Oat_Phawat

Part I – Introduction

Canada-based New Gold Inc. (NYSE:NGD) released its second-quarter 2022 results on August 4, 2022.

Note: This article is an update of my article published on July 13, 2022. I have followed NGD on Seeking Alpha since January 2019.

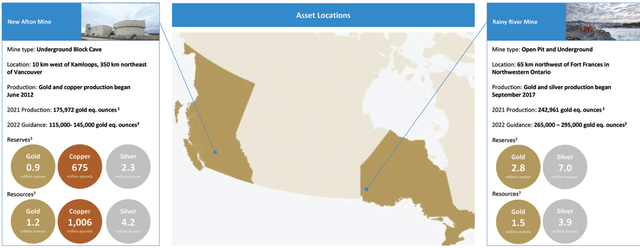

NGD Map Presentation (New Gold)

1 – 2Q22 Results highlights

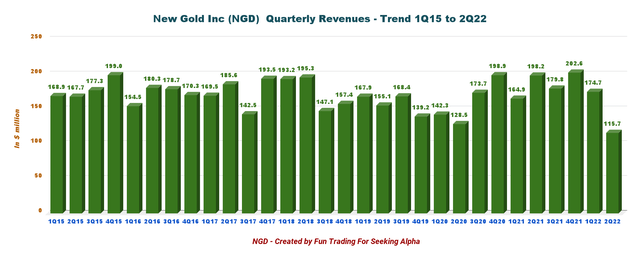

Revenues for the second quarter of 2022 decreased significantly from $198.2 million to $115.7 million due to lower gold and copper sales, partially offset by higher realized gold prices.

Lower sales in the quarter were impacted by the timing of concentrate shipments at New Afton of approximately 7,500 gold eq. Ounces which have been deferred to the third quarter.

The company posted a net loss of $37.9 million compared to a loss of $15.8 million in 2Q21. Adjusted net loss was $16.7 million from an income of $26.7 million in 2Q21.

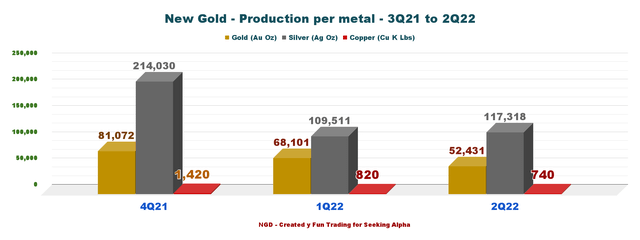

Gold equivalent production for the quarter was 70,514 ounces (52,431 ounces of gold, 7.4 million pounds of copper, and 117,318 ounces of silver). All-in sustaining costs AISC were $2,373 per GEO in 2Q22, including total cash costs of $1,296 per GEO.

Heavy rainfall affected the Rainy River mine, which experienced flooding in the open pit and impacted the mine plan, and led to lower gold production for 2Q22.

Also, at New Afton, underground tonnes mined per day decreased over the prior-year periods due to the planned completion of Lift mining activities and the closure of the low-grade-higher cost recovery level zone in June, earlier than planned. The production ramp-up of the B3 zone continued on schedule during the quarter, with development expected to be completed by September.

It was a terrible quarter in terms of gold production, and the stock tumbled to its lowest point on a one-year basis on the news. As a result, 2022 operational and cost guidance were updated to reflect the changes in the plan and related cost impact and other factors.

My investment thesis has not changed since my prior article on July 13. I believe the stock is essentially a trading opportunity but should not be considered a long-term investment. New Gold’s assets are weak and technical issues are recurring often, increasing the risk of holding the stock. However, it is clear that the company will probably announce better gold production in the third quarter since most of the technical problems have now been resolved.

CEO Renaud Adams said in the conference call:

Production and mine sequencing were impacted by heavy rainfall resulting in the flooding of the pit. While significant progress has been made to date to restore the situation and optimize each step moving forward,

2 – Stock Performance

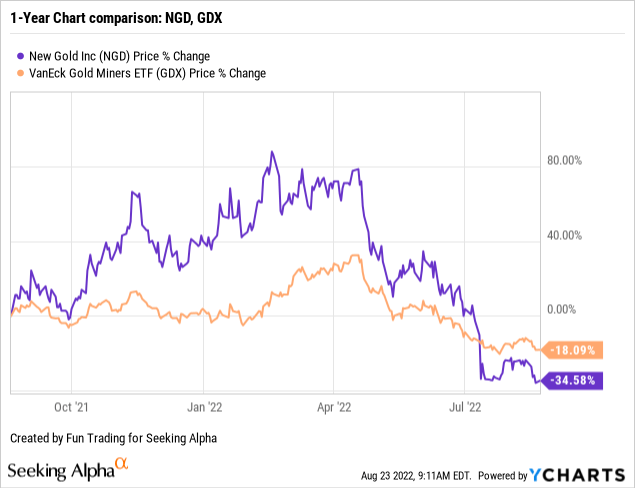

NGD has underperformed the VanEck Vectors Gold Miners ETF (GDX). NGD is now down 35% on a one-year basis.

3 – Gold Production Details For The Second Quarter Of 2022

Note: The gold production has been covered in my preceding article on July 11, 2022. This part is an update of this preceding article.

1 – The raw numbers

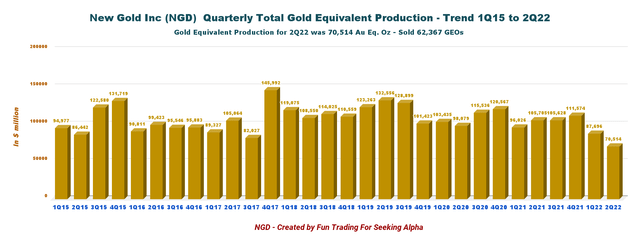

NGD Quarterly Gold equivalent production history (Fun Trading)

NGD produced 70,514 GEOs during the second quarter. The production of gold equivalent ounces GEO includes gold, silver, and copper. Also, adding even more salt to the wood, the company said it sold 62,367 GEOs in 2Q22. The reason was an unfortunate timing in sales.

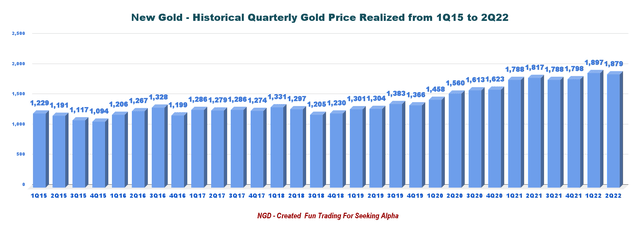

The gold price realized for 2Q22 was $1,879 per ounce.

NGD Quarterly Gold Price history (Fun Trading )

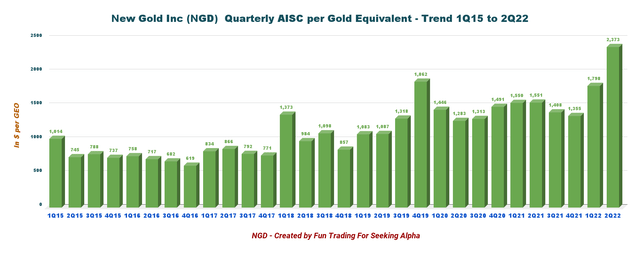

AISC was $2,373 per ounce, which is terrible and should come down to a more reasonable valuation. The spike was due to the low production sold this quarter due to a timing delay at the New Afton mine and the temporary flooding experienced at the Rainy River mine.

NGD Quarterly AISC history (Fun Trading)

Below is shown the production for the past three quarters and per metal:

NGD Quarterly production per metal 4Q21 to 2Q22 (Fun Trading)

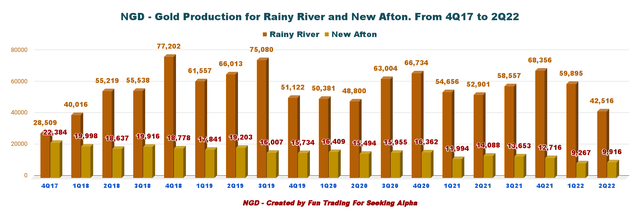

Gold production for the Rainy River mine was 42,516 Au ounces and 9,916 Au ounces for the New Afton mine.

NGD Gold production per mine 2Q22 (Fun Trading)

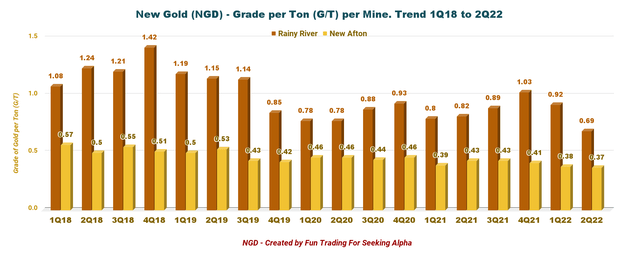

The gold production was 52,431 Au ounces, a multi-year low. Furthermore, because of the ore used in Rainy River, the grade per tonne was significantly lower this quarter. Unfortunately, it was also the case for the New Afton mine.

NGD Quarterly Grade per mine history (Fun Trading)

2 – What happened?

2.1 – Rainy River

The company indicated that the operations at the Rainy River were adversely impacted by heavy rainfall and flooding. The total tonnes mined from the open pit were lower because the company utilized the low-grade ore material during the quarter producing lower gold ounces. However,

The lower tonnes mined (ore and waste) year-to-date has caused a change to the mine plan for the remainder of 2022… This change requires the operation to continue to process low-grade ore material in the second half of 2022 – (earlier press release).

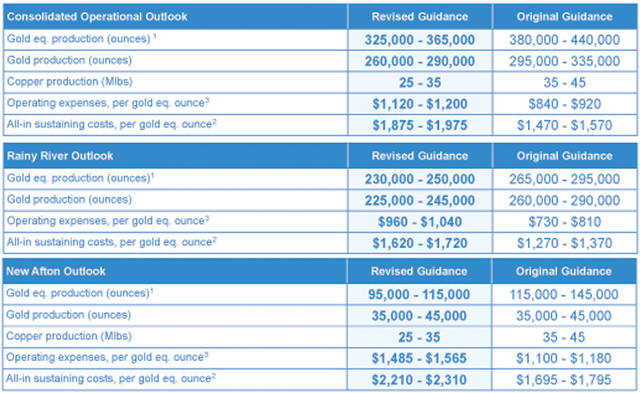

This operating change has forced the company to revise and lower the Rainy River’s gold equivalent production for 2022. It is now expected to be between 230K to 250K GEOs from 265K to 295K GEOs.

Moreover, operating expenses per GEO are forecasted to be between $960 to $1,040 per GEO, from $730 to $810 per GEO. The increase is due to the lower gold production and current inflationary cost pressures.

Finally, all-in sustaining costs AISC are expected to be between $1,620 to $1,720 per GEO, from $1,270 to $1,370 per GEO.

NGD 2022 new guidance (New Gold Press release)

2.2 – New Afton

The company focused on B3 and C-Zone development and closed the low-grade-higher cost recovery zone earlier than planned, which is a positive. However,

As a result of the early shutdown, tonnes mined were lower than expected. To maintain mill feed, the operation utilized the low-grade stockpile during the quarter, resulting in lower grades and recoveries, and ultimately, lower production.

- Copper production guidance for 2022 is now expected to be between 25 to 35 million pounds (previously 35 to 45 million pounds).

- Gold production is expected to be at the low end of the annual production guidance range of 35,000 to 45,000 ounces.

- Due to the lower production, as well as, current inflationary cost pressures, operating expenses per gold eq. ounce are now expected to be between $1,485 to $1,565 per GEO (previously $1,100 to $1,180 per gold eq. ounce), and all-in sustaining costs are now expected to be between $2,210 to $2,310 per gold eq. ounce3 (previously $1,695 to $1,795 per gold eq. ounce). Production ramp-up at the B3 zone continues to advance with development expected to be completed by September.

3 – Commentary and trading strategy

It was very alarming news for shareholders. The issue is that the Rainy River has been deeply impacted, affecting the production for the remaining 2022 and possibly even 2023. We are talking about 19.2% of the 2022 production gone.

It was not the first time the Rainy River mine inflicted pain on New Gold’s shareholders.

On August 11, 2021, New Gold Inc. released its second quarter of 2021 results. The company had a piece of bad news about the Rainy River, as well, and NGD dropped to a 52-week low.

The market sold off on the news, but the stock recovered later. However, the market may be less accommodative, especially with a weakening gold price due to the FED’s hawkish action against rampant inflation.

Thus, I do not recommend a long-term investment in NGD for apparent reasons. However, after this giant slide, I believe the stock is now attractive, and I suggest buying NGD and trading the stock, which will probably recover a little from this low price.

Note: NGD trades in the NYSE American and can trade below $1 without the threat of delisting. However, in rare cases, the NYSE American exchange can force a company to reverse split to avoid delisting.

New Gold Inc. – Balance Sheet In 2Q22 – The Raw Numbers

| New Gold NGD | 2Q21 | 3Q21 | 4Q21 | 1Q22 | 2Q22 |

| Total Revenues in $ million | 198.2 | 179.8 | 202.6 | 174.7 | 115.7 |

| Net Income in $ million | -15.8 | -11.3 | 150.9 | -7.8 | -37.9 |

| EBITDA $ million |

47.6 |

49.5 |

212.9 |

46.5 |

13.2 |

| EPS diluted in $/share | -0.02 | -0.02 | 0.23 | -0.01 | -0.06 |

| Cash from Operating Activities in $ million | 110.3 | 54.3 | 105.7 | 67.8 | 37.4 |

| Capital Expenditure in $ million | 80.0 | 55.4 | 58.1 | 78.2 | 76.1 |

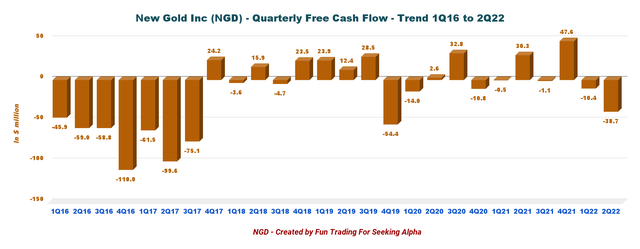

| Free Cash Flow in $ million |

30.3 |

-1.1 |

47.6 |

-10.4 |

-38.7 |

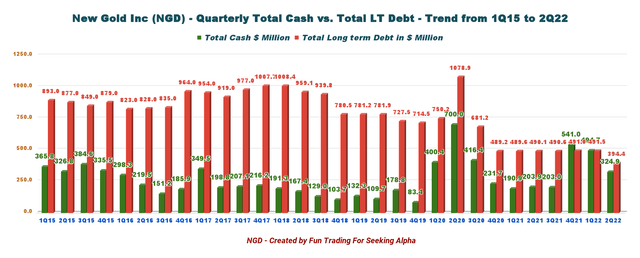

| Total cash $ million | 203.9 | 203.0 | 541.0 | 494.7 | 324.9 |

| Total Long-Term Debt in $ million | 490.1 | 490.6 | 491.0 | 491.5 | 394.4 |

| Shares outstanding (diluted) In millions | 680.8 | 680.8 | 687.5 | 681.3 | 682.0 |

Data Sources: Company release

Note: More historical data are available for subscribers only.

Analysis: Balance Sheet Discussion

1 – Revenues of $115.7 million in 2Q22

NGD Quarterly Revenues history (Fun Trading) New Gold posted revenue of $115.70 million for 2Q22, down 41.6% from the same quarter a year ago and down 33.8% sequentially. The company posted a net loss of $37.9 million compared to a loss of $15.8 million in 2Q21. Adjusted net loss was $16.7 million from an income of $26.7 million in 2Q21.

2 – Free cash flow was a loss of $38.7 million in 2Q22

NGD Quarterly Free cash flow history (Fun Trading) Note: The generic free cash flow is the cash from operating activities minus CapEx.

The free cash flow for 2Q22 was a loss of $38.7 million, with a trailing 12-month free cash flow loss of $2.6 million.

3 – Net debt is $69.5 as of June 30, 2022

NGD Quarterly Cash versus Debt history (Fun Trading)

New Gold’s net debt was $69.5 million this quarter. As of June 30, 2022, the debt was $394.4 million, and the total cash was $324.9 million. The total liquidity position was $807 million at the end of March 2022.

On May 16, 2022, New Gold announced redemption of the outstanding $100 million aggregate principal amount of its 6.375% Senior Notes due 2025. NGD paid with cash.

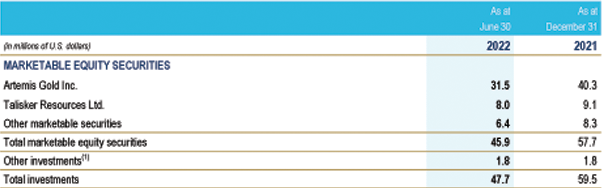

Note: New Gold’s total investment in 2Q22 was worth $47.7 million compared to $59.5 million in 4Q21. The most significant investment is in Artemis Gold and the Blackwater project. This amount is included in the total cash above.

NGD other investments (NGD PR)

Technical Analysis And Commentary

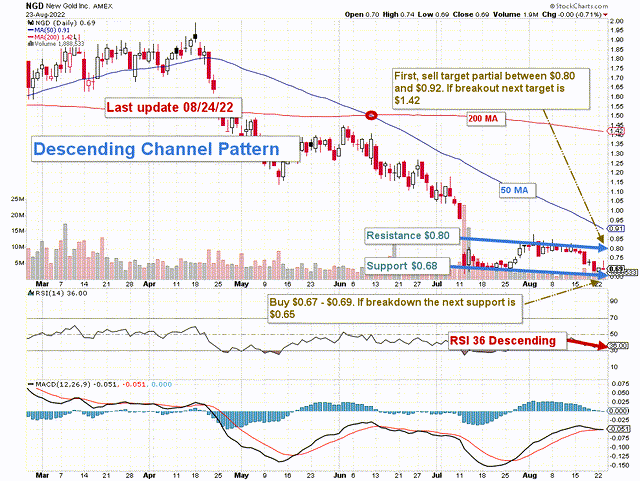

NGD forms a descending channel pattern with resistance at US$0.80 and support at US$0.68. NGD dropped significantly on July 12 when it reported production problems at the Rainy River.

The overall strategy that I promote in my marketplace, “The Gold And Oil Corner,” is to keep a core long-term position and use about 55%-65% to trade LIFO (see note below) while waiting for a higher price target for your core position between US$1.40 and US$1.45.

I suggest selling about 50% of your position between US$0.80 and US$0.92 and accumulating between $0.69 and $0.67. Furthermore, NGD is excellent trading stock and is particularly liquid, making it easier to trade.

The gold price is again struggling to stay above US$1,740 per ounce due to the Fed’s action against the rampant inflation that threatens the world economy. The market expects the Fed to hike the interest rate by 50-point and potentially 75-point for the third time. In this case, the gold price will struggle to stay above $1,700, and NGD could drop to lower support around US$0.63-US$0.65.

Watch gold and silver prices like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment