Zocha_K

Introduction

In December 2021, I wrote a bearish article on SA about NexTech AR Solutions (OTCQB:NEXCF) in which I said that its rebranding as a Metaverse company didn’t solve any of its financial problems and that there could be significant stock dilution ahead. In January, the company issued 8.1 million new shares as part of a private placement and its Q1 2022 results showed a slump in revenues of over 50% year on year and a net loss of C$ 7.7 million ($5.9 million).

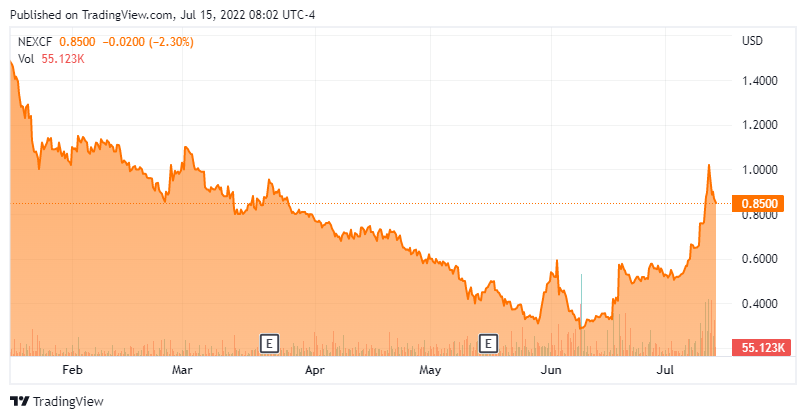

Yet, the market valuation of NexTech has more than doubled since early June and one of my subscribers told me that he thinks there’s a short squeeze going on. In view, there isn’t one but this share price increase could be a good short selling opportunity. Let’s review.

Overview of the recent developments

In case you haven’t read my previous article on NexTech, here is a quick description of its business. The company specializes in augmented reality (AR) solutions by converting images from 2D to 3D and rebranded itself as a Metaverse company in November 2021. Its products include an AR spatial mapping platform named ARway, a self-serve virtual events platform named Map D as well as a suite of products under the ARitize brand for 3D model creation. Perhaps the product that is most focused on the Metaverse is ARitize Maps, which is an app that gives users access to an all-in-one Metaverse creation studio.

However, the majority of revenues continue to come from three e-commerce platforms that specialize in the sale of vacuum cleaners, animal food supplements, and health supplements, respectively. And unfortunately for investors, NexTech has a history of underdelivering. Back in 2019, the company was expecting its gross margin to grow to 70% in 2020 and revenues to C$40 million ($30.6 million) by 2021.

NexTech AR Solutions

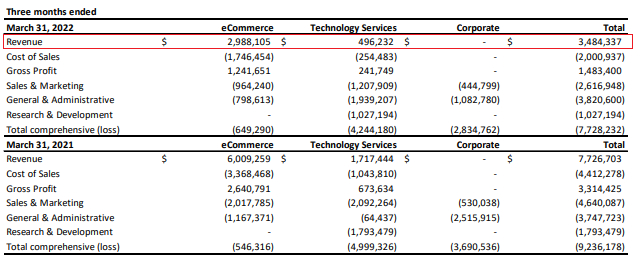

NexTech’s revenues and margins didn’t come even close, and the company then pivoted to the Metaverse. Yet, Q1 2022 revenues crashed by 54.9% year on year and came in at just C$3.5 million ($2.7 million) while the gross profit margin was only 42.6%. What’s even worse is that over 85% of those revenues came from the e-commerce segment.

NexTech AR Solutions

The idea of NexTech is to pivot to a SaaS business model and become a 3D modeling factory for the Metaverse but it seems that either the market isn’t there or that the company can’t get a significant share of it. As of March 2022, the annual recurring revenue was only C$0.8 million ($0.6 million), which isn’t enough to cover even a quarter of G&A expenses. Sure, this is an increase of 62% compared to Q4 2021 but I think it’s too little too late as operating expenses are C$7.5 million ($5.7 million) per quarter.

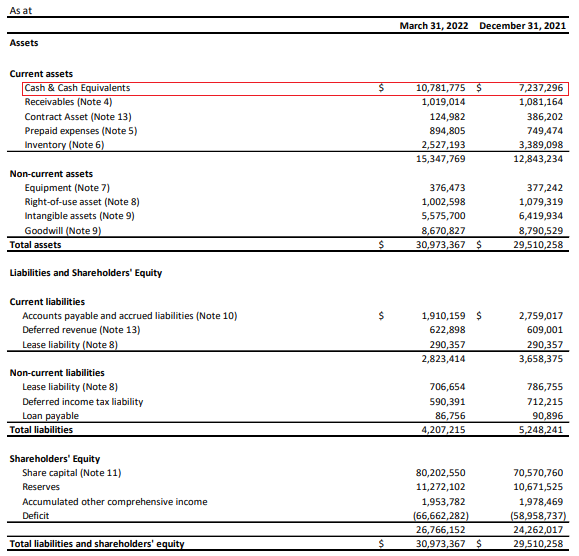

Turning attention to the balance sheet, NexTech finished March with C$10.8 million ($8.2 million) in cash and cash equivalents. Considering cash used in operating activities was C$5.5 million ($4.2 million) in Q1 2022 alone, I think it’s likely that more stock dilution is coming before the end of this year.

NexTech AR Solutions

So, what’s next for NexTech? Well, the company recently announced that it’s spinning out ARitize Maps which will become part of TSX-listed firm named PC 1. The latter currently has 10,350,000 shares and will carry out a consolidation which will decrease this number to 8 million or below. Under the deal, NexTech will receive a total of 16 million PC 1 post-consolidation shares. Considering PC 1’s shares are trading at C$0.105 ($0.08) as of the time of writing, it doesn’t seem that NexTech is getting much for ARitize Maps.

Overall, I expect NexTech to continue generating losses and diluting shareholders over the coming year and I was surprised to see that its share price has staged a significant recovery over the past month.

Seeking Alpha

There haven’t been any significant catalysts for the share price in the recent past so it’s logical to think that there is a short squeeze taking place here. However, the data doesn’t support this theory. According to figures from Fintel, the short interest is only 97,479 shares and it takes 0.16 days to cover as of the time of writing. In addition, there are 900,000 shares available for borrowing.

Whatever the reason behind the recent share price strength, I think that it opens a window of opportunity to open a short position as the market valuation is likely to return to the June levels. The short borrow fee rate is 16.17% as of the time of writing.

Looking at the risks for the bear case, I think there are two major ones. First, revenues from the AR business could finally pick up some traction and NexTech could become profitable in the near future. However, I view this as unlikely taking into account the company’s history of underdelivering. Second, sometimes the share prices of microcaps increase for spurious and unknown reasons, and it’s possible that this will happen again here in the future.

Investor takeaway

The financial results of NexTech deteriorated significantly in Q1 2022 and the company is far from the $30 million in annual revenues it wanted to achieve by 2021. I think that losses will continue to pile on over the coming months and it seems that more stock dilution by the end of 2022 could be inevitable.

Yet, the market valuation of the company has doubled over the past month and I think that this creates an opportunity to open a small short position here. The short borrow fee rate is below 16.17% but there are no put options available, so it could be best for risk-averse investors to avoid NexTech.

Be the first to comment