Mohamad Faizal Bin Ramli/iStock via Getty Images

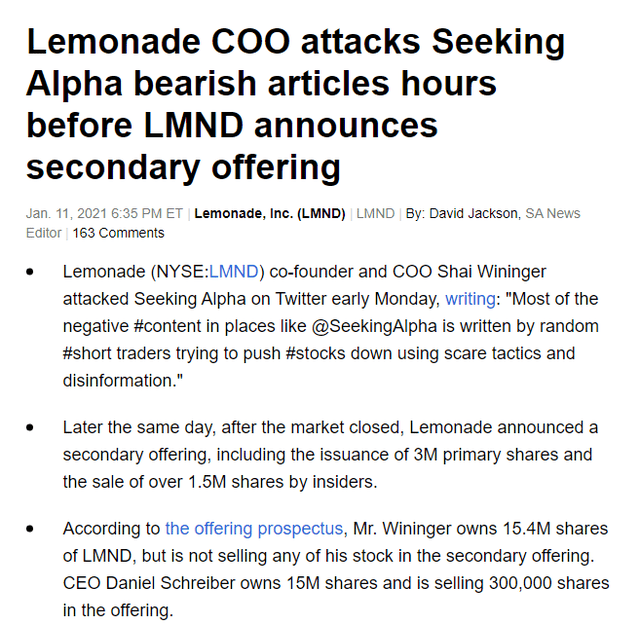

If you want to get my attention as a company, attacking short sellers is a great way to make an introduction. Insurance technology firm Lemonade (NYSE:LMND) became an instant classic in this genre in January of 2021.

Lemonade co-founder and COO Shai Wininger tweeted a series of criticisms against alleged short sellers and Seeking Alpha at the same time insiders were selling off their own shares of LMND stock, leading to this memorable headline:

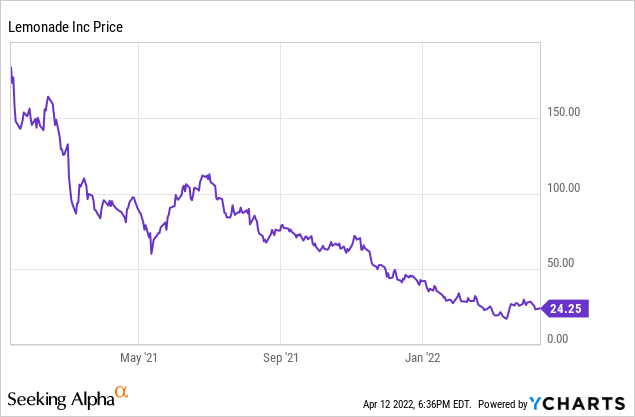

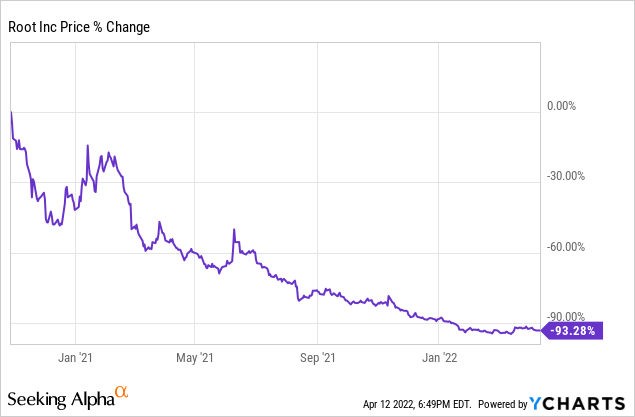

When management teams go after short sellers, it’s almost always a sign that the company indeed is a bad apple. Here’s Lemonade’s stock price performance since Wininger attacked Seeking Alpha and the purported short sellers:

That’s an 85% loss for anyone that’s counting. The insiders, it should be noted, made an excellently-timed sale with that stock offering.

In any case, enough of that backstory. With Lemonade shares down precipitously, is there any value here today? No, not at all. In my opinion, shares could easily be down another 50% from here by year-end.

Insurance: Not So Easy To Disrupt

At the time of the Lemonade IPO, this seemed like a reasonable concept for a business. The company was going to use its purportedly superior artificial intelligence to disrupt the insurance industry.

Turns out, however, that insurance is not so easy to disrupt. The incumbents have been in the business for decades. They may not have the best apps or ways of marketing to millennials, but they’re really good at, you know, writing insurance policies at a profit.

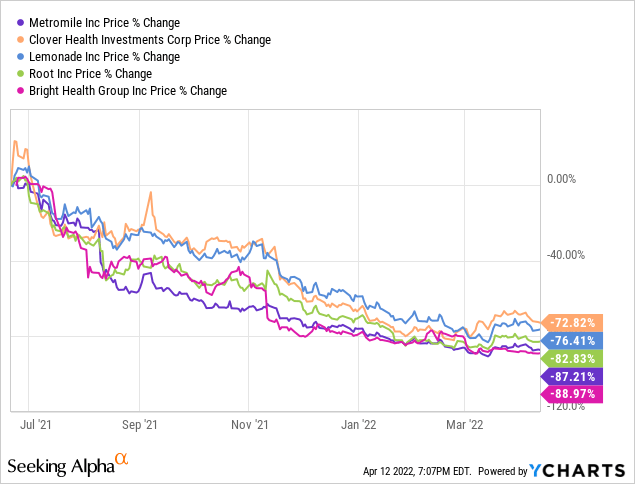

Over the past year or two, we’ve gotten a rash of new insurance upstarts in the marketplace. They’ve all been terrible investments:

A common thread among most of them has been that their insurance underwriting, the actual core of the business, has been very poor compared to the incumbents in the industry.

Clover Health (CLOV), for example, has posted profoundly bad results in its Medicare Advantage plans, with medical cost ratios moving above 100%. The first rule of insurance is supposed to be that you charge a higher premium than you will have to pay out to customers. The insurance disruptors, by contrast, don’t seem to be any good at actually doing this. And no amounts of buzzwords or fancy tech interfaces can make an insurance company profitable if its underwriting is subpar.

To give it credit though, Lemonade actually appeared to be on a solid enough trajectory early on. From its January 2021 prospectus:

“In parallel to this growth of top line and increasing efficiencies, our gross loss ratio declined steadily from 161% in 2017, to 113% in 2018, to 79% in 2019 and to 71% for the nine months ended September 30, 2020.”

That’s a solid series of numbers. It appeared Lemonade might be an insurance newcomer that was actually capable of high-quality insurance underwriting. Alas, those expectations would soon be dashed.

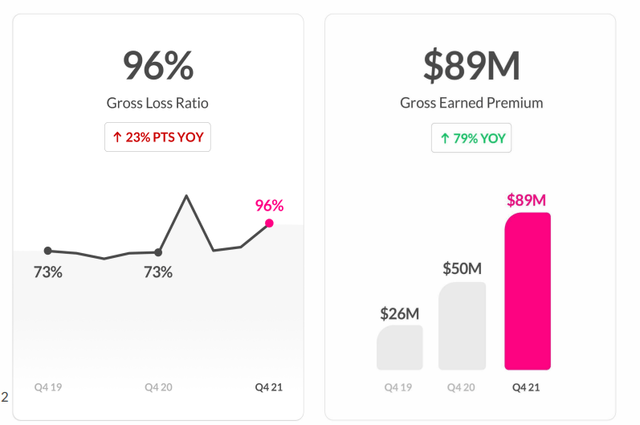

Lemonade loss ratio (Shareholder Letter)

Now, as Lemonade continues to grow gross premiums, the gross loss ratio has soared to nearly 100%. In the prospectus, it seemed like investors could expect the loss ratio to remain reasonably healthy, it seemed like the loss ratio was improving as the business got larger. Instead, its loss ratio has gone dramatically in the wrong direction even as it scales up. So which is it?

In its Q4 letter, Lemonade gave this explanation for a large part of the rise in its gross loss ratio:

“A meaningful driver of this sequential increase is an unfavorable prior period development due to a handful of older large losses for which we under-reserved.”

This is not a statement you want to read from any insurance company. It’s especially not one whose marketing appeal was around having AI for better underwriting and a sophisticated technological approach to buying reinsurance. As Seeking Alpha author and insurance industry expert Matthew Queen explained, Lemonade relies heavily on reinsurance as compared to most rivals. So getting this part of the equation is problematic for its overall results and future outlook.

There’s also the matter that Lemonade writes generally shorter-term insurance as well. As one highly-influential Twitter account put it:

“Am trying to understand how they were under-reserved on short-cycle pet and renters insurance, and didn’t catch it until the 4Q. Disruptive controls…?!”

That just about sums it up.

Lemonade’s 2022 Guidance: Not Good

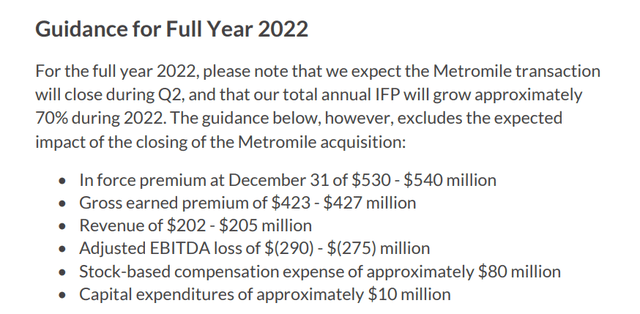

I don’t think I need to add much commentary to this slide, I’ll just post in its full glory:

2022 Guidance (Shareholder Letter)

The company anticipates losing $290 million on an adjusted EBITDA basis while generating just $203.5 million of revenue. On a net income basis, things will likely be significantly worse.

To add insult to injury, the company anticipates paying out $80 million of stock comp. That’s nearly 40% of revenues! And for a business that is losing more than a dollar for every dollar of revenues it brings in and whose stock lost most of its value last year. It’s breathtaking.

Oh, and this is before they finish their acquisition of Metromile (MILE). Metromile, last year, only generated $102 million of revenues but managed to lose $216 million overall. That’s no better than Lemonade.

Given Lemonade’s difficulties in managing risk in its existing insurance portfolio, it’s unclear how adding another dysfunctional company to the mix can possibly improve things. In my opinion, it’s likely that this will be a record year of losses and cash burn for Lemonade, accelerated by the Metromile purchase.

I’d add one more quick point here. The company spends more on sales and marketing than it earns in revenues. Even if the insurance policies were significantly profitable, which they’re not, it’s unclear how this business model is supposed to ever make money. Before you say that they just cut marketing spending, consider that Lemonade has high churn. Turn down marketing and you lose the operating scale.

Cash Isn’t A Margin Of Safety For LMND Stock

You may see investors try to claim that Lemonade is cheap at current levels because of its balance sheet.

It has a ton of cash and investments on the balance sheet, roughly $1.1 billion as of its last report. And that’s true enough. However, insurance companies usually have a lot of either cash or invested assets, part of the business model is generating premiums to invest in financial assets, after all. Those premiums aren’t just free cash, though. An insurer will eventually have to pay out cash to policyholders for their claims.

In Lemonade’s case, it has more than $200 million of unearned premiums on the liability side of its balance sheet. Overall, it has more than $500 million of total liabilities. So it’s not like Lemonade could just close up shop tomorrow and distribute all $1.1 billion of that cash to shareholders as a special dividend.

Lemonade is guiding to an adjusted EBITDA loss of almost $300 million this year, and Metromile lost $216 million last year, meaning the combined firm could potentially be on a runrate to lose something like half a billion dollars annually going forward. Against that backdrop, Lemonade’s $1.1 billion cash pile might not actually last that long.

The Bottom Line

If for some unfortunate reason I had to own a position in the insurance tech space, I’d rather own Root (ROOT) than Lemonade. Root is in a more attractive line of insurance (auto) than Lemonade, and the stock is down way more from the highs. On top of that, Root’s insurance loss ratio, while trending in the wrong direction, is still performing a little better than Lemonade’s. Despite those modest plusses as compared to the likes of Clover or Lemonade, Root stock is now down 93% from its peak:

Unlike Lemonade, Root is actually a value, at least on a purely balance sheet basis.

Last quarter, Root had $836 million of cash and investments, against just $783 million of net liabilities. Throw in other assets such as receivables, and Root has way more balance sheet holdings than total obligations. Combine with a stock price that is already approaching penny stock territory and there’s apparent value here on a liquidation basis.

At today’s stock price, Root has a negative enterprise value of $248 million. Investors think the operating business is currently worth a quarter of a billion dollars less than zero given how badly Root’s results have been lately. And, I’d remind you, Root has slightly better operating metrics than Lemonade.

Why is Root selling at such a massive negative enterprise value? Because investors reasonably conclude there is a good chance that Root will simply burn through all the excess cash and eventually whittle away the margin of safety on the balance sheet. Lemonade will likely do the same, except it’s still selling at an enterprise value well above zero.

I think there’s a decent chance that Lemonade will eventually end up at a negative enterprise value as well, given its large and accelerating losses. As it does so, shares should drop into the single digits. Judging by Root’s stock price, a struggling insurance tech business is worth more dead than alive.

Lemonade’s remaining balance sheet assets should be discounted significantly to book value given the improbability that the company can reach profitability before diluting shareholders dramatically and/or ceasing operations.

Lemonade’s book value is now down to $16 per share and should keep declining as its operating losses pile up. Financial results should go from bad to worse in a hurry once Metromile joins the fold, and shares will likely fall under book value soon after. Given Lemonade’s historically unprecedented losses for an insurance company, it’s hard to see paying more than 0.5x book value for something like this, given that many far higher quality insurance names which make profits and pay dividends have sold under book value for most of the past decade.

And even then, half of book value ($8/share) might be generous, given how quickly book value will continue to erode.

For one more data point, Lemonade is still going for 13 times revenues. Admittedly, you probably should never value an insurance company on revenues. But some tech investors might do so anyway. How does 13x revenues compare for insurance companies? Progressive (PGR), arguably the best-run auto insurer, sells for 1.4x revenues. Plenty more downside for LMND stock on that basis as well.

Honestly, in my opinion, the only real value in Lemonade shares is in hopes of a takeover if someone overpays for Lemonade’s customer base, or as a trading vehicle that might catch a short squeeze given the high short interest. That’s about it, and that’s rather thin gruel for a long position.

Be the first to comment