naphtalina/iStock via Getty Images

Quick question. How many of you are going to cancel your cell service if we have a moderate recession? How many of you who run a small business plan to no longer use communications services in a slowdown? Folks, names like AT&T (NYSE:T) are basically like key utility companies. Everyone needs the services. While there is fierce competition and the companies that operate mobile services are constantly being promotional (and that can weigh on revenues) the fact of the matter is the services are necessary. Connectivity is absolutely necessary in 2022.

With that said, we have been trading very defensively, and our members will attest, we are now about 6% hedged/short in this market. The market stinks right now. The raising of rates this rapidly is certainly slowing the economy, and we just do not know how hard we will land. But what we do know is we want to own companies for the next few years that are going to see revenues hold up, and preferably ones that pay a nice dividend. This is where AT&T comes in.

The price action has been absolutely atrocious in this stock. And every time is it declines, the yield gets higher, and higher. The dividend, as we will discuss, certainly looks safe, despite some cash flow concerns near-term. But this price action, it has been horrific.

That said, considering how bad the market has been the last week, ever since the most recent inflation report, AT&T stock has held up mildly better, though communications stocks have not been spared. We think at these levels, the stock is a buy, and we decided to enter the stock heavily, along with selling slightly out of the money puts given how high option premiums are with the volatility in the market.

Not without risk

We would like to begin with the risk here. Despite that fact that we reentered heavily, it does not mean returns are a guarantee. The company has been a mess for a long time in our opinion. Shareholders have been crushed, even after a spinoff of movie and streaming assets. Obviously, one of the biggest risks with holding AT&T has continued to be the debt. Now we will say that for a few years management has been trying to shore up the balance sheet by selling off assets and paying down some of its debt. Since the spinoff debt has come down, but it is still eye-popping. At the end of the second quarter, net debt was $131.9 billion. This means there is a net debt-to-adjusted EBITDA of 3.23x. Keep this risk in mind, but as long as debt is paid down, we focus on income potential here. We would like to see that debt ratio under 3.0 as soon as possible.

The government is also a risk. They can make legal changes that could significantly impact AT&T’s ability to generate revenue or expand their business. Privacy concerns come to mind as our mobile phones know a lot about us. AT&T and its competition know exactly who we are, who we call, and where we are at any given moment with geolocation data. This issue is a subject of a recent FCC probe. They are investigating mobile carrier’s compliance with privacy rules. This is just one example but results could lead to fines, added legal costs, or even worse, further burdensome regulation that simply costs more. And right now, as we will see with cash flow being an issue, we do not want to see anything that leads to more costs.

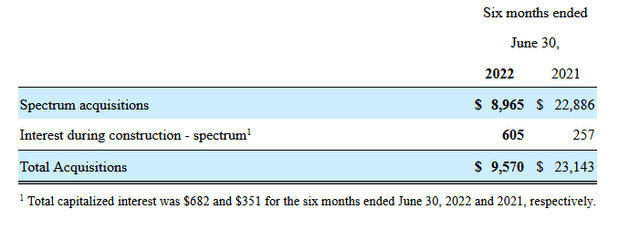

Another source of costs that can be unpredictable is what is paid to pick up airwaves/spectrum access. The most recent auction saw a competitor make some big bids. AT&T barely participated in this one, but they have been very heavy buyers on the order of many billions of dollars time and again in the past.

Rates are a risk particularly as they relate to interest expense and that pesky debt. The company tries to hedge its bets by entering into and designating interest rate locks to partially hedge the risk of changes in interest payments attributable to increases in the benchmark interest rates during any borrowing period. These are so-called cash flow hedges. Gains and losses on such action are amortized into income over the life of the related debt. This can backfire.

Finally, we think the biggest risk to owning the shares would be if there was a true collapse operationally and cash flow deteriorated so much the dividend was cut. This would decimate shares. We are in it for the dividend.

The dividend

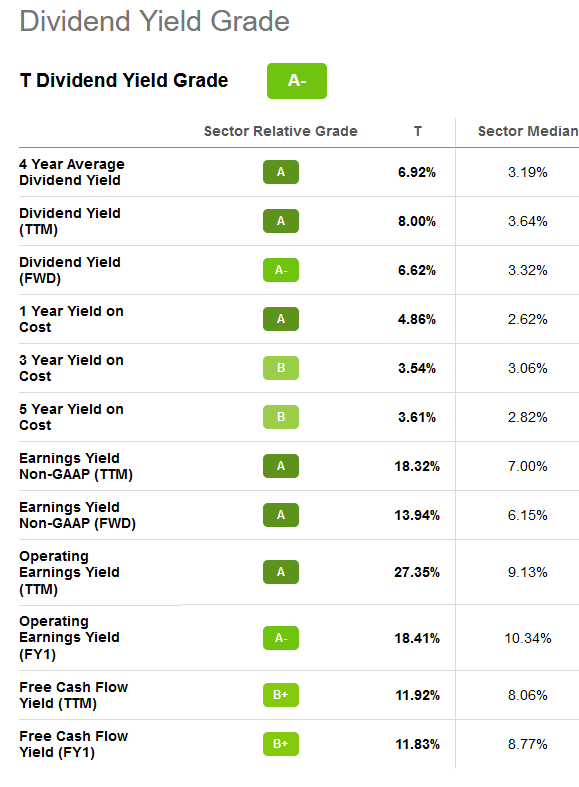

We made the purchase here in the low $16s, as the yield is solid and the payout metrics look sound.

Seeking Alpha dividend page

Right now, if you bought 1,000 shares here at $16.30, it would nearly take 15 years to get your investment back in the form of dividends, assuming the dividend of $1.11 annually is never changed and continues to be paid. That is a long wait but if it happened all future dividends are straight profit even is the stock goes to zero. You get the point. For income investors, the dividend is not getting cut, even if there are cash flow concerns.

The Q2 report sparked more selling

Let’s be real. The stock has been falling since the Q2 report. Due to inflation the company is experiencing massive cost pressures in its business, and in fact saw $1 billion more in costs than it thought it would have. We think the company will be getting even more promotional to attract customers. That said, the results were good at first glance. Analysts covering the company had a consensus revenue expectation of $29.47 billion for Q2. We expected revenue to be higher and in the $29.75-29.8 billion range. Well the top line hit $29.60 billion, much better than expected vs. consensus but lower than we expected. Still, it was a beat of nearly $130 million vs. consensus.

Frankly this was the best Q2 for postpaid in many years. They saw wireless postpaid growth saw 0.813 million adds and another 316,000 Fiber net adds. For 5G, they are now on track to hit 100 million people vs. their year-end goal prior of 70 million. The strong top line revenue performance helped drive the bottom line to a beat versus consensus of $0.03, at $0.65.

Great, but why is the stock getting hammered? Well, the market stinks, but expenses are so high, offsetting the revenue somewhat. Operating expenses were $24.7 billion and projected to get worse. Operating income fell to $5 billion, though adjusting for one-time and special items the operating income was $5.9 billion up from $5.7 billion, but free cash flow and the outlook for future free cash flow has led to a lack of confidence. CEO John Stankey acknowledged this at a presentation last week:

As a result of that, the best thing that we can do is we continue to work really aggressively on the cost side of the equation. The economy, from a volumes perspective and our customers’ willingness to use our products and services, still remains really strong. However, we are seeing input rising — cost of inputs rising literally at every portion of the business and having to work really aggressively to carry that through. So we had a real aggressive approach on costs in place before. We’re working even harder now looking for other opportunities to move through that because I think that will be the best way to give us the runway we need.

The rising costs, while management is trying to control them and sees the issues, have crimped free cash flow.

Free cash flow is key

When it comes to strong dividend paying income stocks we always look to the free cash flow generation of the company. AT&T is interesting because if free cash flow is projected to improve then the stock tends to rally. We are imploding here the last two months and it is almost entirely due to free cash flow and the expectations for less of it in the future. Free cash flow is really how the dividends that are paid are covered. When the company pays more than it brings in, it slips further on the balance sheet. The dividend has been being comfortably covered by free cash flow for so long. But capital investment from operations was so much higher than expected at $6.7 billion in Q2. This led free cash flow at a very disappointing $1.4 billion. It gets worse now. Cash flow was guided by management to be just $14 billion for the year. This should still cover the dividends to be paid of about $4.2 billion for H2 2022, considering free cash flow thus far was $4.2 billion. So look for another $9.8 billion in free cash flow this year. The dividend will be covered, but the payout ratio will be far less safe. What was most surprising is the company did not cover it. Q2 dividends paid were $2.09 billion, about a $700 million deficit.

Take home: we’re buying

Look there are strong headwinds with the overall slowdown of the economy thanks to the Fed’s actions and consumer spending after the pandemic. We have gotten defensive in this mess of a market but cannot walk away from a 6.7% yield that looks secure. This is an income name that has had a lot of ups and downs. We are at buyable levels and we plan to buy from here down to $15 if we get there. Cash flow is the key, and we believe the downturn is short-term. We will be paid to wait.

What do you think?

Your voice matters. Are you a bull? Or do you see this as dead money? Let the community know below.

Be the first to comment