Justin Sullivan

Investment Thesis

For the past year or so, I’ve been considering taking up a position in AutoZone, Inc. (NYSE:AZO), the well-known retailer of automotive replacement parts and accessories. It’s hard not to be enticed by AutoZone due to its strong business fundamentals and long-term operating history. AutoZone has grown free cash flow (“FCF”) at an 11.5% CAGR and EPS at a 17.2% CAGR over the past 10 years. These are enviable results by any measure.

Additionally, automotive retailers such as AutoZone, O’Reilly’s (ORLY), and Advance Auto Parts (AAP) are considered to be somewhat recession-resistant. This is because penny-pinching consumers are less likely to purchase new vehicles during economic hard times, but will instead opt to repair and/or maintain their existing vehicles to save money. Considering the U.S. is currently teetering on the edge of a recession or may already be in one, this may be a catalyst for AutoZone.

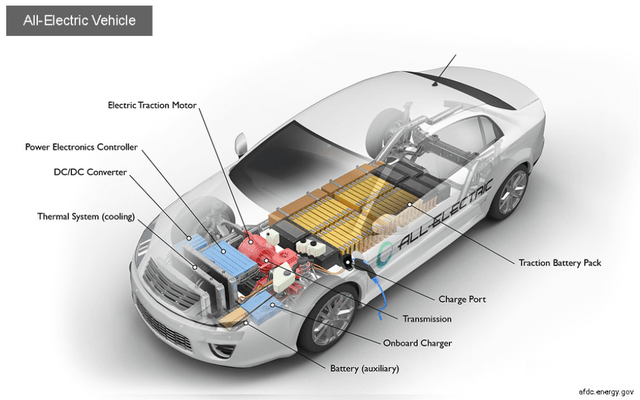

So why can’t I bring myself to buy? The answer – electric vehicles (“EVs”). In the short term, AutoZone looks like a winner, but over the long term, I’m far less certain. It’s easy to see EVs are the future, and, like them or not, they have far fewer moving parts, no engine oil, many have no transmission fluid, etc… Once EVs represent the majority of vehicles on the road, I can’t help but believe this will drastically cut into AutoZone’s revenue and profitability.

As much as I like AutoZone’s fundamentals, I can’t recommend buying it here unless you’re looking to get the last few puffs out of the cigar. With a recession on the horizon, AutoZone could benefit from the consumer’s economic woes, but beyond that, I recommend staying on the sidelines.

The Cigar Butt Strategy

If you’re unfamiliar with the cigar butt strategy pioneered by Benjamin Graham and Warren Buffett, it seeks to find companies believed to have one or two bull runs left in the future. Imagine you’re an avid cigar smoker walking down the street, and you find what appears to be a quality cigar discarded in an ashtray. The cigar is only 3/4 smoked and you, being a deep value cigar enthusiast, decide to pick it up for the last few puffs. A little disgusting to imagine, but a good analogy for stocks. In this article, I’ll explore the idea AutoZone may represent such an opportunity.

The Rise Of EVs

The writing is on the wall in regard to the transition to EVs. It no longer seems just a possibility, but an inevitability. The U.S. has vowed to end sales of gasoline-powered vehicles by 2035, and they’ve been joined by six major automakers and 29 other countries in making the vow. This is great for companies such as Tesla (TSLA) and Ford (F), but I can’t help but believe it’s a major headwind for automotive retailers such as AutoZone.

Yes, it should take a considerable amount of time (decades even) for EVs to overtake internal combustion engines (ICEs), but with the stock market being forward-looking, I wonder how far into the future it’ll look to price AutoZone’s shares. How long did it take for Blockbuster to go under after Netflix (NFLX) hit the scene? I don’t think the impact to AutoZone will be as drastic or as quick, but it does feel reminiscent.

EVs Require Less DIY Maintenance

EVs are a threat to AutoZone because they have far fewer moving parts. With fewer moving parts comes fewer opportunities for parts to break. EVs have no valves or pistons requiring standard motor oil, and many don’t have transmission fluid. I’m not suggesting EVs require no maintenance, fluids, batteries, etc… because they do, but the maintenance cycle is likely to be much more intermittent than ICEs.

Here’s a list of common maintenance items for EVs:

- 7,500 miles: Check fluids and inspect the systems. Rotate tires.

- 15,000 miles: Replace wiper blades.

- 36,000 miles: Replace cabin air filter.

- 75,000 miles: Replace hood gas struts.

- Every 5 years: Fill vehicle fluids and replace brake fluid.

- Every 7 years: Change air conditioning desiccant.

In addition to the standard oil change and fluids replacement, here’s a list of maintenance items applicable to ICEs but not to EVs:

- Replacing the spark plugs

- Changing out fuel filters

- Swapping the drive belts

- Replacing the water pump

- Carburetor flooding/issues

- Blown head gaskets

- Replacing belts/hoses

- Radiator problems

- Ring and cylinder wear

- Bearings/crankshafts/camshafts

- Exhaust system/pipes

Ultimately, I think the transition to EVs means there will be far fewer consumers heading to AutoZone on a regular basis. With sales of engine oil, miscellaneous moving parts, transmission fluid, etc… potentially deteriorating over the next many years, I find it hard to be optimistic about AutoZone’s future.

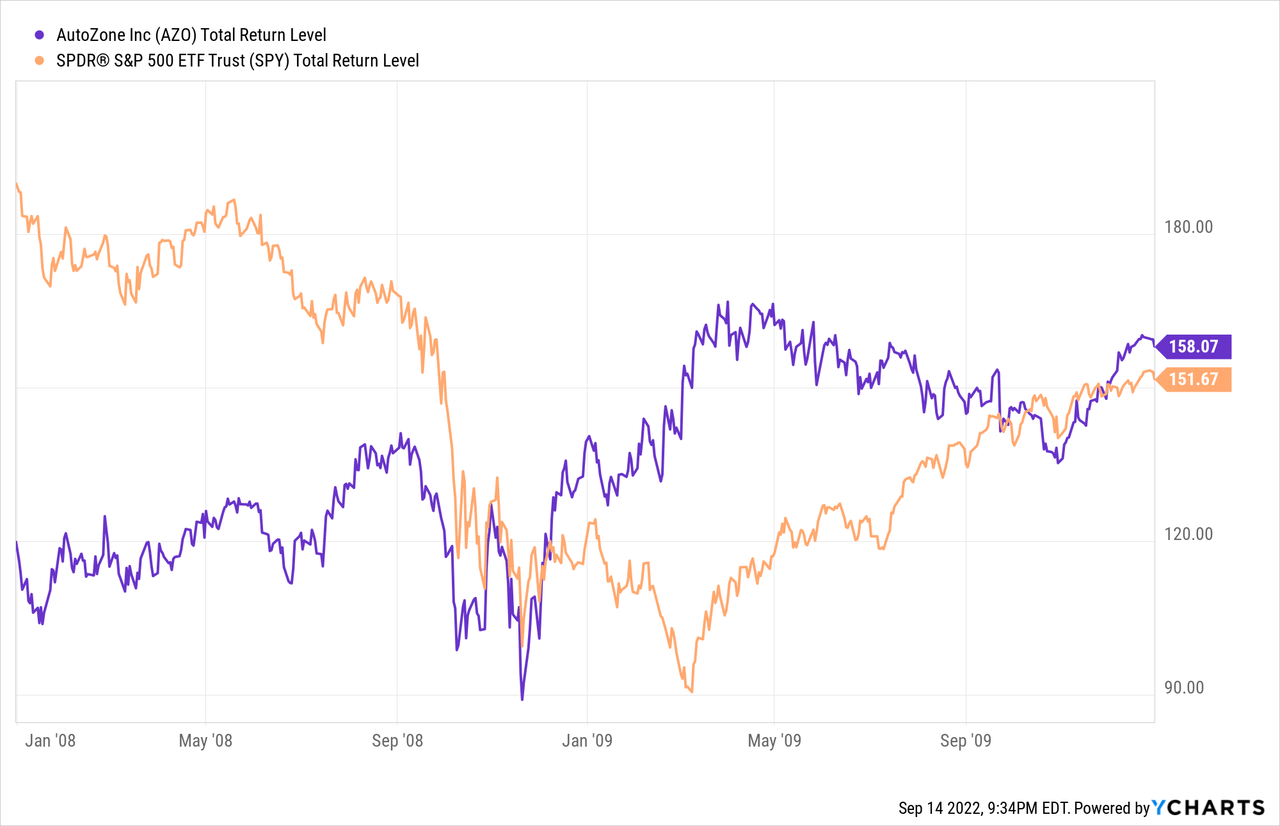

Cigar Butt In A Recession

The only bright spot I see is AutoZone may be a cigar butt story given the economy is currently on the brink of a recession. Automotive retailers such as AutoZone have performed well in prior recessions due to vehicle owners forgoing vehicle upgrades and instead opting for maintenance and repair. For example, during The Great Recession of 2008, AutoZone grew sales by 5.7% in 2008 and its stock gained 20% while the S&P 500 dropped 34%. That’s a 54% beat of the index. Following August’s CPI report showing inflation rising to 8.3%, I can’t help but wonder if AutoZone may again be poised to outperform.

Valuation

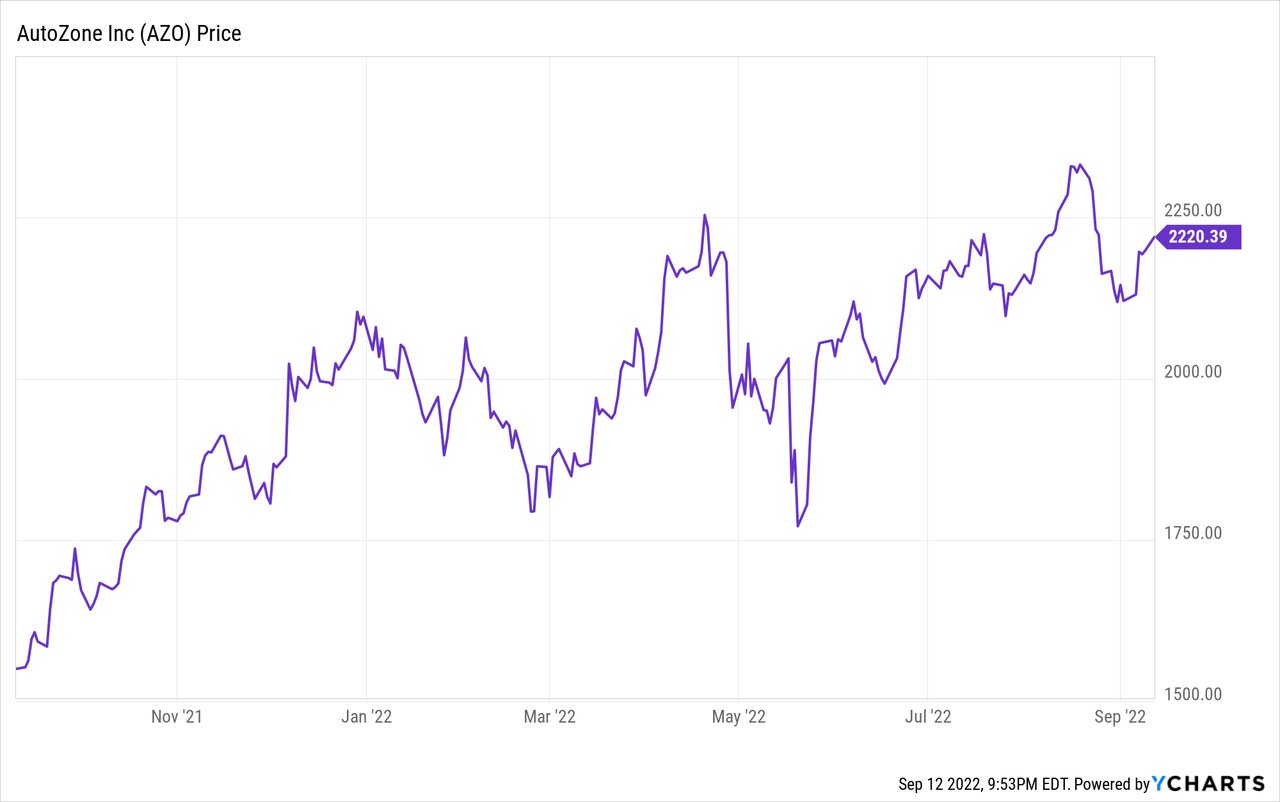

AutoZone’s past financial performance has been fairly consistent and predictable, so I feel comfortable using the P/E for valuation. According to Seeking Alpha, AutoZone’s 5YR average P/E is around 16.9. With a current P/E of 19, AutoZone appears to be around 10-15% overvalued from a historical perspective, but all-in-all, at $2,133, I believe shares to be fairly valued or slightly overvalued. This doesn’t surprise me too much, given the market is forward-looking and may be expecting a recession, resulting in a premium or fully-priced valuation for AutoZone.

My greater concern is the long-term EPS story if EVs truly start to eat into AutoZone’s revenue and earnings. I feel like AutoZone’s EPS could be on the verge of plateauing, with the potential to head lower over time. Share repurchases may mask and/or extend the time it takes before EPS starts to trend lower, but it makes a 5-7 year price target very difficult to estimate.

Risks

Risks to this investment thesis are a bit odd because I feel the need to provide my thoughts if you were to sell due to the EV concerns OR if you were to buy to ride the recession wave.

Sellers

If you were to sell AutoZone due to the EV concern, there’s a potential I’ve overstated the concern they truly represent. Or it could take 50+ years for the EV transition to play out and impact AutoZone. In the meantime, its possible shares of AutoZone continue to appreciate alongside earnings. Investors would miss out on the price appreciation if this were to play out.

Additionally, it’s possible AutoZone strikes some sort of deal with Tesla or Ford to supply specialized EV parts for the auto manufacturers. This could be a major catalyst for AutoZone, resulting in continued growth in revenue and earnings.

Buyers

If you were to buy AutoZone to ride out the recession, it’s possible it, too, succumbs to the woes of the economy and tanks alongside it. There’s no guarantee AutoZone will be recession-resistant during this or future recessions simply because it was in past recessions. Also, if investors are simply looking to hold AutoZone through the recession and sell once the economy finds solid footing, market timing comes into play, which requires a good bit of luck. Time it wrong and there’s the potential to give back all the recession gains.

Conclusion

I’m a fan of AutoZone and admire its financial performance and business fundamentals, but I think its future is too uncertain to invest in for the long term. Instead, investors may consider taking up a position or holding onto shares while the economy faces headwinds caused by inflation and rising interest rates. If the past is any predictor of the future, AutoZone may be poised to outperform while the overall market continues to sink. However, once the economic headwinds begin to ease, it may be a good opportunity to sell into strength, then sit on the sidelines until AutoZone’s future gets a bit clearer. Take one final puff from the cigar, then park it in the ashtray and wait.

Be the first to comment