oatawa

Note: I have covered ASOS previously, investors should see this as an update to my earlier articles on the company

ASOS (OTCPK:ASOMY) is a very well-known British company, not merely due to its strong brand power as one of the market leaders in the fast fashion industry. But also as the ‘gold standard’ of the UK market – one of, if not the most successful UK listed company since its IPO in post-tech bubble 2001.

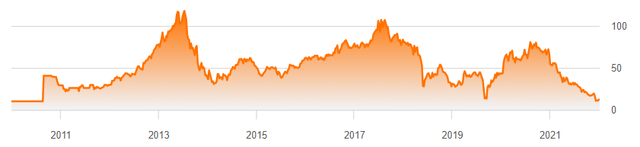

However much of that great performance could’ve been obtained by 2014 as past that point ASOS’s share price (and the underlying business) has experienced significant turbulence:

ASOS Share Price (Seeking Alpha)

The trading update released a few weeks ago accelerated the decline, to the point where I now believe shares offer good value at current levels. The company is experiencing near-term hiccups regarding growth, supply chain difficulties and macro-economic pressures. However, ASOS’s strong brand power coupled with what I believe to be strong long-term tailwinds will allow the company to return to growth over the coming years.

Profit warning as growth stagnates

ASOS shares sunk more than 30% on the 16th of June after the company made significant reductions to its guidance. They previously expected profit before tax of £110M to £140M and has now guided for profit between £20M and £60M. I believe the broad guidance range is reflective of the uncertain nature of the current consumer environment. This is worsened by the excessive amount of customer returns ASOS has been receiving which was the large driving factor behind the new guidance.

Whilst the company did experience a growth slowdown, they still managed to achieve growth of 4% in the three months to 31 May – they achieved this in tough conditions which underlines the strength of ASOS’ offering and the staying power of the brand. The company expects this level of growth to continue – the company guided for growth between 4% and 7% for the FY. It’s also important to note that ASOS is now lapping previous periods of outperformance which came as a result of large COVID tailwinds. This is the case for the majority of tech companies and therefore market expectations should slowly adjust to the fact that growth will be slower when compared to these periods.

Looking ahead, as shown by the guidance, the coming quarter will be dominated by headwinds as consumers and therefore ASOS continue to feel the brunt of inflation. Despite these near-term pressures, the company does continue to execute on key components of its strategy, such as US expansion. ASOS delivered 15% growth in the US over the period, which the company said reflected the strength of the Topshop brands and increased demand for going out-wear. Considering the US is also facing a whole host of economic pressures similar to this UK, this strong growth is very pleasing. As US sales are less than a third of the UK, there is plenty of room for further expansion too. I foresee the US segment of ASOS’s businesses continuing to grow its share of revenue at a fast pace moving forward. Overall, for a business that is very prevalent in the UK market and is nearing maturity in terms of brand awareness, this change in revenue mix is a positive and expands ASOS’s growth runway.

ASOS has come through difficult times, it can do it again

ASOS isn’t a share for the faint-hearted, the company has experienced numerous hiccups on its growth journey, in particular, 2018 comes to mind as a notably difficult period. At the end of 2018, ASOS issued a profit warning, similar to now citing weakened consumer confidence as the major contributing factor to lower sales. The shares sunk on the news, however the pandemic proved to be an inflection point in allowing ASOS to bounce back – an inflection point that I believe is very enduring. Amid the current market turmoil, the 2022 tech growth stock crash would quickly make you think that all COVID benefits have been lost, when in reality many tech firms are just lapping COVID-induced 2021 performance. That isn’t to say the market reprice wasn’t necessary – it certainly was. Considering at the end of 2021 equity valuations were at their highest ever, a dramatic change in economic conditions made a reprice necessary. However this crash made no exceptions, leaving many quality high-growth businesses attractively priced. I believe ASOS has now become one of them.

ASOS also showed its resilience in the last major recession. In 2008 ASOS’s share price did sink by over 30% (in line with much of the market) – a reflection of its volatility. However, the underlying business actually performed well throughout this period. In the year to the end of March 2009, ASOS delivered revenues of £165 million, up over 100% from the year prior. The following year ASOS grew revenues by about 30%. This performance meant ASOS was largely undisrupted by the 2008 crisis. Whilst the crisis is directly comparable to now, it does highlight the strength of ASOS’s offering among British people and the ability of the eCommerce platform to maintain and even grow demand amid difficult economic conditions.

I do not believe the recent profit warning was as severe as the one in 2018. This time weakened consumer confidence is driven by external factors (such as inflation), headwinds that many companies are feeling the brunt of. Despite this, ASOS is still delivering revenues well in excess of Pre-COVID levels yet now trades below Pre-COVID prices – I believe this is excessive market pessimism and ASOS can bounce back once inflation comes under control. The ease of shopping with ASOS and the breadth of offerings have continually made the company a lucrative one-stop-shop for consumers and that isn’t going to change anytime soon. Morgan Stanley recently outlined their belief that the e-commerce market still has the ability to grow from $3.3 trillion today to $5.4 trillion by 2026. ASOS is in a perfect position to ride this growth wave as a company that has built up its brand and customer network over decades. The long-term market tailwinds are strong.

ASOS now trades on a historic P/E of 6 and a Forward P/E of 15 (at the upper end of expectations). Operating Cash Flow was £209 million for FY21, highlighting the cash-cow potential of the company under more accommodating conditions. Cash flow will most likely be negative for FY22 after a negative operating cash flow of £156 million in H1 – this was driven by a large increase in inventory ahead of the Spring/Summer period to reduce lead times. Even after this cash burn, the total cash position at the end of February was £406 million – 40% of the company’s market capitalization. Management has also shown that they believe the share price is undervalued as two Non-execs and the Chairman bought in the open market the day after the trading update.

Conclusion

I believe ASOS has the ability to push through current headwinds and deliver profitability similar to that of FY21 on a more consistent basis in future years. On the whole, FY22 will be a disappointing year, but at current prices, the market is more than pricing that in. I believe the latest market reaction to the trading update was overly pessimistic. ASOS is a company that has proven it can mitigate significant headwinds before and has a history of great operating performance showing significant margin improvement over the years as the company has scaled. The recent reprice has significantly de-risked investing in ASOS as the market has become accommodated to the numerous headwinds the company is facing. ASOS has a strong enough cash buffer and customer network to come through this difficult period and return to stronger growth in 2023.

Be the first to comment