Joa_Souza/iStock Unreleased via Getty Images

Introduction

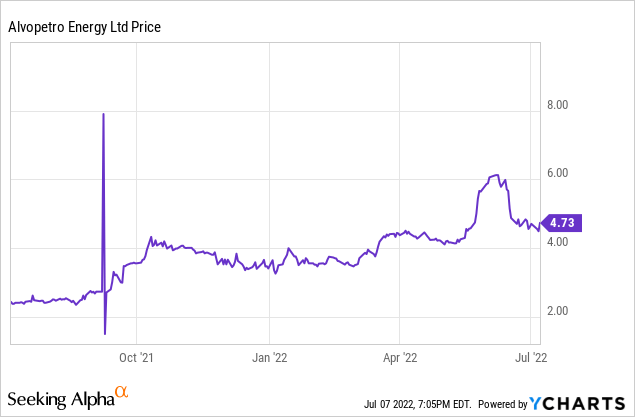

When I last discussed Alvopetro (OTCQX:ALVOF) about six months ago, the company was getting close to being able to hike its natural gas prices, which are fixed on a six-month basis. This means the first quarter of 2022 was the first quarter the higher natural gas price was helping the company, and this was immediately visible in the financial results.

Alvopetro’s primary listing is on the TSX Venture Exchange where it’s trading with ALV as its ticker symbol, and I would strongly recommend using the Toronto listing to trade in the company’s shares. The average daily volume in Canada exceeds 16,000 shares per day, and the current market capitalization is just over C$200M. Using the current exchange rate, this translates to US$161M (or US4.73/share) and as the company reports its financial results in US Dollar, I will use the USD as base currency throughout this article.

The First Quarter Shows The Impact Of The Higher Natural Gas Prices

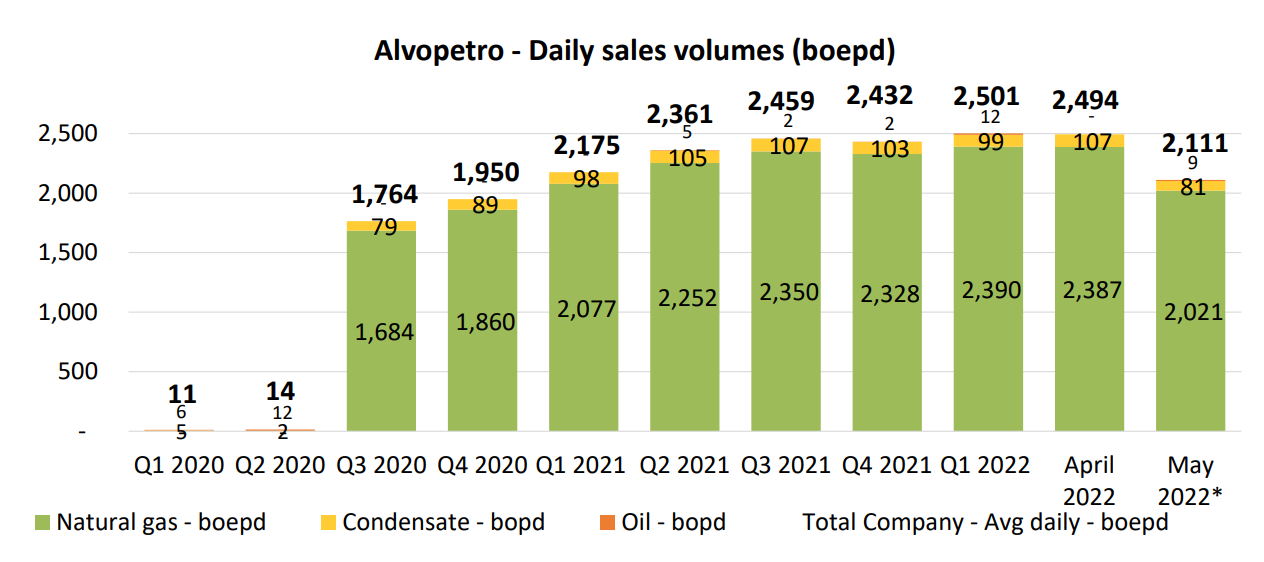

As you can see in the image below, Alvopetro has been a relatively consistent producer as the company focuses on keeping its natural gas production steady and paying down debt rather than blindly pursuing growth at all costs.

Alvopetro Investor Relations

In the first quarter of this year, the average production rate expressed in oil-equivalent barrels was 2,501 but as you can see, about 96% of the oil-equivalent output actually consists of natural gas. The oil production was just 12 barrels per day, with condensate representing approximately 99 barrels per day.

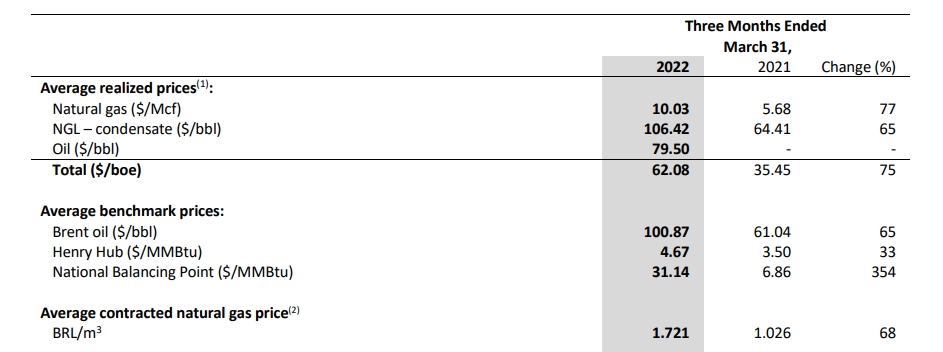

This means that Alvopetro should obviously be looked at from a natural gas perspective (despite publishing its results in an oil-equivalent format). The average received natural gas price in the first quarter was US$10.03 per Mcf, an increase from the $5.68/Mcf received in the first quarter of last year.

Alvopetro Investor Relations

Perhaps I should first explain how the natural gas pricing works for Alvopetro. The company has entered into an agreement with Bahiagas to sell its natural gas using a floor price and a ceiling, with the ceiling of US$9.61/MMbtu indexed to the US CPI. The natural gas price gets fixed for periods of six months, providing excellent visibility for Alvopetro, but the downside is obviously that it cannot take advantage of the swings during said six-month period. The most recent reset was on February 1st, and now represents US$11.28/Mcf, but as the contract is priced in BRL, there will be some swings in the USD-equivalent and a stronger BRL helps the company’s financial statements in USD.

Keep in mind, the new contract price only kicked in on February 1st, which means the Q1 results contain 2 months of the new gas price and one month of the ‘old’ natural gas price. The second quarter will contain three months with the higher natural gas price, while in Q3 we will see another reset on August 1st. That reset will again be based on not just the natural gas price in Brazil but on a combination of the Brent oil price, the Henry Hub natural gas price and the National Balancing point. As Brent and Henry Hub have been all over the place in the past few weeks, it remains to be seen what the next contract price will be.

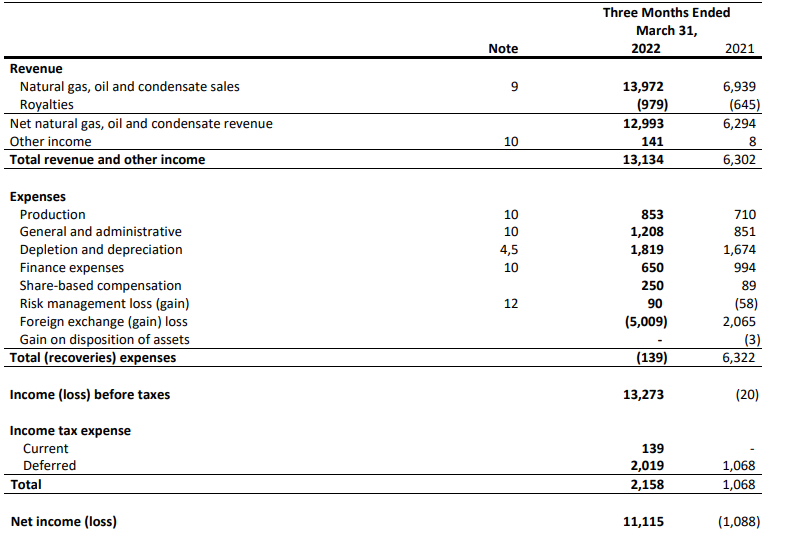

In any case, Alvopetro is currently printing cash. The company reported a revenue of US$14M and a net revenue of $13.1M after taking the royalty payments into consideration.

The operating costs are exceptionally low. As you can see in the image below, the ‘pure’ production expenses were just $853,000. That’s just under $0.75/Mcf. The majority of the expenses are actually depreciation and depletion expenses and the corporate overhead expenses.

Alvopetro Investor Relations

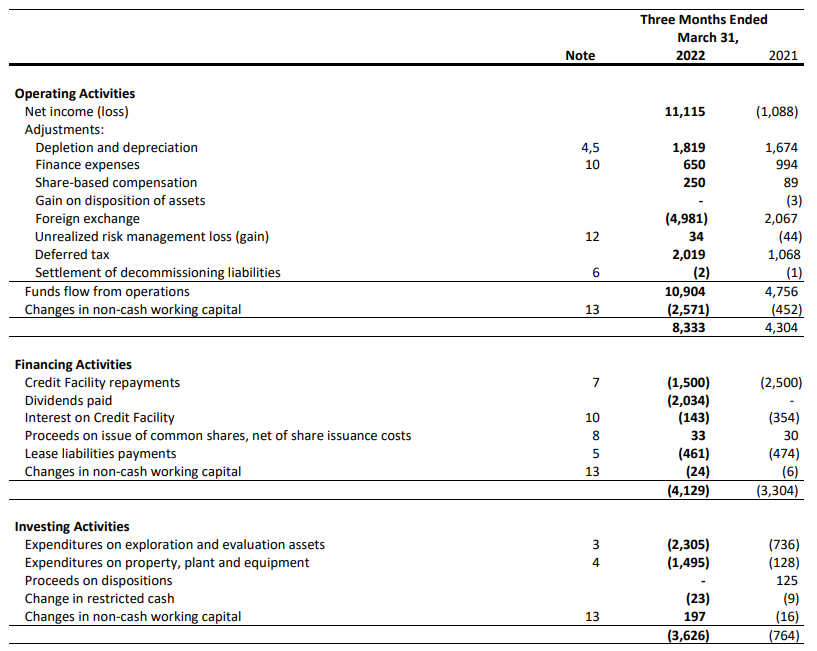

The company reported a net income of $11.1M but keep in mind the pre-tax income was fueled by a FX gain, so we should perhaps focus on the cash flow result of Alvopetro to get a better understanding of how the company is performing.

The operating cash flow was US$10.9M, but this included a $2M deferred tax charge and excluded the $0.6M in interest and lease payments. So on an adjusted basis, the operating cash flow was approximately $8.3M.

Alvopetro Investor Relations

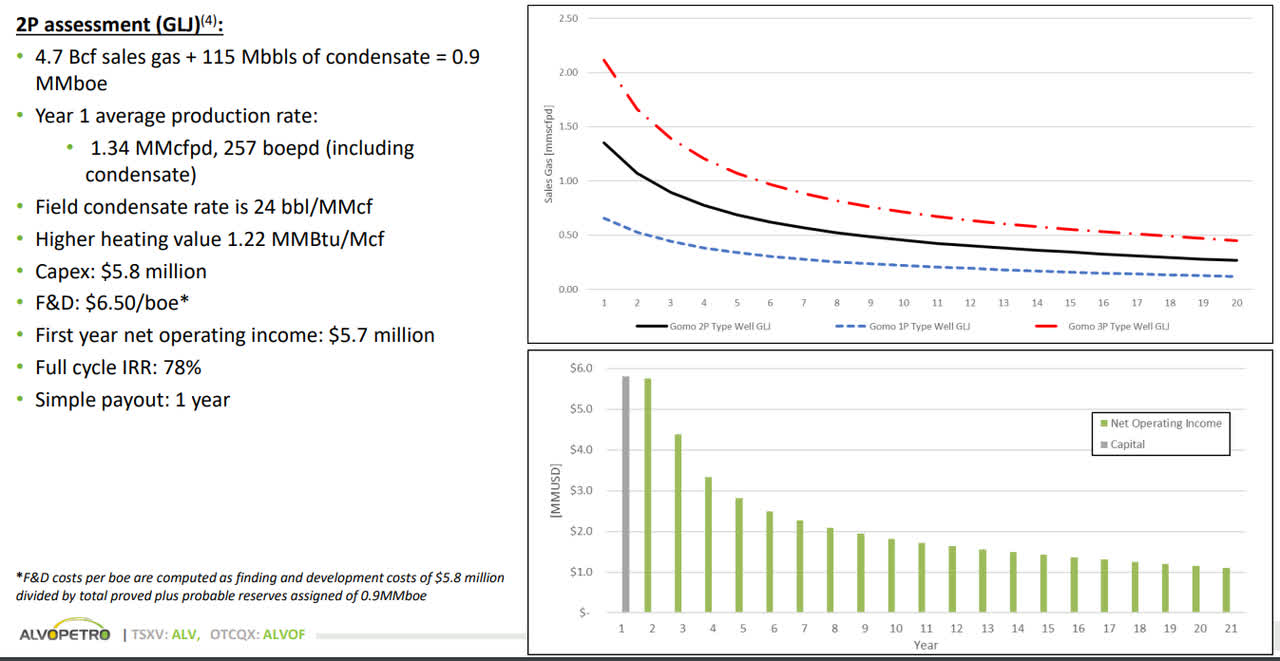

The total capex was $3.8M, which was about four times higher than in the same period last year and more than twice as high compared to the depletion and depreciation expenses. The capex was mainly related to the completion of the 182-C1 well for a total cost of $1.9M, while the company also spent $1.2M on the pipeline and production facility costs of the Murucututu gas field. The latter could be an interesting source of further growth to Alvopetro as the 2P reserves had an estimated value of $72M as of the end of 2021.

Alvopetro Investor Relations

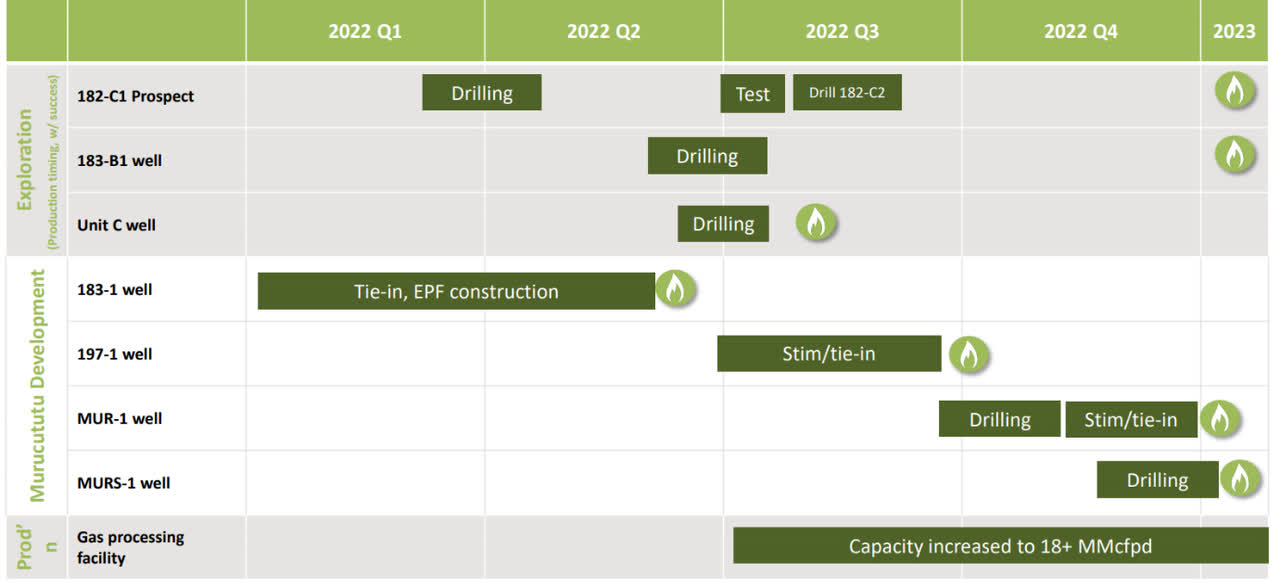

As you can see below, Alvopetro plans to remain busy this year. A good decision as not only are the exploration and development investments easily covered by the incoming cash flows, especially as the new 183-1 well will be linked up to the pipeline soon. The 197-1 well will also soon be tied in to the pipeline, so we should see a nice bump in the gas production results this summer and Alvopetro should be able to increase its daily production rate in the fourth quarter.

Alvopetro Investor Relations

And even despite these relatively aggressive investments in growth, the free cash flow was still about US$4.5M or around C$5.9M in Q1. Divided over 34M shares, that’s US$0.13 per share which means the company is trading at just 9 times the free cash flow and that includes the investments in new gas wells which should start to contribute to the top line soon.

Investment Thesis

Meanwhile, Alvopetro continues to pay a quarterly dividend of US$0.08 per share for a 6.75% dividend yield. The payout ratio is just around 60% (and again, this includes the growth investments) while Alvopetro continues to reduce its gross debt and net debt. In the first quarter of the year, Alvopetro reduced the amount of cash drawn down on its credit facility to $5M and the existing $12.7M cash position actually means the company ended the quarter with a positive net cash position of in excess of $7M. Subsequent to the end of the quarter, the company repaid an additional $2.5M, and I expect the final $2.5M to be repaid soon. As this credit facility had a cost of debt of around 9.5%, Alvopetro will save in excess of $0.5M per year in interest expenses and this will further boost the free cash flow.

I have no position in Alvopetro, but the strong financial performance and the exploration success likely mean I should go long in the near future. I expect the realized natural gas price to decrease from August 1 on when the price gets reset, but the cash flow should remain relatively stable thanks to the higher production rate when the new wells come online. As the most recent reserves calculation shows a PV10 value of US$255M (US$7.5) on an after-tax basis using approximately $9 as base case gas price, I think Alvopetro has more room to run.

Be the first to comment