onurdongel

Magellan Midstream Partners (NYSE:MMP) finds itself yielding nearly 8.5%, a blistering yield for what has proven to be a consistent dividend grower. That high yield is even more surprising when considering the strong environment for the energy sector, one which seems likely to boost volumes and shore up balance sheets for its customers. While MMP boasts far lower coverage of its distribution on the basis of distributable cash flow than peers, its management team has apparently embraced the value of unit repurchases to a greater extent than any other midstream operator, even stating that the priority for free cash flow after the distribution is share repurchases. Given the strong energy environment and enlightened capital allocation policies, MMP is looking highly buyable here.

Heads up: MMP issues a K-1 tax form and may complicate your tax filing process – consider the tax ramifications before investing.

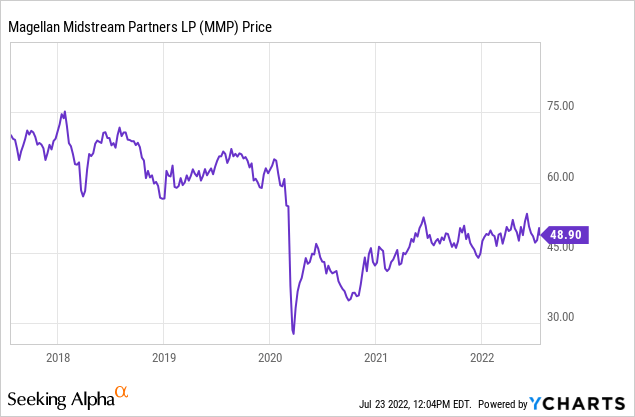

MMP Stock Price

While MMP has recovered from pandemic lows, it remains a shell of its former self.

I last covered MMP in April where I discussed why I was upgrading the stock in light of the strong energy environment. MMP has not moved much since then, presenting investors with a prolonged buying opportunity in one of the safer high yield plays in the market today.

MMP Stock Key Metrics

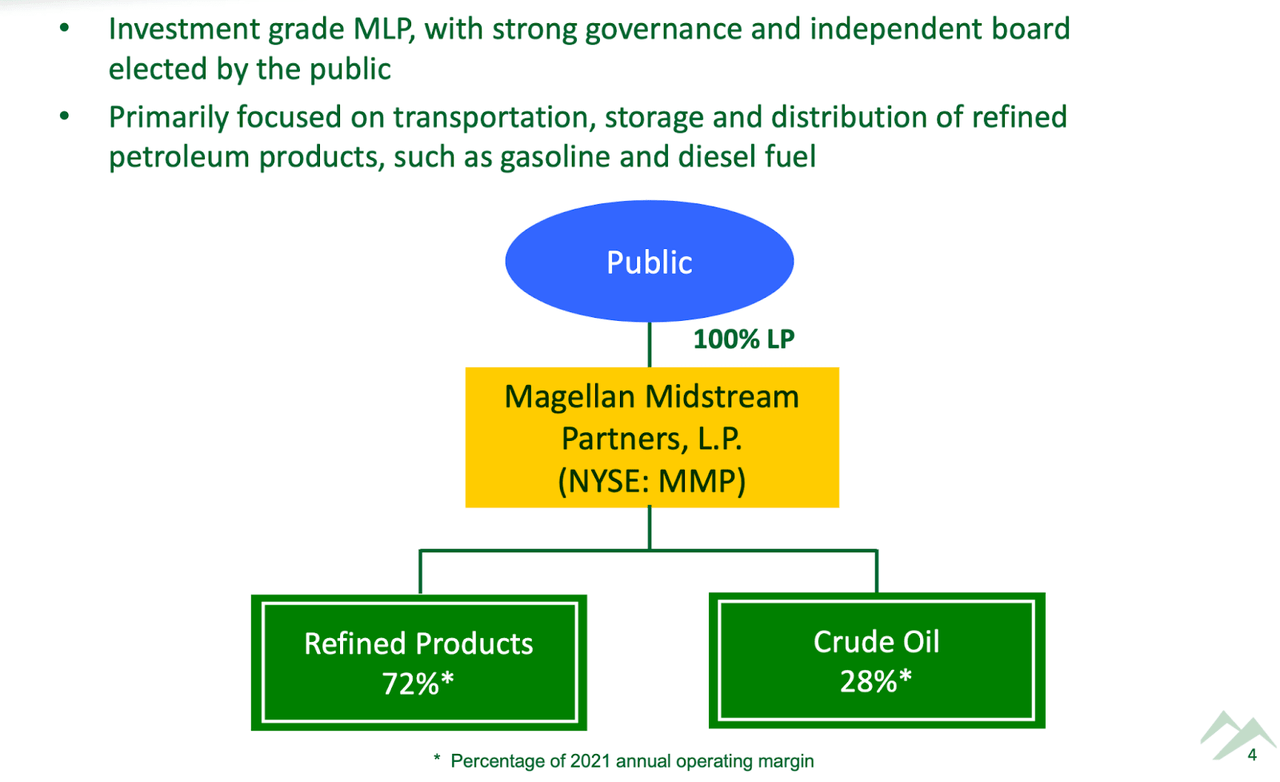

MMP is a midstream operator meaning that it lets its customers use its pipelines in exchange for volume-based fees. MMP’s business is primarily focused on refined products.

May 2022 Presentation

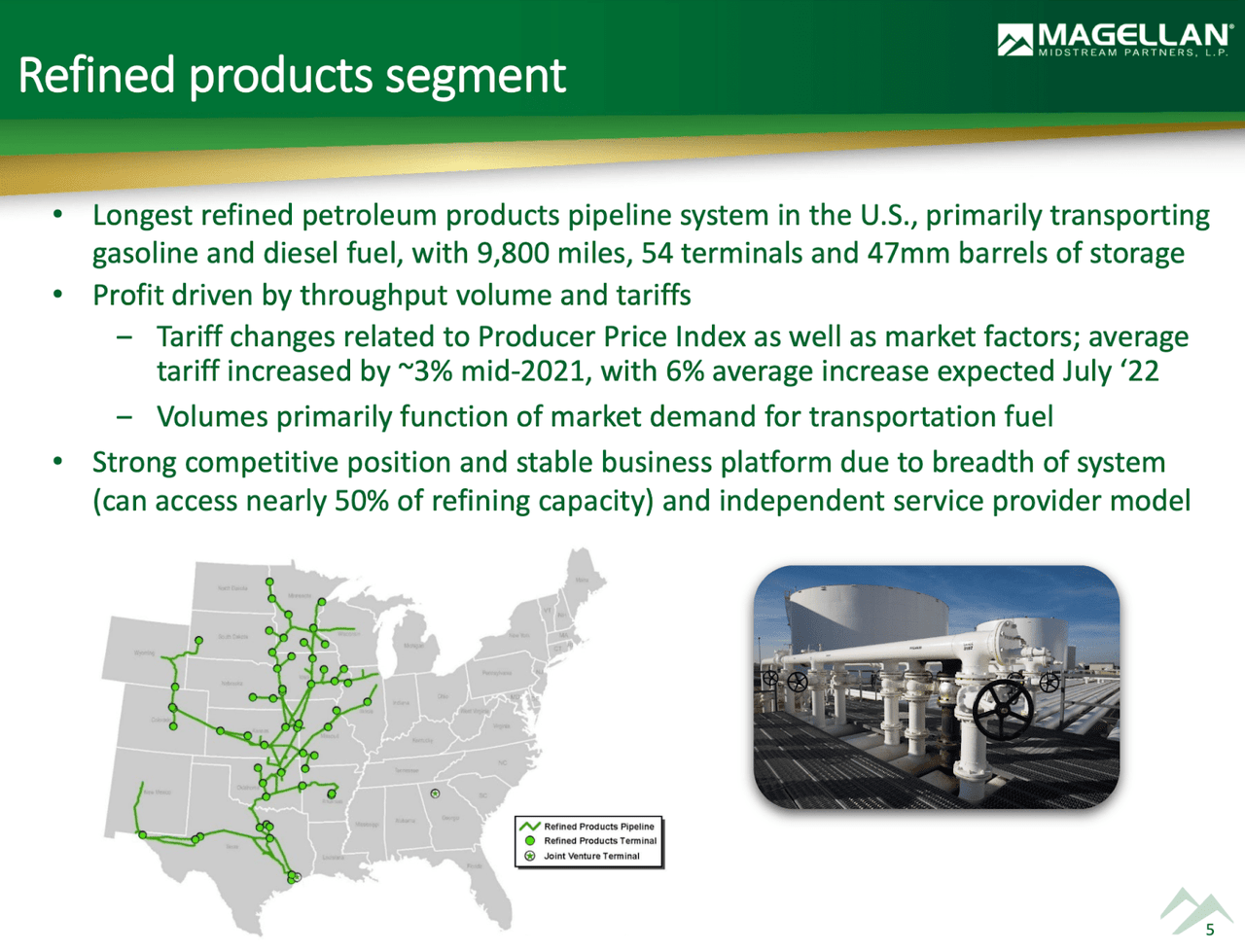

MMP boasts the longest refined petroleum products pipeline system in the country, spanning 9,800 miles.

May 2022 Presentation

On the conference call, MMP has guided for 4% volume growth this year, though the actual figure can come either higher based on the strong pricing environment or lower in the event of a recession.

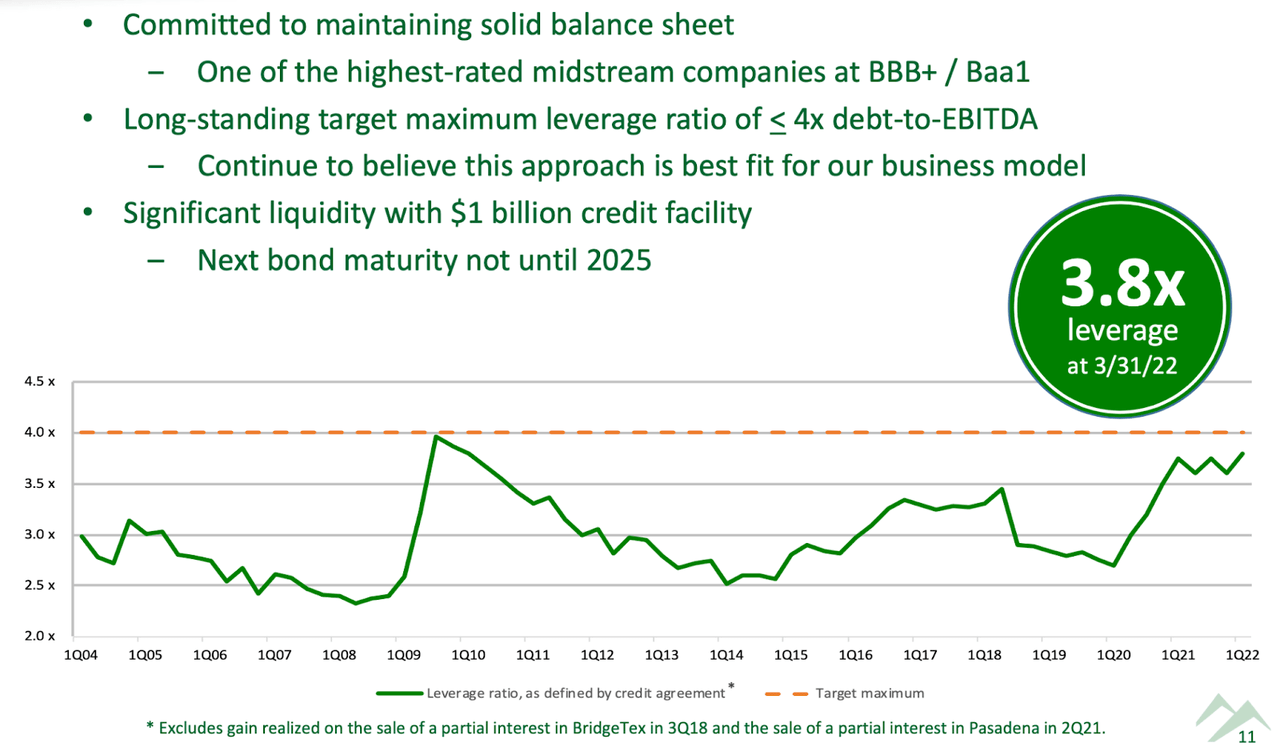

MMP has sustained one of the strongest balance sheets in the sector rated BBB+/Baa1 with debt to EBITDA at 3.8x.

May 2022 Presentation

At a recent investor conference, management stated that they are not interested in further reducing leverage to achieve credit upgrades. The reasoning is that the incremental benefit from a higher credit rating will not offset the shareholder value created from higher leverage. For now, I agree with that sentiment considering the strong energy environment and most importantly, MMP’s leverage is by no means high. If the company needs to reduce leverage in the future, it will be doing so from a strong starting point relative to peers due to the low starting number.

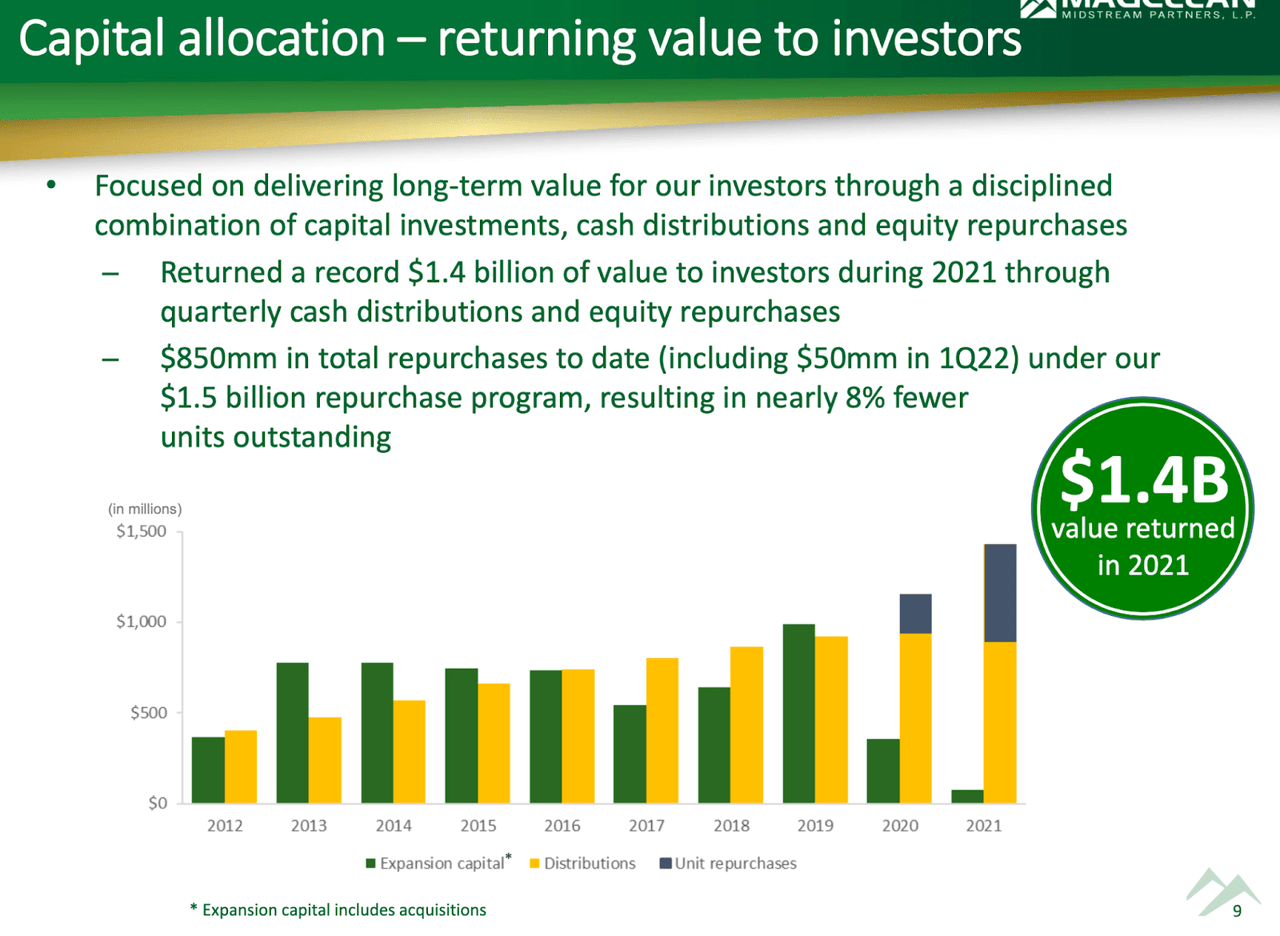

MMP has differentiated itself from peers in its surprising commitment to its unit repurchase program. The company repurchased $50 million in the latest quarter, bringing their total spend on repurchases to $850 million over the past 2 years alone. That has brought units outstanding down 8%.

May 2022 Presentation

While such a result might not be so surprising in other sectors, it is an astonishingly surprising result in the midstream sector, which has historically seen operators shy away from unit repurchases. On the conference call, management reiterated its desire to allocate any free cash flow after distributions to be put towards unit repurchases. The company defines free cash flow as

“a non-GAAP financial measure that represents the amount of cash available for distributions, expansion capital opportunities, equity repurchases, debt reduction or other partnership uses”

Based on the above definition, one can gather that management appears to be signaling a rare preference for unit repurchases over growth expansion projects.

MMP has guided for 2022 to see $1.09 billion of distributable cash flows and $1.46 billion of free cash flows (or around $1.025 billion excluding the pending sale of their independent terminals).

That means that the distribution is covered 1.1x by free cash flow – significantly lower than peers like Enterprise Products Partners (EPD). But that lower coverage is more than offset by management’s focus on unit repurchases as that is arguably the most direct catalyst to take advantage of undervalued equity.

Is MMP A Good Long-Term Investment?

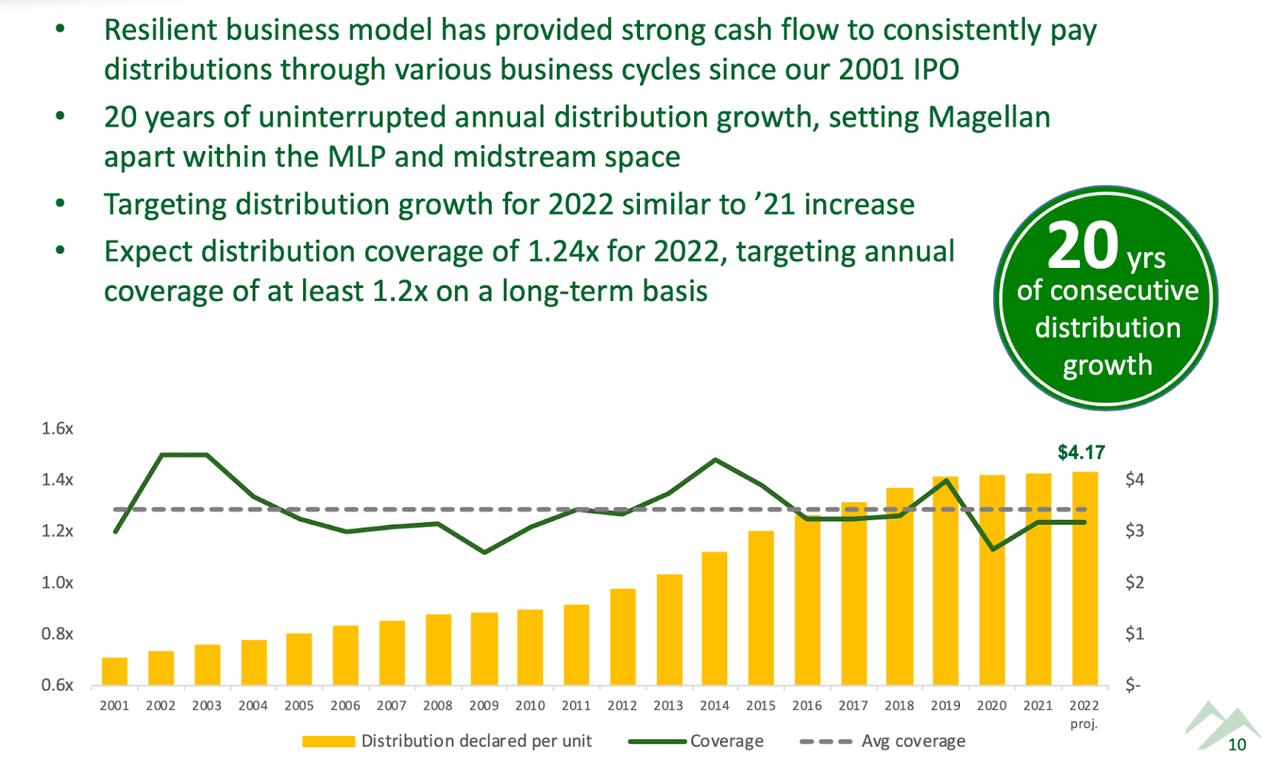

Over the long term, MMP has delivered 20 consecutive years of distribution growth.

May 2022 Presentation

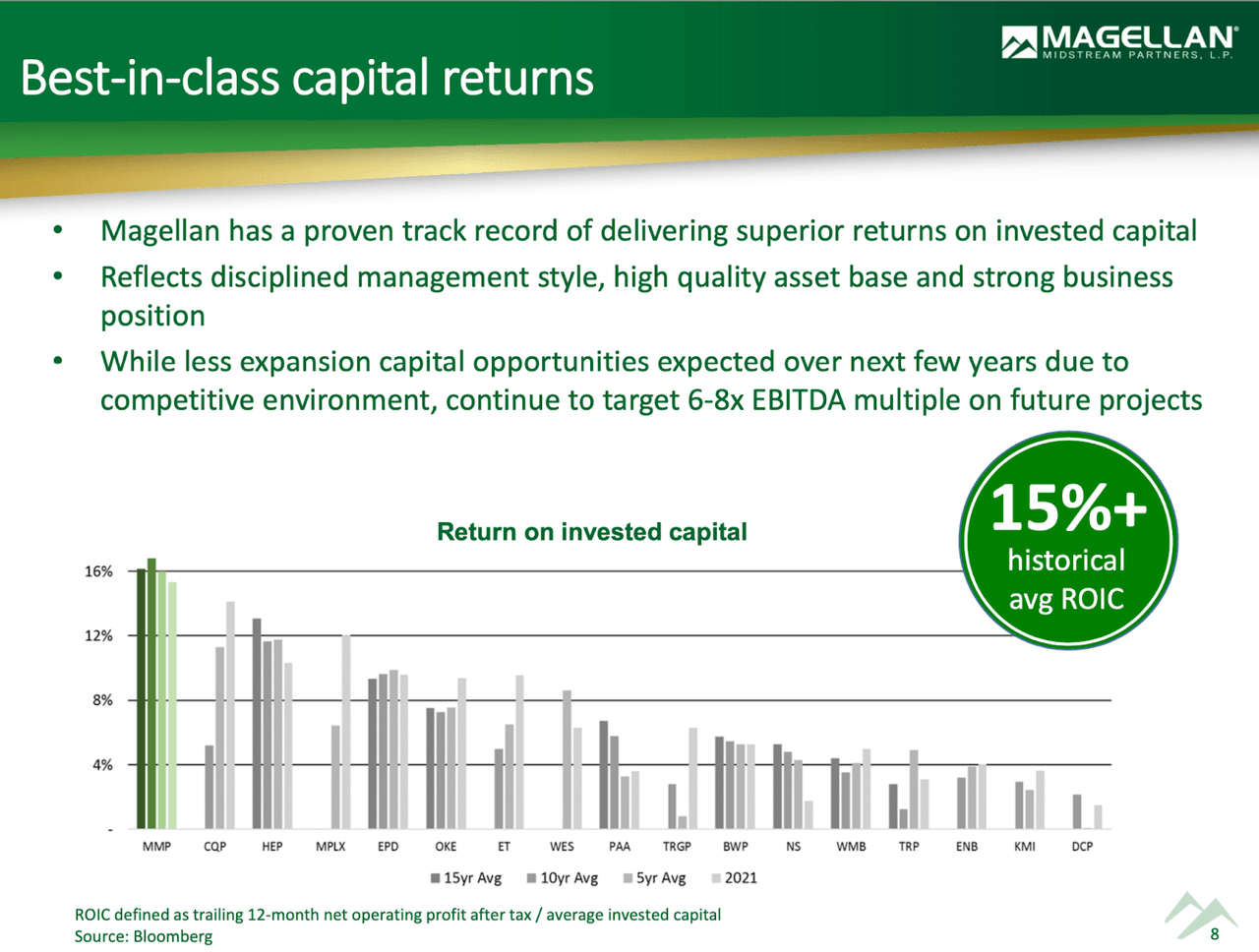

Historically, MMP has achieved the strong results through its growth capital projects, from which it has typically achieved best-in-class returns on invested capital.

May 2022 Presentation

That does imply that a smaller growth capital expenditure outlook is not all roses. In my view there is increasing uncertainty regarding the long-term value of energy pipelines – even in spite of the strong energy environment today – but unit repurchases would send a clear message to Wall Street that management is focused on earning a higher multiple.

Is MMP Stock A Buy, Sell, or Hold?

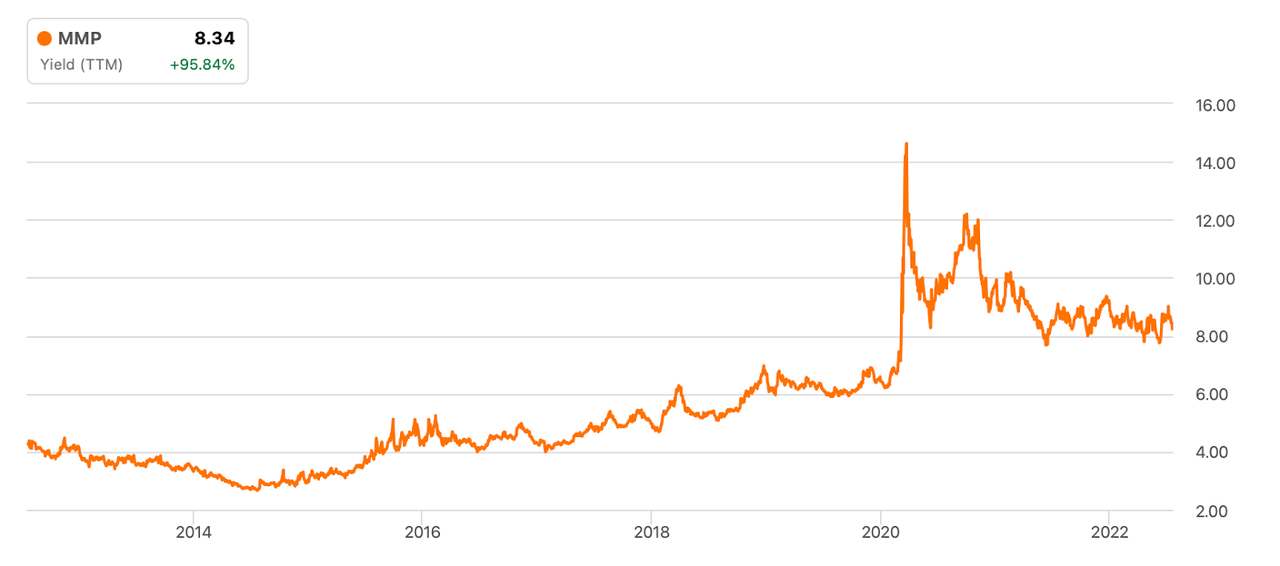

At recent prices MMP is trading at an 8.5% yield and around 10x free cash flows. I note that I am not including the proceeds from the pending divestitures in my calculation of free cash flow. MMP’s 8.5% yield ranks the highest over the last decade excluding pandemic lows.

Seeking Alpha

Due to proceeds from asset sales, MMP may be able to repurchase sizable amounts of equity in the near term. Over the long term though, unit repurchases will be funded by cash flows. At current prices, MMP can repurchase around 1.5% of units outstanding every year out of free cash flow after distributions. That is an impressive amount considering the already high 8.5% yield. One thing to consider here is that MMP may be able to fund additional growth projects while it repurchases units. If US production continues to grow over the long term, then organic growth at MMP’s assets, coupled with leverage, can help fund expansion projects. Here’s how that might work – if we assume 3% organic growth, then applying a 3.8x debt to EBITDA multiple that would lead to around $133 million of annual debt capacity available for expansion projects. That would be in addition to any retained cash flows. I could see MMP trading up to a 6.5% yield, representing 23% potential upside from capital appreciation. Combining the 8.5% yield, 1% to 3% growth, and multiple expansion, I could see MMP outperforming the broader indexes. A key risk here is that of the slim distribution coverage ratio. In the event of a downturn, MMP’s strong balance sheet may be able to help sustain the distribution, but that is not sustainable over the long term. From that perspective, MMP’s distribution might not be as sustainable as peers like EPD. Another potential risk is that MMP has outsized exposure to petroleum products. I have the view that petroleum products are more at risk than natural gas from long term energy transitions. I rate MMP a buy for dividend investors, as the high yield looks misplaced considering the strong energy environment.

Be the first to comment