Funtap/iStock via Getty Images

Investment thesis

AG Mortgage Investment Trust, Inc. (NYSE:MITT) seems undervalued based on traditional valuation metrics and trades 0.54x its book value. However, the company has not recovered from the pandemic yet while the management restructured its portfolio to residential real estate and sold all non-core assets. MITT will benefit from the rising interest rate environment but its average portfolio yield is well below its peers. I am currently neutral on MITT.

Business model

AG Mortgage Investment operates as a residential mortgage real estate investment trust in the United States. The company went through a portfolio simplification in 2021. The management sold almost all of the non-core assets and reduced the exposure to commercial investments to be able to focus on core activities. As of December 31, 2021, 80.5% of equity was allocated to residential investments, and 19.5% of equity was allocated to agency investments while as of December 31, 2020, only 56% of equity was in residential investments. I would call this a radical portfolio transformation, however, due to MITT’s smaller market cap size, it was relatively easy to do compared to larger market cap mREITs.

2022 expectations

While 2020 was a catastrophic year for MITT and 2021 was a year of restructuring, 2022 could bring the company back from its ashes. Like all mREITs, MITT also works best when interest rates are on the rise and spreads can widen. The Fed has already rose interest rates once and plans to do 6 more times in 2022 to tackle inflation. In addition, MITT’s portfolio restructures to residential real estate can come out well in the long term due to the supply and demand characteristics of the residential real estate market suggesting that it will continue to grow despite the rate hikes.

The widening spread will positively impact MITT’s interest income in the second half of 2022 but I am not certain yet that the management can fully capitalize on this. This is because the portfolio’s weighted average yield is far less than its peers. MITT only has a weighted average yield of 3.8% while one of the largest residential mREIT: MFA Financial (MFA) has a weighted average of around 5% as of December 31, 2021. MITT will announce its first-quarter results on May 4, 2022, before the market open. After hectic EPS results in 2021, the analysts expect more balanced EPS results for 2022.

Valuation

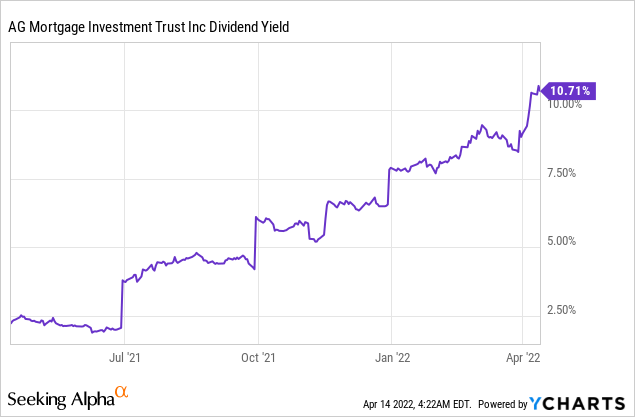

Technically speaking MITT is undervalued based on traditional valuation metrics. The company’s forward Non-GAAP P/E ratio is 7.56, a bit over 30% lower than the sector median of 10.42. MITT’s price to book ratio is 0.54 while the industry average is 0.80. This is mainly due to the falling stock price because the company’s book value has been on the rise in 2021. In addition, MITT is at its dividend yield peak and at the moment you can buy the company with its best dividend yield in the last 12 months. MITT also trades almost at its lowest point in a year and since the start of 2022, the price has fallen by almost 25%.

Despite all of this technical undervaluation, I do not think MITT is undervalued but rather fairly priced. They are lagging behind their competitors with much lower portfolio yield, their portfolio is full of risky assets, and due to the restructuring, the management sold or exited the less risky commercial investments that they had previously. I am convinced that the market is priced in these fundamental risks and I am not buying MITT just yet.

Company-specific risks

A significant portion of MITT’s residential loan portfolio is Non-QM loans (72.9% as of December 31, 2021). Non-QM loans are generally loans to finance or refinance one-to-four-family residential properties that are not considered to meet the definition of a Qualified Mortgage by guidelines adopted by the CFPB and may be considered to be lower credit quality. This makes MITT’s portfolio riskier than its peers. E.g. MFA has Non-QM loans as well but that only represents approximately 41% of its total portfolio.

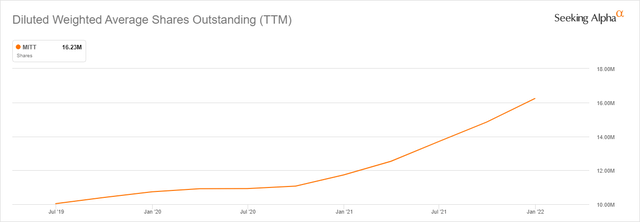

Prepayments risks will remain significant in the second half of 2022 but when the interest rates start to increase further this risk factor will diminish, for now, we need to calculate prepayment risk as well. MITT has been constantly issuing shares that erode shareholder value and lower EPS to finance its operations. The only positive factor is that while issuing common stock at the same time the management is redeeming preferred stocks.

My take on MITT’s dividend

Current dividend

MITT is yielding at 10.71% the highest it has been in the last 12 months. The company paid a consistent dividend until the pandemic when the management had to suspend the dividend payments. Since then they reinstated the dividend in 2021 and currently paying $0.21 per share quarterly.

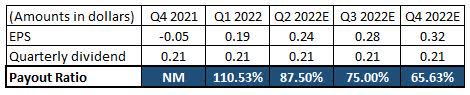

Future sustainability

The payout ratio is stretched to its limits at the moment and I see no room for future increases. According to analyst estimates, they expect a $0.21 per share so no increases are expected for 2022. Interestingly for 2023, the consensus rate is $0.205 which could mean a dividend cut. I do not believe the management would cut the dividend in 2023 because the external economic factors are turning in MITT’s favor with the higher interest rate environment which will widen the spread. This will ease the pressure on its payout ratio in 2022 and 2023 if the management does not increase the dividend.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

MITT is heading for a good 2022 with much better expected results than 2021 or 2020. However, its investment portfolio’s average weighted yield is much lower than its peers and it also contains much more risky assets. The company has an attractive dividend yield and I am relatively confident that the management will be able to maintain the current payouts due to positive external factors. However, I am not that confident in price appreciation. I believe the current price is fair and all the risks are priced in.

Be the first to comment