martin-dm

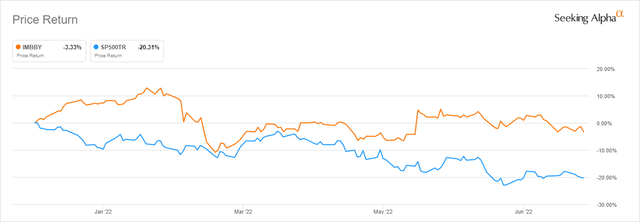

The markets seem to have fallen off the cliff since the beginning of the year as several negative macroeconomic factors weigh themselves heavily against the prospect of future positive market returns. With the S&P 500 finding itself well in bear market territory, having generated a negative 20.31% return year-to-date, investors find themselves in pursuit of safe heavens in the form of inflation hedges and defensive stocks.

As negativity and despair start reflecting themselves onto the market sentiment, a particularly interesting market sector found itself significantly outperforming expectations. Tobacco companies seem to be experiencing another period of youth and show us that they still have a trick or two up their sleeve. Imperial Brands (OTCQX:IMBBY) (OTCQX:IMBBF) is a Bristol-based tobacco company that has managed exactly that and has once again shown that it is almost perfectly positioned to circumnavigate the ongoing crisis.

Accessible shareholder returns

On the back end of the greatest bull run in stock market history, when even rather basic index strategies yielded double-digit yearly stock market returns, investor interest for a “declining” tobacco company seemed at an all-time low. However, tobacco companies in general have one unique attractive feature that has allowed them to generate alpha on the market for the first time in decades. We are discussing the immediately accessible shareholders returns which are immensely fundamentally attractive during a recession-like market.

The combination of the company’s lucrative dividends and the expected share buy-back initiatives create a different situation for Imperial Brands, allowing it to outperform the market for the first time in years and generate a 16.98% alpha year-to-date.

YTD Returns vs S&P500 (Seeking Alpha)

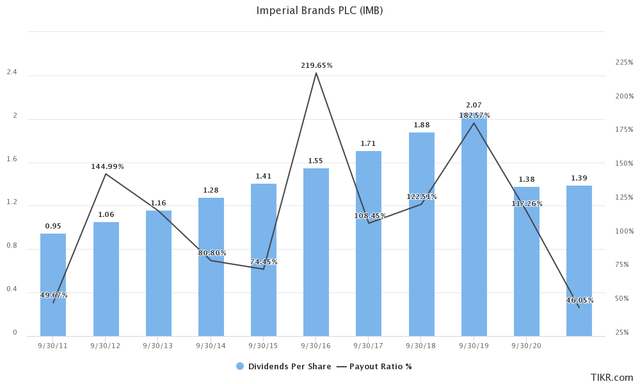

Without much doubt, the strongest argument that the tobacco giant can present to its investors is the attractive dividend yield. With shares of the company selling for £18.38, Imperial Brands is currently offering a quite persuasive 8.52% dividend yield, which makes it one of the best dividend play opportunities in the market, as well as making it the best dividend yield in the tobacco sector.

Dividend History and Payout Ratio (TIKR Terminal)

In terms of costs, the dividends themselves are costing the company £1.3-1.4 billion per year. If we are to take a look at the cash flows, we can see that the company seems to have quite a lot of breathing space in this regard. They are maintaining a relatively strong free cash flow forecast and analysts are expecting that they will be able to generate in the area of £2.2-2.5 billion pounds for the foreseeable future. This also allowed management to slightly increase the dividend by 1%.

Turning to cash. I have a clear priority to optimize the sustainable free cash flow generation from the business. As you can see, our cash delivery on a 12-month basis remains strong with cash conversion of 102% driving free cash flow of GBP 2.4 billion. We increased the dividend by 1%, leaving the net cash flow after dividends of GBP 1.3 billion to support further debt reduction.

Lukas Paravicini, CFO – HY2022 Conference Call

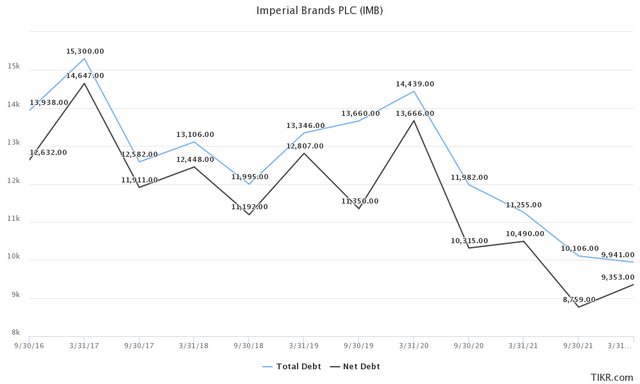

The balance sheet

As was the case with all of the big tobacco companies, Imperial Brands got itself into issues with the debt levels it faced, with management being almost laser-sharp focused on deleveraging the balance sheet. According to the latest report half-year report, Imperial Brands carries £9,70 billion in total debt and £9,15 in adjusted net debt. The focus on deleveraging allowed the company to shave off almost £4 billion in less than three years, which is quite a commendable result.

Total and Net Debt (TIKR Terminal)

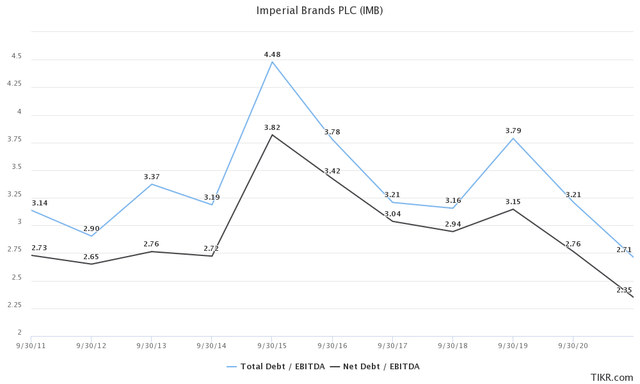

The mid to long-term goal, as outlined by management, was to bring down Net Debt/EBITDA to the lower end of the 2-2.5 times range. In the first half of the year, the company managed to essentially deliver on that promise by reducing net debt by an additional £1.2 billion to £9.8 billion. This has Net Debt/EBITDA reduced by 0.2x from 2.6 times, ultimately bringing it down to 2.4 times.

Debt to EBITDA ratios (TIKR Terminal)

We can conclude that management did an excellent job in terms of cutting down the debt and ultimately freeing up the cash flows of the company in order to allow for enhanced shareholder value creation. This is first and foremost important as related to the rather lackluster share buy-back programs over the past decade which can finally be brought under the spotlight.

The main focus of management in the latter years was to pay down the debt and to attempt to significantly deleverage the balance sheet to broadly more acceptable levels. This meant shareholders did not have a chance to enjoy the full benefits of the strong cash flows guided toward major share buy-back programs during the time frame.

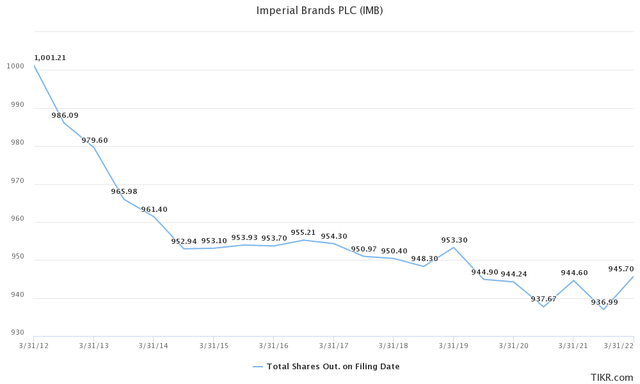

Shares Outstanding (TIKR Terminal)

Over the past decade, through share buy-backs, the company brought down its outstanding shares from 1,00 billion to 945.7 million shares. In total, 55.51 million shares that have been bought back amount to roughly 0.60% in terms of buybacks per year, which means that the buy-back programs up until now can be considered “token” at best.

So as we pointed out before, the share buyback is — or the capital allocation strategy that we have is an integral part of our strategy. More importantly is actually a key value driver for us. And so we are very focused on that. I think we gained a lot of confidence from the good progress we have made to the half year and that we are on track to the full year and to the guidance we have given. And where we are at the lower end, we’ll come to the market with an update to when we do the share buyback.

Lucas Pavaricini, CFO – HY2022 Conference Call

However, as we can see from both what management is willing to share on the earning calls and what we can see from the presentations, they will be more willing to engage in more significant buy-back initiatives in the following years, especially since the debt levels were finally brought under control.

The argument against

While there is a lot to like about Imperial Brands. There are also two distinct reasons we believe the company is deserving of being slightly discounted from the major competitors in the sector.

Imperial Brands has failed to timely engage in tobacco alternatives and new category products. As of today, almost all tobacco companies remain focused on new categories of products including Vapor, THP, and modern oral products groups. The expansion into new product groups allows for tobacco companies to partially offset the decline in the top and bottom lines. Also, possibly most importantly, new product groups do not suffer from the same level of regulatory scrutiny and societal condemnation as is the case with traditional tobacco.

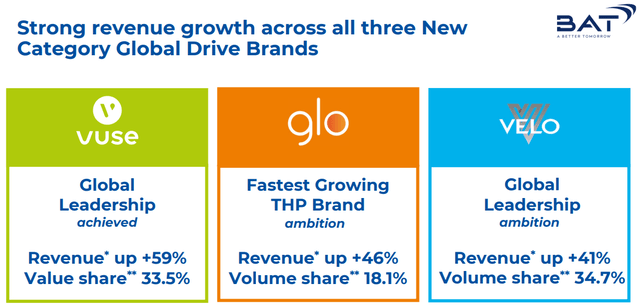

BTI/BTA New Category Products (FY 2021 Presentation)

This is a category where competition has proven to have had a much better foresight and is already yielding the results. For example, British American Tobacco (BTI), which can be considered the market leader in new tobacco products, has taken a big gamble on developing its “new category group” Vapor, THP, and Modern Oral products. They are also far ahead in terms of brand image as the company is already significantly engaged in marketing the Vuse, Glo, and Velo. While the category still largely remains unprofitable, the strong execution from British American Tobacco resulted in the fact that the new categories already account for 7.9% of total revenues, with revenues rising by 50% per year.

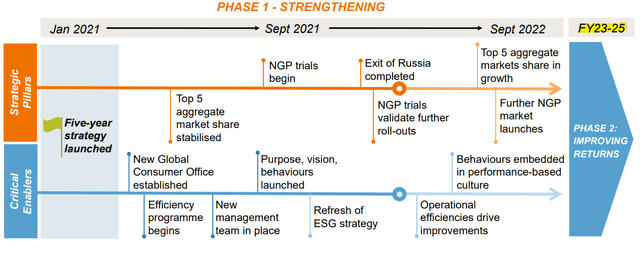

Imperial Brands’ lackluster performance in this segment is only fully apparent once they are compared to the previous “success story.” Their venture into what they define as the “Next Generation Products” or “NGP” is far behind.

“In next generation products, consumers have given positive feedback on our recent trials, validating our new insights-driven approach. We will now roll out our Pulze and iD heated tobacco proposition to further European markets and, in US vape, we are extending our refreshed blu marketing proposition. We have also started a pilot in France for an all-new vapour device, the first new NGP product from our redesigned innovation pipeline. Our focus for the remainder of 2022 will be to invest further in our five priority markets and begin the roll-out of our NGP strategy. While these are uncertain times, as we move into 2023, we will have in place the capabilities and culture necessary to support the next phase of our strategy and deliver sustainable growth in shareholder value.”

Stefan Bomhard, CEO – HY2022 Report

Five-Year Plan (HY 2022 Slides Presentation)

Next Generation Products in the case of Imperial Brands have contributed to the top-line only with £111 million, representing less than 1% of the revenues. The products are currently in trial phases and there are only limited rollouts to specific markets, meaning that the company is not even yet fully ready for a full-scale launch, as outlined in the “five-year plan.”

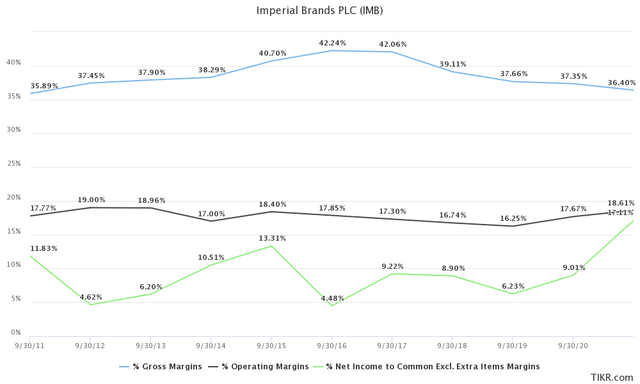

Another reason why I find the company a less than optimal choice is the margins. One of the most attractive things about operating within the tobacco industry is the constantly high margins the big tobacco companies can enjoy. However, this is yet another aspect in which we can notice a distinct difference between Imperial Brands and its competitors.

Imperial Brands Margins (TIKR Terminal)

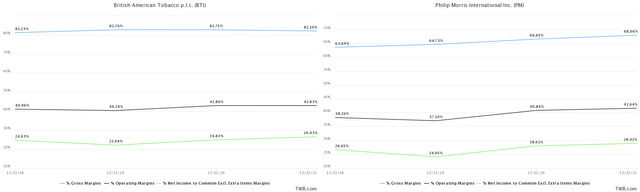

When it comes to the margins, there is a noticeable difference between Imperial Brands and competitors such as British American Tobacco (BTI), Phillip Morris (PM), and Altria (MO), who all seem to enjoy the benefits of much higher margins. In our view, this comes down to two separate factors.

First, is the fact that Imperial Brands engages in a relatively low-margin business segment such as distribution. And the second factor is simply the fact that the company, unlike the competition, failed to build up strong product brands over the decades.

Competitor Margins (TIKR Terminal)

Closing thoughts and arguments

On the surface of things, Imperial Brands seems to be almost perfectly positioned to weather the ongoing storm, both as an inflation hedge and a defensive stock. The addictive nature of the products they are selling makes tobacco an unlikely candidate for a discretionary spending cut for the average consumer. Further to the point, they make simple-to-produce and easy-to-ship products where price hikes can be easily pushed down to the customer level. In that sense, the company is delivering a remarkable level of resilience and certainty, which comes as greatly attractive in such difficult times.

At the same time, very attractive valuations and a convincing dividend that is well ensured by the free cash flow generation make the Bristol-based tobacco company a free cash flow powerhouse that looks like an exciting investment. However, a more in-depth look at the company’s fundamentals tells us that the company appears to be held back by several issues. As mentioned in one of my previous articles, the unwillingness of management to engage in the early development of new category products has come back to haunt them. Imperial Brands is still struggling to properly launch its NCG segment while other companies in the sector are not only finding themselves able to rely more on new revenue sources from NCG, but are also now ahead in pursuing ventures into cannabis-related products.

Another significant downside is that the dividend now looks slightly lackluster after the recent FDA ban on Juul products eliminated a good portion of NCG potential over at Altria, which stock price subsequently crashed and is offering an 8.65% dividend yield while being an arguably better company. Similar is the case with British American Tobacco, which now has the best exposure to NCG and cannabis in the market while offering a 7.21% to potential investors. While strong cash flows and dependable dividends remain immensely attractive to us, we cannot escape the conclusion that recent developments in the sector created better buying opportunities elsewhere.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment