Justin Sullivan

AT&T (NYSE:T) stock recently dropped by about 10% after the company reported its Q2 results. Despite better-than-expected EPS and revenues, enthusiasm was dampened by cash flow concerns. After the recent plunge, AT&T’s stock is yielding about 7.3%. Moreover, at around 7.4 times forward EPS estimates, AT&T is dirt cheap again. The market may be overreacting, as the recent earnings report was robust, and the cash flow dip is probably a transitory phenomenon.

Additionally, the company has outlined a detailed strategy on how it plans to expand over the next several years. Furthermore, AT&T is essentially recession-proof and could benefit from a management shakeup. AT&T’s downside appears very limited, and the stock is compelling here. Multiple expansion and other variables could enable AT&T’s stock price to appreciate considerably from here while providing a substantial dividend simultaneously.

AT&T’s Earnings Stumble

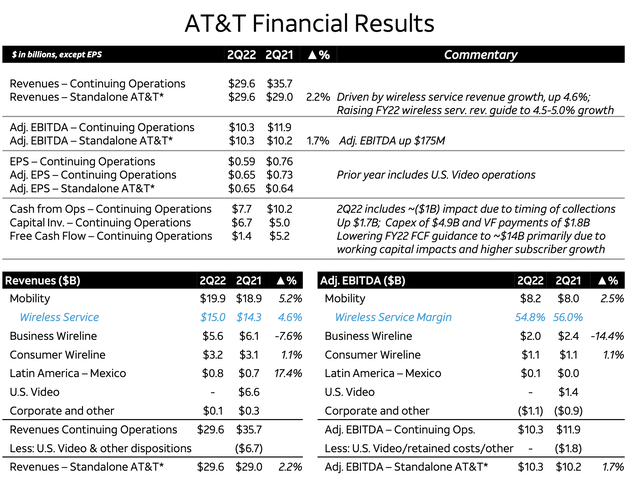

AT&T reported non-GAAP EPS of $0.65, beating consensus estimates by $0.03. Revenue of $29.6 billion was also a beat by $130 million. The company posted over 800,000 postpaid phone net adds and more than 300,000 AT&T Fiber net adds in the quarter. While AT&T increased its mobility service revenue guidance to 4.5-5%, it also decreased its free cash flow guidance to the $14 billion range. AT&T’s headline numbers are substantial, but the cash flow reduction is disappointing. Heavy investments in 5G and working capital needs are impacting cashflows. However, inflation is probably a factor, and as the economy moves past the difficult phase, AT&T’s cash flow issues could resolve quickly.

Highlights (investors.att.com)

If we look closely, AT&T’s numbers were relatively robust. Standalone company revenues came in at $29.6 billion, 2% higher than the $26 billion in the same quarter one year ago. Adjusted EBITDA also grew $175 million or 1.7% YoY. Standalone adjusted EPS increased by 1 cent to 65 cents in the last quarter. Perhaps most importantly, AT&T’s core Wireless Service grew by 4.6% YoY and is projected to continue growing similarly throughout 2022 and 2023. Also, we see some FCF notes that imply the decrease in FCF is a temporary phenomenon. While AT&T’s results remain solid, and AT&T has shown a tenacity for surpassing consensus analysts’ forecasts in recent quarters, it has not prevented the stock from performing terribly against its competition.

AT&T Hasn’t Done Well Against The Competition

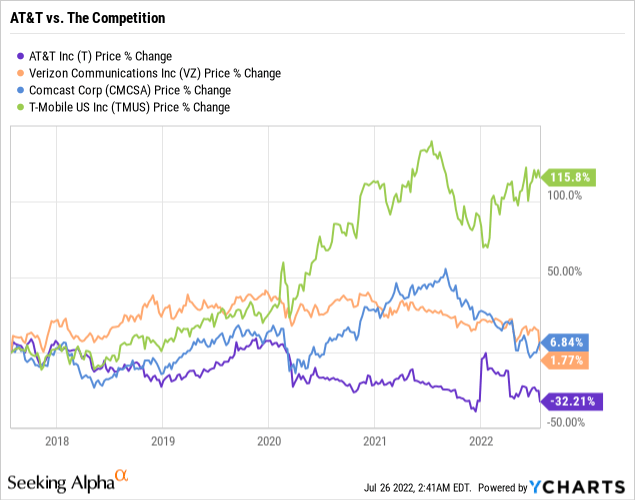

AT&T’s stock has performed terribly, down by roughly 33% over the last five years. Verizon (VZ), AT&T’s closest competitor, is up slightly over the same time frame. Comcast (CMCSA) is also higher, and T-Mobile US (TMUS) has crushed the competition over the last five years. It’s essentially the same if we drag the chart out further, as AT&T’s is down by around one-third over the previous ten years.

So, you’re getting the dividend, but the share price continues to drip lower. We saw a disastrous takeover of Time Warner. AT&T likely overpaid for the media giant, but worse, it mismanaged the merger horribly. Five years later, AT&T spun off WarnerMedia for far less than it had paid to acquire the company. Moreover, AT&T still has a boat load of debt and faces a costly build-out of its 5G network. Where is the innovation? Where is the growth? Where is the higher stock price? AT&T has a great brand and significant potential. The stock is dirt cheap, but where is anything growth-related or even constructive?

Time For A Management Change

How long will shareholders wait for a real management shakeup? AT&T’s management hasn’t done anything productive with the company for many years. AT&T’s stock has been worse than dead money for decades and trades at the same price it was back in 1995, nearly 28 years ago. AT&T has become incredibly inefficient and is essentially a bureaucracy that needs to change quickly. AT&T needs a new sheriff to establish order and return the company to growth and increasing profitability.

AT&T had the right idea when former CEO Randall Stephenson “retired”. However, Stephenson was replaced by the serving President and COO John Stankey, which didn’t change anything. With Stankey at the helm, we’re getting a continuation of AT&T’s old regime, and that’s not what we want. Instead, we want an outsider. We want someone who will bring a fresh, new perspective and innovation to AT&T. We need a person who will turn AT&T around and get the company growing again. The market would probably appreciate a management shakeup, and one could be approaching if AT&T’s performance doesn’t improve soon.

AT&T – Essentially Recession-Proof And Dirt Cheap

AT&T pays an excellent dividend of roughly 7.3% at the current stock price. However, a juicy premium is not the only thing that makes AT&T attractive. At around seven times forward EPS estimates, AT&T is remarkably cheap. Therefore, the downside is probably very minimal, even in a downturn or a recession. Furthermore, AT&T’s business is essentially a staple. Consumers will continue using wireless and wireline services even when the economy slows or dips into a recession. There may be a slight drop in demand, but not like with consumer discretionary products and other cyclical segments in the economy. Thus, demand could increase for AT&T’s stock as the slowdown approaches.

Moreover, with its ultra-low 7.4 forward P/E multiple, AT&T could go through a mild multiple expansion, leading to a substantially higher stock price as we move on. Even a nine times P/E multiple like Verizon’s would result in an up move of around 20% for AT&T. If the company’s P/E multiple expands to 10, we should see about a 35% rise in its share price. Therefore, own AT&T here. I own it for the dividend. I own it for the possible multiple expansion. I own it because the stock should benefit if AT&T announces a management change. And I own it because AT&T is one of the most reliable names in the business. The stock has been down for too long, and AT&T could benefit from a post-WarnerMedia turnaround process. My one-year price target range is $22-25, implying a 20-35% gain from AT&T’s current price.

Be the first to comment