gilaxia/E+ via Getty Images

Summary

As before, I recommend buying TDCX Inc. (NYSE:TDCX). My opinion has not changed since I first wrote about TDCX; rather, this piece serves as a follow-up to the thesis in light of the company’s Q3 2022 earnings report. In my opinion, the current TDCX valuation is still attractive and has the potential to earn investors a 1-year return of 26%.

Earnings overview

TDCX announced S$173 million in revenue and S$55 million in adjusted EBITDA, with a margin of 31.8% for the quarter ending in September of this year. Even though the economy as a whole is weak and the tech industry is slowing down, I guess the year-to-date growth was driven by a strong contribution from travel and hospitalization after the COVID rebound, a greater contribution from newer geographies like Colombia, India, Romania, and South Korea (10% revenue growth), and the ramp up of a major short-form video platform is something to be proud of.

With 6 new logos added during the quarter, TDCX’s year-to-date total for new logos now stands at 31%. On the other hand, as of 3Q22, 72 clients had launched campaigns, up significantly from 48 clients in the previous quarter. Another thing to note is that TDCX has used technology and organizational optimization to continue fulfilling these customers’ campaign needs despite a steady exodus of staff.

Omnichannel CX solution gains momentum

If we narrow in on the travel and healthcare sectors, we see that the company has maintained its strong momentum since reopening, and that 29% of its sales have returned to where they were before Covid. Management is optimistic about the industry’s continued expansion through 2023, thanks to the opening of markets in North Asia. On the other hand, fintech’s revenue has grown by double digits annually, with crypto clients contributing less than one percent of total revenue.

Marketing services did well, but I expect to slowdown in the near-term

In the third quarter, TDCX Inc. revenue rose 32% to S$43 million, with the leading short-form video platform contributing the bulk of that growth. Consequently, I anticipate a deceleration in growth in 4Q22E and FY23E as global tech platforms cut advertising budgets in response to macro and industry headwinds.

Strategic plans to expand internationally

TDCX’s international presence is a strength, and the company’s efforts to grow internationally seem to be paying off, as shown by the fact that Colombia, India, Romania, and South Korea all contributed 10% to the company’s growth.

North Asia and Latin America, previously underserved markets for TDCX, are now expected to become significant revenue generators for the company, according to my understanding. TDCX also opened its newest campuses in the Philippines and Turkey in 3Q22. TDCX is better equipped to expand into the Middle East and Asia markets with the 3000 sq m Turkey campus, which offers services in Turkish and Arabic in addition to European languages. TDCX has converted an associate in Hong Kong into a wholly owned subsidiary in order to accelerate its growth in Greater China. TDCX intends to expand into Indonesia, Vietnam, and Brazil in the future.

Even though these changes haven’t yet shown up in the numbers, I’m sure TDCX is making progress and will benefit in the long run.

Continuous success in signing up new logos

As compared to the 20 clients signed in the same period last year, the company’s 12 new logos in the quarter represent a slowdown. Cloud hosting and automated food delivery are just two of the 12 new clients. Management emphasized the ongoing diversification of client concentration, noting that non-top five, broad-based clients are expanding at more than twice the rate of group growth. The top two clients accounted for 56% of total revenue in the quarter, down from 63% the year before, while the top five clients accounted for 82% of total revenue, down from 85%.

Wage is still a headache

The latest report includes some “bad” news: the cost of providing benefits to employees increased by 30% in the most recent quarter. Both the cost of living and the competition for qualified workers have risen, making this a reality. In contrast, TDCX has been able to keep delivering projects despite a rapidly expanding pipeline and the loss of a significant portion of its talent pool in recent quarters. Management claims that wage growth is an issue for the entire industry and that improved labor management at TDCX could increase demand for services currently outsourced.

Management guidance

TDCX has reduced the range of revenue it expects to earn in FY22 from S$650-675 million to S$655-670 million, with the midpoint remaining unchanged at S$662.5 million. I anticipate a slowing in global internet growth and the continuation of cost-cutting initiatives, both of which will put pressure on omnichannel CX solutions and digital marketing businesses despite the positive trends in travel, healthcare, and fintech. But compared to global peers, the high exposure to fast-growing markets in Asia and the Pacific may help reduce downside risks.

Valuation update

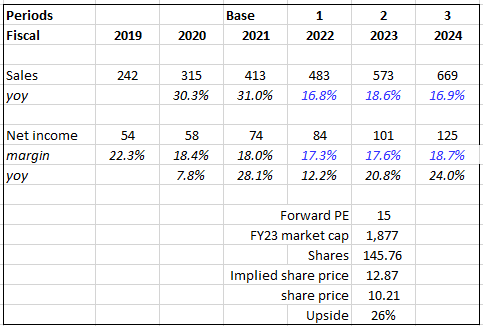

I believe the current market price still presents a decent entry point for investors to enjoy a 1-year return of 26%.

Key updates to model:

- Sales: reduced growth rate to reflect new consensus estimates

- Valuation: TDCX has traded down from 16x to 15x, and with the same belief, I assumed no change in multiples forward. Any positive change will certainly add more upside to the stock.

Author’s calculations

Conclusion

There are a number of reasons why I believe TDCX will continue to outperform its competitors in the coming years. These include: 1) its large base of new economy customers (93% of revenue in FY21); 2) its attractive market opportunity in the outsourced CX solutions industry; 3) its unique customer-centered, tech-like work culture; and 4) its successful offshore model, which can help TDCX Inc. grow globally.

Be the first to comment