ArtistGNDphotography/E+ via Getty Images

Investment Thesis

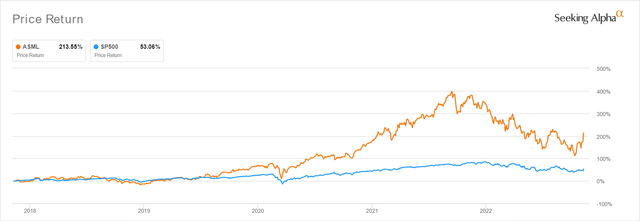

ASML 5Y Stock Price

Seeking Alpha

ASML Holding (NASDAQ:ASML) has reached our price targets of low $400s during the recent destruction in mid-October 2022, which triggered our initial portfolio position. Market analysts are also overwhelmingly optimistic about ASML’s upgraded guidance, causing its share price to rally 47.91% since the recent bottom.

There is definitely more confidence in the market now than it was earlier in the year, since the October CPI report has finally shown that the Feds’ previously hawkish stance is working. The upbeat results have caused the S&P 500 Index to lift by 5.54% on 10 October 2022, while ASML further rallied by 14.57%. With 85.4% of analysts predicting a 50 basis points hike by December, similar to the Bank of Canada’s recent moderation, Mr. Market seems confident that the Fed will pivot soon.

Therefore, we may have seen the last of the market’s bottom and be on the cusp of a long-term recovery. Time will tell, since ASML will naturally outperform moving forward, with the stock market always being forward-looking.

ASML Reported Record €38B Backlog, Despite The Destruction Of Semi Demand

By its FQ3’22 earnings call, ASML reported a record-breaking €8.9B of bookings and over €38B in the backlog. These numbers indicated tremendous YoY growth of 43.54% and 200%, respectively, while accounting for over 600 DUV scanners and 100 EUV scanners. Therefore, we expect delivery to be well staggered through 2024, due to its projected annual capacity of 375 DUV and 60 EUV machines by 2023.

ASML also guided a growing deferred revenue of €6.4B from fast shipments in FQ4’22 against €4.9B in FQ1’22, despite the easing in the global supply chain issues thus far. As a result, indicating the insatiable global demand for its products and the consequent semiconductor chips, despite the peak recessionary fears, and supposed destruction of demand.

Part of the phenomenon is obviously attributed to the growing capital expenditure from American companies seeking independence from Taiwan Semiconductor (TSM) in manufacturing. Intel (INTC) would likely account for much of ASML’s backlog, due to the former’s ambitious plan to be the no 2 foundry globally by 2030. INTC has already poured over $80B in multiple chip facilities in the US, the EU, and Ireland, on top of acquiring Tower Semiconductor for $5.4B in Q1’22. Naturally benefiting from the Chips Act, the company would likely receive more than a few billion in federal funding and tax breaks, much of which will be put into leading-edge equipment purchases from ASML.

Micron (MU) would likely be another ASML customer, since it is building two new fabs in Utah and New York for 2025 completion, with another in Japan for 2023. Naturally, we cannot forget TSM’s foray in Arizona and Samsung’s aggressive expansion with $32B in investments through 2023. The ongoing global digital transformation and electrification efforts are obviously not decimated by the recessionary fears, due to ASML’s aggressive ramp-up in output for 2025 and beyond. The company is now actively guiding an annual production capacity of 90 units for 0.33 of low NA EUV and 600 units for DPV, with an unspecified sum for 0.55 High-NA EUV. ASML’s chief financial officer Roger Dassen, said:

But I have to say the lion’s share of our customers really keeps on pushing us in terms of getting the tools and getting them sooner rather than later. There is a few customers that are indicating a preference for some delay but the lion’s share of the customers are really pushing and they are raising their hands to say, if there is a delay someplace else, then please get the tools to us even earlier… I think clearly, the secular trends – as we always call them – are very much intact. I mean, customers really want to make those technology transitions. They really are building capacity also beyond 2023. And also there is still this element of tech sovereignty that we’ve been talking about. The fact that governments want to be more self-sufficient in their semiconductor manufacturing. (ASML)

Therefore, ASML investors have much to be happy about its upgraded FY2025 revenues of up to €40B, given the impressive top-line CAGR of 21.08%, compared to the previous projection of 12.68%. Furthermore, these numbers indicate accelerated normalized growth of 22.53% between FY2019 and FY2025, against pre-pandemic levels of 14.3% and hyper-pandemic levels of 25.4%.

We also expect to see an upwards rerating in ASML’s profitability, with gross margins reaching 56% by 2025, compared to FY2019 levels of 44.7% and FY2021 levels of 52.7%. The company would likely report a stellar net income of €12.96B and Free Cash Flow generation of €11.16B by 2025, with impressive margins of 32.4% and 27.9%, respectively. Thereby, representing an excellent normalized CAGR of 30.78% and 28.32% between FY2019 and FY2025.

ASML’s €12B share buyback program through 2025 also indicated a very optimistic outlook ahead, due to the 12x fold increase from the previous €1B authorization through 2023. Thereby, representing the sustained long-term demand for semiconductor equipment despite the short-term recession. Those that had similarly loaded the stock at previous lows of $400 would also be looking at an excellent dividend yield of 1.65%, against its 4Y average of 0.87% and sector median of 1.44%. Otherwise, decent yields of 1.18% based on its current stock prices, with stellar 5Y total price returns of 226.1% and 10Y returns of 1,278.1%.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- ASML Is Recovering From Malaise – Bull Run May Be Coming

- ASML: The Bursting Of The Semi Stock Bubble

So, Is ASML Stock A Buy, Sell, or Hold?

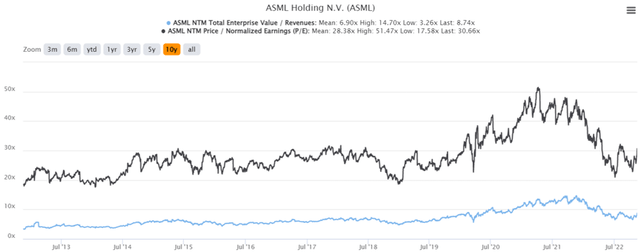

ASML 10Y EV/Revenue and P/E Valuations

S&P Capital IQ

ASML is currently trading at an EV/NTM Revenue of 8.74x and NTM P/E of 30.66x, higher than its 10Y mean of 6.90x and 28.38x, respectively. The stock is also trading at $560.79, down -36.35% from its 52 weeks high of $881.12, though at a premium of 54.42% from its 52 weeks low of $363.15. Nonetheless, consensus estimates remain confident about ASML’s growth, given their price target of $610.00 and an 8.78% upside from current prices.

In the meantime, investors with higher risk tolerance and long-term trajectory may still nibble at current levels, since ASML will remain highly relevant through the next decade. Since the stock has been drastically moderated from previous hyper-pandemic levels, it remains a value buy for the next decade’s portfolio growth and investing. Bottom-fishing investors who have missed the previous $400 may not get a similar chance, assuming a Fed’s pivot by December. Otherwise, best of luck waiting for those bottom levels.

Be the first to comment