metamorworks

Intro

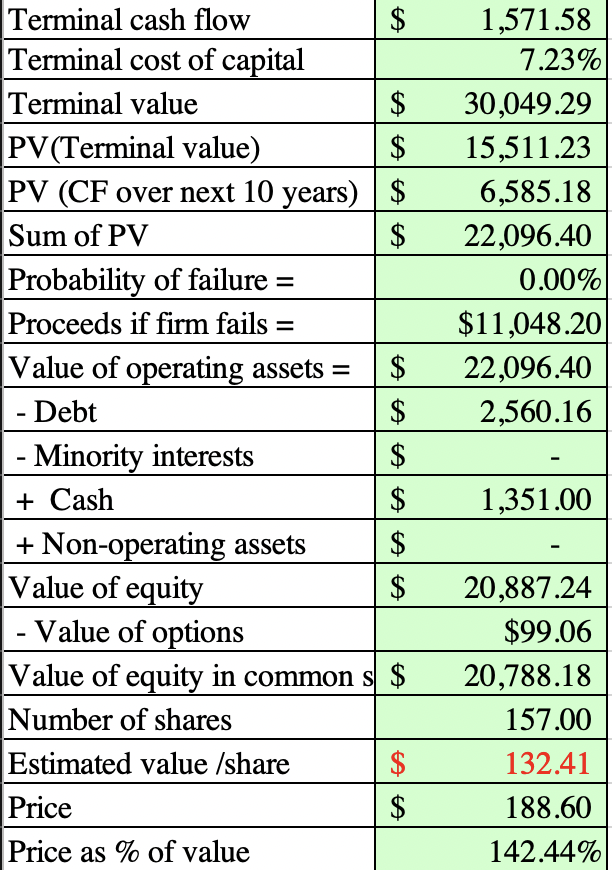

Recent price action has finally brought Illumina, Inc. (NASDAQ:ILMN) back down to earth, but even with super appealing growth prospects, there is too much uncertainty surrounding the firm. I have issued a hold rating on the stock after running a DCF model that indicates the stock is overvalued given the current landscape.

In this article, I am going to thoroughly cover tangible revenue expectations, growth, and future profitability. After, I will briefly discuss the interesting acquisition of GRAIL and development of new technologies, namely Chemistry X, and analyze the firms potential and likelihood of success. Finally, I will connect all these metrics to a DCF model to show the intrinsic value today.

Revenue

To start, let’s dive into the cashflows of Illumina. Typically when crafting a growth story for a firm in its high growth stage I look to TAM (total addressable market) projections. In this case, TAM is rubbish since Illumina has first mover advantage and since most tangible competition is just now emerging. As time goes on, its CAP (competitive advantage period) will fade as new firms explore the space. Because of this, it’s literally a guessing game to try and figure that variable into this valuation. Instead I am going to analyze the firms forward guidance, then build from the foundation that they have laid.

Instruments Segment: Intro

First is the instruments segment. Illumina uses machines and proprietary technology for sequencing and array-based solutions for genetic and genomic analysis. Illumina believes its platform specifically has potential to change the entire preventive care landscape:

By empowering genetic analysis and facilitating a deeper understanding of genetic variation and function, our tools advance disease research, drug development, and the creation of molecular diagnostic tests. We believe that this will trigger a fundamental shift in the practice of medicine and health care, and that the increased emphasis on preventive and predictive molecular medicine will usher in the era of precision health care. -Company 10K Filing

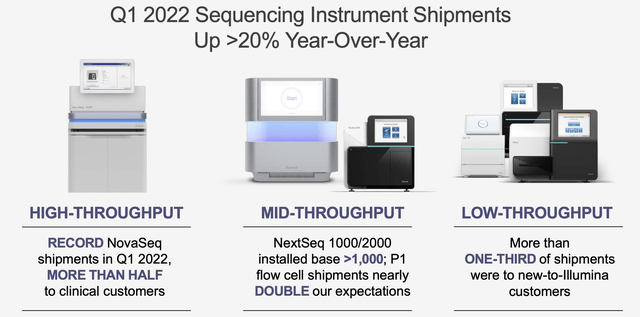

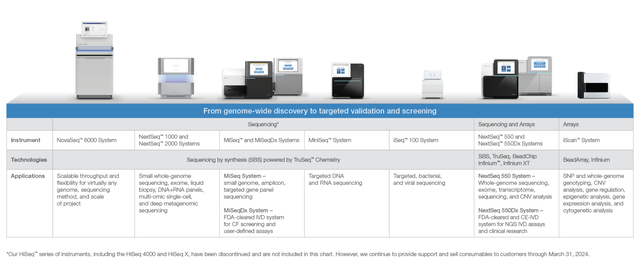

The instruments segment can be broken down into three distinct categories, low-throughput which is your smaller less diverse technology, mid-throughput, and finally high-throughput which is commonly used in more serious testing environments for robust needs. To be even more specific, here is a graphic with insight into each of the Instrument lines:

Instruments Segment: Growth

Revenue growth with medical instruments is where the real interest lies as it has been surprising to the upside. Most of this rise is attributed to changing dynamics within the instrument space. As clinical adoptions move away from the research side and into practical application, Illumina realizes “higher” utilization. With this, Illumina is seeing a move towards larger panels and high-throughput instruments as utilization increases. In turn, these customers must purchase a variety of new instruments to accomplish their needs. This has all culminated to Illumina guiding 10% growth in instruments alone. For example, NovaSeq, their high-throughput offering, realized a record last year with 384 placements with 30% of these placements originating from the oncology testing space which CFO Sam Samad noted at the BofA Securities 2022 Healthcare Conference “[we have] never before been the case for a high-throughput instrument”. Samad also further noted that this shift has caused a “decentralization” of their customer base as many new customers are purchasing products from all categories beyond NovaSeq from Illumina. Furthermore, mid-throughput also reaped the benefits of this new found dynamic with that area realizing record growth as well (namely the NextSeq 2000). On a different note, backlog, which was $1.085 billion in January, is another variable Illumina cites when emphasizing its 16% total revenue growth projections as it has seen record backlogs thanks to the increases in the two instruments I mentioned above.

Instrument Growth Consolidated (Company 1Q Presentation)

Consumables Segment: Summary

While the Instruments segment has the most growth potential, current revenue can largely be attributed to the “consumables” segment which makes up over 70% of the revenue stream. Illumina’s consumables are kits which sequence entire genomes of any size and complexity, and targeted resequencing kits, which can sequence exomes, specific genes, RNA or other genomic regions of interest for use in understanding disease-mutations and risks. On this segment Illumina states:

Our sequencing kits maximize the ability of our customers to characterize the target genome accurately and are sold in various configurations, addressing a wide range of applications . . . Customers can select from a range of human, animal, and agriculturally relevant genome panels or create their own custom arrays to investigate millions of genetic markers targeting any species. – Company’s 10K Filing

Management projects continued sustained growth from the segment and particularly issued forward guidance of 18% growth through the year. Furthermore, revenue generated from the consumables segment, 80% is recurring indicating that it has a safe moat. Despite the stability from the segment, management rarely discusses development prospects for the consumables segment. For example, in the 3 – 4 conferences I listened to while writing this article, consumables were not a topic of discussion at all. Furthermore, in the actual 10K form, the word “consumable” is only mentioned 18 times versus “instrument” which is mentioned 62 times. Management is focused on growing its other more exciting segments and clearly feels that consumables are reliable enough that it does not need further focus which is why I intentionally left this section barren.

Non-revenue Assets

Currently Illumina has two major “buzz” assets that have made major waves in the past couple months. Management feels that these two assets are critical components to their future growth potential despite the fact they are not actively contributing to revenue growth guidance.

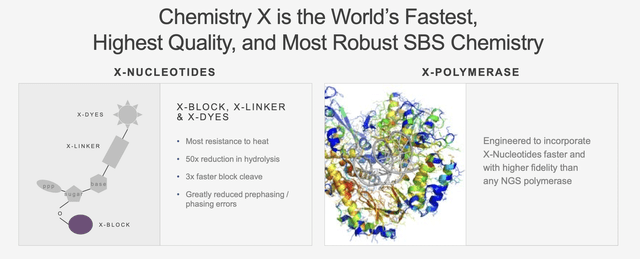

Chemistry X

Chemistry X is the first non-revenue asset I will cover. Chemistry X will be the new foundation all new instruments are built from. Samad said that Illumina believes it is a revolutionary product, a “reimagining” of their chemistry. At Citi’s 2022 Services, MedTech, Life Science Tools & HCIT VIRTUAL Conference Sam Samad said:

In terms of some of the high level metrics we have shared already and that I am comfortable sharing . . . 5x the increased density, twice the faster cycle times, twice the longer reads, 3x the accuracy . . . This will also get us to the $100 genome (from the $600 genome now)

He also reiterated that more technical information regarding Chemistry X will come as time passes. Currently they do not have any definitive dates to give investors, but Samad did note that Chemistry X is out of product development and in full production mode. Meanwhile, at the 40th annual J.P. Morgan Healthcare Conference they shared a slide which illustrates Samad’s point about its capabilities:

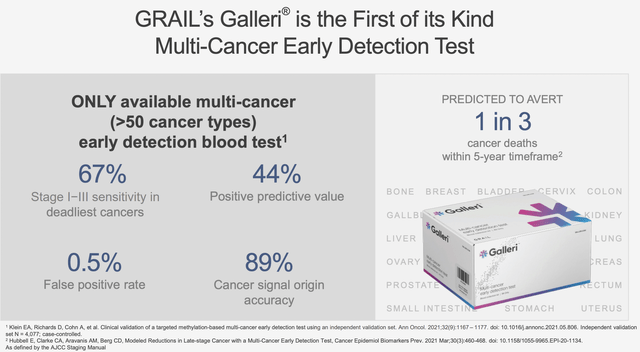

GRAIL

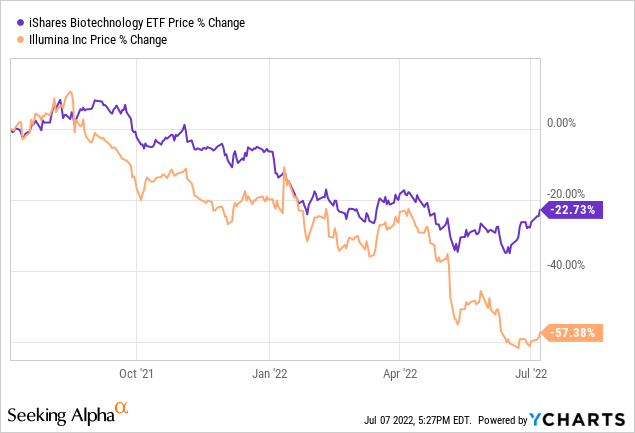

In what has quickly become one of the most publicized events in Illumina’s history, Illumina agreed to acquire cancer focused GRAIL in August 2021. GRAIL itself uses early detection techniques to discover cancer. Its flagship product is Galleri, which uses blood test detects various types of cancers before they are symptomatic. However, this aggressive acquisition left many investors divided for a few reasons. First, the acquisition is sure to have a tough time getting approved as there are several legal hurdles. Second, the revenue for GRAIL is essentially non-existent and Galleri still very much within the early stages of approval. Both of these reasons have resulted in a hefty impact against the share price. When you compare the relative performance between the iShares Biotech ETF and that of Illumina as much is clear:

The sentiment regarding this acquisition is clearly not great as the risks associated with GRAIL have begun to drag on the stock. Still, management is extremely confident that they will realize penetration into this early cancer treatment. They see the TAM of oncology cancer treatment being 45 billion and believe Galleri is a “transformative” product within the space that will tap into that market. Management even believes that GRAIL has the possibility of outperforming their core product even if their core product grows in the mid-teens. Samad specifically noted that already 1500 providers have recommended GRAIL products. He also noted a collaboration with the NHS which he believes will be a major contributor to revenue in the future. On the specifics of Galleri, Illumina shared the following information:

Right now it is hard to imagine how all of this plays into the bigger picture of cancer treatment globally. For the time being, GRAIL is primarily focused on pushing its tests to providers so that they can build relationships with providers and introduce them to the product line. They are also focused on getting full fledged FDA approval and thus their energy for the next year will be focused on those avenues.

Still, the final status of the acquisition remains up in the air. Samad noted that he believes this process can take 2+ years as he notes that this could go all the way to the supreme court. Regardless, he remains confident that the courts will stand by Illumina and allow this acquisition “because there has never been a vertical transaction blocked by the courts”.

Summary

As I stated before, both Chemistry X and GRAIL revenue growth are not included within the forward guidance and as such will not factor into my final DCF model. I believe it is too difficult to project how these assets will factor into the future story for Illumina. Once we get conclusive word on either Chemistry X or the GRAIL deal, I may update the model, but for now, these should only be considered as intangible assets that could be a boom or bust.

Competition

The last aspect of revenue that I would like to touch on briefly is Illumina’s competition. I mentioned before that Illumina has secured first mover advantage and much has been made about their economic moats. Currently I believe that Illumina has major competitive advantages. The largest threat to their revenues right now come from Chinese biotech firm BGI, which will have the ability to enter the US market in 2023 with their standard chemistry IP. Illumina believes that Chemistry X will play a big role in helping offset increased competition from BGI and whatever competitors emerge. Specifically, they control the IP for Chemistry X until 2029 with some patent “runway” to 2037. They believe the dated IP of their competitors will simply be no match.

On China, one of its biggest geographic segments, (where they compete with BGI already) Sam Samad mentioned a 40% growth within the market in its clinical segment last year alone. They are also noticing an increased backlog indicating they are competing well in China with their current technology. This further implies that they are creating products with serious advantages over their competition.

Profitability

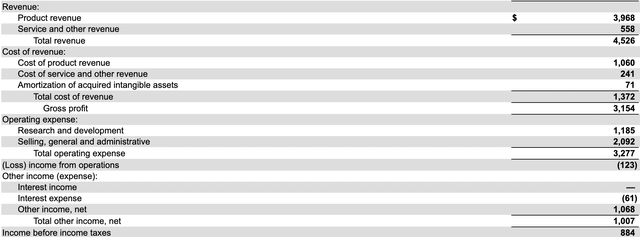

With revenue covered, I am going to now look at the second lever of the DCF model, profitability. There are some pretty funky things happening on Illumina’s 10-K form. Last year Illumina realized an EBITDA of 26.43% and even a net margin of 16.84%, both really good numbers, above average, but seemingly normal for a promising firm. Things only start to get weird once we factor in the income from operations loss of $123 million good for an operating margin of -2.72%. In this next section I am going to explain the discrepancy and cover meaningful projections going forward for Illumina.

Operating income oddities

This sub-section focuses on balance sheet specifics. Most readers can skip to the operating income projections section. I only went through this process in the first place for due diligence and left it here for those who are interested in a full perspective on this valuation.

When developing a DCF for a firm I always rely on operating income as the purest lever for determining a company’s profitability. This is because EBITDA and especially adjusted EBITDA are commonly manipulated or simply not stable enough to be considered. In the case of Illumina this is especially true. For starters, a line in the balance sheet labeled as “other income” emerged separate from revenue with a super high $1.007 billion. Typically this line is reserved by companies for things like interest income from security purchases or goodwill-related gains and rarely exceeds a 5% makeup of the revenue. For Illumina $1.007 billion would make up roughly 22% of their total revenue if it was considered a sales metric, which is why I specifically call this an oddity. Upon further investigation, a footnote indicates that other income increases “was primarily due to the gain of $899 million from our previously held investment in GRAIL as part of the acquisition”. This further indicates why I don’t like EBITDA, which, due to this stipulation comes out to a super high 26.43%. Using EBITDA in this case as a metric is extremely misleading especially for predicting future profitability since this is a one-off situation. Here is a look at a breakdown of how all of these metrics figure:

Notice other income, income before taxes, and income from operations? (Company 10-K)

But the strange happenings don’t end here. You may have noticed the large makeup of SG&A expenses. This doesn’t come off as immediately odd until you consider that these expenses were comparatively only $941 million in 2020, that’s good for a 122% increase in only a year. As was the case with other income from before, this increase is largely attributed to another rarely mentioned and even better hidden balance sheet item, “share-based compensation expense”. Last year shared-based compensation expense was $941 million up from $194 million from the year before. Deeper inside the 10-K I found a section that mentions that $448 million affected SG&A expenses “related to the fair value of accelerated equity awards attributable to the post-combination period” from, you guessed it, the GRAIL acquisition. It is not indicated whether they expect these expenses to fall off the balance sheet or simply moderate, but given history, I expect these numbers to simply moderate.

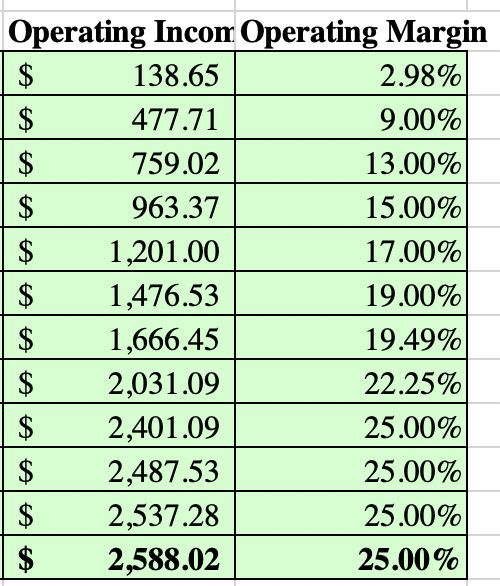

Operating Income Projections

With the oddities from the balance sheet covered, I now feel that we can comfortably come up with profitability projections for Illumina for the next 10 years. Outside of adjusting for the oddities I highlighted in my previous section, I also adjust the margins by converting the lease liabilities and by converting the research and development expense from operating expenses to capital expenses. If you are interested in the reasoning for this or the process, you can read more here and here. These adjustments result in a modest $270 million added to the operating income. Our 10 year projections with all this in mind look like this:

Author’s DCF Model

Going forward GRAIL margins will weigh on Illumina for sometime since GRAIL hasn’t even realized a positive gross profit yet. Still, I expect Illumina to move toward the 20-25% range that they maintained for years prior to the acquisition due to their stellar core business gross margin of 70%.

Valuation

With the two major levers covered, we can now move into the final DCF model for the firm.

Author’s DCF Model

The intrinsic value today of Illumina stands at $132.41 per share. I closely followed the forward guidance given by management to end with a year 10 revenue $11.359 billion. Since management didn’t guide beyond next year, I moderated the level to be 12% between years 2 – 4. Again, this is without factoring in GRAIL or Chemistry X. Because of the adjustments to operating margins, Illumina realized a FCFF of $1.571 billion. The discount rate in this DCF model was reflected as a low 6.67% cost of capital driven down thanks in part to their BAA3 bond rating. The risk-free rate at the time of this valuation was 2.89% and Illumina’s Equity Risk Premium was 5.07% due to its global exposure. ROIC, the metric for gauging the firms return on investment was adversely effected by the GRAIL acquisition resulting in a negative ROIC last year. This initially left a huge drag on the valuation, but I pumped up the sales to capital ratio with the assumption that this effect would normalize as GRAIL matures (or once the deal falls through). In the end, I gave this model a 4/5 confidence with an overall “par” sentiment throughout since I simply referred to management’s guidance.

Final Word

Ultimately I am going to issue a hold rating on the stock. While there is certainly an argument to be made that Illumina should be heralded as the “next Amazon” due to the immense potential from growth assets, I am steering clear until some of the clouding over the stock passes. It is worth noting that I also have an overall bearish view on the market in the near term and think that a further dip in share price is bound to come soon as risky equities continue to be sold into a recession. Thank you for taking the time to read this article and I hope it helped in some way!

Be the first to comment