photobyphm

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 9th, 2022.

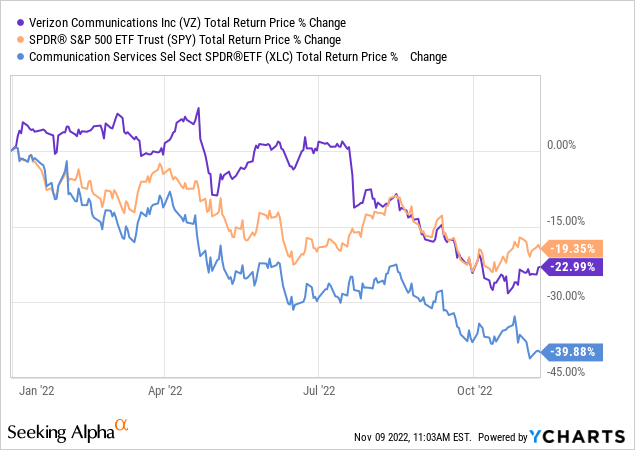

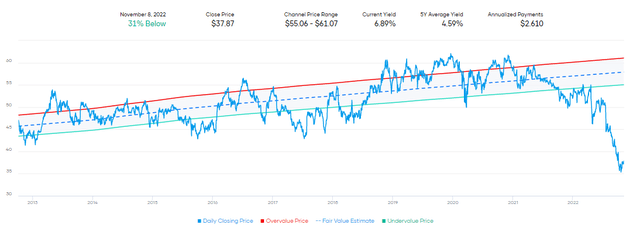

Shares of Verizon (NYSE:VZ) have been under pressure this year, along with the rest of the market and particularly its sector. While shares were holding up relatively well earlier this year, poor guidance earlier this year that showed no growth is expected saw a large gap down in shares. Since then, the shares have remained under significant pressure.

The communication services sector has been the worst performing on a YTD basis. However, a large portion of this has been due to even further weakness in names such as Meta Platforms (META) and Netflix (NFLX).

YCharts

A stock isn’t worth buying just because its price has come down. However, based on its historical valuation and estimates, Verizon is looking like a solid bet for a long-term income investor. It could take years before realizing any potential appreciation in the shares, but one can collect a strong dividend along the way.

Even with a lack of growth this year, expectations would still be that they are going to continue to raise their dividend. They recently mentioned this is important to them. They’ve followed through because they recently did raise right on schedule.

Latest Earnings And Expectations

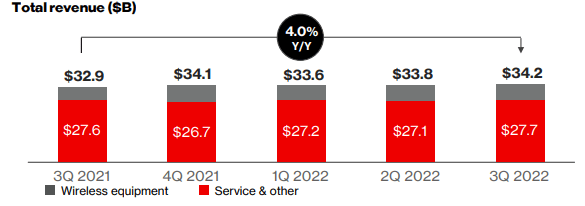

The latest earnings showed that VZ beat on both the top and bottom lines. Revenue year-over-year grew by 4%.

VZ Revenue (Verizon)

This company operates as predictable as a utility company, generating significant free cash flow quarter after quarter and year after year. These latest earnings were even more encouraging than earlier this year. That’s what seems to have helped shares out more lately, after reporting on October 21st. Of course, the market’s latest rally more broadly has certainly helped too.

A sore spot in the latest earnings was the postpaid phone net additions of 8k and the higher-than-usual churn. They noted this being due to the latest pricing actions. However, they aren’t alone, as other carriers are raising too. In particular, AT&T (T) raised prices on their plans. And while T-Mobile (TMUS) can say they haven’t raised prices on their plans, they are raising fees elsewhere to compensate.

Here are the remarks in their latest earnings call about churn:

Overall, phone gross adds were up approximately 5% year-over-year, reflecting continued strength in business as well as the improvement in consumer gross adds. With the impact of 3Q churn, which increased as expected as a result of our recent pricing actions, phone net adds were 8,000 for the quarter.

On the other hand, while phone subscribers seemed weak, broadband growth was strong.

In broadband, our fixed wireless access and Fios service continued to see strong demand. Total broadband net adds were 377,000, a sequential growth of over 40%. All of these services are built to deliver on top of our world-class network. We have a premium network and experience that our customers value and that demands premium pricing. Our network is a core value proposition. America relies on us and we deliver.

VZ Broadband Net Adds (Verizon)

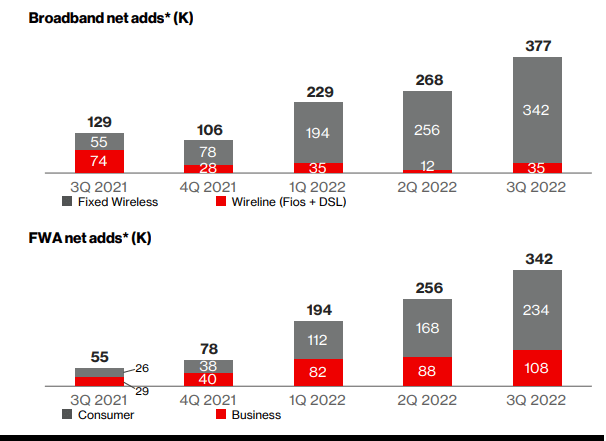

VZ is forecasting that 2022 will show no growth, so seeing that analysts also expected EPS to stall for this year and even the next isn’t too surprising. Following that, analysts do expect to see some earnings growth. Revenue over the following years is expected to grow around 1.5% to 3.98% for the next five years.

VZ EPS Expectations (Seeking Alpha)

Growth is certainly slow, but competition is fierce in the space. However, we can also see just how cheap the shares are currently trading at by the forward P/E provided in the chart above as well.

Cheap Valuation Means Potential Upside

Regarding the valuation, Wall Street analysts have an average price target of $45.90. That suggests that there is quite a bit of upside from here. Alternatively, based on the historical fair value based on the P/E range, shares of VZ are incredibly cheap. In that case, the fair value estimate comes to $68.57.

VZ Historical P/E Fair Valuation Evaluation (Portfolio Insight)

On a yield basis, history suggests that VZ is extremely undervalued, too.

VZ Dividend Yield Fair Value Evaluation (Portfolio Insight)

All this being said, valuation is under pressure for a couple of reasons. As we touched on above, with no growth expected or very little growth going forward, that certainly isn’t going to excite investors when inflation is elevated.

We also have interest rates rising rapidly. That means that a risk-free yield on the 10-Year Treasury of around 4% is a very tempting alternative. That would suggest that VZ’s current yield should be higher – and that happens when the price falls.

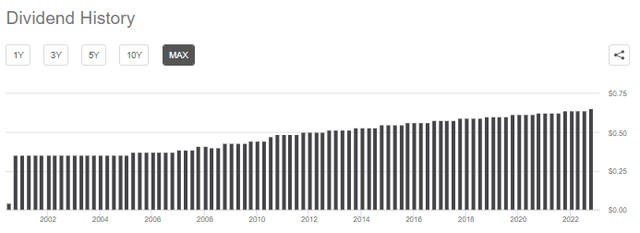

A higher yield can also be achieved when it raises its dividend, which happens annually. That is something worth considering VZ shares over a 10-Year Treasury since VZ can appreciate and its payout can grow.

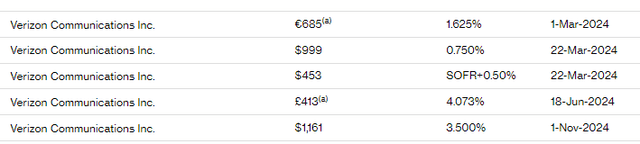

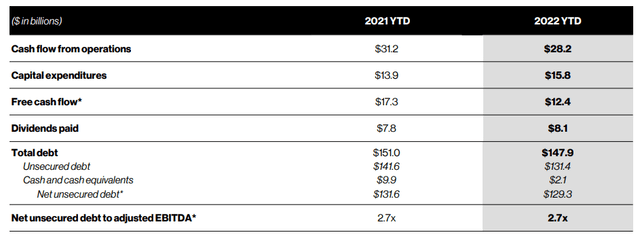

An additional added pressure with interest rates is that debt has become much more expensive now. VZ carries a significant amount of debt, though it trickled down a bit through 2022 so far.

One reason why the cost of debt isn’t too much of a concern is that they have very little that is a variable rate. The majority of their debt is fixed. Of the ~$148 billion in debt, only around $3 billion is floating. Further, they have fixed-rate debt going out to 2061 at a 3.7% rate.

Total debt maturing in the next year is around $14.7 billion. Then, in 2024, they have these maturing. Again, nothing which would really devastate their financial position.

VZ 2024 Debt Maturities (Verizon)

CapEx spending is expected to come down in the next year too. There aren’t specifics exactly yet until they provide further guidance in January.

…we will be more specific on ’23 guidance in January, but nothing has changed around our view of CapEx. So very much in line and that’s because of the great work the team has done this year. I mean we said we’d be at 175 million POPs covered by the end of the year. As you heard Hans say earlier, already at more than 160 million through 3Q. Not only will we be ahead of the 175 million, but we will be at 200 million at some point during the first quarter, so phenomenal speed that the team has built the network there. That means a significant chunk of the $10 billion CapEx for C-band will have been covered between last year and this year.

They also discussed a company-wide cost-savings program. They anticipate this will save them around $2 to $3 billion by 2025.

At the same time, we are making efforts to take cost out of our business. We are constantly thinking about how we run our enterprise everyday to enhance our performance while delivering on our strategy. In this period, we have designed a company-wide cost savings program that we expect will save between $2 billion to $3 billion annually by 2025. A first step in these efforts is the creation of a global service organization under the leadership of Craig Silliman. This is one part of our larger program to leverage cross-functional opportunities across the business.

Admittedly, it is a CapEx-heavy business, but we can see they have significant free cash flow. With the cost savings and lower CapEx next year, they should have more than enough to pay their debt and continue paying out their dividend.

16 Years Of Dividend Growth

One of the more important aspects of investing in VZ in the first place is its growing dividend. This is one of the company’s obligations, too, as management remains committed to a growing dividend.

Our guidance for 2022 remains unchanged. We are building momentum and remain confident that our strategy will deliver strong cash flow growth into the future. It is this confidence, combined with the health of our balance sheet, that enabled us to recently increase our dividend for the 16th consecutive year. We recognize the importance of the dividend to our shareholders, and we intend to continue to put the Board in a position to approve annual increases.

The latest dividend increase came right on schedule. It may only work out to a 2% raise, but it was right in line with the $0.0125 increase they’ve been doing for several years now.

VZ Dividend History (Seeking Alpha)

Conclusion

Verizon looks like a great value for more conservative, longer-term income investors. There isn’t expected to be significant growth, but the cash they generate already is massive. Predictable cash flows mean they can cover their debt obligations while paying out a growing dividend to shareholders.

Be the first to comment