Aaron Yoder/iStock via Getty Images

Due to hiked coal prices as a result of the war in Ukraine, Alliance Resource Partners (NASDAQ:ARLP) was able to report record quarterly total revenues and income from operations in the third quarter of 2023. Coal prices are still more than 100% higher than a year ago. U.S. coal production in 4Q 2022 is expected to be 151.4 million short tons, compared with 146.7 million short tons in 4Q 2021. Also, the U.S. coal price in 4Q 2022 is expected to be $2.47 per million Btu, compared with $2.05 per million Btu in 4Q 2021. However, U.S. coal production and price levels are not as strong as in 3Q 2022. With the current market condition, ARLP will report another strong financial result in 4Q 2022; however, not as strong as in 3Q 2022. The stock is a buy.

Quarterly results

ARLP’s Illinois Basin segment adjusted EBITDA in the third quarter of 2022 was $120.8 million, up 24% QoQ, and 74.25% YoY. ARLP’s Appalachia segment adjusted EBITDA decreased by 18% QoQ to $102.0 million in the third quarter of 2022. As a result of higher coal sales volume and higher coal price in the Illinois Basin segment and lower coal sales volume and lower coal price in the Appalachia segment, ARLP’s coal segment adjusted EBITDA increased from $222.6 million in 2Q 2022 to $224.6 million in 3Q 2022. Compared with 3Q 2021, ARLP’s coal segment adjusted EBITDA increased by 77.8%. Furthermore, ARLP’s oil & gas royalties segment adjusted EBITDA increased by 87.5% YoY and 3.4% QoQ to $35.8 million. ARLP’s coal royalties segment adjusted EBITDA increased by 21.4% YoY and 22.3% QoQ to $11.2 million.

The company reported consolidated total revenues of $628.4 million, compared with $415.4 million in 3Q 2021 and $616.5 million in 2Q 2022. ARLP’s adjusted EBITDA increased by 75.6% YoY and 2.0% QoQ to $271.5 million. The company’s net income attributable to ARLP in 3Q 2022 was $164.6 million, compared with $57.5 million in 3Q 2021 and $161.5 million in 2Q 2022. ARLP’s free cash flow increased from $120.5 million in 3Q 2021 and $78.9 million in 2Q 2022 to $244.5 million in 3Q 2022.

“ARLP was also able to execute new coal sales commitments for delivery of 5.6 million tons through 2025 at prices supporting higher margins in the future. With ARLP sold out for this year and solid contracted coal sales volumes in 2023 and 2024, we have good visibility into our ability to generate cash flow growth over the next several years,” the CEO commented. “Assisted by the supply driven energy crisis the world has experienced this year, ARLP is on track to achieve record financial results in 2022,” he continued.

The coal market outlook

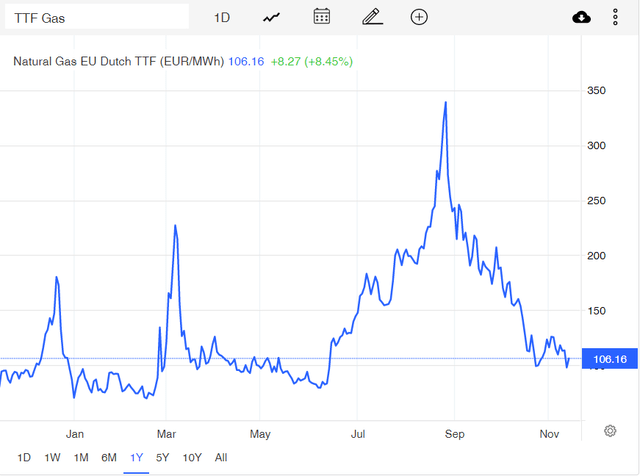

According to Figure 1, the coal price per ton decreased from $458 on 5 September 2022 to $324 on 11 November 2022. However, coal prices are still more than 100% higher than in November 2021. Due to the energy crisis in Europe and jumped natural gas prices in 2022, the demand for coal jumped. The European Union’s ban on coal imports from Russia, combined with hiked natural gas prices, caused coal production to increase. As the coal supply increased, its price declined. According to World Bank, coal production is expected to increase significantly in 2023 as major coal exporters increase production. Also, according to Figure 2, natural gas prices in Europe plunged to their pre-war levels as risks of natural gas rationing concerns over winter eased. To meet the high demand for natural gas during winter, the European Union planned to fill 80% of its storage sites by 1 November 2022. As of 12 November 2022, more than 95% of the EU gas storage was filled.

Figure 1 – Newcastle coal futures

tradingeconomics.com

Figure 2 – Europe natural gas prices

tradingeconomics.com

In its 3Q 2022 financial results, ARLP sold 6.1 million tons of coal from its Illinois Basin operations, compared with 5.8 million tons in 2Q 2022. The company’s Illinois Basin’s coal sales per ton sold increased from $49.80 in 2Q 2022 to $51.44 in 3Q 2022, up 3.3% QoQ.

In Appalachia, the company’s coal sales volume and coal sales price per ton sold decreased by 0.8% QoQ, and 1.3% QoQ, to 3.076 million tons and $76.82, respectively. ARLP expects its Illinois Basin coal production to increase by more than 2 million tons in 2023.

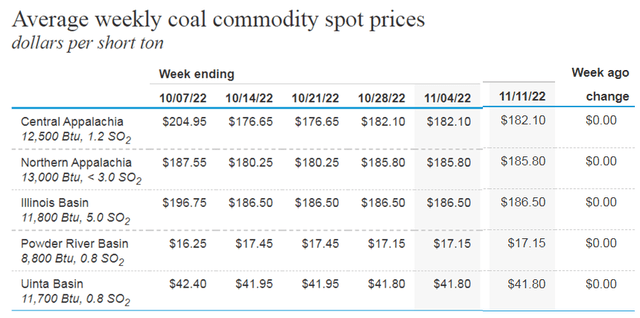

Figure 3 shows that the average weekly coal spot price in Central Appalachia decreased from $205 per short ton in the week ending 7 October 2022 to $182 in the week ending 11 November 2022. The average weekly coal spot price in Northern Appalachia decreased from $188 per short ton in the week ending 7 October 2022 to $186 in the week ending 11 November 2022. Moreover, the average weekly coal spot price in Illinois Basin decreased from $197 per short ton in the week ending 7 October 2022 to $187 in the week ending 11 November 2022. According to ARLP’s 2022 full-year guidance, the company expects its coal sales to be between 35.5 to 35.9 million short tons, including Illinois Basin coal sales of 24.4 to 24.6 million short tons and Appalachia coal sales of 11.1 to 11.3 million short tons. ARLP expects its domestic coal sales to be 31.6 million short tons in 2022, 31.6 million short tons in 2023, and 21.8 million short tons in 2024.

Figure 3 – Average weekly coal commodity spot prices

eia

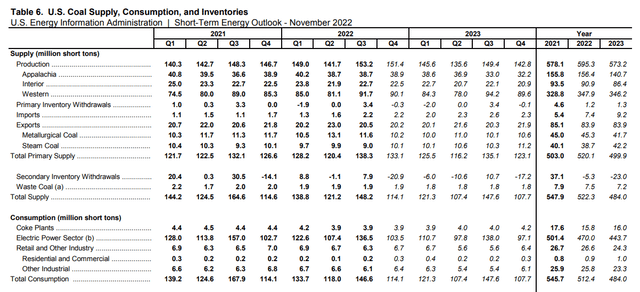

EIA expects U.S. coal production to be 595 million short tons in 2022, up 3% over 2021. However, due to moderating natural gas prices and coal plant retirements, U.S. coal production is expected to decrease by 4% in 2023. U.S. total coal consumption increased from 118 million short tons in 2Q 2022 to 147 million short tons in 3Q 2022. In 4Q 2022, U.S. coal consumption is expected to decrease to 114 million short tons; however, will increase to 121 million short tons in 1Q 2023. According to EIA, in 2Q 2022, coal price in the United States was $2.26 per million Btu and increased to $2.49 per million Btu in 3Q 2022. U.S. coal prices in 4Q 2022 and 1Q 2023 are expected to be $2.47 per million Btu. Altogether, despite decreased coal prices in the past two months, with the current oil prices and the coal market outlook, ARLP can meet its full-year 2022 guidance. I expect the company to report attractive financial results in the fourth quarter of 2022. However, the company’s 4Q 2022 financial results will not be as strong as in 3Q 2022.

Figure 4 – U.S. coal supply and demand

eia

Performance outlook

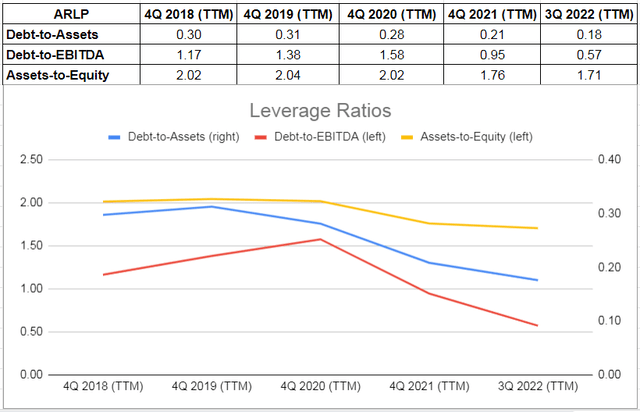

The debt-to-assets ratio is one of the significant calculations that measure the company’s debt capacity. This ratio indicates the proportion of assets that are being financed with debt. The higher the ratio, the greater the degree of leverage and financial risks. The company’s debt-to-asset ratio has been decreasing in the past years. ARLP’s debt-to-asset ratio decreased from 0.28 in 2020 to 0.21 in 2021, and due to higher energy prices in 2022, decreased further to 0.18 on 30 September 2022. ARLP’s debt-to-EBITDA ratio (which determines the probability of defaulting on debt) plunged from 1.58 at the end of 2020 to 0.95 at the end of 2021. It decreased further to 0.57 on 30 September 2022. Finally, ARLP’s asset-to-equity ratio decreased from 2.02 at the end of 2020 to 1.76 at the end of 2011 and 1.71 at the end of 3Q 2022. The decreasing assets-to-equity ratio during the past years indicates that the company has been using lower debt to finance its assets. The leverage ratios of ARLP show that the company can meet its current and future obligations (see Figure 5). As ARLP is well-positioned to benefit from the coal market condition, I expect the company’s leverage ratios to improve by the end of the year.

Figure 5 – ARLP’s leverage ratios

Author (based on SA data)

Summary

As the natural gas prices in the European Union and North America are decreasing, the demand outlook for coal is not as strong as it was few months ago. U.S. coal consumption will be significantly lower than in 3Q 2022. Also, coal prices will not be as high as in the third quarter of 2022. However, due to the continuing war in Ukraine and colder temperatures in the following months, coal prices are supported. I expect coal prices this winter to be higher than last winter. Thus, ARLP can benefit from the market condition and stay considerably profitable in the upcoming quarters. The stock is a buy.

Be the first to comment