jimfeng/E+ via Getty Images

Though it may seem old school, transportation of goods by rail is still a significant activity in most parts of the world. Today, one of the leading companies in this space when it comes to the production and sale of railroad freight car equipment is The Greenbrier Companies (NYSE:GBX). Over the past few years, the financial picture for the company has been rather mixed. A global economic slowdown caused by the COVID-19 pandemic hit business hard. Fast forward to today, and some of the data provided by management is incredibly bullish. At the same time, the company is also having a difficult time converting higher sales into attractive cash flows. That, combined with the uncertainty associated with another slowdown amidst high inflation and supply chain issues has led to shares falling quite a bit in recent months. While investors are right to be concerned, the data that we do have today suggests that shares might have some nice upside potential in the long run. It’s unlikely that the company will go under in the current environment, but it is very possible that some additional pain could be on the horizon. Short term, this could prove rather painful for investors. But for those who are focused on the long haul, now might be an excellent time to consider buying in.

Understanding The Greenbrier Companies

At its core, The Greenbrier Companies focuses largely on the production and sale of rail cars and other railroad equipment. To best understand the company, however, we should break it up into its three key segments. First and foremost, we have the Manufacturing segment. Through this, the company produces most freight railcar types that are currently used in the North American market. The only exception here is that it does not produce coal cars. Examples of products produced under this segment include conventional railcars, tank cars, intermodal railcars, and railcar equipment dedicated to the transportation of light vehicles. Throughout Europe, it also produces a variety of tank, automotive, and conventional freight railcar types. Plus it also produces oceangoing and river barges that are dedicated to the transportation of merchandise between ports within the US. During the company’s latest completed fiscal year, this segment was responsible for 76.1% of the company’s revenue and for 49.8% of its profits.

The next segment to pay attention to is called Wheels, Repair & Parts. Through this segment, the company provides wheel services throughout North America. Its shops provide complete wheel services like reconditioning of wheels and axles, as well as new axle machining, finishing, and downsizing. It also provides similar activities through a joint venture that falls under this segment. On top of this, the company provides railcar maintenance throughout North America and it reconditions and produces railcar cushioning units, couplers, yokes, side frames, and other related railcar parts. Last year, this segment was responsible for 16.4% of the company’s revenue but for only 4.4% of its profits. In the final segment is called Leasing & Services. In short, the company operates railcars on behalf of other clients, with a fleet under management of roughly 8,800 railcars. It also provides management services like railcar maintenance management, railcar accounting services, and other related activities. This segment accounted for 7.5% of the company’s revenue last year but was responsible for an impressive 45.8% of its profits.

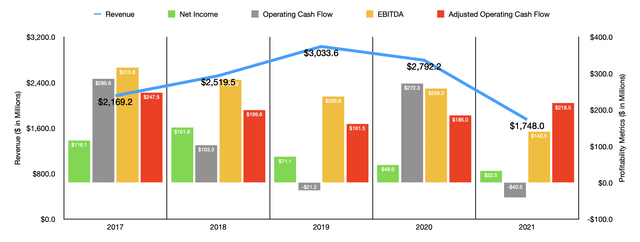

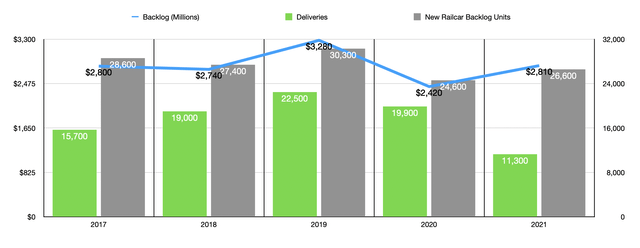

Author – SEC EDGAR Data

Financially speaking, the picture for The Greenbrier Companies has been quite mixed in recent years. After seeing revenue rise from $2.17 billion in 2017 to $3.03 billion in 2019, it began a consistent year-over-year decline. In 2021, revenue came in at just $1.75 billion. The primary culprit behind this decline was a drop in the number of deliveries of railcars. From 2017 to 2019, the company saw the number of deliveries rise from 15,700 to 22,500. But by 2021, this number had plummeted to just 11,300. Although the 2021 fiscal year proved to be very painful, there was some positive data. After seeing the number of new railcars in its backlog peak at 30,320 nineteen, this number dropped to 24,600 and 2020. But by the end of 2021, this number had grown back up to 26,600. As a result of this increase, the estimated revenue associated with the rail cars in its backlog increased from $2.42 billion in 2020 to $2.81 billion last year.

Author – SEC EDGAR Data

Profitability has also been a problem for the business. In four of the past five years, net income dropped year over year, declining from a peak of $151.8 million in 2018 to just $32.5 million in 2021. Operating cash flow has been all over the map, ranging from a low point of negative $40.5 million last year to a high point of $285.6 million in 2017. If we adjust for changes in working capital, however, cash flow has been rising since 2019, climbing from $161.5 million to $218.5 million. Even EBITDA has shown no real trend. Although it did drop between 2017 and 2019, it ticked up from $236.9 million in 2019 to $258.3 million in 2020 before plunging to $140.5 million last year.

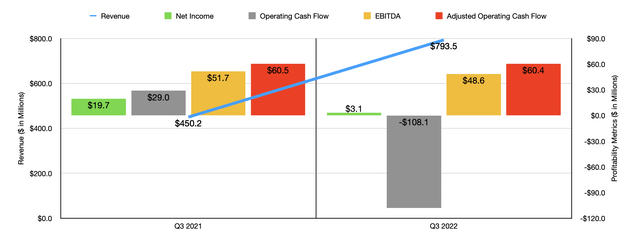

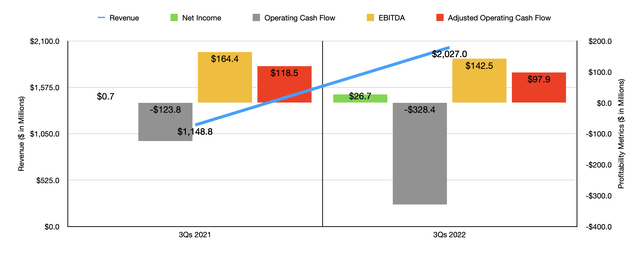

Author – SEC EDGAR Data

The good news for investors is that the 2022 fiscal year is, so far, looking up for the company from a number of angles. On July 11th of this year, management reported financial results covering the third quarter of the year. Sales came in at $793.5 million. That not only crushed the $450.2 million reported the same time one year earlier; it also beat expectations to the tune of $57.4 million. Revenue in the first nine months of its 2022 fiscal year came in at $2.03 billion. That’s nearly double the $1.15 billion reported the same time one year earlier. This increase was driven in large part by a rise in deliveries, with that number climbing from 7,200 in the first nine months of its 2021 fiscal year to 13,000 the same time this year. At the same time, the number of units in the company’s backlog jumped to 30,900, pushing estimated revenue associated with this backlog to $3.6 billion.

Author – SEC EDGAR Data

On the bottom line, things have been mixed. Net income in the latest quarter came in at just $3.1 million. That compares to the $19.7 million reported just one year earlier. On a per-share basis, the $0.09 that management reported fell far short of expectations to the tune of $0.48 per share. Operating cash flow went from a positive $29 million to a negative $108.1 million. If we adjust for changes in working capital, it would have ticked down only modestly from $60.5 million to $60.4 million. Meanwhile, EBITDA came in at $48.6 million. That’s down from the $51.7 million reported the same quarter one year earlier. For the full nine months reported for the current fiscal year, this situation does look slightly better. Net income of $26.7 million crushes the $0.7 million reported one year earlier. On the other hand, operating cash flow plunged from negative $123.8 million to negative $328.4 million. If we adjust for changes in working capital, this metric fared quite a bit better, dropping from $118.5 million to $97.9 million. At the same time, EBITDA dropped from $164.4 million to $142.5 million. Some investors may be worried about the impact that rising costs will have on the company. But management has assured investors that they have been successful in pushing these costs through to their end clients. This does not mean that this will remain the case. But the data so far is encouraging.

Author – SEC EDGAR Data

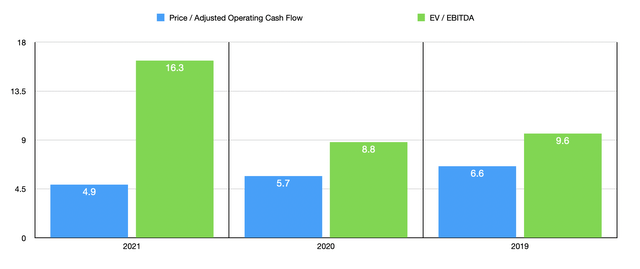

When it comes to valuing the company, I decided to look at it through the lens of its 2021 fiscal year. However, I also provided data for its 2020 and 2019 fiscal years. These can be seen in the chart above. In short, the firm is trading at a price to adjusted operating cash flow multiple of 4.9. And the EV to EBITDA multiple should come in at 16.3. To put the pricing of the company into perspective, I decided to compare to five similar firms. On a price-to-operating cash flow basis, four of the five companies had positive results, with multiples ranging from 3.8 to 83.1. Only one of the five companies was cheaper than The Greenbrier Companies. Meanwhile, using the EV to EBITDA approach, the range was from 3.8 to 101.8. Three of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Greenbrier Companies | 4.9 | 16.3 |

| Trinity Industries (TRN) | 3.8 | 14.1 |

| Manitex International (MNTX) | 71.7 | 38.3 |

| Twin Disc (TWIN) | 83.1 | 8.3 |

| Westport Fuel Systems (WPRT) | N/A | 3.8 |

| Vicinity Motor Corp. (VEV) | 20.8 | 101.8 |

Takeaway

At this point in time, I understand why investors are concerned about The Greenbrier Companies. An economic slowdown seems to be taking place and there are concerns about what inflation will do to demand for the company’s railcars and other products and services. Even so, revenue seems to be fine and backlog is robust. The company still expects to deliver between 18,500 and 19,500 railcars for the current fiscal year. Yes, profitability did miss expectations significantly in the latest quarter. But relative to similar firms, shares of the business do look to be quite cheap. All combined, I do think that shares are cheap enough to warrant some upside potential moving forward. I would make the case that there are probably better prospects on the market. But because of how cheap the stock is and the strong backlog it has to support it moving forward, I cannot help but to rate this a soft ‘buy’ at this time.

Be the first to comment