Ronald Martinez

(Note: This article was in the newsletter October 2, 2022)

AT&T Inc. (NYSE:T) is currently having a stock price reaction as though the past will repeat. The market is known for “blaming” a stock for mistakes, miscues, or even just plain unexpected challenges well into the future no matter whether it is justified or not.

In this case, the company is now focused firmly on the remaining business. Just about every presentation made has management stating cycles of 3 years or so depending upon the topic. Management also stated during at least some of these presentations that the turnaround really began about 2 years ago. That means that some of the benefits will begin to appear at a time when the market is expecting the worst.

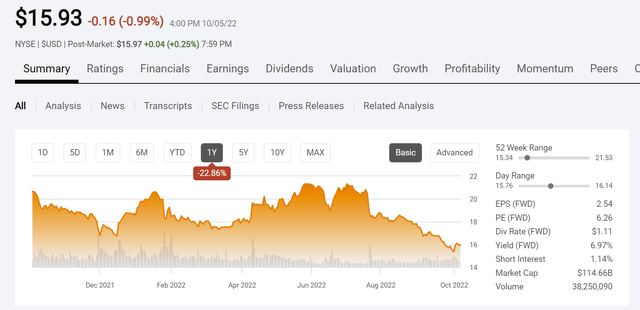

AT&T Common Stock Price And Key Valuation Measures (Seeking Alpha Website October 5, 2022)

The first thing the bears do is get out the common stock price chart shown above. No matter whether they cite the 10-year history or anything shorter, it is so easy for them to demonstrate that this management has cost shareholders dearly.

But left out of the discussion was the history of AT&T as a landline company whose main business was in decline. Management certainly could have done nothing while liquidating the company at a certain point once the landline business was no longer viable due to advancing technology.

This management instead decided to take advantage of that cash flow to try and figure out a future for the company. Admittedly, some things did not work out, to say the least. But this company now has a very viable future both with cellphones and the Internet thanks to that strategy.

Very seldom does such a significant business change go without a few hitches. Had management seen the future, there are several things they definitely would not have done. So, the stock could have performed better.

Mr. Market’s Reaction

The problem in the current situation is not that management succeeded in establishing a future. Instead, the problem is that the company has had basically negative net returns in the process of getting to the future. That has frustrated the market enough to assume negative returns well into the future.

The current CEO was promoted into the job in 2020. He clearly “got the memo” that changes were needed and has pursued those changes since becoming CEO. The market focuses instead on the fact that he was an insider and is essentially the same face of an administration that brought about the returns on the stock price shown above.

I have worked in a lot of turnaround situations and can tell anyone that CEOs are generally “their own person” who may or may not follow the past administration. For whatever reason you want to use, this current CEO has pursued a path of focusing the company on core businesses and getting the noncore businesses to someone that knows what to do with them. That is likely to dramatically change the results going forward to the benefit of shareholders.

AT&T Cash Flow

Cash flow upset the market when free cash flow, a non-GAAP measure, “dried up.” But anyone who has reviewed the 10-Q knows that Accounts Payable soaked up nearly $4 billion of cash flow and did the same the previous fiscal year (that number exceeded $4 billion).

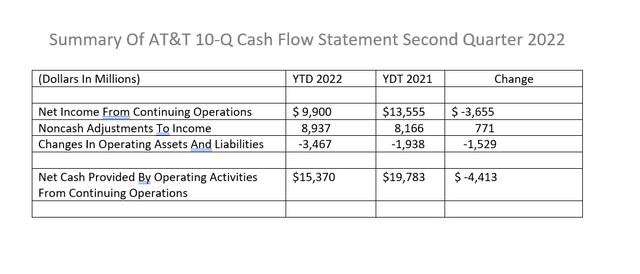

Summary Of The 10-Q Net Cash Provided By Operating Activities From Continuing Operations For the Second Quarter YTD Statement (AT&T 10-Q Cash Flow Statement Summarized By Author Second Quarter 2022)

I put some things above in the Changes in Assets and Liabilities so my in-between numbers are slightly different. What is clear are the changes in operating assets and liabilities along with the few adjustments below that were materially unfavorable in the current fiscal year. Deferred Customer Contract and Acquisition Costs were a nearly $1 billion unfavorable swing that is part of the Changes In Operating Assets and Liabilities.

The main point is the market is worried about an accounts payable shift that happened the year before. There was a lot of noise made about cash flow “drying up.” However, if it happened the year before, then management will handle the situation. Now management stated that some were slow to pay and that made receivables head up (and soak up cash flow as well). But the main swing appears to be Accounts Payable as shown on the cash flow statement. If that is the case, then that unfavorable swing is likely to reverse elsewhere in the year.

The accounts payable shift clearly towers over everything except the reclassification of some income (or losses) to discontinued. As the newly focused business gets “whipped into shape,” it remains to be seen whether or not that Accounts Payable change happens every year in the second quarter.

Management did discuss that customer payments slowed a day or two (that is disclosed in several places besides the conference call and slide presentation). Now, that may prove to be a worry if management does not properly handle the situation in the future. But clearly, the biggest reason for a lack of cash flow is that negative accounts payable change.

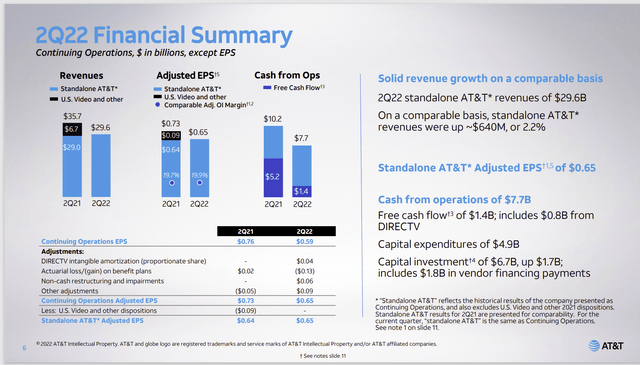

AT&T Second Quarter 2022, Financial Summary Results (AT&T Second Quarter 2022, Earnings Slide Presentation)

Interestingly, a lot of market commentators were worried about the lack of free cash flow in the second quarter. But free cash flow has to take secondary consideration to cash flow from operating activities (because if the cash flow statement does not show cash flow, then there can be no free cash flow regardless of the calculation).

Cash on the cash flow statement dropped sharply in the second quarter. That can be blamed on debt repayments or another line item of the reader’s choice (even a combination depending upon the viewpoint of the reader).

What is clear is that the material sale of divisions combined with getting the remaining company on track has clearly made cash flow almost unintelligible for the time being. Frankly, cash flows will likely clean up over the next six months or so and then some significant interpretations are possible.

The Results

Management is doing what is stated it would do when the refocus strategy was announced along with some noncore sales. There has been a focus on comments like no free cash flow. But in reality, there is so much going on due to the noncore sales that it is very hard to tell if there are any lingering long-term problems.

What is clear is that the new CEO began the project of refocusing the company sometime before tangible events were announced or were visible to shareholders.

A fair amount of debt has been paid as a result. I personally would like to see debt repayments be a priority over the dividend. But I also would like to see management progress over the next 6 months to a year before I decide if the current strategy is on track.

Worrying about the dividend can be a viable way to go if debt reduction is the priority. It is hard to make a case for any free cash flow, no matter the calculation, if you as a shareholder, believe debt levels need to come down yesterday.

On the other hand, the debt rating points to a fair amount of management flexibility with regard to the dividend. A lot will depend upon costs and margins when management finally has the core business running the way it is supposed to be running. Right now, that is hard to tell.

Large companies often take a lot of time (due to sheer logistical challenges) to get where they are going to go. Probably a five-year horizon would be an adequate amount of time. But that time period began probably 2 years or so ago.

If you believe that management is “on track” to get things where they need to be over time, then the dividend is likely to prove to be in good shape. If you are not happy with business conditions and the pace of debt payments, then by all means factor in a dividend cut in the future. Right now, it looks like the business is going to grow and management is on track.

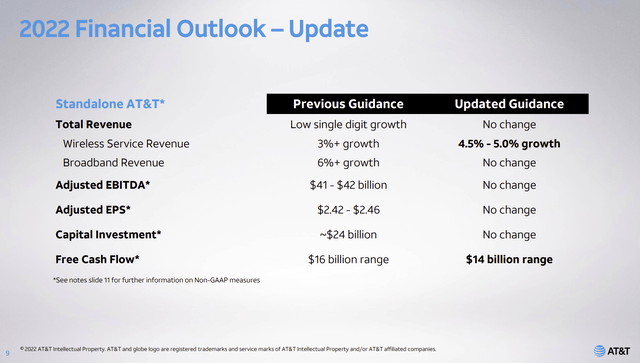

AT&T 2022 Guidance (AT&T Second Quarter 2022, Earnings Conference Call Slides)

It does not take a lot of growth to change the free cash flow. Similarly, some inflation can put a dent in free cash flow.

Rather than free cash flow, I prefer to take cash flow from operating activities, both before and after changes in accounts. I then deduct expenditures including dividends to see if I agree with the expenditures and priorities.

Free cash flow does not mean much if a recession absorbs the cash flow into working capital enough to make the free cash flow calculation meaningless.

Basically, management got what they wanted. Now over the next two to three years, they have to get the company to perform (and debt to be paid) as management stated. The preliminary growth and new business announcements appear to mean that management is on track. But waiting for the financial statements to “clean up” from all that is happened is not a strong point for the market.

Still, this company is financially strong enough that waiting does not imply a lot of risk. But the largest risk is the market assigning past results to future results which would decrease the current price to lower levels still. The stock will be back as long as management performs as advertised. I am going to bet on management.

Be the first to comment