JHVEPhoto

Thesis

Google (NASDAQ:GOOG, NASDAQ:GOOGL) employees have been anxious over the past month after seeing Meta Platforms (META) and Amazon (AMZN) implementing significant layoffs to reduce their cost base.

Activist investor TCI Fund Management leveraged the momentum from the recent tech layoffs calling on Google’s management to slash its cost base to lift its operating leverage.

While Google indicated in its Q3 earnings commentary that it would channel its resources on its most important priorities, it had yet to suggest that slashing headcount was an immediate priority.

Notwithstanding, The Information reported recently that Google had revised its performance management system, potentially placing 6% of its employees into the “low-performance” zone. Hence, Google’s adjustment suggests that some headcount reduction could occur in 2023.

Furthermore, Google Cloud has also reportedly tweaked its commission model for its sales teams. Accordingly, its revisions could align Google Cloud’s compensation model closer to its hyperscaler peers by focusing on consumption rather than deal value. While it could help reduce its remuneration costs, the impact on its competitiveness is uncertain.

Therefore, we don’t believe Google has been standing still while its tech peers moving aggressively to slash costs. In contrast, we believe Google is undergoing a growth normalization phase that should stabilize in 2023, mitigating the impact on its operating leverage.

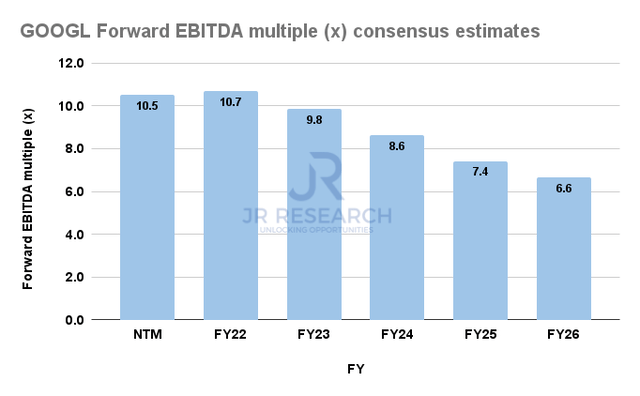

GOOGL last traded at an FY24 EBITDA of 8.6x, well below its 10Y average of 10.5x. Therefore, we postulate there’s significant potential for re-rating as it laps highly challenging comps from FY23.

Maintain Buy.

Google’s Cost Base Still Looks Reasonably Well-Controlled

TCI highlighted in its letter to CEO Sundar Pichai that it was not satisfied with Google’s growth in OpEx. It articulated:

We are writing to express our view that the cost base of Alphabet is too high and management needs to take aggressive action. A highly bloated cost base doesn’t serve the ability of a company to reinvest and for the stock price to appreciate. – WSJ

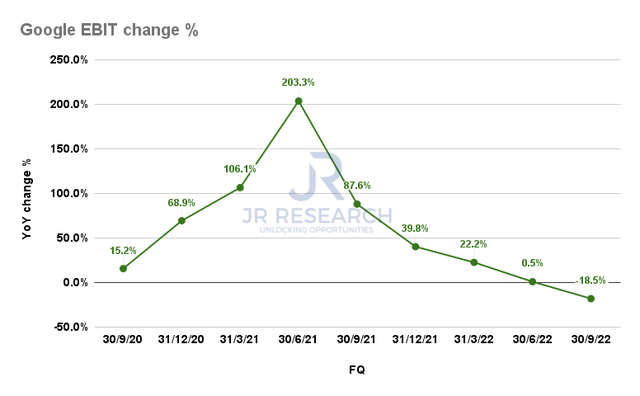

Google EBIT change % (S&P Cap IQ)

As seen above, Google posted an EBIT growth of -18.5% YoY in FQ3, down significantly from last year’s 87.6% increase. It’s also down markedly from Q2FY21’s high of 203% growth, as Google benefited tremendously from the pandemic-induced growth.

Hence, a significant moderation from the highs should be expected, as Google’s advertising growth slowed over the past year. But, the critical question is whether Google grew its OpEx base well ahead of itself over this period.

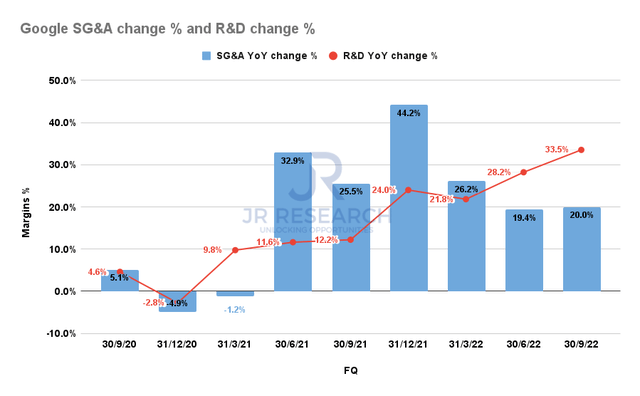

Google SG&A change % and R&D change % (S&P Cap IQ)

Google’s SG&A grew by 32.9% in FQ2’21, while its R&D increased by 11.6% over the same period. Hence, Google didn’t invest aggressively as it could have, which helped it to post a record surge in EBIT.

Of course, the moderation from the highs in Q2’21 has caught the eye of the market and investors like TCI. Google has continued to increase its R&D expense, growing nearly 34% in FQ3’22 and in an uptrend. However, its SG&A growth has fallen markedly from the highs of 2021, partially offsetting the increase in R&D.

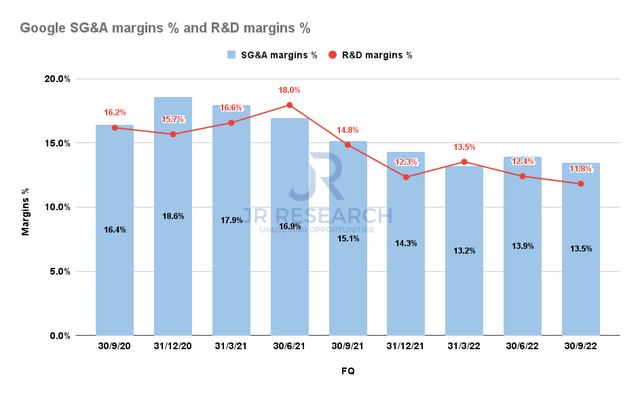

Google SG&A margins % and R&D margins % (S&P Cap IQ)

Therefore, as seen above, we didn’t glean anything amiss from Google’s SG&A and R&D margins. The company has been relatively consistent in its expense management, and both segment margins have been trending down.

As such, Google’s EBIT was hit hard as topline growth slowed significantly from its 2021 highs, even though its expense base has been relatively consistent. As such, the pressure is on Google to reaccelerate its operating leverage moving ahead while retaining its talent and R&D edge.

Furthermore, TikTok (BDNCE) has also lowered its revenue target from $12B for FY22 down to $10B, representing a 16.7% reduction. However, eMarketer’s forecast suggests that TikTok’s revenue growth could reach $14.15B in 2023, up nearly 41.5% from FY22’s revised outlook. Hence, competition from TikTok will likely get even more intensive, not less, as the ad industry attempts its recovery from 2022’s malaise.

YouTube remains in pole position for now as it looks to curb the rise of TikTok. Nevertheless, it needs to deal with TikTok’s increasing ambitions in long-form music and podcasting while staking its share in e-commerce through TikTok Shop.

Hence, TikTok is broadening its growth drivers across the tech ecosystem as Google looks to lift its AI-driven investments to protect its competitive edge. Therefore, we believe Google still needs to prove its ability to navigate a highly challenging landscape worsened by significant macroeconomic headwinds. There’s no doubt about that.

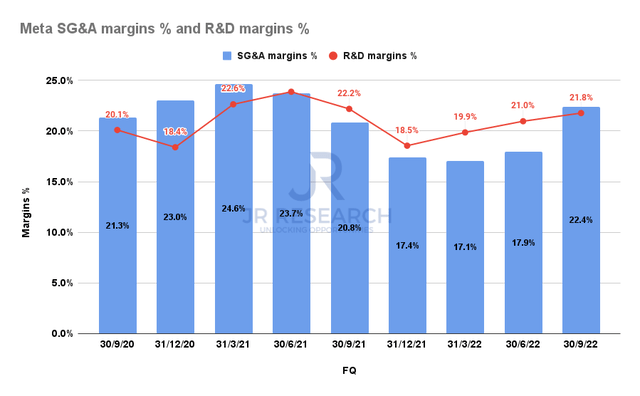

Meta SG&A margins % and R&D margins % (S&P Cap IQ)

However, we don’t think Pichai and team have “bloated” their OpEx base so significantly that they couldn’t reaccelerate its operating leverage. Unlike Meta Platforms (as seen above), which saw its OpEx base creeping higher over the past three quarters, even as revenue growth slowed dramatically.

Is GOOGL Stock A Buy, Sell, Or Hold?

GOOGL Forward EBITDA multiples valuation trend (S&P Cap IQ)

We believe the critical question is whether investors have confidence in Pichai and team in lifting its revenue growth moving ahead, despite significant macro and competitive headwinds.

Based on the revised consensus estimates, GOOGL last traded at an FY24 EBITDA multiple of 8.6x. Hence, we believe the market has already reflected significant uncertainties in its execution. Nevertheless, Google must demonstrate that it could return to profitability growth over the next two years for a material re-rating.

However, investors need to understand that the market is forward-looking. By the time it recovers its growth momentum, we believe its EBITDA multiple will likely be above its 10Y average, and a fantastic entry opportunity (such as now) will no longer be available.

We are confident in Google’s execution and OpEx discipline, as discussed earlier. Maintain Buy.

Be the first to comment