Viktoria Korobova/iStock via Getty Images

This is my inaugural Avadel Pharmaceuticals (NASDAQ:AVDL) article. As I will discuss, Avadel presents attractive multi-bagger potential. It is currently in an FDA waiting period of indeterminate length, expected to be less than a year, albeit it could be longer as hereafter discussed.

LUMRYZ (FT218) in treatment of narcolepsy is currently in a holding pattern

On 12/16/2020, Avadel submitted its NDA for its LUMRYZ (FT218), an investigational once-nightly formulation of sodium oxybate designed to treat excessive daytime sleepiness and cataplexy in adults with narcolepsy.

The FDA had previously granted FT218 an Orphan Drug designation on the “plausible hypothesis” that it would prove clinically superior to a previously approved oxybate formulation. Indeed, Avadel had set its sights on Jazz Pharmaceuticals’ (JAZZ) tragically flawed $1.6 billion, twice-nightly sodium oxybate therapy XYREM.

The FDA accepted FT218 for filing in 02/2021, setting its PDUFA date for 10/15/2021. When 10/15/2021 arrived, the FDA stunned Avadel with an unexplained delay.

Then on 05/24/2022, Avadel filed an 8-K announcing an enigmatic new status for LUMRYZ. The 8-K alerted that it had:

…received a proposed, final label and medication guide for FT218 from the U.S. Food & Drug Administration (“FDA”). In addition, the Company was notified by FDA that the FT218 New Drug Application (“NDA”) patent statement pertaining to US Patent No. 8,731,963 (the “REMS patent”) was deemed inappropriate by FDA. As such, FDA has requested the Company add a certification to the REMS patent to its NDA. FDA further confirmed, based on the final proposed label, that no additional patent certifications will be required.

Subsequently on 07/19/2022, Avadel advised that the FDA granted tentative approval to LUMRYZ, also known as FT218. CEO Divis characterized this as a critical milestone validating LUMRYZ’s safety profile and clinical efficacy.

LUMRYZ is a clearly superior therapy to Jazz’s mega-blockbuster XYREM/XYWAV combo

Jazz Pharmaceuticals muscled its way to billion dollar revenues and a nearly $10 million market cap on the back of its XYREM therapy. XYREM was FDA approved for several sleep related conditions beginning in 2002. According to its 2022 10-K (p. 7), XYREM’s $1.3 billion in net product sales made up 41% of its net product sales.

Subsequently in 08/2021, Jazz nabbed FDA approval for XYWAV to treat IH, a related sleep condition characterized by chronic EDS. Incredibly after an 11/2021 XYWAV launch, Jazz was able to report that XYWAV had net product sales of $535.3 million, representing another 17% of its total net product sales.

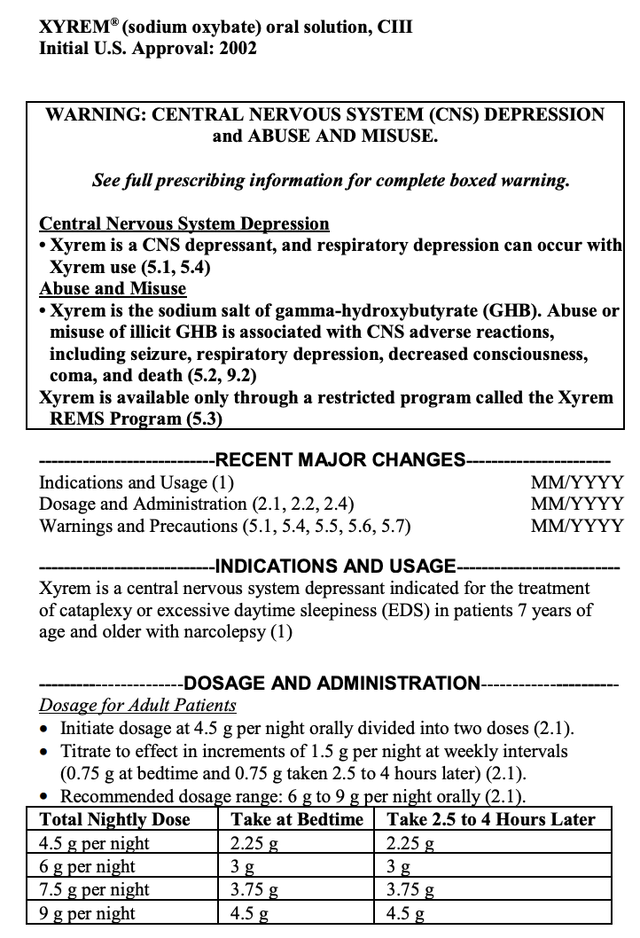

The labels for XYREM and XYWAV are indistinguishable in key respects as shown below. The XYREM label reads:

accessdata.fda.gov

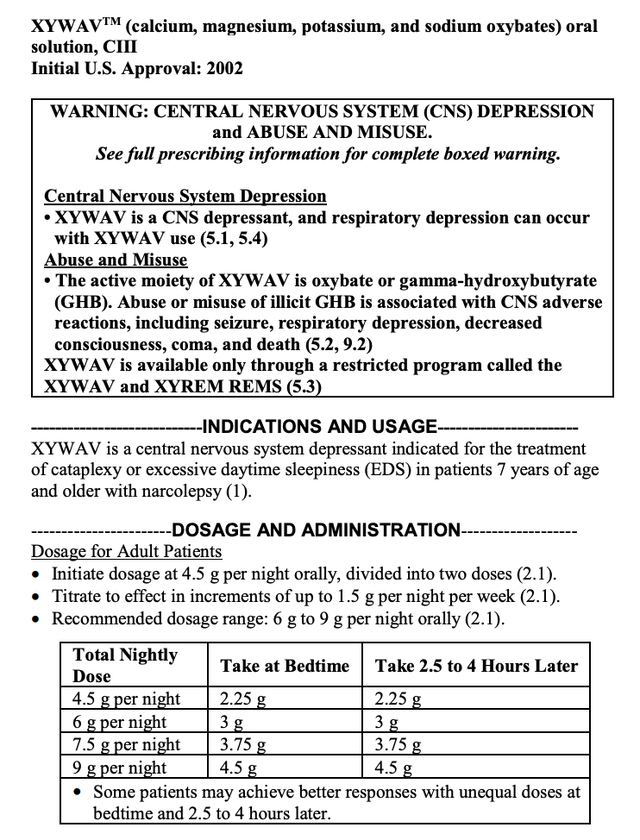

The analogous Xywav label components read:

accessdata.fda.gov

The indications between the two reflected by their labels are exactly the same. The black box warnings are not identical but are each quite similar in important respects. Why does it matter in connection with an article about the prospective approval of LUMRYZ?

Well, it matters a lot to both Jazz and Avadel. Consider that XYREM and XYWAV are both used in treatment of sleep disorders. Combined they make up 58% of Jazz’s net product sales. Then check out their dosage and administration instructions.

Each requires patients to take two doses, one at bedtime and a second dose 2.5-4 hours later. Hunh…how does that work? You take your first pill right before you get in bed, then you set an alarm to wake up 2.5-4 hours later.

That guarantees a disrupted night’s sleep, for sleep disorder patients mind you. LUMRYZ on the other hand features an extended release formulation such that it only requires a single dose. It is little wonder that Jazz is doing everything possible to derail FDA approval of LUMRYZ.

Tentative approval does not permit marketing of a therapy; it does derisk the process

During Avadel’s Q2, 2022 earnings call (the “Call”), Avadel indicated that the tentative approval grant established June 17, 2023 as the latest date of a potential final approval with expiry of the remaining REMS patent. Tentative approval is not common in my experience.

At first blush, the grant of tentative approval looks and smells like a significant derisking of LUMRYZ. It does provide FDA confirmation of LUMRYZ’s safety profile and its efficacy; it may not however establish 06/17/2023 as the date by which final approval is assured.

According to an FDA guidance:

…A drug product that is granted tentative approval is not an approved drug and will not be approved until FDA issues an approval letter after any necessary additional review of the NDA …

Impatient of this delay, Avadel is working to accelerate the FDA’s final decision by undertaking several litigation initiatives as hereafter discussed, including the following:

- filing a lawsuit against the FDA in the U.S. District Court for the District of Columbia alleging that the FDA’s decision requiring Avadel to file a patent certification regarding U.S. Patent No. 8,731,963 (the “REMS patent”) was arbitrary, capricious and contrary to law, and asking the Court to vacate the FDA’s decision and order FDA to take final action on the LUMRYZ NDA;

- pursuing delisting action in the U.S. District Court for the District of Delaware to remove the REMS patent, which expires on June 17, 2023, from the FDA’s Orange Book;

- preparing for a claim construction hearing (“Markman hearing”) in the existing patent litigation in the U.S. District Court for the District of Delaware which is scheduled for August 31, 2022. The Court has previously stated that claim construction was needed prior to ruling on the motion to delist the REMS patent from the Orange Book.

During the Call these diverse litigation strategies drew intense inquiry. Management is hoping that it can accelerate a full approval. Unfortunately litigation is highly resistant to inpatient litigators. Those hoping for approval prior to June 17, 2023 are likely to be disappointed.

What about a slam dunk for full approval by June 17, 2023? Again that is a question in my mind. I point to the last question during the Call by an unidentified analyst seeking to drill down on the situation. In his answer CEO Divis admitted:

So I think the short answer to the question is you know, not speaking directly for how long after June ’17 that will occur, but we will take the necessary steps to file the necessary documentation and request the FDA to begin the process to make whatever final decision need to be made to convert from a tentative approval to final approval in advance of that, such that when that patent expires, the FDA should be in a position to do so.

So June 17 is not the final approval date that Avadel bulls would hope for; my expectation is that the FDA will act with its typical dispatch on June 17.

Avadel has daunting liquidity metrics to shore it up as it pursues truly final approval

During the Call, CFO McHugh laid out Avadel’s financial situation. As of June 30, 2022, Avadel had $104.1 million of cash, cash equivalents and market securities. It also had ~$17 million in tax refunds of which $10 million was in hand with $7 million expected in H2 2022.

He anticipates that this liquidity, coupled with planned cost reductions, will take Avadel to mid 2023. Accordingly as he put it:

…as we progress towards a final approval decision that could occur by June 2023 or earlier, we will seek opportunities to strengthen the balance sheet and ensure we have the capital resources available to prepare for the launch of LUMRYZ into what we believe is a greater than $3 billion market opportunity.

Considering that Avadel has $123.8 million in convertible notes due by 10/2023, it is clear that it has some work to do before it will be able to realize on its $3 billion opportunity. Its 08/31/2022 $500 million mixed shelf offering shows that it is taking prudent steps so that it will have the liquidity to take LUMRYZ to the next step of final approval whensoever that may occur.

Conclusion

How often have I had to remind myself in the context of the FDA that derisked is not without risk. Here again with LUMRYZ is an asset that is truly derisked but still faces an uncertain gauntlet. That said, shares in Avadel with its ~$0.4 billion market cap and its derisked blockbuster therapy present an unusual opportunity for significant gains.

It will be no walk in the park. Shareholders will have to endure its wait for final FDA approval, and then watch as it works to prove its market thesis. Consider buying in small increments as the shares hit inevitable downdrafts. In time, sweet dreams will be yours.

Be the first to comment