Art Wager/E+ via Getty Images

Introduction

Now in its second month, Russia’s invasion of Ukraine has not only sent shockwaves throughout the global community but also reignited new energy market worries. As I write this column, WTI crude is trading at $104.21 per barrel. Brent crude stands at $108.85 per barrel. It was just two years ago that WTI traded at negative prices. Today, Norwegian energy research firm Rystad Energy has new forecasts of $240 a barrel by the summer. Uncertainty certainly abounds.

What’s an energy investor to do? My analysis below seeks to aid those looking to undertake investment analysis during this unprecedented time for oil and natural gas. To achieve this, I am highlighting an industry mix of three picks: an independent, a global major, and a natural gas-focused ETF. Before I dive into these assessments, I want to provide some context that informs them.

Russia-Ukraine

Energy investors know that, prior to the outbreak of war in Ukraine, Russian exports of natural gas met more than 30% of Europe’s total demand. Unfortunately, there is no short-term solution to fill the gap should Russian gas supply be cut. In fact, European natural gas prices spiked almost 70% on day one of the invasion. Writing in London recently for the New York Times, reporter Stanley Reed offered this perspective:

Much as it is changing attitudes across Europe, including Germany, the continent’s largest economy, Russia’s invasion into Ukraine is reshaping energy markets globally. For years, Europe has imported enormous volumes of gas from Russia to heat homes and power industry, but now that practice, which depends on billions of dollars’ worth of pipelines, faces severe curtailment.

For energy investors looking at U.S. companies, the invasion of Ukraine is a reminder of the strategic importance for the U.S. to rely on domestic resources. As Bloomberg reported last month, “‘The United States ought to be looking at ourselves, frankly, as an arsenal of energy for the world,’ Representative Liz Cheney, a Republican from Wyoming, said Sunday on CBS’ “Face the Nation.” ‘We ought to be unleashing our own energy resources, our own energy production.’”

And back in February, the White House’s press secretary said that, in response to the market turmoil, the U.S. needs to “decrease its reliance on foreign oil by switching over to renewable energy, not increasing domestic production.” The fact of the matter is Europe is importing more LNG from the U.S. to deal with its current energy crisis, not importing more wind turbines or solar panels.

Failed Domestic Energy Policy

In my opinion, therefore, there is a bigger issue at play here in the U.S. that investors must weigh: failed domestic energy policy. I came across a recent energy prices brief from C-MACC, an energy consulting firm in Houston, that summed up my thinking nicely:

While it is easy to blame current high prices on the Russo-Ukrainian war, the supply-demand imbalance has much more to do with very poor planning by the Biden administration that both grossly underestimated energy demand growth relative to supply and is choosing poor tactical approaches to creating the energy supplies that the U.S. and the world need.

Since government policy has an outsized influence on the energy sector relative to other industries, investors in oil and natural gas plays should be especially diligent when considering the following:

- Market chatter about “9,000 unused leases” must not be taken seriously. We are at a 20-year high for the producing lease percentage on federal lands. Almost two out of every three leases are producing. And as far as permits are concerned, there are currently almost 100,000 producing wells right now on U.S. federal lands.

- The Interior Department’s delay of its five-year offshore oil and gas leasing program (more on this below).

- Hostility toward pipelines, and not only the cancellation of Keystone XL, but also the Constitution, Magnolia Extension, Atlantic Coast, and Mountain Valley.

- Before the invasion, President Biden pressured OPEC and countries like Russia to produce more oil.

The confluence of these factors will have a chilling effect on investment by energy companies looking to invest in new ventures and projects. Nevertheless, there are positive roads ahead. In light of these dynamics, I assess three investment options within the context of these international and domestic market-moving issues.

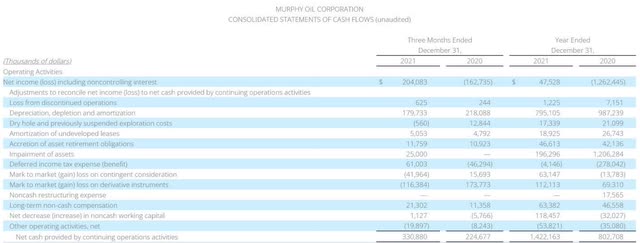

Murphy Oil

My first assessment is Murphy Oil (NYSE:MUR). Based in Houston, Murphy’s primary assets are in Eagle Ford, the second largest shale play in the U.S., and in Deepwater Gulf of Mexico. It also holds undeveloped reserves in promising emerging markets such as Vietnam and Mexico. I will start by looking at the company’s most recent earnings released at the end of January. As the chart below shows, MUR’s net income has seen a tremendous improvement. For the last three months of 2020, we saw a loss of more than $162 million. However, net income of roughly $204 million was generated during the same timeframe last year.

I also liked what Murphy CEO Roger Jenkins had to say upon the earnings announcement. “We produced more oil than originally planned, with less capital, while also lowering our total debt by 17 percent.” Looking ahead, Jenkins continued, “With a great year of execution in 2021 and significant incremental cash flow coming this year, we can now increase our long-standing dividend while simultaneously continuing our debt reduction strategy.”

This cash flow view from management is certainly cause for confidence. Specifically, MUR generated $496 million of free cash flow in 2021. Investors should also be on the lookout for the dividend increase here. With a dividend yield right now of 1.64% (at $0.60), the company’s yield already sits nicely above the U.S. average across industries of 1.2%.

Murphy’s stock has been performing extremely well in the run up to the current spike, as well. A quick look at the chart below (as of market close on April 13) shows that MUR’s shares have gained more than 154% over the past year. I expect this upward momentum to continue well into 2022.

Looking into other fundamentals, I am also optimistic concerning current revenue trends. 2020 revenue from sales to customers stood at $1.751 billion. The same full-year revenue for 2021 came in at $2.801 billion. Additionally, MUR has reduced its long-term debt from 2020 to 2021 by $523 million.

Before I turn to my second assessment, given MUR’s significant Gulf of Mexico (GOM) exposure and how GOM leases factor into the second company I analyze, I want to further highlight the ambiguity caused by the Biden administration’s five-year offshore leasing plan delay. For the last 42 years, the Interior Department has been required to have a five-year plan to meet the U.S.’ energy needs. Part of this plan is offshore oil and gas leasing, and the current plan is set to expire on July 1. A new plan is nowhere in sight. According to a new study from Energy & Industrial Advisory Partners, a delay in the leasing program will mean nearly 500,000 barrels per day less from GOM from this year through 2040. Moreover, in 2036, “the lost GOM production could mean 885,000 fewer barrels of oil and natural gas per day – a 33% decrease from where we’d be with a five-year program in place.” Investors must factor in how this delay will jeopardize offshore operators if the plan is not renewed.

Exxon Mobil

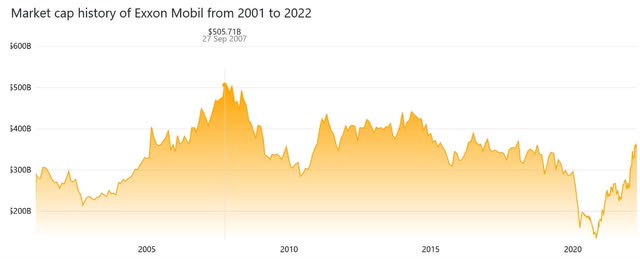

My second assessment is Exxon Mobil (NYSE:XOM). Once the world’s largest company – it boasted a market capitalization in excess of $505 billion back in the fall of September 2007 – XOM has indeed rebounded after a brutal two-year stretch.

With the onset of the Covid-19 pandemic, we saw fuel demand plummet and the company’s shares go into free fall, down to $31.45 per share on March 23, 2020. This was followed by Engine No. 1, a tiny hedge fund owning only 0.02% of XOM, shocking the investing world with its shareholder activism campaign against the company.

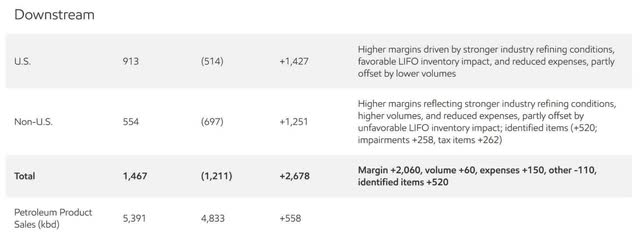

It’s a very different ballgame now, however. I like XOM for several reasons as this terrific comeback story unfolds – and accelerates. First, XOM’s growth potential is enormous. I also see XOM’s recent bids for 94 drilling leases in shallow water GOM off the Texas coastline as a net positive ahead of its carbon capture plans. Additionally, XOM’s downstream division has really picked back up again. As the chart below shows (Q42021 in the left column; Q4 2020 in the right), this segment is trending where you want to see as global demand for refined products and plastics continue to grow.

Second, XOM’s management has always been the envy of the industry. I like to analyze this fundamental closely when looking at large multinationals. A new hire resonates with me as the company continues to pivot to a lower carbon world. Starting next month, Dan Ammann, former General Motors president and CEO of Cruise autonomous vehicle company, will be serving as president of XOM’s Low Carbon Solutions. This is an exciting appointment, and one that investors should note towards the company taking its climate commitments seriously.

Third, SA contributor The Value Pendulum recently highlighted a cash flow data point that caught my attention. Per an article last week (“Where Will Exxon Mobil Stock Be In 5 Years?”), “XOM is expected to generate $100 billion in excess cash flow between 2022 and 2027, which could be potentially utilized for shareholder capital return and deleveraging.” Cash flow is always important to me, and these projections further solidify my bullish position on XOM.

First Trust Natural Gas

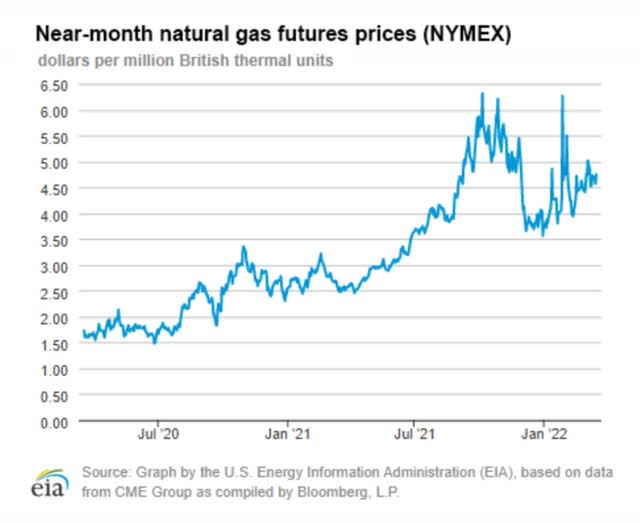

My last assessment is the First Trust Natural Gas ETF (NYSEARCA:FCG). FCG tracks the ISE-Revere Natural Gas Index, which is made up of U.S. companies that generate a majority of their revenue from natural gas E&P. As the chart below details, natural gas prices have been on an upward march ever since President Biden was sworn in January of 2021. (Disclosure: I am long natural gas futures). More recently, as of last September, natural prices had skyrocketed 99% YTD.

U.S. Energy Information Administration

Looking at FCG’s fundamentals, I like several things I am seeing. First, it has a modest management expense ratio (MER) of 0.60%. Second, FCG’s price/cash flow sits at 4.57, putting it in the 99th percentile relative to the asset class median. Third, FCG has net assets of $587 million, which are substantially larger than most its peers.

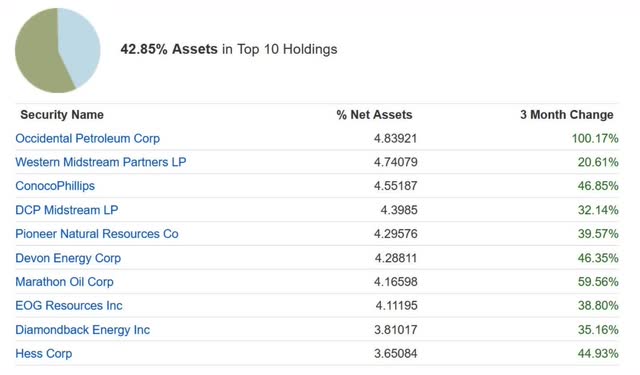

Next, take a look at FCG’s top 10 holdings per this chart. As of the end of this past February, the three-month performance of these holdings has been superior. Energy investors like me looking to take advantage of the rise in natural gas prices, which I believe will be sustained, surely have an excellent bucket of top equities here by going long FCG.

Additionally, I believe the steadiness of the dividend is also something investors should lock in here. Per SA contributor Michael Gayed in “FCG: Don’t Pass On This Natural Gas ETF,” “FCG has paid dividends consecutively for the last 13 years and its TTM dividend yield is 1.69%. As there has been no consecutive year-over-year growth in its dividend payouts, we can assume that its forward dividend yield to be almost equal to its TTM yield of 1.69%.” One cautionary note to close: FCG’s tracking error. It’s currently at 39.28, and there is a lot of room for improvement there.

Conclusion

Perhaps some investors were as surprised as I was – and it was telling – that President Biden only mentioned climate change twice in his 62-minute State of the Union address. We have no domestic energy strategy, and the Russo-Ukrainian war will continue to keep us on our toes. The Wall Street Journal’s Editorial Board made an excellent point last month. “Europe offers another reminder to the U.S. that blocking fossil-fuel development here won’t keep carbon ‘in the ground.’ It merely hands a strategic weapon to dictators that they will turn around and use against us.” Hopefully my assessment here of MUR, XOM, and FCG provides more informed analysis for you to use going forward to make prudent oil and natural gas investment decisions in these dynamic market conditions.

Be the first to comment