wdstock/iStock Editorial via Getty Images

It’s hard being an investor this year. At a time when stocks are getting hammered, the energy sector has become the unlikely savior of investors this year. Several macroeconomic and geopolitical conditions that favor the global energy market have had a lot to do with the blockbuster performance of the energy sector this year but this analysis is not about high-flying oil companies. Under normal circumstances, stock investors find safety in seemingly unshakeable business sectors such as consumer discretionary and utilities. Although utilities have not attracted investors’ eyeballs this year amid the stellar performance of oil companies, many utilities have handsomely beaten the S&P 500 this year. Consolidated Edison, Inc. (NYSE:ED) stock, one of the most-followed stocks in this sector, has gained almost 12% this year against S&P 500’s 16% decline. This analysis aims to determine whether this outperformance will continue in the future or whether things will turn a corner.

The business

Consolidated Edison is a publicly traded energy company in the United States that operates in the regulated electric, gas, and steam delivery markets. The company serves 3.5 million customers in New York City and Westchester County, with 1.1 million in Manhattan alone. ConEd also operates transmission lines, transmission substations, distribution substations, in-service line transformers, overhead and underground distribution lines, as well as natural gas mains and service lines. The company primarily serves industrial, commercial, residential, and government customers.

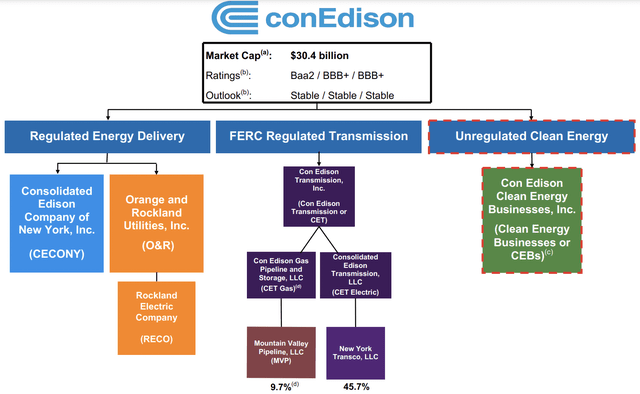

The company operates through three segments which include regulated energy delivery, FERC-regulated transmission, and unregulated clean energy. Consolidated Edison Company of New York, Inc. (CECONY) is in the regulated utility business and engages in regulated electric, gas, and steam utility operations. Orange & Rockland’s (OR) is a regulated utility business that is in the regulated electric and gas delivery businesses. The Clean Energy Businesses (CEBs) segment develops, owns, and operates renewable and sustainable energy infrastructure projects, as well as provides wholesale and retail customers with energy-related products and services. This is North America’s second-largest owner of solar electric projects. Con Edison Transmission invests in and manages electric transmission projects as well as gas assets.

Exhibit 1: Organizational structure

Source: Q3 earnings presentation

The company recently announced that it has won the PA Consulting 2022 ReliabilityOne award for providing reliable electricity services and developing innovative technology in the Northeast Metropolitan Service Area. ConEd received the Outstanding Technology & Innovation Award for developing enhanced supervisory control and data acquisition (SCADA) as well, which gives operators better insights into system conditions and allows them to proactively reconfigure the interconnection to route power efficiently when other equipment is out of service.

The company maintained its earnings beat streak with Q3 earnings

ConEd has topped Wall Street estimates for earnings in each of the last 9 quarters, including the third quarter of this year. At Leads From Gurus, our philosophy is to invest in companies that consistently top earnings estimates as consistent earnings beats often lead to meaningful alpha returns in the long term.

Consolidated Edison reported earnings per share of $1.63 for the third quarter. The company reported total revenue of $4.16 billion which was boosted by higher electric, gas, and steam revenues, as well as non-utility revenues. Electric revenues totaled $3.3 billion in the third quarter, up 12.7% year-over-year while gas revenues increased 32.8% to $453 million, steam revenues increased 5.5% to $58 million, and non-utility revenues increased 23% to $326 million.

The company’s total operating expenses increased 18.6% YoY to $3.27 billion, with fuel expenses rising 34.1% and the cost of resale gas rising 123%. Consolidated Edison’s operating income increased 4.6% to $889 million, with cash and temporary cash investments totaling $70 million as of September 30.

Consolidated Edison, amid uncertain macroeconomic conditions, continues to deliver stable returns.

The outlook for ConEd

Electric utility companies derive a sizable portion of their revenue from regulated operations. Regardless of economic cycles, demand for utility services remains relatively stable, enabling them to generate consistent income. In extremely uncertain events such as severe weather conditions, companies face the risk of disrupted operations. The recent economic downturn caused by the global public health crisis has also affected production and supply.

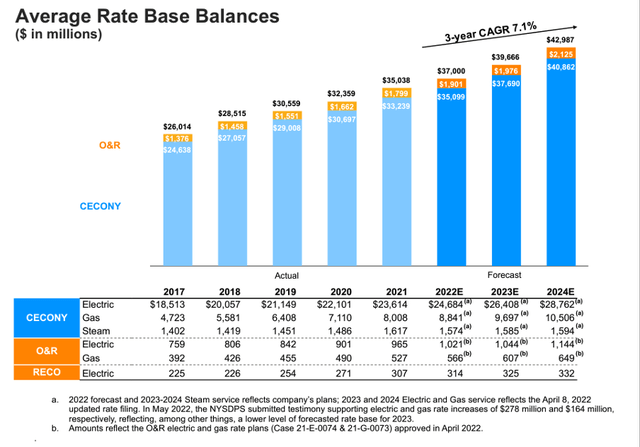

The ongoing rise in interest rates, on the other hand, is a major source of concern for capital-intensive utilities. An investor-owned utility can apply to a regulator for a rate or policy change to adjust rates when costs have risen and the revenues can no longer cover the operating expenses. CECONY filed a rate case with the NYSPSC on January 28, 2022, in support of new electric and gas rates that would go into effect on January 1, 2023, with an update filed on April 8, 2022. The New York State Department of Public Service testified in the NYSPSC proceedings on May 20, 2022, in support of rate increases for gas and electricity of $278 million and $164 million, respectively, a lower-than-anticipated rate base for 2023.

Exhibit 2: Average rate base balances

Source: Q3 earnings presentation

With rising interest rates, inflation, and high natural gas prices all having the potential to drive up costs, Moody’s recently downgraded its outlook for the regulated utility sector in the United States to negative. These challenges are anticipated to persist into 2023, and regulators may continue to reduce the burden on consumer bills by approving smaller rate increases.

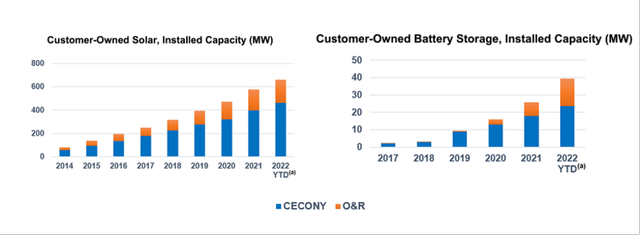

The utility industry is rapidly transitioning, with more companies declaring zero-emission targets. ConEd has a $15.7 billion capital expenditure plan for 2022-2024, 30% of which will be dedicated to expanding its renewable energy portfolio. The company intends to construct a resilient, 21st-century electric grid capable of delivering 100% clean energy by 2040, electrify the majority of building heating systems by 2050, and go all-in on electric vehicles. Consolidated Edison has already committed $780 million for CECONY Reliable Clean City Projects, which are currently under construction. The company also intends to invest $100 million in R&D by 2030 to support the transition to a clean energy future, including the creation of hydrogen and long-term energy storage technologies. In the third quarter of 2022, the company installed 1,270 EV plugs, 40 MW of customer-owned solar, and 2 MW of customer-owned battery storage capacity.

Exhibit 3: Clean energy metrics

Source: Q3 earnings presentation

Many players in the industry are selling a part of their portfolios to better focus on their regulated utility business and boost earnings, as the challenging environment persists. During the quarter, ConEd announced a $6.8 billion agreement to sell its interest in Con Edison Clean Energy Businesses, Inc. and Clean Energy Businesses to RWE Renewables Americas, LLC, a subsidiary of RWE Aktiengesellschaft. Con Edison intends to use the proceeds to repay debt to the tune of $1.05 billion and invest in its regulated utility operations.

Despite a bleak market outlook, Consolidated Edison’s operations have produced consistent earnings with positive recurring cash flow and the company continues to distribute an attractive dividend. The company’s dividend payout has steadily increased over the years, and ConEd will increase the payout for the 48th consecutive year in 2022.

A challenging period awaits ConEd

There is pressure on electric utilities to embrace a cleaner, sustainable grid to be in sync with the broad sustainability measures introduced by the U.S. government. Despite the not-so-promising outlook from the regulatory front for meaningful rate increases, utility companies will have no option but to invest in clean energy to avoid regulatory headwinds in the future. Failure to keep up with these investment requirements could also lead to a deterioration of investor sentiment toward these companies. To put it simply, ConEd and many of its peers are caught between a rock and a hard place.

Until there is more clarity about the regulatory decision on Consolidated Edison of New York’s request for rate increases, investors should tread carefully as a lower-than-expected rate increase could force ConEd to rethink its capital allocation policy at a time when operating costs are increasing across the board. In the worst-case scenario, the company might fail to cover operating costs for a few quarters, which may force ConEd to sell assets. Such a development may harm the company’s long-term growth potential, which is why investors need to monitor this situation carefully.

The company’s clean energy investments should also be monitored carefully as this transition may lead to unexpected inefficiencies in the business until ConEd finds its way around.

Takeaway

Consolidated Edison has rewarded its investors handsomely this year – not just with dividends but also with market-beating capital gains. The company is now entering a transitionary period, and the next few months will reveal the ROEs investors should expect from ConEd in the coming years. The company is already trading above its historical valuation multiples, and it seems best to wait for more clarity on regulatory decisions to initiate an investment in ConEd stock.

Be the first to comment