fcafotodigital/E+ via Getty Images

Investment thesis

In his most recent memo “I Beg to Differ”, legendary investor Howard Marks argued that investors seeking above-average returns have to invest in things that others haven’t flocked to and caused to be fully valued. To put it differently: successful investors have to do something different. At first glance, this conclusion seems to be a no-brainer. He, however, opines that this fundamental recognition is less widespread among the investment community than you might think. In a world where the majority of investors is well-informed and highly computerized, ordinary efforts count for increasingly less, it calls for more perceptive thinking or what Marks calls second-level thinking.

He strongly made the case for distinguishing second-level thinkers from those who operate at the first level:

First-level thinking is simplistic and superficial, and just about everyone can do it (a bad sign for anything involving an attempt at superiority). All the first-level thinker needs is an opinion about the future, as in ‘The outlook for the company is favorable, meaning the stock will go up.’

According to Marks, second-level thinking is deep, complex, and convoluted. The second-level thinker takes numerous things into account:

- What is the range of likely future outcomes?

- What outcome do I think will occur?

- What’s the probability I’m right?

- What does the consensus think?

- How does my expectation differ from the consensus?

- How does the current price for the asset comport with the consensus view of the future, and with mine?

- Is the consensus psychology that’s incorporated in the price too bullish or bearish?

- What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

In this light, I have re-read the recently published Seeking Alpha article about DAVIDsTEA (NASDAQ:DTEA) written by the well-respected and highly popular SA contributor Henrik Alex. His report paints a rather bleak picture about the company’s future and was accompanied by lots of gloomy statements in the comments section, which pretty much resembles the very bearish sentiment around DAVIDsTEA. As a matter of fact, this report was arguably the primary reason for the stock to drop by around 30% in a couple of days following the publication.

In an attempt to differentiate between first-level aspects and second-level thinking, I will briefly address all the concerns raised in this article affecting the sector as a whole as well as some company-specific allegations made in the comments section. In the final part, this report aims at gauging the current market sentiment around the stock and discusses some potential upside surprises not reflected in today’s market cap.

Let’s talk business

1. Inflationary pressure

Having learned about rapidly rising input costs and producer prices on an almost daily basis for more than a year now, it should be no surprise that first-level thinking would suggest that this global cost pressure should significantly squeeze the operating margins of all sorts of retailers, but especially the gross margins of a specialty tea retailer which just recently emerged from restructuring proceedings.

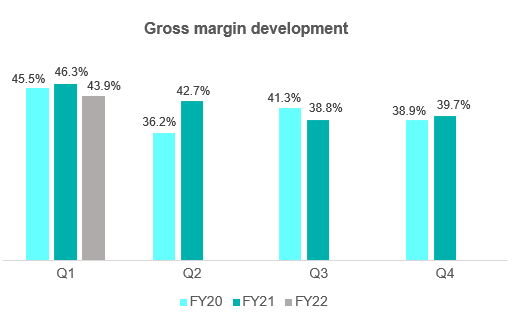

Looking at DAVIDsTEA’s gross margin below, we find an uptick in the margin (y-o-y) in two out of the last four quarters. Admittedly, the gross margins have probably also been impacted by a shift in the product portfolio (tea vs. tea accessories) and sale channel (e-commerce/wholesale vs. brick-and-mortar stores) over the last 12 months. Nevertheless, it’s hard to make the case for a structurally deteriorating gross margin based on this past information. It must also be noted that DAVIDsTEA started to outsource all of its product warehousing and distribution activities to a specialized fulfillment provider in Q4 2021, having a negative effect on its gross margin (at the benefit of a reduced headcount in this area, please see below). Unfortunately, we can’t dive much deeper as there is no publicly available breakdown of its cost of sales.

Source: Own calculation by the author based on 10-Q & 10-K filings of DAVIDsTEA

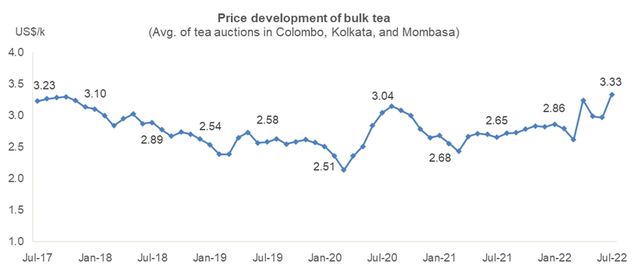

As a proxy for the company’s major input source, at least in quantitative terms, I looked at the price development of bulk tea at three major tea auctions (according to World Bank’s database) to get a sense of the price changes over the last year. The plotted average of these three auctions shows that purchase prices for tea have been climbing since the beginning of the year. However, despite substantially rising fuel and fertilizer prices over the last couple of months, the average tea price in 2022 is just 6.7% above its 5-year average. Presumably, some of the other ingredients going into its numerous tea blends besides tea leaves might have increased more substantially.

Source: World Bank Commodities Price Data

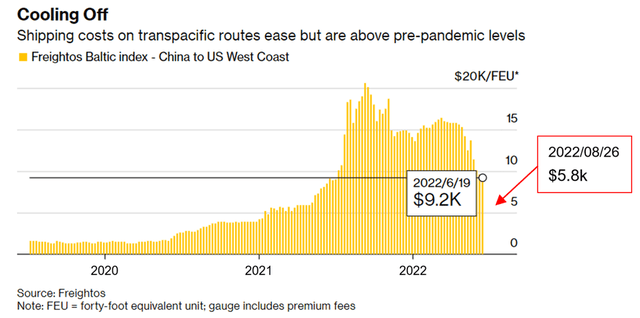

In addition, as sharply increasing ocean transport costs have negatively impacted the gross margins of some retailers over the past quarters, a closer look at global freight rates is warranted. After reaching a peak of around $20k/FEU in September 2021, the all-important container freight index for China/East Asia to North America West Coast routes (Freightos Baltic Index – FBX01) has come back significantly from its all-time highs. In the last couple of months, the freight rates have been more or less in free fall, declining from $15.3k (end of April) to $5.8k (end of August) – a staggering loss of approx. 66% in just 4 months.

Source: Bloomberg – Companies See Relief in Falling Spot Rates for Transpacific Freight

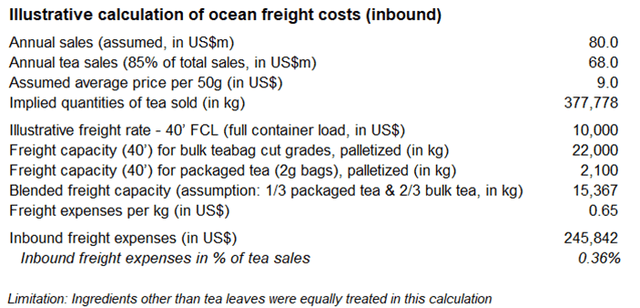

Going a step further, I tried to do some back-of-the-envelope calculations to get an idea of the relative importance of inbound freight cost as part of the cost of sales. The cost estimation shown below assumes a highly conservative freight rate of $10k (40-foot shipping container) and is based on some own as well as external assumptions. According to my illustrative calculations, ocean freight expense only accounts for less than 0.4% of tea sales (transport costs for tea accessories have not been examined). Thus, even elevated and volatile freight rates shouldn’t have a big impact on DAVIDsTEA’s gross margin.

Source: Own calculation by the author

So far, we just looked at the cost side of the equation. To get a better understanding of the pricing power, or more specifically, as to what extent price hikes have already been implemented (ergo, already having a positive impact on the gross margin), I have compared today’s prices with the ones exactly two years ago. Based on a sample of more than 50 items, management has raised prices in Canada for most of its matcha tea blends by around 10%; however, prices for the other “non-matcha” types of tea (accounting for the vast majority of its portfolio) have predominantly kept flat over the last 2 years – approx. 25% of the sampled tea blends in this category have also risen in price by about 10% (Aug 2020 vs. Aug 2022). In the current context of sharply rising consumer prices in the food & beverage sector, these seem to be rather modest price increases, which may strengthen DAVIDsTEA’s relative value proposition leaving some room for future price hikes (only to catch up with some other players in the market).

2. Supply chain issues affecting availability of merchandise

Looking at the chart above, I would not expect supply chain issues to deteriorate over the next couple of months – at least from a logistics point of view. The falling freight rates are probably a result of 1) easing Covid-19 restrictions in Asia (e.g., Shanghai lockdown) and 2) western households starting to pull back from a two-year spending spree, especially for discretionary goods, due to declining consumer confidence and persistent inflationary pressures. Both aspects, in particular the latter one, have led to a broad inventory glut, which many retailers are currently struggling with. Unlike these retailers, DAVIDsTEA is not a victim of this “bullwhip” effect as there was no extraordinary demand during the pandemics and there is comparatively little markdown risk for tea blends in general (“Regularly putting some items on sale” is a marketing strategy and should not be confused with this phenomenon). On the other hand, I also don’t expect the company to struggle to replenish its stock. Management has always taken a very conservative approach when it comes to the continuous build-up of inventories.

3. Labor shortages and rising salaries

Admittedly, it’s difficult to judge to what extent DAVIDsTEA might be affected by a potential shortage of labor. And yes, like in many parts of the western world, a tight labor market accompanied by a still very solid economic environment have contributed to considerable wage growth rates over the last couple of months in Canada. The average hourly wages of employees were up 5.2% on a year-over-year basis in July, matching the pace of wage growth recorded in June.

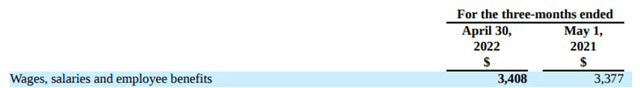

In contrast, DAVIDsTEA’s personnel expenses only increased by 0.9% in the most recent quarter compared to the first quarter in 2021.

Source: 10-Q filing of DAVIDsTEA

This figure arguably understates the inflationary pressure to some degree as the company probably had a lower headcount in Q1/2022 compared to the prior year quarter. Unfortunately, there is no publicly available information with regard to its current workforce.

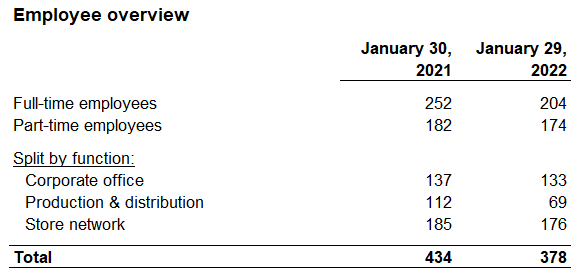

What we do know is that DAVIDsTEA has rightsized its organization in the last fiscal year even further (after massive layoffs resulting from the restructuring proceedings (CCAA) in 2020). In particular, management cut back its production & distribution staff by nearly 40%, while at the same time entering into a partnership with a leading 3PL provider to outsource all of its product warehousing, distribution and shipping activities for Canada and the US. This move aimed at significantly enhancing its distribution capabilities and improving customer experience across North America, e.g., shorter delivery times, as well as making its workflows more efficient in general.

Source: Own calculation by the author based on 10-K filings of DAVIDsTEA

On the other hand, in order to succeed in its ambitious omnichannel growth strategy, management is selectively trying to fill vacancies across the board (e.g., wholesale specialist, store employees, or social media & digital graphic roles) with currently 12 job postings on the company website.

4. Declining Covid-19 related e-commerce tailwinds

As a matter of fact, revenues from e-commerce and wholesale have sharply come down over the last three quarters compared to prior year periods, which were heavily driven by a pandemic-fueled surge in online sales. In the most recent quarter, e-commerce and wholesale revenues decreased by 21.2% y-o-y to C$15.7 million. It’s indisputable that there was some sort of pull-forward effect where consumers were stocking up on tea in the midst of the pandemic. In my opinion, we should reach the bottom in Q2 or Q3 this year, from which e-commerce sales can grow again, but this time on a sustainable basis. In addition, the substantial cut back on marketing spend for most of 2020 and 2021 – as a result of the ongoing restructuring proceedings at the time – had arguably significantly contributed to the subsequent decline in e-commerce sales. However, since exiting the CCAA proceedings, DAVIDsTEA has increased its marketing budget quite considerably, for example, marketing expenses rose by more than 90% y-o-y to C$2.3 million in the most recent quarter.

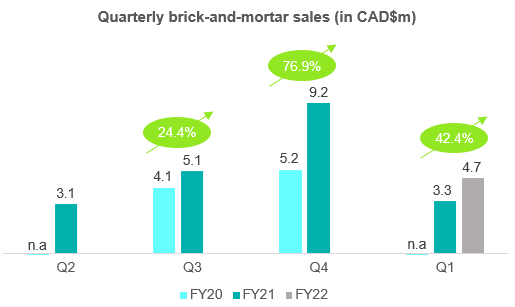

Besides, the strong sales development of its 18 Canadian flagship stores has probably also impacted the e-commerce side of the business. As can be seen below, the brick-and-mortar segment shows very promising quarterly growth rates between 24% and 77% y-o-y (though from a low base).

Source: Own calculation by the author based on 10-Q & 10-K filings of DAVIDsTEA

5. Consumer budget constraints

It’s conventional wisdom that the continuing rise in food and energy prices is increasingly impacting consumer spending and investment. Based on point-of-sale data for July 2022, a recent research report (covering the whole US food retail market, including e-commerce) points out, among other things, that in some areas consumers are opting for value-oriented categories to preserve quantity and also tend to trade down to more affordable brands within a category to some extent. However, the report also highlighted that premiumization continues in select categories despite the high inflation:

Mirroring behavior from the Great Recession of 2008-2009, consumers are trading down to trade up on small luxuries, such as premium and super-premium imported beer, […] refrigerated juices and drinks.

All these findings shouldn’t come as a big surprise and yes, with food inflation at very elevated levels and an almost unavoidable recession next year due to the current monetary tightening, shoppers are increasingly looking for value. But is there more to it than these high-level observations?

In the absence of a listed direct competitor of DAVIDsTEA, I will be referring to Starbucks’ (SBUX) most recent quarter in an attempt to answer this question (admittedly, not the perfect comp but it still shares some common characteristics). The company posted very strong Q3 results with record revenues of US$8.2 billion and 9% comp growth in North America. Apart from a record-breaking quarter (e.g., company-operated stores in the US delivered in the past three months 5 of the top 10 grossing sales days in its history), management was also very upbeat in the earnings call:

While we are sensitive to the impact inflation and economic uncertainty are having on consumers, it’s critically important that you all understand we are not currently seeing any measurable reduction in customer spending or any evidence of customers trading down, reflecting the strength of the Starbucks brand, deep customer engagement and loyalty, pricing power and the premium nature of our beverage and food offerings.

In this analyst call, the Starbucks brand was also pictured as an “affordable luxury” that consumers are not willing to give up.

Now, what is the customer universe DAVIDsTEA is catering to?

On a macro level, it can’t be denied that functional and healthy beverages are on the rise with a strong demand for fruit/herbal and loose-leaf black tea blends among the younger demographic, as consumers are increasingly seeking healthier alternatives to their fruit juices and soft drinks.

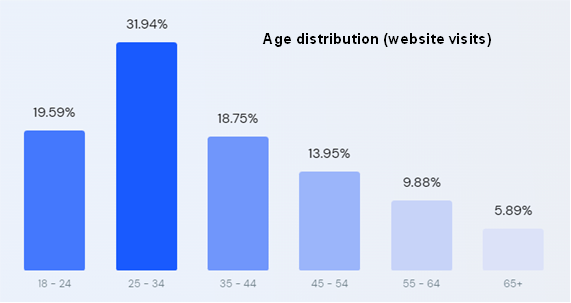

According to the company and recent web statistics, the average customer of DAVIDsTEA is female (representing c. 80% of total sales in 2019) and highly skewed towards younger age groups.

Source: Similarweb

Basically, the company is targeting individuals with a health-conscious lifestyle who can afford and are willing to pay a somewhat higher price for a purpose-driven brand. Apart from pure taste, those targeted customers often also appreciate the origin of their tea blends (e.g., organic and fair trade-certified tea based on an ethical sourcing policy) and DAVIDsTEA’s ambition to make a positive impact on the tea community in general. This all comes with a price not everyone is willing and able to pay, even in good economic times.

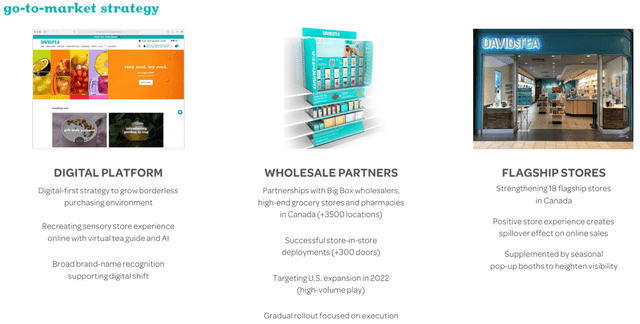

Source: Investor presentation (AGM, June 2022)

In my opinion, the company’s core customer base is less susceptible to economic downturns and views DAVIDsTEA not only as a superb product and great experience but values all the things that ladder up to the equity of the brand and the quality of the tea.

Finally, it’s worth noting that the decrease in sales from C$213 million in 2018 to C$104 million in 2021 was not the result of constrained consumer budgets or a deteriorating value proposition of its premium product offering, but was mainly caused by substantially less exposure to potential customers following the deliberate downsizing of its retail store network.

6. Related party transactions

Famous claim on Seeking Alpha: “DAVIDsTEA engages in transactions which favor the Segal family at the expense of the company”

In fact, during the second quarter of 2019, the company entered into a secured loan agreement of C$2.0 million with Oink Oink Candy Inc. (“Squish”), a company which is controlled by Sarah Segal. However, it should also be mentioned that Rainy Day Investments – the investment vehicle of the major shareholder Herschel Segal – guaranteed all of Squish’s obligations through its ownership in the company.

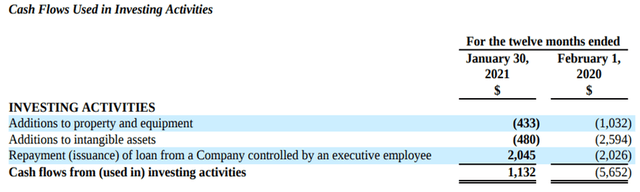

During the first quarter of 2020, the loan plus accrued interest of C$45 thousand was fully repaid (as shown in the graph below). Quite frankly, in a zero interest rate environment back then, investing a small portion of its cash balance at an annualized interest rate of around 3% (without incurring any risk) must be viewed as beneficial for DAVIDsTEA’s shareholders (though it was not a meaningful amount).

Source: 10-K filing of DAVIDsTEA

As shown in the most recent 10-Q filing, there are neither any financial arrangements outstanding as of now nor did DAVIDsTEA engage in any relevant related party transaction in the last quarter.

7. Segal family vs. outside shareholders

Claim: “Segal family is exploiting the company at the expense of outside shareholders”

To briefly recap: The around 90-year-old Herschel Segal, co-founder and still the major shareholder of the company, stepped down from his interim CEO position in December 2020 and also resigned from his function as executive chairman of the board in the second half of 2021. He was succeeded by his daughter Sarah Segal as CEO of the company and by his wife on the board of directors. Admittedly, such decisions can definitely not be viewed as good corporate governance for a public company, but on the other hand, he still owns more than 45% of DAVIDsTEA.

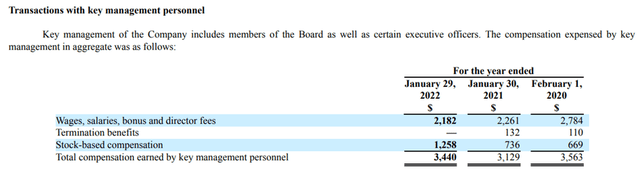

In this section, it’s not my goal to judge Sarah’s competency or her accomplishments to date, but just to debunk the frequently-voiced allegation above. First, as shown below, base salaries for the company’s management team and board of directors decreased by around 20% over the last three years. The increase in stock-based compensation is a combination of a higher share price during 2021 and one-time stock awards (options) for Sarah and Frank Zitella (CFO/COO) as a result of job promotions and the associated higher responsibilities. If granted in a reasonable fashion, I personally endorse a high relative proportion of stock options (awards) as it further aligns the interests of management and shareholders.

Source: 10-K filing of DAVIDsTEA

Secondly, on a more general level, it just doesn’t make any sense to pull money out of the company with high salaries and similar actions when the family owns around 50% of the company (Herschel and Sarah Segal including stock options). Assuming an EBITDA multiple of 10x, a reduction of C$0.5 million in salary expenses would increase the value of the company by C$5 million (from which the Segal family would benefit the most). Finally, it should be noted that Sarah and Frank have received almost the same total compensation in 2021 (as shown in the footnotes of the most recent 10-K filing).

8. Cash flow development

Claim: “DAVIDsTEA is burning substantial amounts of cash even after exiting the restructuring proceedings”

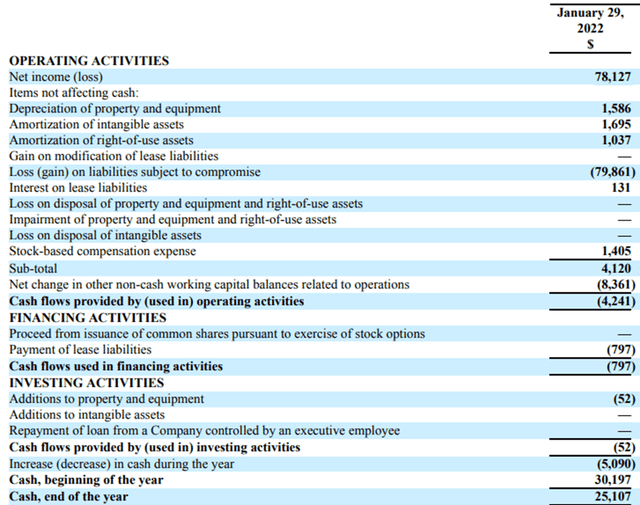

As a matter of fact, these allegations are just not true. As shown in the graph below, DAVIDsTEA generated a positive operating cash flow – before changes in working capital – of C$4.1 million in the last financial year ending January 29, 2022. In my opinion, it is only reasonable to exclude annual fluctuations in the working capital balance as these items can easily be manipulated by management and thus can distort year-over-year comparisons. Particularly in FY21, DAVIDsTEA’s working capital balance had been significantly impacted by the settlement of the company’s creditors’ claims through a one-time payment of C$17.6 million. Just to be clear, this payment as well as professional fees in connection with the CCAA proceedings of approx. C$2.0 million weighed on DAVIDsTEA’s cash flow as well.

Even after deducting lease payments (part of financing activities) and CapEx, the company was still able to generate a positive free cash flow of C$3.3 million in its transition year 2021. In this context, it should be highlighted that its new business model is not subject to any meaningful capital expenditure, e.g., CapEx in FY21 amounted to only C$52 thousand.

Source: 10-K filing of DAVIDsTEA

Despite the admittedly disappointing sales development over the last 12 months (as discussed above), DAVIDsTEA still managed to produce a positive operating cash flow (excl. changes in working capital) of C$1.3 million (as per April 30, 2022).

9. Potential buyout

Claim: “The Segal family will never sell the company”

Well, it isn’t going to happen until it happened. The hard fact is that Herschel Segal owning more than 45% of the company is around 90 years old (and yes, he could bequeath his stake to his wife/daughter) – in any case, change is imminent. In my opinion, there should be no shortage of potential suitors from the large CPG universe, in particular those which favor direct-to-consumer brands. Taking into account the new company structure and the vast revenue and cost synergy potential, an interested bidder could easily pay 4 times gross profit, still making the transaction accretive to earnings from inception. This would result in an enterprise value of nearly US$130 million. Adding the net cash amount, the purchase price would be around US$145 million or US$5.50 per share – an upside of more than 300% from current levels.

Now let’s turn the tables – what’s priced in?

Current valuation

On the basis of a significantly leaner organization and a more balanced go-to-market strategy, DAVIDsTEA was able to generate sales of C$104.1 million and an adjusted EBITDA of C$5.3 million in its transition year 2021. From an operational point of view, the last year was characterized by substantial investments in its IT infrastructure and especially by a further expansion of its wholesale footprint in Canada to 3.500 locations with big-box stores, grocery chains, and pharmacies, leading to sales from its e-commerce and wholesale channel of C$83.5 million. In this respect, the deals with Costco and Walmart in Canada should be mentioned in particular.

Source: Investor presentation (AGM, June 2022)

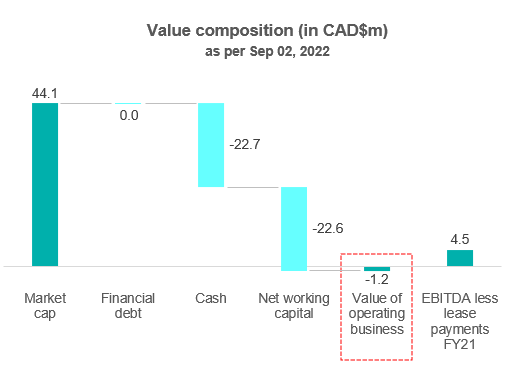

Despite the significant structural progress the company has achieved over the last two years, unfortunately, the market does not appreciate its recent operational performance at all. As shown in the waterfall chart below, at the current market cap, the market implicitly assigns a negative value to the operating business of DAVIDsTEA (market cap less net cash less net working capital). Apart from not receiving any credit for its operating business from the capital market, the current valuation also does not take into account the fact that the DAVIDsTEA brand might be of some substantial economic value for other players in the beverage sector, alongside other IP rights (e.g., blends/recipes).

In my opinion, much of today’s valuation can be explained by the current sentiment of institutional money: except for the more than 10% ownership stake of activist investor DOMO Capital Management, all institutional investors in total own only a meager 325k shares, representing an institutional stake of below 1.5% (per FactSet database) as of this writing (However, to my knowledge, Sarah had a least one meeting with a (potential) investor over the last month). The total lack of institutional money accompanied by an absence of (daily) trading volume led to a highly inefficient market for the stock, a classic example of a stock market anomaly. Thus, even a slight increase in buying or selling pressure can easily push the stock in either direction by a magnitude of 30-40% within a couple of days (as regularly observed in the past). Therefore, such illiquid stocks are out of sync with reality from time to time. A positive free cash flow and an (adj.) EBITDA of C$5.3 million in a transition year shouldn’t go hand in hand with a negative value for the operating business.

Source: Own calculation by the author based on most recent 10-Q and 10-K filings of DAVIDsTEA

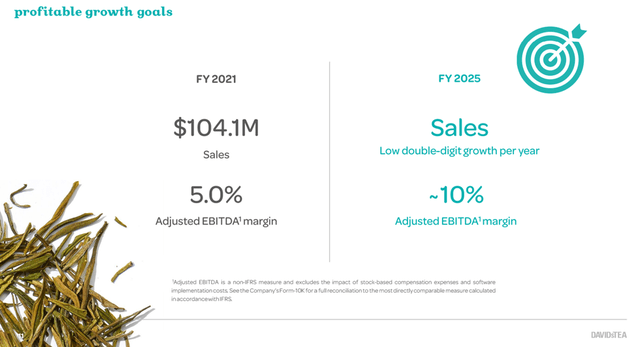

Looking at the most recent company presentation from June 2022, the current market cap raises even more questions. For the first time in years, DAVIDsTEA issued a mid-term guidance. Management is targeting low-double digits sales growth annually until the end of 2025 along with an expansion of the (adj.) EBITDA margin to 10% during this period. Even though I won’t assess the established sales and profitability goals here, it should be highlighted that Sarah referred to them as “conservative targets which could be raised in the upcoming years”. It is also worthy of note that there was no need for the executives to put themselves under this pressure to meet these goals in the future.

Source: Investor presentation (AGM, June 2022)

Future growth initiatives

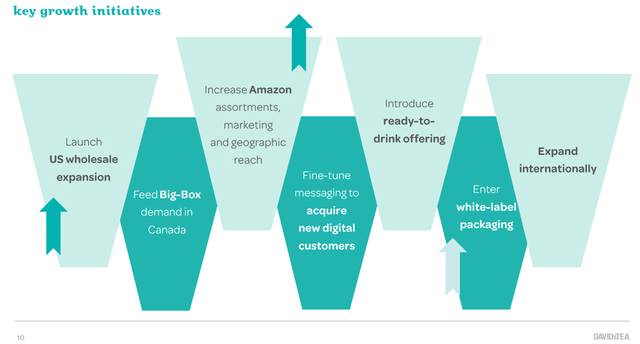

To back up these sales and profitability projections, the company also provided us with a set of short- and medium-term growth initiatives:

1) Launch of US wholesale expansion: Starting with the most crucial growth initiative, management is currently putting a substantial part of its efforts into replicating its success story in Canada with a roll-out in the US by the end of this year. According to Sarah, it will be a gradual implementation with a focus on quality and execution, so maybe they start with a specialized, regional retailer. From a brand philosophy perspective, a partnership with Whole Foods would also make a lot of sense. Ultimately, they probably will also target the big-box retailers Walmart and Costco (as they did in Canada) to seize this high-volume sales opportunity.

On August 31, DAVIDsTEA entered into a revolving credit line agreement in the amount of C$15 million providing the company with the financial flexibility “to accelerate its omnichannel growth strategy”. Apparently, Scotiabank put significantly more trust in the company’s business plan as opposed to equity investors. In my opinion, this financing was a prerequisite before finalizing the US wholesale expansion. I expect a deal announcement to be imminent. It should be highlighted that this news went completely unnoticed by the capital market. The average daily trading volume in the following three days amounted to a meager 16k shares, representing around 20k USD in value terms (and even though I purchased a few thousand shares after this news).

In the meantime, DAVIDsTEA quietly engaged in collaboration with Lululemon (LULU), which marks its first return to the US after its exit during the pandemic in 2020. The company opened a pop-up shop earlier this month above the Lululemon store in Boston which gives it a good opportunity to connect with a new, health-conscious audience. As per a news report, a spokesperson for DAVIDsTEA said that “this had the ability to be the start of a larger growth plan”.

Source: Tea & Coffee – DAVIDsTEA’s pop-up store within Lululemon’s Newbury Street store in Boston

2) Increase Amazon assortment and geographic reach: The company’s new distribution center (3PL partner) will be fully commissioned in 2022 and along with SQF certification DAVIDsTEA will become an Amazon-certified facility in Canada which should significantly improve its service delivery and help to grow its Amazon business.

3) Acquire new digital customers: The company has significantly increased its marketing spend, a substantial portion probably devoted to online ads and social media, e.g., in August the company partnered with an famous Instagram influencer who has a followership of more than 2.2 million people.

Source: Investor presentation (AGM, June 2022)

4) Introduce ready-to-drink offering: After signing the deals with Walmart and Costco, it seems like management has finally opened up and is now leveraging DAVIDsTEA’s brand by catering to a much larger customer audience – an evolution from being a shop for tea purists to offering tea bags and now apparently about to sell ready-to-drink tea. According to my conversation with the company, “it’s already in the works for a while, but these things take time” until they finally make it to the shelves of the supermarkets.

5) International expansion: According to the company, this expansion could take many different shapes and forms, e.g., through partnerships or wholesale arrangements. In addition to expanding its geographic reach through Amazon, I was told that it continuously receives unsolicited requests to open stores abroad via license agreements, for example. Thus, management is currently looking at different opportunities to grow its business internationally.

Takeaway

In a nutshell, DAVIDsTEA’s current valuation is factoring in a bankruptcy scenario in the short/medium term – the fact that the company is actually net cash positive (without any financial debt) doesn’t matter anymore. The market has already passed its judgment with regard to the discussed points above and doesn’t give any credit for management’s outlined medium-term growth strategy, despite at least one imminent catalyst. Everyone who begs to differ might consider this stock as a highly attractive investment opportunity, especially from a risk/reward perspective at these currently depressed levels.

Be the first to comment