Maskot

Shares of targeted protein degradation pioneer Arvinas (NASDAQ:ARVN) have nearly tripled from IPO price point of $16 back in 2018. On the other hand, so far in 2022 shares have fallen by 45%.

While I’ve been highly interested in the protein degradation space of late (feels like the early innings of RNAi), the majority of companies participating in this theme are too speculative for me to gain exposure to.

Arvinas, at first glance, would seem to offer us a better mix of stability and upside given cash position of over $1.3 billion, resultingly low enterprise value of $1 billion, global collaboration with big pharmaceutical giant Pfizer (PFE) and multiple shots on goal within the multi-faceted pipeline (expanding into other areas outside of oncology).

Let’s dig deeper to determine if this one meets our criteria for ROTY, including validating data sets and accelerating clinical momentum.

Chart

Corporate Slides

Figure 1: ARVN weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares gap up in late 2020 on the heels of positive interim phase 1 data for ARV-471 in metastatic ER+/HER2- breast cancer. From there, shares briefly peaked above $100 before gradually falling back to $45 presently. My initial take is that a bottom has been established at $40, and barring any negative news investors interested in this name could do well to buy a pilot position at current levels as clinical momentum accelerates for both prostate and breast cancer programs.

Overview

Founded in 2013 with headquarters in Connecticut (280 employees), the company’s lead program is the Estrogen Receptor (ER) PROTAC drug for ER+ HER2- breast cancer.

Corporate Slides

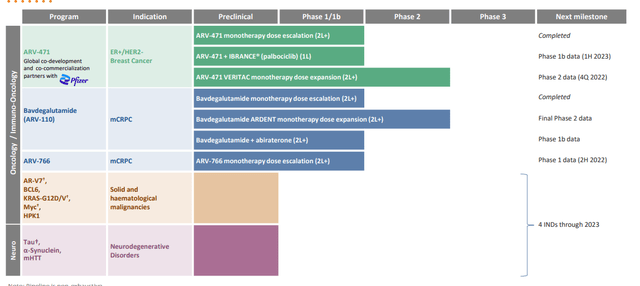

Figure 2: Pipeline (Source: corporate presentation)

At Goldman Sachs Global Healthcare Conference presentation, analyst notes that several SERD inhibitors in this space have failed recently. So, the devil’s advocate question is why ARV-471 should have success where these peers have produced disappointing results. Management responds that 471 is unique in this space in that it’s the only PROTAC. Preclinically, they have a lot of confidence that it will degrade better than competitor compounds. The goal for the industry over the past 20 years has been to create a better version of fulvestrant (achieved over $1 billion in global sales at peak in 2018 before generic competition came to market). Also, setbacks of competitors to a degree helps alleviate competitive fears in the 2nd line space.

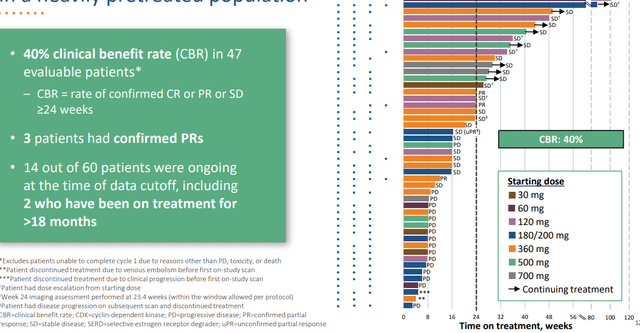

With the usual caveats for comparing across trials, Arvinas’ patients were much later line than many others, all prior CDK4/6 treatment, 80% with prior fulvestrant, 80% with prior chemotherapy and still had over 40% CBR (clinical benefit rate).

Corporate Slides

Figure 3: Promising 40% CBR achieved for ARV-471 in heavily pretreated population (Source: corporate presentation)

Personally, I’m still not a fan of using this endpoint as opposed to more traditional ones like ORR (response rate) and OS (overall survival). In that respect, ORR was just 7.9%, a number that is far from promising to my eyes. While in the image above we can see some patients with stable disease staying on treatment for a respectable amount of time, overall durability is not remarkable in the least. Also, I do not see much of a dose response. On the pro side, safety profile looks quite clean with discontinuation rate and dose reduction in just 2% of patients.

Starting with preclinical data, management showed that better degradation led to better responses. That was true for 471 as well as competitors. However, in the clinic no one has shown dose dependency on ER degradation for benefit (not because it’s not there, but because there is very little data). Best data to argue better degradation leads to better results starts with fulvestrant itself, which started at 250mg then was increased to 500mg (which in turn led to better benefit and degradation increased from mid 20s to 40% or so). So far in the clinic Arvinas has shown degradation of around 60% (preclinical was over 90%).

Phase 2 study is ongoing with data coming by the end of the year, but it is not gating (with partner Pfizer they will start two pivotal studies by the end of the year with monotherapy and combination in metastatic breast cancer). Keep in mind under the Pfizer deal terms, Arvinas receives a 50% split of global profits as well as up to $1.4B in milestone payments (already received $1B in upfront payment & equity investment).

As far as what they need to see in phase 2 data relative to current treatments, again this trial is not about gating and more about dose finding (testing out 250mg and 500mg). Management would like to see excellent tolerability continue and 40%+ CBR rate (higher than what you would expect given that only a third of these patients are driven by ER). The lack of a “go forward signal” and guidance in this manner as well as very low bar that the company is setting forth are a possible red flag to my eyes.

Referring to landmark results for Daiichi (OTCPK:DSKYF) and AstraZeneca (AZN) for their Enhertu trial in HER2 low patients, management points out that Enhertu data was in later line patients than Arvinas’ trial. They also think that most doctors will start with an ER access therapy before moving to that. So, they don’t see it as competitive but again keeping an eye on it as practice changes. To my eyes, it’s certainly a competitive threat and could reduce market opportunity for Arvinas, but management puts on a brave face nonetheless. Right now, they see Enhertu as more of a potential combination partner than a competitor.

Together with Pfizer Arvinas is starting an umbrella study this year with multiple combination agents. There is an ongoing phase 1b study for 471 combined with Ibrance (CDK4/6 inhibitor) and they will have data by the end of the year (safety and dose finding study). There are very few benchmarks for this combo. As for other potential combination agents, they could be Pfizer or non-Pfizer products (goal is to make 471 the backbone of care across lines of study). As for safety of this combo, preclinical data does not point to added toxicity so far but burden of proof is on the human results. Efficacy would be great, but main goal is determining PK/PD (again, I don’t like how they set the bar low or simply avoid setting expectations at all).

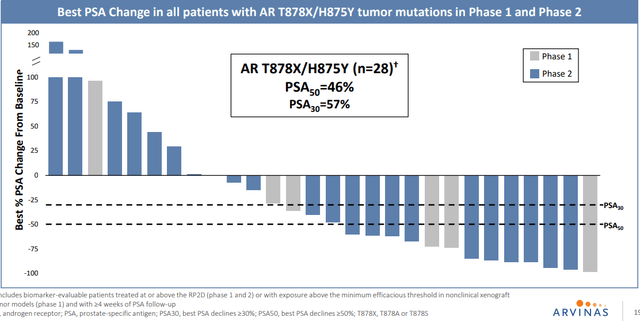

Moving on to AR-degrader bavdegalutamide (bav) in metastatic prostate cancer, they saw a clinical signal in late 2020 that showed a fairly high 40% PSA50 rate in group of patients with AR T878X/H875Y tumor mutations.

Corporate Slides

Figure 4: 46% PSA50 in all patients with AR T878X/H875Y tumor mutations in P1 and P2 expansion subgroups (Source: corporate presentation)

That was enough of a signal to go ahead and design a phase 2 study around, to look specifically at that population (trying to get into more AR-dependent population via less-pretreated group). They hope to start a pivotal study by the end of the year in that 875/878 group. To my eyes, durability looks decent but not amazing (43% of patients on drug for over 6 months) and while they achieved tumor reductions in 6 of 7 patients in these subgroups, only 2 had actual RECIST responses. When asked how big of a population (and opportunity) the data points to, management responds that the literature points to maybe 5% of overall prostate population each for 878 and 875. However, in the company’s study it was closer to 20% and could be consistent with what others are seeing including KOLs (because as enzalutamide and other therapies move earlier, they get more patients with this profile as it arises as a resistance mechanism to AR-targeted therapy).

Phase 2 was released in February (over 100 patients) which was enough to convince them to pursue accelerated approval pivotal study (trial enriched for 875/878 group and signed a collaboration with Foundation Medicine to this end). Data shown so far has been on PSA50 (not an approval endpoint) and pivotal study would be directed toward response rate or PFS. Prior objective to move forward was PSA50 25% or above and they ended up with above 40% (still think the bar has been set low). As for path forward in earlier lines of therapy, could be monotherapy as well as combinations (pre NHA/novel hormonal agent space). This would be broadly directed and not to the aforementioned specific mutations.

As for their other programs in AR, ARV-766 started as the backup to bav and hits the L702H mutation (the one well-known resistance driving point mutation that bav does not hit). That equates to 3% to 9% of patients (could be increasing with prior therapy by NHAs). Initial hypothesis is simply a molecule that looks like bav but hits that mutation (not sure if there are other differences that indicate a broader profile than bav as well, will see in the data).

As for their 3rd AR drug, AR-V7 is a splice variant of AR which is not degraded by bav or most other AR-targeting therapies. V7 degrader would be targeted toward the other end of AR and if successful would degrade V7 and all forms of AR. Most companies have had very little success targeting this so far, and this is a farther out goal than 766 (next generation play).

As for the company’s broader AR strategy, they’ve gotten beyond 766 as a backup molecule. They think of each agent as complementary (not competing for same populations). Bav could be targeted as late line therapy and 766 goes for earlier lines. One could be used for other AR-driven diseases in oncology or outside of oncology as well. Next year’s phase 2 data for 766 will allow them to compare and contrast the two to find the difference and determine whether it’s broader or not.

Triple negative breast and ovarian are also known to have an AR element to them, and outside of oncology there’s polycystic ovarian and other indications that could present opportunities for Arvinas. Existing anti-androgens are not being used in those areas and there’s very little data to-date.

As for timing for additional program rollouts outside of ER and AR, management is guiding for 4 INDs to the end of 2023 (for both oncology and neuroscience). KRAS is getting a lot of attention and they’ve shown a bit of data for G12C program they had, but now they’ve pivoted to multi-faceted (G12D, G12V or even pan-KRAS to hit multiple mutations). G12C space is looking increasingly crowded, so it’s a good thing they pivoted to related targets and applied learnings from initial program there. They already showed they could degrade KRAS G12C very well, did it with covalently-bound PROTAC but did not have enough benefit over an inhibitor to be useful. For targets where they can create a good enough inhibitor, there is not a need for a PROTAC. G12D & V programs would use traditional reversible PROTAC, not covalently bound.

As for other opportunities and areas for PROTACs to be developed, they have a joint venture with Bayer (OTCPK:BAYRY) called EarthBio (did not anticipate originally moving into plants and agriculture, but they also have E3 ligases). JV is going well. They are very much focused on oncology and neuroscience, also have targets in immuno-oncology (HPK1) and immunology. There is lots of space and they do not need to do everything. Further partnerships are likely to expand the value of the platform as opposed to going it solo. They also use Pfizer collaboration as an example, where Arvinas had the cash and was content to go it alone. However, Pfizer convinced them it would be more beneficial to join efforts and go more broadly than otherwise would be possible.

Public pipeline has 10 to 12 programs, up to 25 or so when undisclosed are included (everything is moving ahead, nothing is lying in waiting). Vast majority of programs seen in pipeline will be developed in-house and they feel pretty confident about their abilities. Making a PROTAC has ceased to be difficult (many academic labs can do it), but creating one that works as a drug with drug-like properties (safe, tolerable, etc.) has been more difficult. They did an AI partnership in Fall, have done other collaborations to look for places to stay ahead in target discovery (BD efforts are focused on enhancing the platform).

As for reasons to own the stock in the next 12 months, management notes they will have 3 pivotal studies ongoing, proof of concept for a 3rd clinical programs and a couple more programs entering the clinic with supportive data.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $1.347B (decrease of $159M over the first six months of the year). Net loss for the quarter rose to $70M, while research and development expenses nearly doubled to $75M. General and administrative expenses rose to $24M. As for operational runway, management is guiding for ample cash to support “multiple years beyond 2024”.

Management reiterated that they are on track to initiate two pivotal programs with ARV-471 in metastatic breast cancer 2H 22 as well as pursue phase 2 study for ARV-766 in molecularly defined metastatic castration-resistant prostate cancer. For the latter, a productive meeting with the FDA led management to pursue this pathway which could lead to the fastest potential path to approval for patients both inside and outside the US. As one would expect, the single arm phase 2 study (hope of getting accelerated approval) would be followed by a confirmatory phase 3 study needed for full approval (to start in 2H 23, also in patients with AR T878X/875Y tumor mutations). Management also notes that final dose selection for the phase 3 study will be based on data from additional patients in the ongoing phase 1/2 study (likely confirms the 400mg dose).

For ARV-471, it’s evident to see Pfizer’s hand in the planning of aggressive clinical studies across multiple settings. In Q4, they will present data from the VERITAC phase 2 expansion study (200mg and 500mg).

2H 22 Arvinas will initiate 5 studies – phase 3 monotherapy, phase 3 combo, phase 1b combination with CDK inhibitors or other targeted therapies, phase 1b combination with everolimus and phase 2 neoadjuvant study in patients with early breast cancer. Early data from the palbociclib combination will be presented at medical conference 1H 23, but as this is primarily for the purpose of safety expectations are low.

Not to be forgotten, phase 1 data for ARV-766 in mCRPC is expected in 2H 22 with phase 2 expansion study to initiate before the end of the year as well.

Strengthening of management team in August could be considered a green flag as well, with newly created position of Chief Commercial Officer going to John Northcott (prior experience includes leading development and commercialization for Avastin and Imbruvica). He served as CCO for Pharmacyclics and also held commercial leadership positions at Genentech and Pfizer. Lisa Sinclair was appointed as SVP Corporate Operations (prior served as Head of Commercial Strategy at Rallybio and VP of R&D Strategy at Alexion, AstraZeneca Rare Disease. Prior she also served as VP Global R&D Portfolio at AstraZeneca. It’s always comforting to see leadership lineup headed by those with relevant experience in these areas.

As for SERD competition in ER+ HER2- breast cancer for ARV-471, Zentalis Pharmaceuticals (ZNTL) discontinued its oral SERD program. Sanofi discontinued its oral Serd amcenestrant on August 17th.

Several competitors will have important data sets coming soon, including pivotal results for AstraZeneca’s camizestrant 1H 23 and Eli Lilly’s imlunestrant by the middle of 2023. Radius’/Menarini’s elacestrant has already filed for regulatory review for 2nd and 3rd line indications after showing statistically significant improvement in efficacy over standard of care for overall study population as well as in patients with ESR1 mutation. Specifically, risk of disease progression or death was reduced by 30% in all patients and by 45% in those with ESR1 mutation.

As for institutional investors of note, Avidity Partners owns 6.1% stake and EcoR1 Capital owns 5.9% stake. Pfizer also owns a 6.6% stake.

As for insiders, President and CEO John Houston owns over 840,000 shares.

As for leadership lineup and previous experience, I touched on two key new hires above. President and CEO John Houston served prior as SVP of Specialty Discovery at Bristol-Myers Squibb (BMY). VP of Oncology Clinical Research Debbie Chirnomas served prior as Global Medical Head at Pfizer for Xtandi and Clinical Lead for Mylotarg. Chief Medical Officer Ron Peck served prior as SVP Clinical Research at Tesaro (bought out by GSK for $5 billion). Not to read between the lines, but it was interesting in August to see John Young join the board of directors (35 years at Pfizer including positions of Senior Advisor and Chief Business Officer).

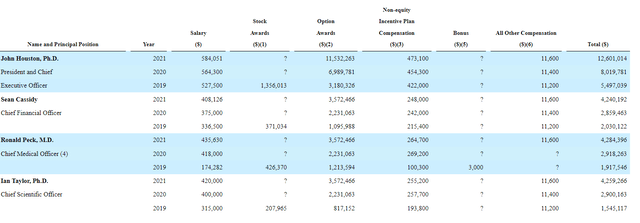

Moving on to executive compensation, cash component appears to be in the normal range for a company this size. Similarly, stock and options awards appear sufficient but not excessive on the whole.

Proxy Filing

Figure 5: Executive compensation table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for prior financings, December 2020 stock offering took place at $70 per share (50% higher than current levels).

As for IP, Arvinas has issued composition of matter patents for ARV-471 and pending applications for composition of matter patents for ARV-766. Company’s current IP estate includes 29 issued U.S. patents, 48 granted foreign patents, and 328 pending patent applications. With key patents expiring in mid 2030s to early 2040s, strength of IP is evident here.

Final Thoughts

To conclude, while I’m a fan of the protein degradation theme and would like to gain exposure to it, I’m not sure I can get on board with Arvinas as an investment at least in the near term. I did not like the low bar set by management for upcoming data sets, not to mention increasingly heavy competition in areas they are pursuing such as prostate cancer and ER+HER2- breast cancer. I appreciated that apparently they’ve gotten the FDA on board for a possible accelerated approval pathway in mutation-specific groups in prostate (efficient way to get to market).

It’s always possible that reading into the tea leaves, the new board member is a first step in eventual buyout by partner Pfizer. However, long time readers know that M&A appeal alone is not enough to interest me in a company. Arvinas, to its credit, has shown that PROTACS can be drugs and keeps churning them out (programs in potentially lucrative areas such as KRAS and neurodegenerative diseases to enter the clinic in coming years). I need data that “wows” me and I have not seen it here yet.

For readers who are interested in the story and have done their due diligence, I still cannot recommend purchasing a position here as I view risk/reward profile to be either balanced or unfavorable.

From an ROTY perspective (focus on next 12 months), I might revisit the story in a year or so to see how the pipeline has progressed including additional data updates and the clinical plan for newer assets entering phase 1 studies.

Key risks here include fierce competition in indications being pursued such as breast and prostate cancer, as treatment landscape is evolving at an expedited pace and I think companies need truly game-changing data to be able to keep up. Dilution does not appear to be a concern in the near term, given the company’s strong cash position and current burn rate. Setbacks in the clinic whether delays or disappointing data would weigh on shares, as would any possible negative developments for ongoing partnerships including with Pfizer.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful.

Be the first to comment