, the market is now anticipating slowing growth and a potential recession, while the Fed is battling headline inflation rates. Based on the data in the chart below, it appears that inflation expectations track nearly two months ahead of headline inflation rates. For example, 10-year inflation expectations bottomed in March 2020, while headline CPI didn’t bottom until May 2020. Meanwhile, inflation expectations peaked in April 2022, so the headline inflation rate may peak in June 2022.

Even if inflation is peaking in June, it won’t stop the Fed from probably raising rates by 50-75 bps in July. Based on the pace at which inflation expectations are now falling, it seems like inflation in July should begin to fall quickly. Still, even if headline inflation drops in July, the Fed will be forced to raise rates in September because inflation will remain well above its targeted 2% average rate. This will present the markets with a significant worry that the Fed will overtighten right into a recession.

Volatility Explosion

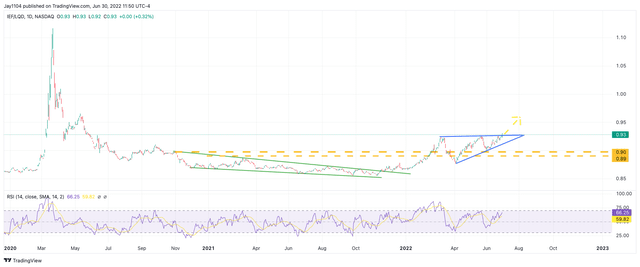

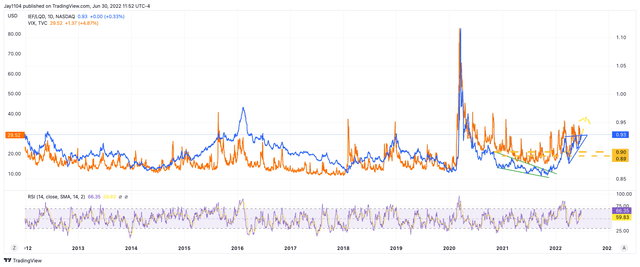

These worries will probably result in financial conditions tightening even further. Based on the ratio of the LQD to IEF, which is a good indicator of spreads between corporate bonds and treasury rates, and an indicator of financial conditions, we may be entering a period of much tighter financial conditions and greater volatility that comes with those conditions. The IEF/LQD ratio has been consolidating for a few weeks, but today was the first time it broke above that trading range.

The IEF/LQD ratio also is highly correlated with the VIX index, and typically when the IEF/LQD ratio spikes, there is a spike in the VIX index. It probably isn’t by chance that the VIX index has also been consolidating over the past several weeks and has failed to give the equity markets the last capitulation move down.

If financial conditions begin to tighten at a much faster rate, then it seems only natural that the VIX index will spike and that the S&P 500 should have a big move lower.

In case there wasn’t enough evidence to support the mounting signs of a recession. The Atlanta Fed GDPNow model forecasts a second-quarter decline in real GDP of -1% as of June 30. That would be two consecutive quarters of negative real GDP.

Today’s data seems only to reinforce the idea that inflation is persistently high, which is a problem for the Fed. But at the same time, it is clear the consumer is pulling back and may even be showing signs of spending less in the months ahead and potentially sending the economy into a recession, with the markets entering a new realm of worry.

Be the first to comment