Maria Vonotna

Thesis: Opportunistic Buybacks To Fuel FFO Per Share Growth

Urstadt Biddle Properties (NYSE:UBA, NYSE:UBP) is a small retail REIT that owns primarily grocery-anchored shopping centers in suburbs of the New York tri-state area that are generally within commuting distance of New York City.

The REIT owns 77 properties, and 87% of its base rent derives from properties anchored by a grocer, pharmacy, or wholesale club. Nearly one-third of rent (29%) comes from tenants in these three categories.

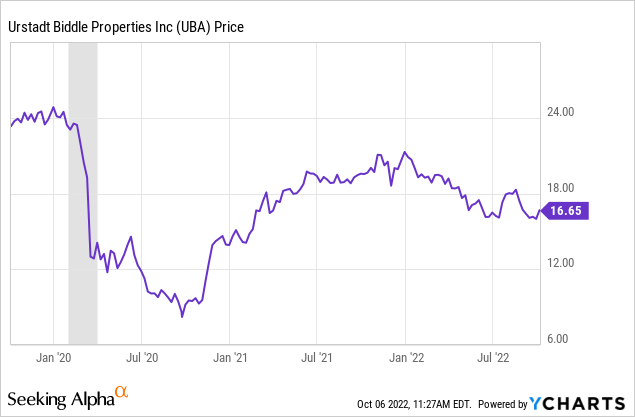

After more than doubling off its COVID era lows from Fall 2020 to the end of 2021, UBA has slid back downward this year on concerns over poor rent growth and a high cost of equity.

For REITs, a high cost of equity can be a self-fulfilling cycle in which a low stock valuation results in an inability to issue equity for accretive growth, which then stunts growth in FFO per share. It can be very hard to break out of this rut.

But UBA appears to have a way to generate some modest per-share growth. The silver lining of the REIT’s dividend cut in 2020 (after 26 consecutive years of raises) is that it has freed up cash for opportunistic buybacks, even though the dividend is now back at 85% of its pre-pandemic level. In the last quarter, UBA began buying back shares at a fairly substantial clip, and the board just authorized those buybacks to continue.

Though I continue holding UBA in hopes to see the dividend eventually restored to its pre-pandemic level, which would render a dividend yield of 6.7% based on the current share price, I am happy to see management prioritize buybacks over dividend increases right now.

Let’s take a look at why.

Buybacks

Recently, UBA’s board gave management the authorization to buy back up to 2 million shares at management’s discretion and without an expiration date. Comparing that to 38.53 million total shares outstanding, we find that the total authorized buyback represents 5.2% of shares outstanding.

But let’s look at the actual pace of buybacks set in the last quarter to see how many buybacks to reasonably expect.

In fiscal Q3, management repurchased 310,473 shares of UBA for an average of $17.43 apiece ($5.41 million) and 3,071 shares of UBP for an average of $18.17 apiece ($55,800). That’s almost $5.5 million worth of shares repurchased in one quarter, and at stock prices above where they are trading right now.

How much free cash did UBA have to spend on these buybacks in the last quarter?

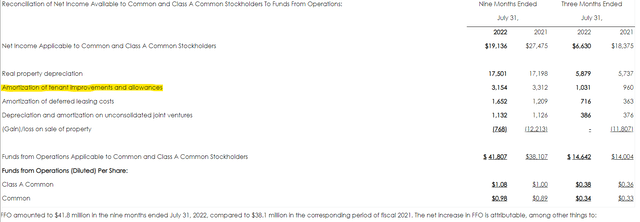

Well, consider that UBA does not include property improvement costs and leasing commissions in the expenses deducted from FFO.

Notice above that, even though these are cash expenses, tenant improvement allowances are added back from net income to FFO, which means they are not deducted from FFO. Deferred leasing costs are commissions that will be paid out of a portion of newly signed rent over time, so they aren’t cash expenses during the current quarter.

For fiscal Q3 specifically, we get around $13.5 million in free cash before dividends, based on subtracting $1.1 million in property improvement, tenant improvement, and cash leasing costs from FFO of $14.6 million. That was plenty to cover the $7.1 million in common dividend payments and $3.4 million in preferred dividends ($10.5 million in total dividends), with another $3 million to spare.

That $3 million wasn’t enough to cover the $5.5 million spent on buybacks during the quarter. So, where did the additional cash come from? Answer: the credit facility, from which UBA pulled $10 million of its total capacity of $125 million.

As of the end of July 2022, the floating interest rate on the credit facility stood at 5.1%, and that has surely gone up further as the Fed has raised rates. But UBA’s dividend yield is 5.7%, so the REIT is probably still saving cash, on balance, by using the credit revolver for share repurchases.

How much cash would UBA be able to reasonably devote to buybacks on an annual basis?

Currently, UBA’s annualized property improvement, tenant improvement, and leasing commission costs are around $13.3 million (based on $10 million actual costs in the nine months ending in July 2022), according to the fiscal Q3 10-Q, but $2.3 million of that was for a redevelopment project that might be considered “growth” investment (turning part of a shopping center into a self-storage facility).

But management also mentions in the 10-Q:

We expect to incur approximately $11.8 million for anticipated capital improvements, tenant improvements/allowances and leasing costs related to new tenant leases and property improvements during the remainder of fiscal 2022 and fiscal 2023.

That’s $11.8 million spread over five quarters, or $2.36 million per quarter, or $9.44 million annualized. Let’s round it up to $9.5 million – maybe leasing will be slightly better than expected.

So, subtracting $9.5 million from the estimated FFO of $56.5 million for fiscal 2022, we get around $47 million in free cash, or $1.22 per Class A common share. That is plenty to cover the $42 million in annualized common and preferred dividends, or $0.95 per share in common dividends and $0.09 in preferred dividends.

However, that only leaves about $5 million in total free cash flow after dividends with which to engage in buybacks.

Assuming an average cost per UBA share of $17, two million shares repurchased would cost $34 million. Now, there is no expiration date on this buyback authorization, but if UBA was to repurchase the full amount authorized, where would the additional $29 million come from?

Recall the $10 million pulled from the credit facility, of which only maybe $2.5 million has probably been used on buybacks. So, UBA currently has the capacity to repurchase about $12.5 million ($5 million in FCF after dividends plus $7.5 million of cash from the credit facility) worth of shares over the next year.

Again assuming an average repurchase price per share of $17, UBA would be able to use this cash to buy back a little over 735k shares over the next year, or about 2% of shares outstanding.

This will give a gradual boost to FFO per share over time, even if total FFO remains flat.

Presumably, FFO and FCF after dividends will also grow over time as a result of leasing activity and rent growth, which will allow for more buybacks. And if/when the share price recovers to a point where it no longer makes sense to engage in further buybacks, management can use available cash to pay down the credit facility.

Another option would be to use available cash and/or the credit facility to redeem the Series H preferred stock (UBP.PH), which yields 6.25% at par and passed its call date in September 2022. But since there is $115 million of this preferred stock outstanding, this would require drawing 100% of UBA’s credit facility capacity, so I doubt this will happen anytime soon.

Balance Sheet Resilience

Before wrapping up, I’d like to touch on UBA’s balance sheet strength, because during the current rising rate environment, balance sheet durability has become of paramount importance.

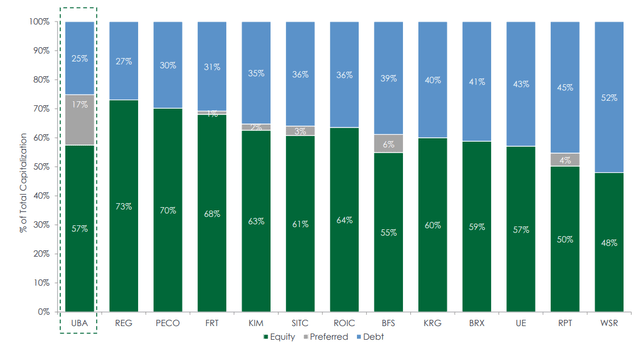

Looking at total capitalization, we find that UBA has the lowest share of debt in its retail REIT peer group.

But notably, this does not include preferred equity. If we include preferred equity, then we find that UBA’s equity share of capitalization is actually on the lower end of its peer group. Is UBA’s large share of preferred equity a good or bad thing?

Well, UBA has $225 million of preferred equity split between the 6.25% par yield Series H (UBP.PH) and the 5.875% par yield Series K (UBP.PK), with a weighted average yield of 6.07%.

The bad news about UBA’s preferred equity is that it comes with a fairly high cost of capital. The good news is that it is perpetual capital with no mandatory redemption date. Thus, management does not need to worry about any maturities for these preferreds.

In a rising rate environment, I think that the lack of concern about maturities is more of a strength than the relatively high yields are a weakness, as far as the preferred equity goes.

On the debt side, UBA only has $1.7 million in variable rate debt as of the end of July. As of midyear, that variable rate debt had an interest rate of 5.1%. The rest of the debt, $302.6 million, was in the form of fixed-rate mortgages that had a weighted average interest rate of 3.8%.

UBA fortunately has no mortgage debt maturing until 2024. In 2024, only $19.8 million is scheduled to mature, so really, the next big round of refinancing won’t come until 2025, when $88.1 million is set to mature.

Where will interest rates be in 2.5 years? Of course, no one knows the future, but I would gander to say they will likely be lower. Consider, for instance, that the bank prime rate only got as high as 5.5% in 2019, at the end of the last rate-hiking cycle. Today, the prime rate sits at 6.25%.

In any case, having only 25% of total capitalization in debt should surely be seen as a strength right now.

Bottom Line

UBA is one of my favorite holdings. The Urstadt and Biddle families own about 20% of the company, mostly through the super-voting UBP shares, and they run it more like a privately held business than your average publicly traded retail REIT.

The benefit of being public, though, is that management can engage in buybacks when it becomes opportune. That opportune time is now, so I’m glad to see management utilizing cash this way. Over time, it will gradually boost FFO per share and lower the payout ratio, making even safer the common and preferred dividends.

For those who would like to tap into UBA’s cash flows at a higher yield and less volatility (albeit with less upside), both of the preferred stocks currently yield over 7%.

Be the first to comment